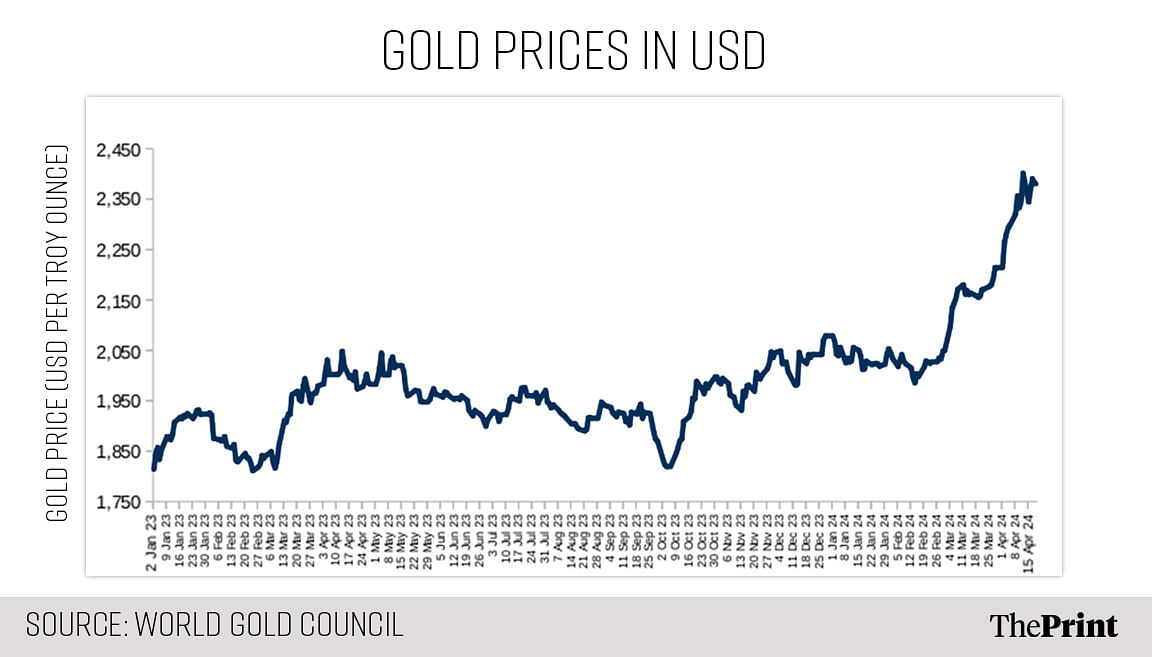

Gold prices have risen by a steep 15 percent in the last three months, surging past the USD 2400 per ounce mark for the first time in early April. The rally in gold is driven by strong buying by central banks in the last few months. The People’s Bank of China (PBOC) has been at the forefront, purchasing gold for 17 consecutive months.

While the surge in gold demand could be partly attributed to its safe haven appeal in times of economic and political turmoil, the ability of the United States to use their currency to impose sanctions has prompted a lot of these banks to diversify their reserves away from dollars.

Apart from central banks, the attractiveness of gold for households has also seen a rise. Elevated inflation, uncertainty in the financial market and lack of attractive investment options have triggered a rise in demand for gold by households.

India’s forex reserves

Typically, foreign exchange reserves consist of foreign currency assets, gold, Special Drawing Rights (SDRs) and the International Monetary Fund (IMF) reserve position. For India, foreign currency assets are the most significant component of the forex reserves. It includes assets, such as securities and deposits in major currencies like the US Dollar, the Euro and the British Pound.

The SDR is an international reserve asset created by the IMF, the value of which is based on a basket of currencies. Currently, the basket consists of US Dollar, Euro, Chinese Renminbi, Japanese Yen and Pound Sterling. The reserve position in the IMF represents India’s IMF quota.

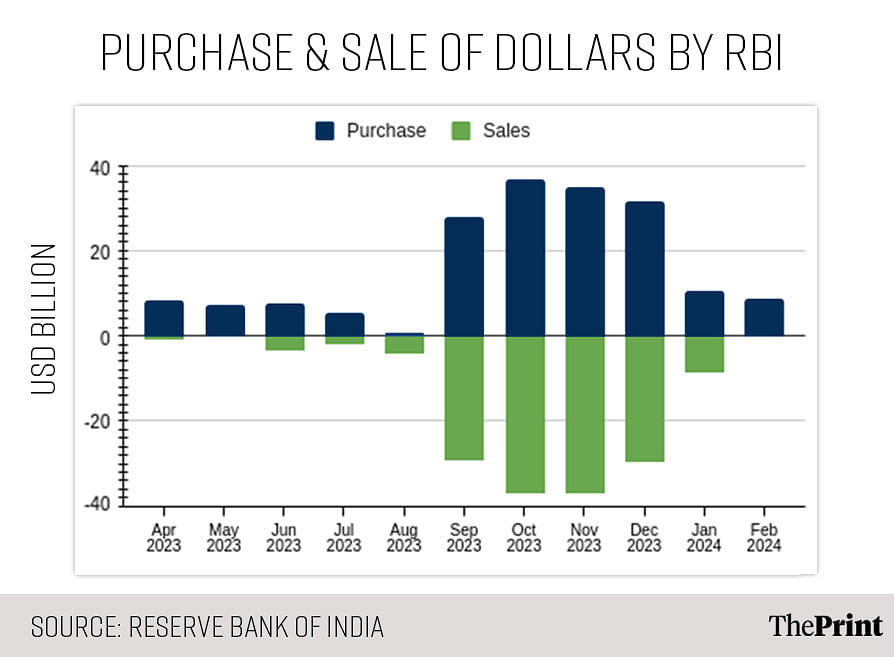

Movements in the foreign currency assets occur mainly on account of intervention by the RBI through purchase and sale of foreign exchange, income arising out of deployment of foreign exchange reserves, and changes due to revaluation of assets.

The adequacy of reserves has been a pertinent policy question. A number of traditional approaches, such as the import cover and short-term debt coverage, have been used to assess the adequacy. However, recent discourse suggests the need to revisit and supplement these approaches based on economy-specific factors, including the exchange rate regime, nature and comprehensiveness of capital controls framework, and reliance on commodity-intensive trade.

At the end of June 2023, India’s foreign exchange reserves cover of imports was 10.2 months, and the ratio of short-term debt-to-reserves was 20.8 percent.

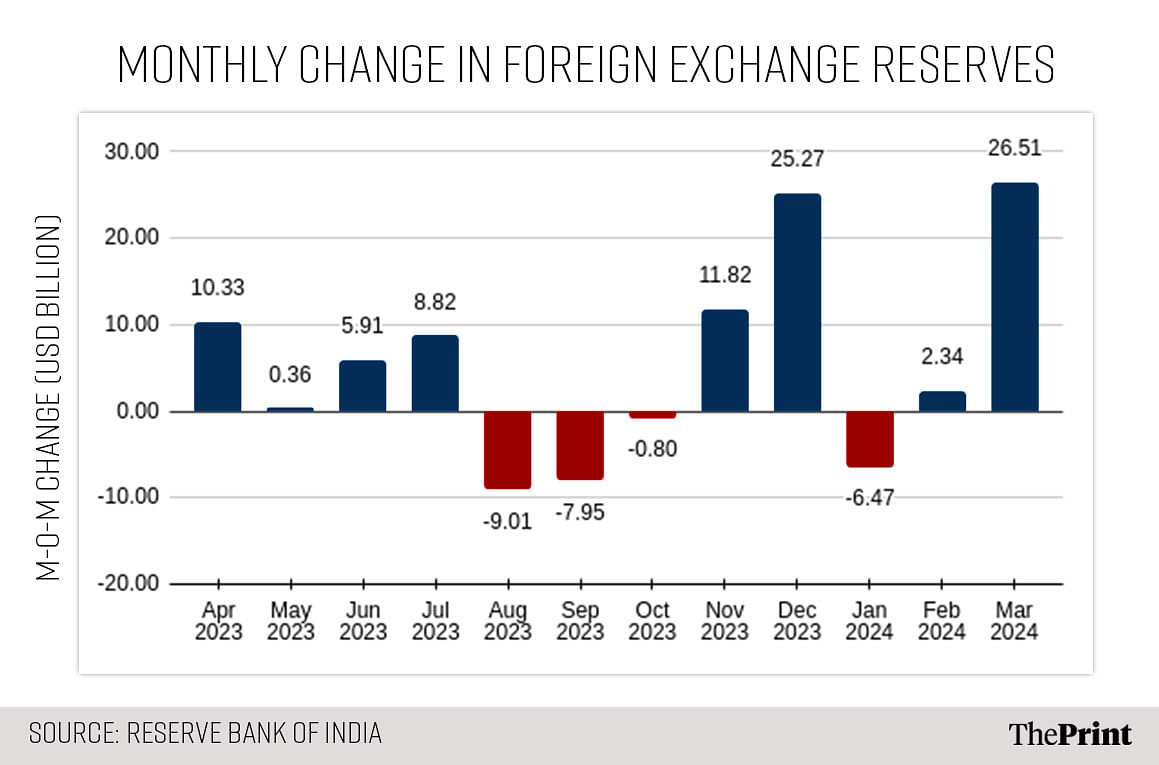

India’s foreign exchange reserves rose to USD 645.58 billion by the end of March 2024, compared to USD 578.44 billion at the end of March 2023 – an increase of USD 67 million. In 2022-23, forex reserves had fallen by USD 39 million. The trajectory of change shows that in times of crisis, foreign exchange reserves decline.

RBI’s two-way intervention in the last financial year kept the rupee-dollar rate in a narrow range. Despite variations in the dollar index, the rupee was broadly range-bound. The RBI bought dollars during heavy FPI inflows and sold dollars to prevent the depreciation of the rupee.

Foreign currency assets accounted for 88 percent of the overall forex reserves at the end March 2024. The next important component is gold holdings, whose share was 8 percent in the same period.

Also Read: India set to grow faster than expected, but geopolitical tensions, inflation & global debt loom

Central banks adding more gold to their reserves

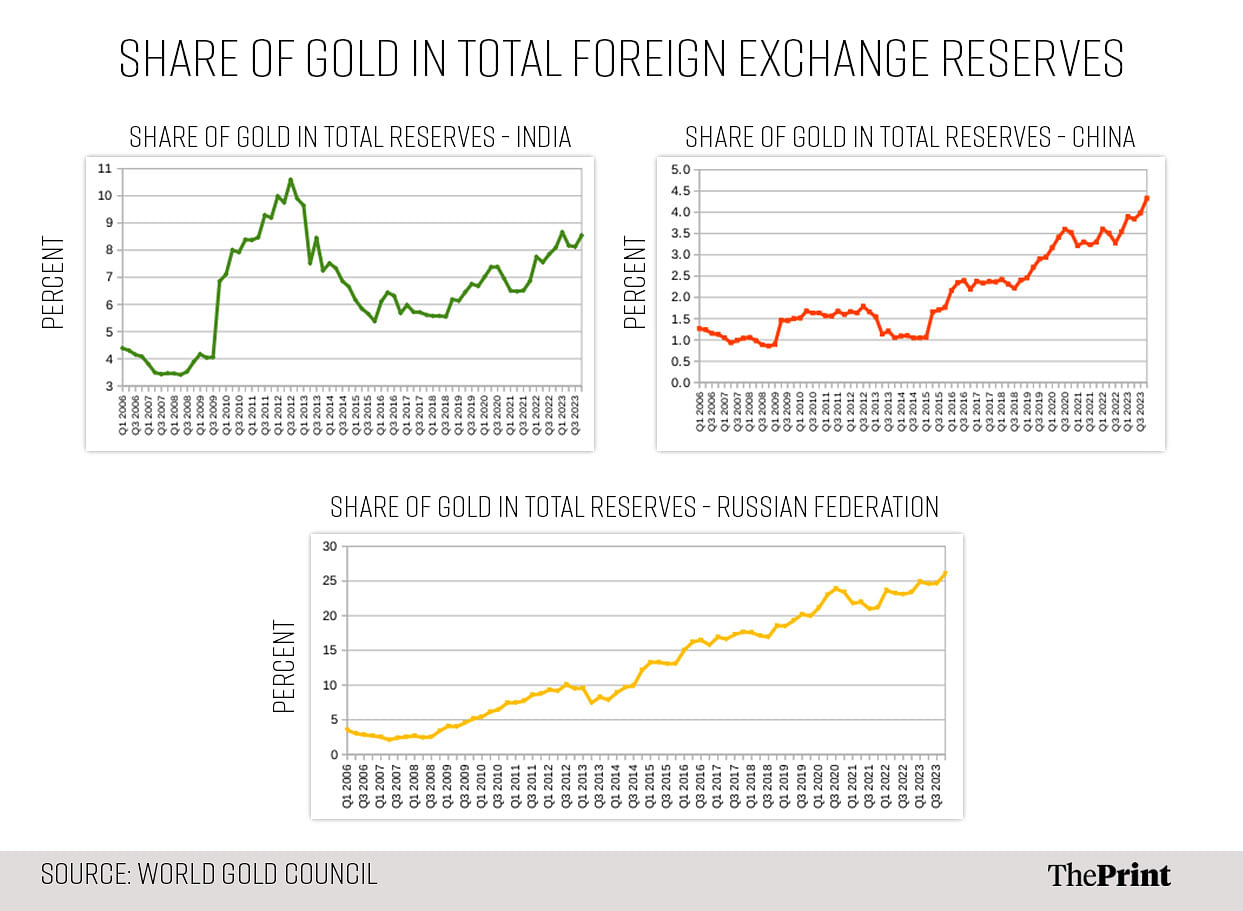

Gold’s ability to hold value in times of political and economic uncertainty makes it a favoured asset in central bank reserves. Cross-country studies suggest a statistically significant effect of global risk on the gold holdings of central banks. In recent quarters, a number of them have bought gold to shield their portfolio against uncertainty. As a consequence, the share of gold in their foreign exchange reserves has risen. For India, it has increased to 8.5 percent in Q4 of 2023, compared to 6.9 percent in Q4 of 2021. During the same period, China’s share of gold has gone up to 4.3 percent from 3.3 percent. In 2023, central banks’ net gold purchases totalled 1,037 tons. This was the second consecutive year, when central banks added more than 1000 tons of gold to their reserves.

For Russia, the focus on gold is part of a wider strategy to fortify its economy against Western sanctions. After its invasion of Ukraine, Russia was heavily sanctioned. Yet, its economy has exhibited resilience. Apart from its oil exports, gold has contributed to bolstering the economy. The country pegged the Rouble to gold, thus dissociating the economy from the dollar.

China faces a similar threat of sanctions due to its military ambitions and trade tensions with the US. This concern has led the move towards diversification of reserves and aggressive buying of gold. While PBOC’s gold purchases still represent a small fraction of the total reserves, central banks’ purchases led by China are likely to persist as a strategy towards diversification.

Strong demand from retail investors

The rally in gold prices is not just fuelled by central banks. Chinese demand for jewellery, gold bars and coins has risen to record highs. Amidst the protracted property crisis, volatile stock markets and a weak currency, the demand for gold as a store of value has gained traction. Further, the elaborate capital controls limit investors’ options overseas. Gold exchange traded funds have also witnessed sustained inflows.

Gold is considered a long-term hedge against inflation. A recent paper by Renuka Sane and Manish K Singh shows that gold has consistently beaten inflation and provided real returns. Thus, in times of high inflation, the appeal of gold as a store of value rises.

In the next few weeks, the price of gold will depend on the strength of the dollar. A stronger dollar will make gold less attractive for other currency holders. De-escalation of the Middle-East crisis could also soften gold prices going forward.

Radhika Pandey is associate professor and Rachna Sharma is a Fellow at the National Institute of Public Finance and Policy.

Views are personal.

Also Read: In India, households optimistic about state of economy despite rising debt, expect inflation to ease