By now, a number of states have announced their budgets for the next financial year 2024-25. The budget documents give a picture of the states’ fiscal health, their receipts position and expenditure priorities at a time when the general elections are around the corner.

The nature of transfers from the central government is also seen to impact the fiscal performance of states. This article presents the highlights of the budgets of three major states: Bihar, Uttar Pradesh and Punjab.

Bihar: Revised estimates show substantial deviations from budgeted targets

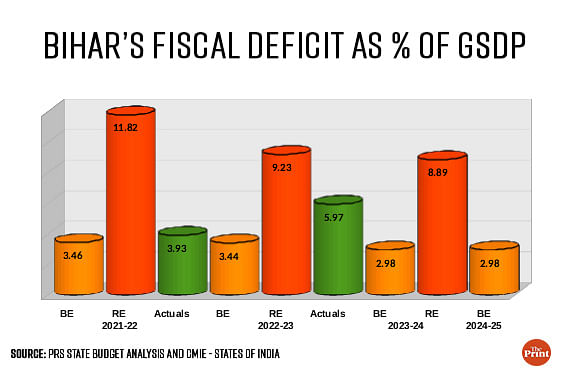

Bihar has budgeted its fiscal deficit at 3 percent of Gross State Domestic Product (GSDP) for the next financial year. For the current year, too, the budgeted target was 3 percent of GSDP but the revised estimates suggest that the deficit would rise to 8.9 percent of the GSDP.

Substantial deviations are also visible on the revenue account.

For FY 25, the state has budgeted a revenue surplus of 0.1 percent, but going by the trends of the current year, the assumption of a revenue surplus appears optimistic. For the current year as well, the state had budgeted a revenue surplus of 0.5 percent of GSDP, but the revised estimates suggest that the state will incur a revenue deficit of 4.1 percent of GSDP. The fiscal ratios for the next year (2024-25) assume a nominal GDP growth of 13.5 percent.

The higher than budgeted deficit in the current year (2023-24) is owing to higher expenditure. The revised estimates suggest that the total expenditure is estimated to rise by 20 percent over the budgeted estimates: with revenue expenditure estimated to rise by 20 percent and capital expenditure expected to rise by a substantial 35 percent over the budget estimates.

The revised estimates appear to be overstating the capital expenditure, as the monthly accounts released by the Comptroller and Auditor General (CAG) suggest that by January end, the state has managed to spend 74 percent of its budgeted capital expenditure. To assume that the budgeted target would be achieved and surpassed by 35 percent in the next two months is highly optimistic. In all probability, the state would underspend on its budgeted capex.

For the next year, revenue expenditure and capital expenditure are pegged to be lower by 10 percent and 26 percent, respectively, over the revised estimates of the current year.

Concerns have been raised on the credibility of the revised estimates put out by the state. For the financial years 2021-22 and 2022-23, the revised fiscal deficit estimates were seen to be unrealistic but the actuals were relatively closer to the budget estimates.

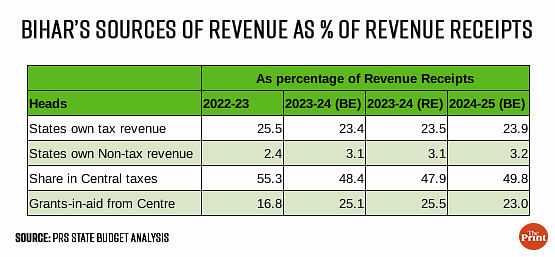

Bihar: Lower transfer of grants could upset the fiscal math

On the revenue front, states own resources are budgeted at 27 percent while resources from the central government including grants and share in central taxes are pegged at 73 percent of the revenue receipts for 2024-25.

Of the total revenue receipts of Rs 2.26 lakh crore, Rs 52,000 crore is budgeted as grants from the central government. This is an overestimation, as for the current year, Bihar has received just 16 percent of the Rs 53,000 crore budgeted as grants. The wide gap between the budgeted and the actual flow of grants indicates the prominence of conditional grants. As such, the Fifteenth Finance Commission has increased the proportion of grants conditional upon reforms by states.

Another concerning feature of Bihar’s finances is its stock of outstanding liabilities. These are pegged at 35.7 percent of the GSDP in the budget estimates for the current and the next year. These are higher than the debt path laid out by the 15th Finance Commission for 2023-24 (at 33.1 percent of GSDP) and 2024-25 (at 32.8 percent of GSDP).

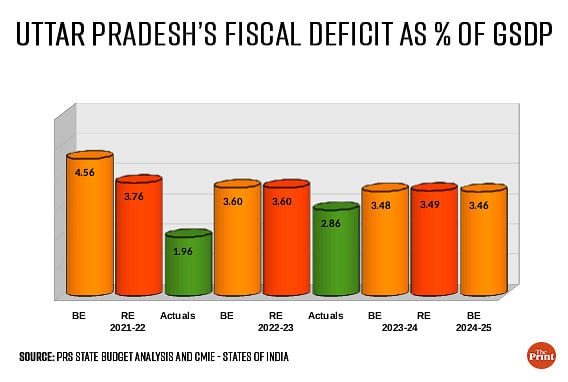

Uttar Pradesh: Higher revenue surplus a welcome sign but shortfall in grants a concern

Uttar Pradesh has targeted a fiscal deficit of 3.46 percent of GSDP for 2024-25. This is marginally lower than the revised estimates of fiscal deficit for the current year at 3.49 percent of GSDP. In contrast to Bihar, UP has budgeted a much higher revenue surplus of 3 percent of GSDP. Unlike Bihar, UP is estimated to have a revenue surplus in the current year as well, as per its revised estimates.

The rise in revenue surplus from 1.7 percent of GSDP in 2021-22 and 2022-23 to 3 percent in 2023-24 and 2024-25 (Budget estimates) is a positive feature of UP’s finances and reflects an improvement in the quality of expenditure. In sharp contrast to Bihar, Uttar Pradesh has projected its nominal GDP to grow by a meagre 5.8 percent in 2024-25. This seems to be an under-estimation and may surprise on the upside, leading to reduced fiscal ratios in 2024-25.

Total expenditure is projected to increase by 16.5 percent next year over the revised estimates of the current year. Revenue expenditure is projected to rise sharply by 17 percent while capital expenditure is projected to grow by 6 percent over the revised estimates of the current year. The projection of a 17 percent jump in revenue expenditure seems to be an overestimation. In the current year, the UP government has managed to spend 61 percent of the budgeted revenue expenditure till January 2024.

The state government is also unlikely to meet its capex target for the current as well as the next year. Till January, only half of the budgeted capex has been spent. The savings on expenditure would lead to lower deficits in the current and the next year.

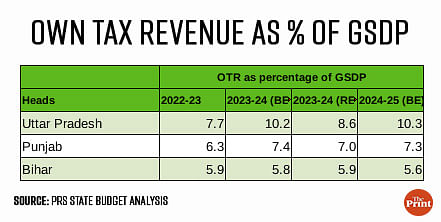

On the revenue front, while states own tax revenue (OTR) is projected to rise by 27 percent over the revised estimates of the current year, there could be challenges owing to shortfall in grants from the central government. In the current year (till January), grants in aid account for only 36 percent of the budget estimate. With a 27 percent jump, the state’s OTR is budgeted at 10 percent of GSDP. Last year as well, the OTR was budgeted at 10 percent but the revised estimates show a decline in the ratio to 8.6 percent.

For 2024-25, the outstanding liabilities at 32.7 percent of GSDP is marginally higher than the revised estimates of liabilities at 31.7 percent of GSDP for 2023-24. In addition, the provision of guarantees on borrowings made by state owned entities, particularly by power sector entities puts additional pressure on the liability position of states.

Punjab: Committed expenditure and power subsidy accounts for bulk of revenue receipts, leading to concerns on quality of expenditure

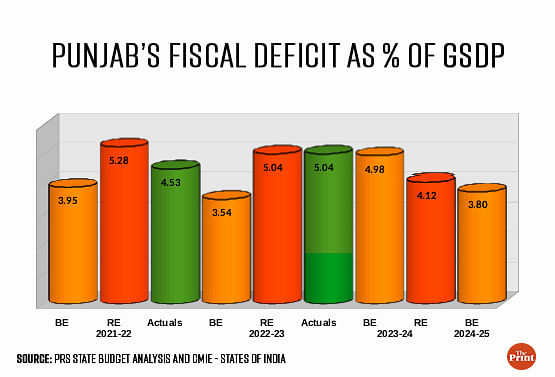

The Punjab government has budgeted a fiscal deficit at 3.8 percent of GSDP. The growth in GSDP is projected at 9 percent over the revised estimates of 2023-24. Fiscal deficit, though, still elevated is an improvement over the 4.1 percent deficit for the current year.

The quality of expenditure is a cause of concern as the revenue deficit is pegged at 2.9 percent of GSDP for 2024-25. For the current year, the fiscal deficit was budgeted at 4.98 percent of GSDP but the revised estimates show a reduction in deficit to 4.12 percent. However, the reduction in deficit is at the expense of a significant cut in capital expenditure by the state. The revised estimates for capex for the current year is 38 percent lower than the budgeted estimates.

Comparison: Quality of expenditure

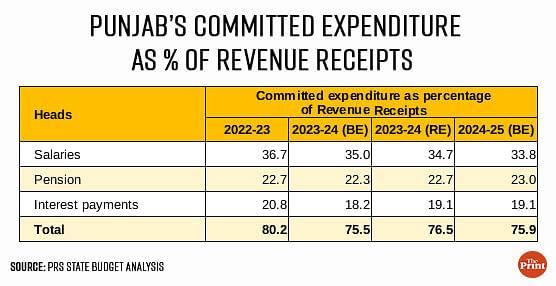

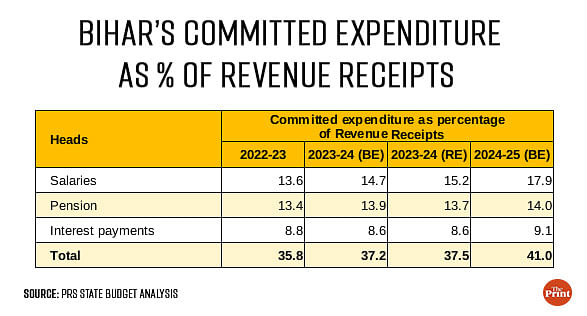

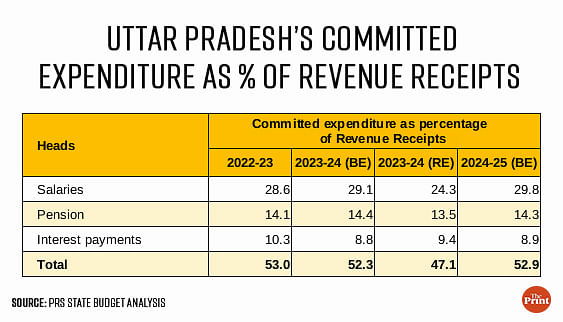

For Punjab, the share of capital expenditure in the total expenditure is stuck at around 3-3.5 percent of the overall expenditure. A greater share is allocated towards committed expenditure, which includes salary, pensions and interest payments. In 2024-25, committed expenditure is pegged at 76 percent of the state’s revenue receipts.

In addition, power subsidy to households, industry and farmers is a critical feature of the state’s finances. For 2024-25, Rs 20,200 crore has been allocated towards power subsidy, which accounts for a sizable 19 percent of the state’s revenue receipts.

Comparison: Committed expenditure

On the revenue front, the tapering of the revenue deficit grant and the discontinuation of the GST compensation grant will impact the state’s revenue receipts. These need to be offset by the state’s own resources.

Radhika Pandey is associate professor and Rachna Sharma is a Fellow at the National Institute of Public Finance and Policy (NIPFP), New Delhi.

Views are personal.

Also read: How India’s GDP grew by 8.4% in Q3, propelled by strong performance in industrial & services sectors