In recent weeks, many international agencies have upgraded their growth projections for India for the current year. Global growth has also been steady, but the recovery is slow. Going forward, there are risks to the growth outlook, such as the fresh spikes in commodity prices amid geopolitical conflicts, high inflation and uncertainty about interest rates, the weakening of the property sector in China and elevated debt burdens in many economies. These lend uncertainty to the optimistic growth projections.

Revisions to India’s growth outlook

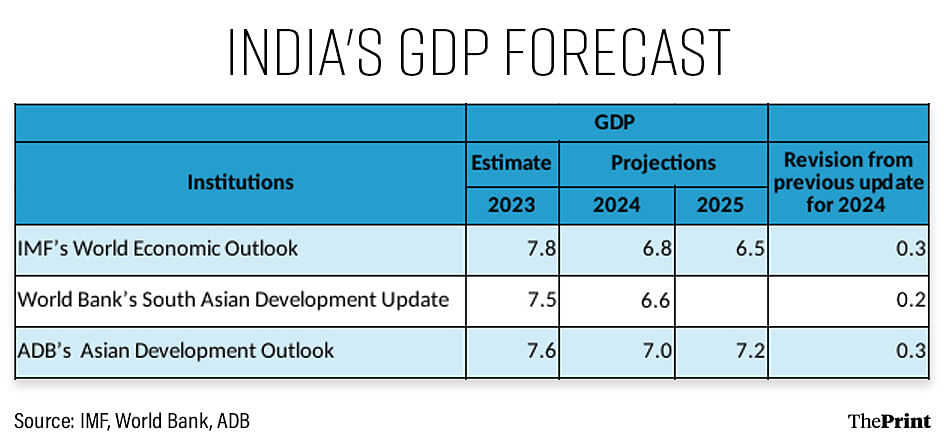

The International Monetary Fund (IMF), in its April edition of the World Economic Outlook, has raised India’s growth forecast for 2024-25 to 6.8 percent from 6.5 percent, on the back of strong domestic demand and a rising working age population. For the next financial year, India is projected to grow at 6.5 percent. The IMF is not the only agency to revise India’s growth forecast.

The Asian Development Bank, in its latest publication, Asian Development Outlook, has revised India’s growth forecast for 2024-25 to 7 percent, up from its earlier forecast of 6.7 percent. For the next year, growth is pegged at 7.2 percent. According to this report, growth is likely to be boosted by strong investment, recovering consumption and improving exports.

The World Bank’s South Asia Development Update pegs India’s growth for 2024-25 at 6.6 percent, up by 0.2 percent as compared to the October edition of the report. In fact, the growth projection of 6-6.1 percent in South Asia for 2024-25 is largely driven by India. Growth in other South Asian economies is projected to remain well-below pre-pandemic averages.

Global growth likely to be stable

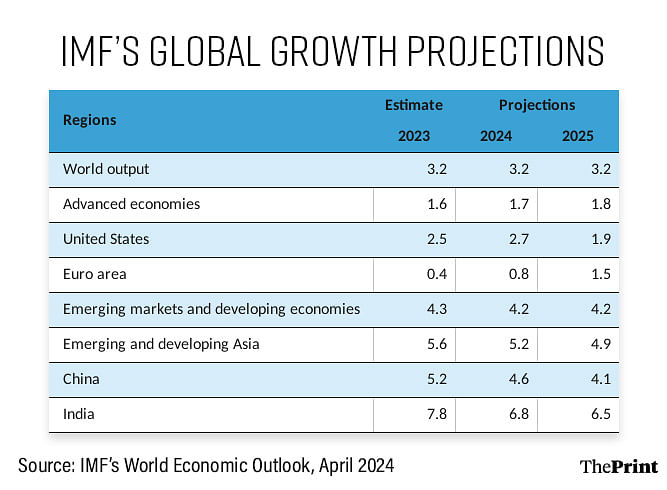

According to the IMF’s estimates, global growth estimated at 3.2 percent is likely to grow at the same pace in 2024 and 2025. Global growth projection has been revised up, compared to the January update and the World Economic Outlook’s October edition. However, the projection is much below the historical annual average of 3.8 percent.

The drivers of global growth are likely to see some shift. Growth in advanced economies is likely to see some improvement, while in emerging and developing economies, growth is likely to be stable. Amongst the advanced economies, growth in the US is projected to rise from 2.5 percent to 2.7 percent in 2024, before moderating to 1.9 percent next year. However, the key highlight is the strong growth recovery expected in the Euro Area, due to the rise in household consumption amidst the easing of inflationary pressures.

In emerging markets and developing economies (EMDEs), growth is likely to be stable at 4.2 percent in 2024 and 2025. Within the EMDEs, growth in China is expected to weaken from 5.2 percent in 2023 to 4.6 percent in 2024 and 4.1 percent in 2025. The growth slowdown stems from the protracted weakness in the property sector and the waning of the impact of fiscal stimulus.

Also Read: In India, households optimistic about state of economy despite rising debt, expect inflation to ease

Global recession concerns were misplaced

In late 2022, there were concerns of stagflation and recession due to rises in interest rates. Policy makers anticipated that a sustained rise in interest rates would lead to a rise in borrowing costs, posing a drag on spending and demand. However, contrary to these concerns, household spending remained robust.

There were two principal reasons for this. First, households in major advanced economies were able to draw on their savings accumulated during the pandemic to limit the impact of higher borrowing costs on their spending. However, now, the stock of savings to limit the impact of a rise in borrowing costs may be declining. Second, a rise in the labour force amidst strong employment growth supported activity compatible with the disinflation trend. However, the recent data has started to show some slack in labour markets.

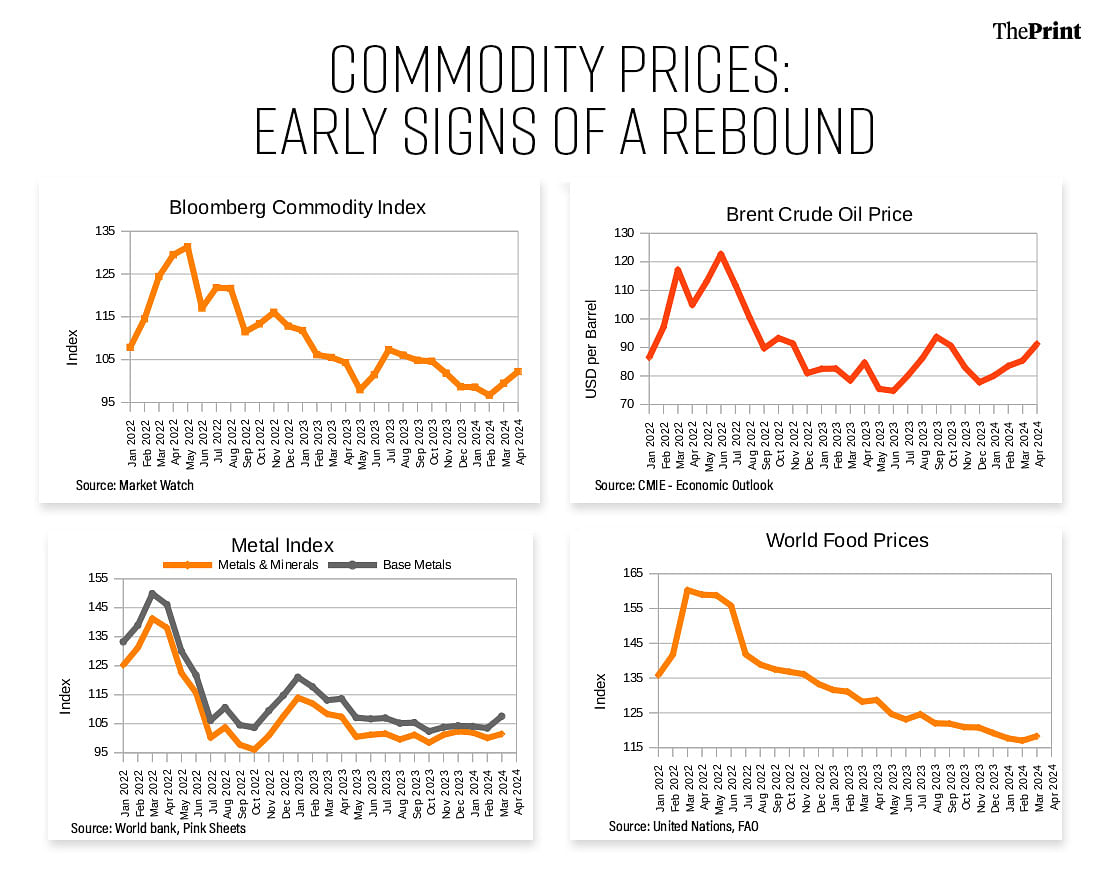

Challenges to global growth outlook: rise in commodity prices

While global growth has surprised on the upside, fresh sources of risk are emerging. In addition to the ongoing war in Ukraine and continued attacks in the Red Sea, there is now a risk of a wider war in West Asia following Iran’s attack on Israel. This could lead to spikes in energy, food and transportation costs. Initial signs of an uptick in commodity prices are already visible.

The Food and Agriculture Organisation’s Food Price Index, which captures the monthly changes in the international prices of globally traded food commodities, was up 1.3 points in March from its February level. The index registered its first uptick after seven consecutive months of decline. Similarly, the World Bank’s global metal and mineral price index rose by 1.4 percent from its February levels. Oil prices have also risen amid tensions in the Middle East. Iran is one of the major producers of oil within the Organisation of Petroleum Exporting Countries (OPEC).

The flare-up in prices could complicate the disinflationary process and delay the rate cut cycles. If prices remain elevated, inflation projections, both global and domestic, will have to be revised. Expectations are gaining ground that interest rate cuts may be off the table in several economies, if geopolitical tensions persist.

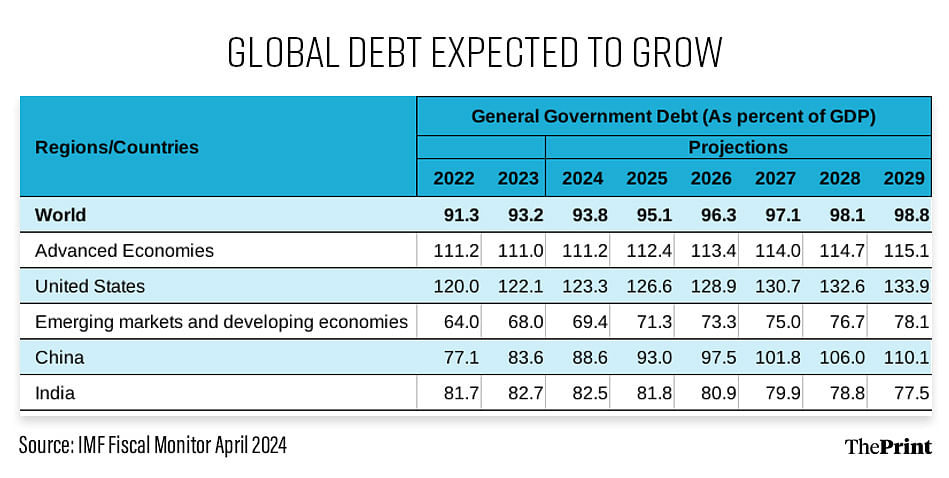

Rise in global debt and deficit after two years of decline

Another challenge to global growth is the stalling of the progress made on global debt and deficits. After a sharp decline in 2021-22, public debt and deficit levels edged up in 2023. The global public debt-to-GDP ratio was 93 percent in 2023, 9 percentage points above the pre-pandemic levels and 2 percentage points above the previous year. Global debt is expected to inch up further in the coming years, according to the IMF’s projections.

The rise in global debt is led by the largest economies, the United States and China. The implications of the rise are not restricted to their economies. These two economies shape the outlook on global debt and deficit. The volatility in the US government bond yields could trigger risk-off sentiments, leading to capital outflows and tighter financial conditions in the rest of the economy.

Fiscal expansion in China, amid slowing growth, could weigh on its trading partners. China is a major source of demand for commodities, such as metals and soybeans. A slowdown in demand could hit the fiscal revenues of its trading partners, particularly the commodity exporting countries. Slowdown in China could also dry up bilateral funding and outbound investments in several low-income economies.

Radhika Pandey is associate professor at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: Private sector green shoots & strong manufacturing, but elevated inflation: India’s FY24 report card