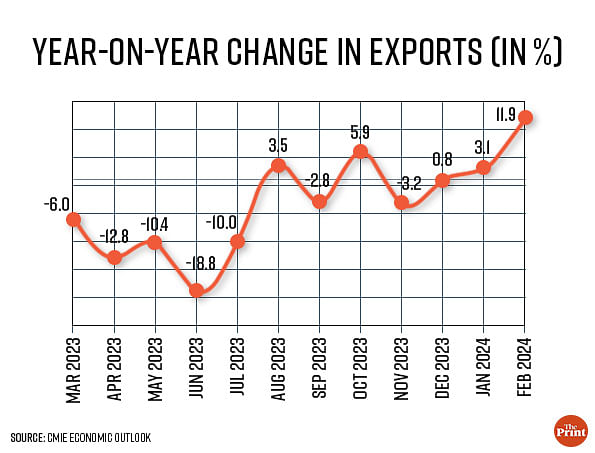

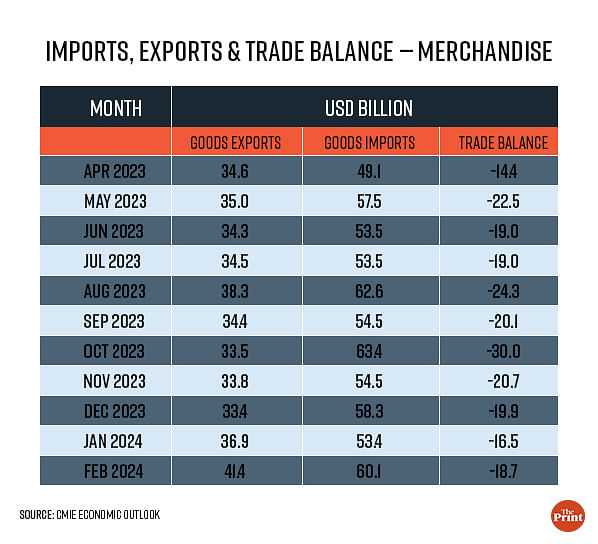

Despite the constraints to trade imposed by the crisis at the Red Sea, India’s merchandise exports grew by 12 percent in February from the year ago period. At USD 41.4 billion, merchandise exports were the highest in 11 months. Although for April-February, exports are down by 3.3. percent, if the positive trend continues in March, exports for the full year may be able to reach the levels of the last year. Improvement in global growth projections and diversification of India’s exports towards high value items bode well for India’s export outlook.

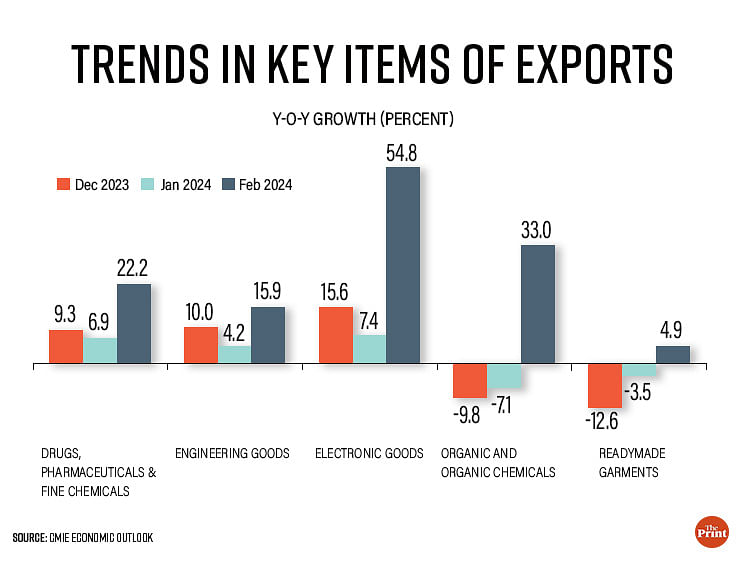

At a broader level, exports of electronic goods, engineering goods, chemicals and pharmaceuticals played a key role in boosting India’s exports in February. The exports of electronic goods grew by 54.8 percent in February. Exports of pharmaceuticals and engineering goods grew by 22 percent and 15.9 percent, respectively, while exports of inorganic and organic chemicals grew by 33 percent. In contrast, exports of traditional items such as gems and jewellery contracted by 11 percent.

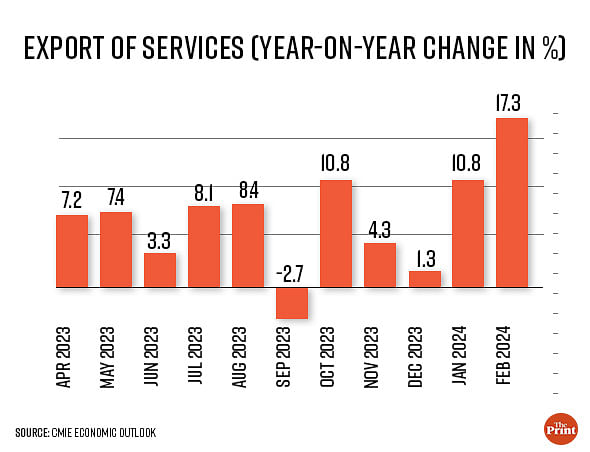

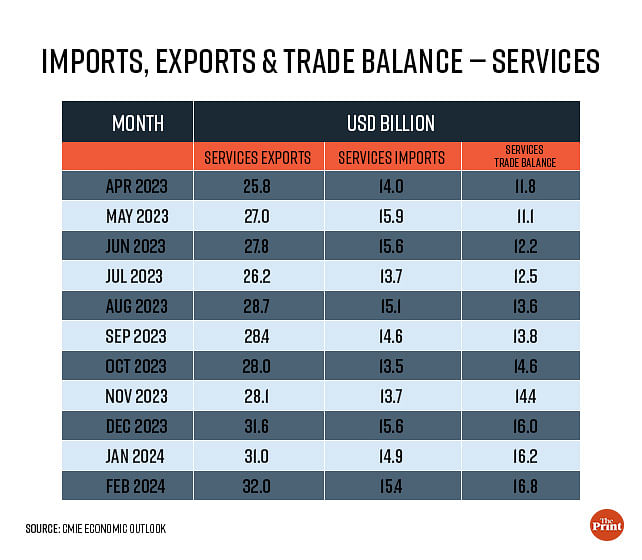

Exports of services hit an all-time record in February, leading to a significant reduction in the overall trade deficit and expectation of a lower current account deficit for the current year.

Also Read: Shortfall in central grants to poor quality of expenditure — what budgets of Bihar, Punjab & UP show

Improvement in global economic outlook a positive for India’s exports

The rebound in India’s exports comes at a time when many global agencies have revised upwards their global growth projections for 2024. Recently, S&P Global Market Intelligence raised its global growth forecast from 2.3 percent to 2.6 percent on the basis of better growth in countries like the US, UK and India.

Fitch also raised the global growth forecast by 0.3 percent to 2.4 percent. A sharp revision to the US growth forecast to 2.1 percent from 1.2 percent has been one of the key drivers of upward revision in global growth.

Projections of a modest recovery in global trade growth in 2024 and indications of easing of interest rates by global central banks are likely to give a boost to exports in the coming months.

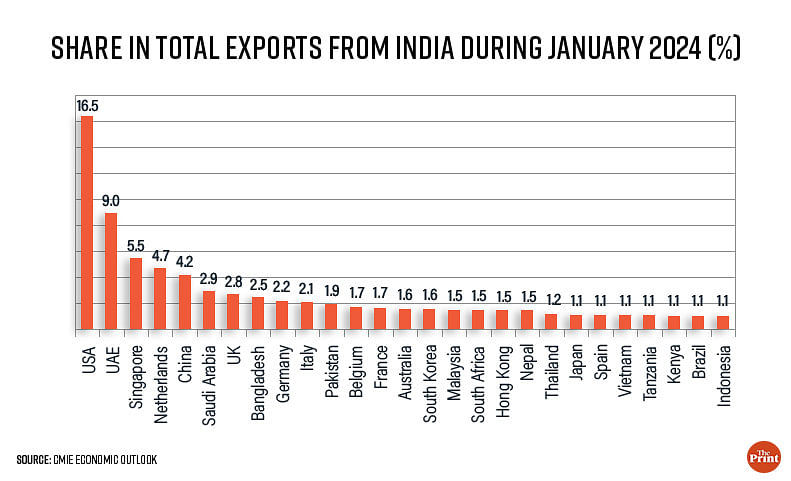

Exports to top destinations

The US continues to be India’s top export destination, accounting for 16.5 percent of the outbound shipments. While UAE features as the second most prominent export destination, its share has risen from 7.2 percent in January 2023 to 9 percent in January 2024. Singapore has emerged as the third most important export destination in January 2024 as its share in India’s exports has edged up from 2.5 percent in January 2023 to 5.5 percent in January 2024.

While exports to the US logged a growth of 3.6 percent, exports to UAE grew by 29 percent and exports to Singapore grew by a massive 130 percent.

Data also reveals interesting compositional shifts in exports to countries. For instance, exports of electronic goods to the US grew by a strong 33 percent, while exports of gems and jewellery contracted in January. Within electronic goods, the key driver has been the export of telecom instruments (capturing exports of mobile phones), which posted a growth of 70 percent. In fact, the US now accounts for almost 40 percent of India’s exports of telecom instruments. The US has replaced the UAE as the most prominent market for smartphones in recent months.

Exports to the UAE were driven by gems and jewellery exports, particularly gold jewellery whose exports grew by 129 percent. In addition, exports of petroleum products grew by 50 percent. For Singapore, the jump in exports mainly came from a spike in petroleum products exports to 280 percent.

Electronic goods turnaround

Exports of electronic goods are powered by exports of telecom instruments. Telecom instruments account for almost 60 percent of electronic goods exports. The turnaround in exports of electronic goods is remarkable — exports more than tripled from USD 7.5 billion in 2017-18 to USD 25 billion in FY 23. During this period, exports of telecom instruments surged from USD 1.2 billion to USD 13 billion.

The surge in mobile exports is propelled by Apple and its contract manufacturers-Foxconn, Wistron etc. The increase has been driven by the government’s flagship schemes such as the Production Linked Incentive Scheme for electronics manufacturing and IT Hardware and promotion schemes under the National Policy on Electronics.

Government data suggests that PLI beneficiaries accounted for 82 percent of mobile phones during 2022-23. Cutting import duties on components used in the manufacture of mobile phones also gave a fillip to domestic manufacturing and exports. However, the cumbersome process of land acquisition still remains a roadblock for establishment of manufacturing units.

Also, there are only a handful of states that are leading the electronics wave in the country with Tamil Nadu being the top performer. The success stories of states such as Tamil Nadu could serve as lessons for other states as well.

Exports of services hit an all-time high leading to expectations of a lower CAD

Exports of services seem to be fast catching up with goods exports. Exports of services hit an all-time high of USD 32.2 billion in February, up 17.3 percent on a year-on-year basis. The surplus in services trade surged to USD 16.8 billion. The rising services trade surplus has narrowed the gap with the merchandise trade deficit. The overall trade deficit was a meagre USD 2 billion in February as compared to more than USD 4 billion in January.

The momentum in services exports is contributed by the expanding ecosystem of Global Capability Centres (GCC) in India. GCCs are transitioning from mere back-end support to being at the forefront of driving cutting edge innovation. A vast pool of English-speaking tech talent is driving the GCC boom in India.

The record services exports, along with the rapid growth of remittances, have led to expectations that India’s current account deficit (CAD) will be below 1 percent of GDP in FY 24.

Radhika Pandey is associate professor and Rachna Sharma is a Fellow at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: Lower on food, higher on conveyance & durables — how consumption patterns changed in past decade