While RBI is pushing bankers to come clean, whimsical application of the law by bankruptcy judges are leading to lengthy appeals and little recovery.

Corporate banking in India is one of those painful-to-watch soccer games stretching goallessly into injury time. Neither the creditors nor the debtors have the energy to carry on, yet they’re dreading the long whistle: That’s when both sides lose.

The match was supposed to end Monday, going by the 180-day deadline the Indian banking referee gave lenders on 1 March to restructure defaulted loans of a minimum size of around $300 million, failing which they would have to send the nonperforming borrowers to the insolvency tribunal.

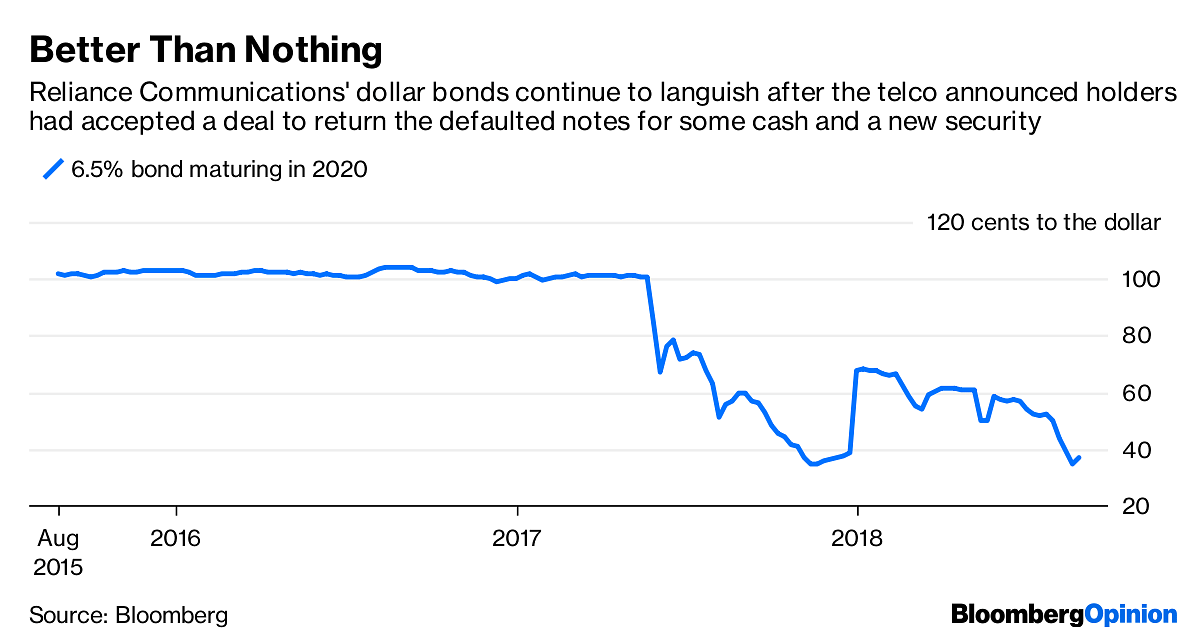

Anil Ambani’s Reliance Communications Ltd. may have just avoided bankruptcy proceedings by settling last Friday with investors in its defaulted $300 million bond. Banks, which have to recover $7 billion of their own from RCom, needed the bondholders to go away in order to press ahead with the telecom firm’s offer to pay off debt by selling spectrum, towers, fiber-optic networks and related assets, as well as real estate.

That may be one happy ending. Overall, though, India’s banks are in no position to meet the 27 August deadline.

Power companies, for instance, have taken the Reserve Bank of India (RBI), the banking regulator, to court over its guideline. A pending judgment gives the lenders some breathing space. Putting just the stranded plants into the care of tribunal-appointed overseers would require a 50 per cent loan-loss provision on their $25 billion exposure. That would be an immediate hit on state-run banks’ non-existent profits. More losses would come later as most of these electricity-generating units would sell for scrap value in liquidation.

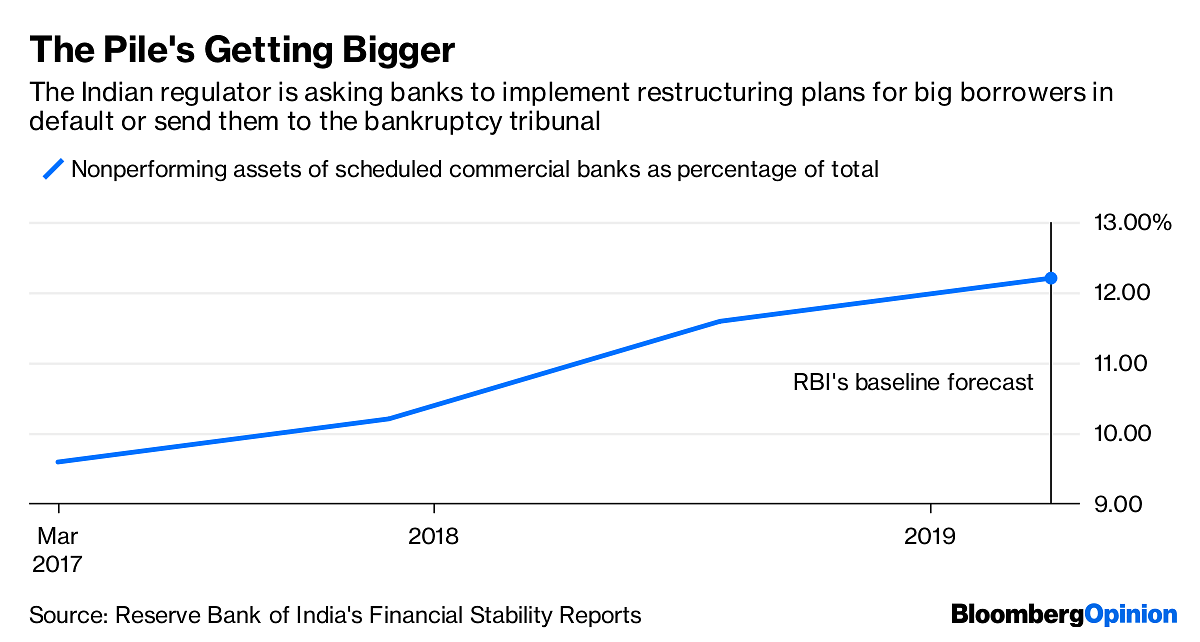

It’s a good thing that the RBI has stuck to its guns: Only by forcing banks to stop telling lies about their asset quality can the regulator finally get on top of a $200 billion bad-loan menace that keeps growing every quarter. However, the problem is with India’s relatively new bankruptcy process, which was supposed to deliver solid outcomes in just 270 days.

In reality, the first year of implementation on 12 big-ticket errant borrowers saw only two resolutions. The tribunal judges have arbitrarily stopped the clock, allowed lenders to retract live cases, permitted new bids to be opened after creditors’ committees had selected a buyer for troubled assets, and even let unsecured operational lenders use the law’s infirmities to get a leg-up on secured financial creditors.

On that last point, consider RCom again. A decent recovery rate for banks, including State Bank of India and China Development Bank, hinges on Anil Ambani’s ability to sell telecom assets to Mukesh Ambani’s Reliance Jio Infocomm Ltd. However, if RCom is forced into formal bankruptcy, the elder Ambani, who happens to be India’s richest person, would be legally prohibited from bailing out his younger sibling.

Using this quirk in the Indian law as leverage, and knowing that any other bid for RCom assets may not be as lucrative, Ericsson AB got the telco to agree to pay it 5.5 billion rupees ($81.5 million) in exchange for a halt on insolvency proceedings. For an unsecured operational creditor to recover a third of its claim is a feat. However, the message to banks, whose secured claims should have ranked more highly, the message from the highly unusual out-of-court deal is not as cheery.

While the RBI is undoubtedly doing the right thing by pushing banks to come clean, for bankers, the prospect of passing more cases through a law that’s still being applied rather whimsically by overworked bankruptcy judges can only mean unpredictable twists, lengthy appeals, high legal fees and very little recovery (except in steel assets).

Since the government won’t be able to fix the legal shortcomings any time soon, the RBI, as referee, will perhaps have to be realistic and allow the exhausted players to struggle deeper into extra time.- Bloomberg

Nehru to Indira Gandhi to Vajpayee and Manmohan Singh – everyone travelled abroad .. All were the PM of India, Rahul ji is not.

Journalists have lost ethics.. No one is neutral…

Rahul Ji should hire a good team for speech writing…

And for Modi Ji..to Question him..well Kudos for that courage…

Did the Press questioned the actions of Indira Gandhi?…I wasn’t born then..didn’t see those times.. so have nothing to say.. history has always been manipulated by the leaders/kings.. so I don’t trust it..