In the just concluded financial year, India’s GDP grew at an impressive pace, posting above 8 percent growth for three consecutive quarters.

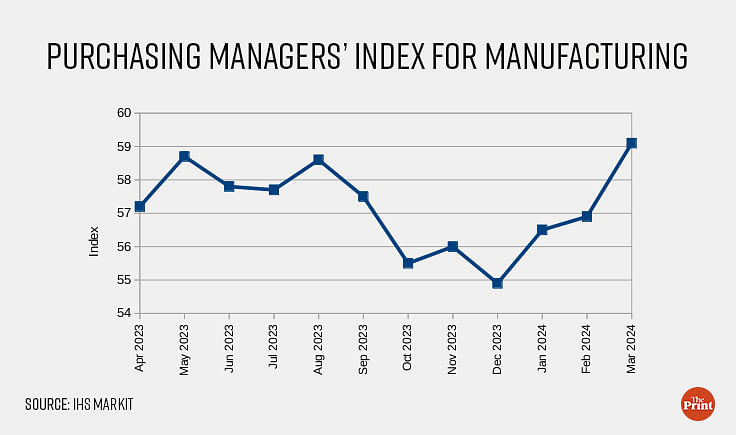

Most of the high frequency indicators show improved activity in the manufacturing and services sector in the financial year 2024. The Purchasing Managers Index for manufacturing and services surged to record high in March.

Steel consumption, sale of passenger vehicles, passengers handled at airports, GST collections reported encouraging numbers in the financial year 2024.

Construction sector was a star performer, driven by the government’s capex push and increased demand for residential properties.

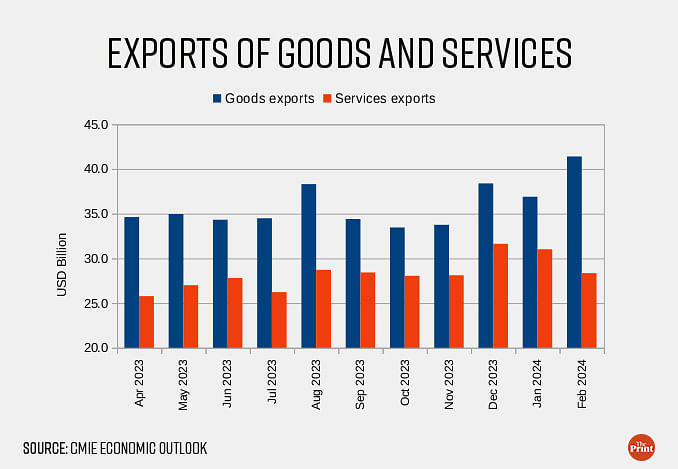

India’s capital market stood out despite global headwinds. While exports were impacted due to subdued growth in India’s trading partners, narrowing trade deficit owing to decline in commodity prices bodes well for India’s current account deficit in the financial year 2024.

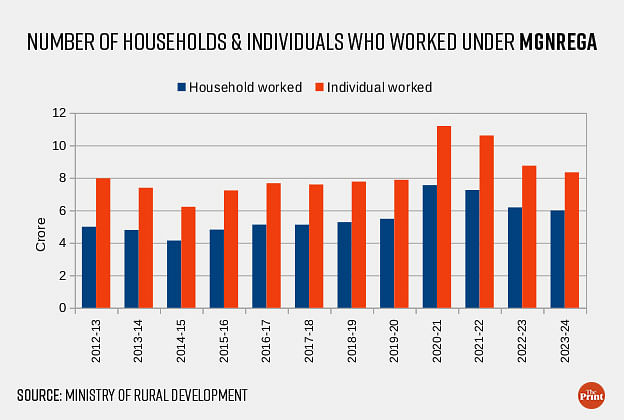

Consumption showed an uneven growth. While some high frequency indicators point to a resilience in urban demand, there were concerns around a sustained pick up in rural demand.

Also read: Merchandise & services exports soar, trade deficit shrinks — how India’s exports have rebounded

Current account deficit to edge lower in FY 2024

In April-February of financial year 2024, exports contracted by 3.3 percent while imports were down by 1.2 percent, but exports of services are seen to be catching up with exports of goods, resulting in a narrowing of the current account deficit. Overall, exports could be lower by 1-1.5 percent in the FY 2024 compared to the previous year.

India’s current account balance recorded a deficit of 1.2 percent of GDP in the quarter ending December, lower than 1.3 percent of GDP in the September quarter. For the year as a whole, the deficit in the current account is likely to be below 1 percent of GDP owing to services receipts.

Foreign Portfolio Investors made a comeback to Indian capital markets in FY 2024

Foreign Portfolio Investors (FPIs) turned net buyers in the Indian market after being net sellers for two consecutive years. While net investments in equity at USD 25 billion were lower than the net flows in 2020-21, the key highlight of the year was the renewed interest of FPIs in the Indian debt market. FPI made net investments of USD 14.5 billion in 2023-24 in the debt market. This is the highest annual inflow since 2017-18. FPIs interest in the debt segment gathered momentum in the second half of the year after the announcement of the inclusion of Indian government bonds in various global indices.

Inflation remained elevated due to high food inflation

In the 11 months of the last financial year, the CPI inflation averaged 5.4 percent with rural inflation exceeding urban inflation. Food inflation during this period was almost 7 percent. While inflation in the fuel and light component declined steeply from 10.5 percent last year to 1.6 percent this year, the other components were in the range of 3.5-4.5 percent.

Among the drivers of food inflation were cereals, vegetables, pulses, and spices, all of them posting double digit growth. Lower production and erratic weather events led to a spike in inflation in food items. In contrast, the core inflation averaged at 4.5 percent, a sharp decline from 6.2 percent in FY 23. The softening of global commodity prices led to a moderation in core inflation.

In the current financial year, inflation is likely to ease to 4.5 percent. However, unfavourable weather events, geo-political conflicts and possible reversal of commodity price decline could fuel inflationary pressures.

Consumption growth was uneven

According to the Government’s second advance estimates, GDP for FY24 will grow at 7.6 percent. With more than 8 percent growth in the previous three quarters, there is a strong possibility that the annual growth would exceed the 7.6 percent estimate. While gross fixed capital formation is projected to post an impressive growth of 10.2 percent, growth in consumption is expected to be muted at 3 percent. Even the production of consumer goods averaged 3.6 percent in the 10 months of the financial year 2024 — the lowest average growth among the various components of IIP per the use-based classification.

The other high frequency indicators present a mixed picture. While passenger vehicle sales are primarily driven by sales of SUVs, two-wheeler sales have been strong this year. Insights into rural demand can also be inferred from the number of persons and households employed under the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA). While the demand for work under MGNREGA eased in the financial year 2024, the number of persons who worked under the scheme remained above the pre-pandemic years. This implies that there is still some stress in the rural jobs market, leading to reliance on MNREGA jobs.

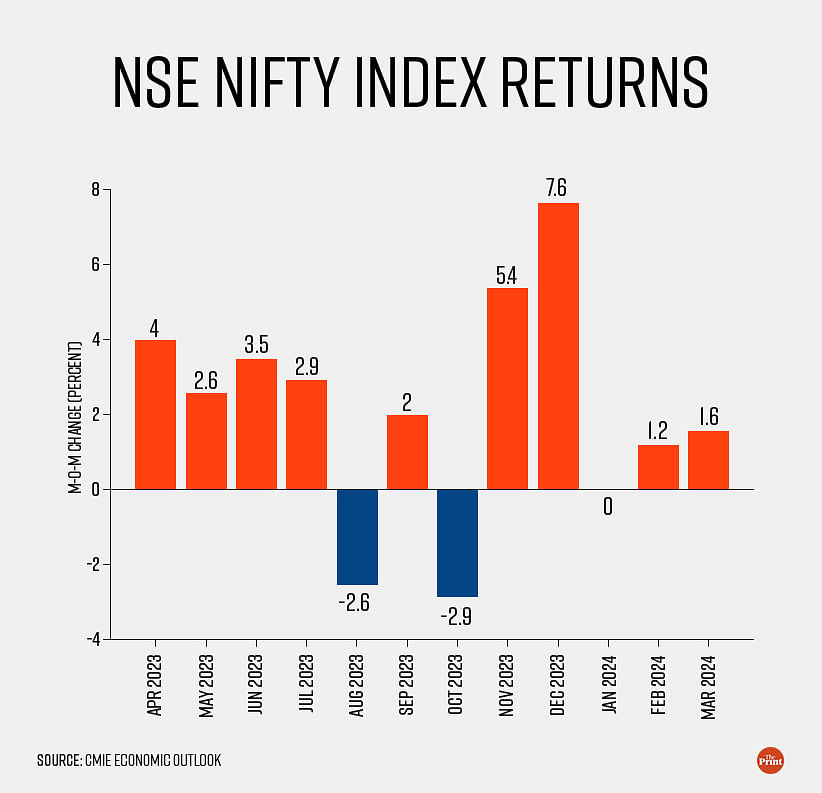

Capital markets performed well despite global turbulence

Despite volatile oil prices, resurgence in the dollar index, Indian capital markets posted decent returns in the last financial year. The 50 share price index Nifty posted a return of 28.6 percent. This is the highest return since 2009-10, barring the pandemic year. The financial year 2024 was a great year for initial public offering as well. Increase in retail investor participation and surge in inflows in equity mutual funds could propel more companies to tap the market in the current year.

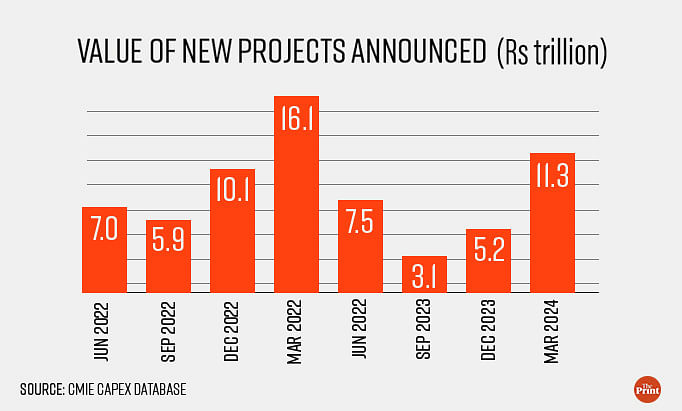

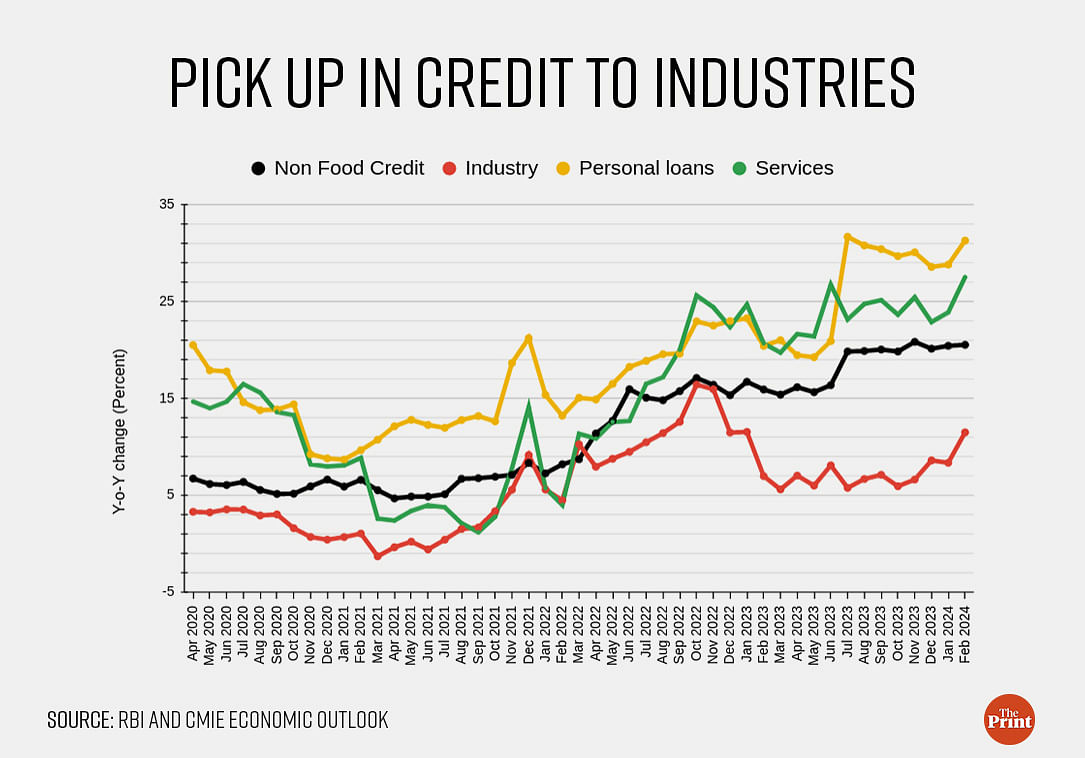

Early signs of revival in private investment

The narrative on growth in FY 2024 principally focussed on the role of public capex as the key driver, while private sector investment did not see a material pick up. But the latest data shows that this might be changing. The sharp-pick increase in new project announcements in the March quarter indicates improved business sentiments and points to early signs of revival in private investments. In the quarter ended March 2024, investment proposals worth Rs 11.3 trillion were made. This is the second highest amount of investment proposals made in any quarter so far. The increase has been led by new investment proposals, mostly in the chemicals and electricity sectors.

Capacity utilisation is slowly inching towards the 75 percent mark. The RBI’s quarterly survey on capacity utilisation showed that it edged up to 74 in the September quarter from 73.6 percent in the previous quarter. Improvement in growth of new orders, a much needed trigger for fresh capacity creation is evident across various indicators. The sharp surge in the Purchasing Managers Index for manufacturing in March was driven by a strong increase in new orders. Growth in credit to large industries also seems to have bottomed out and seeing a pick-up in recent months.

Radhika Pandey is associate professor and Rachna Sharma is a Fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: How Japan’s return to positive interest rates after 17 years could impact world economies