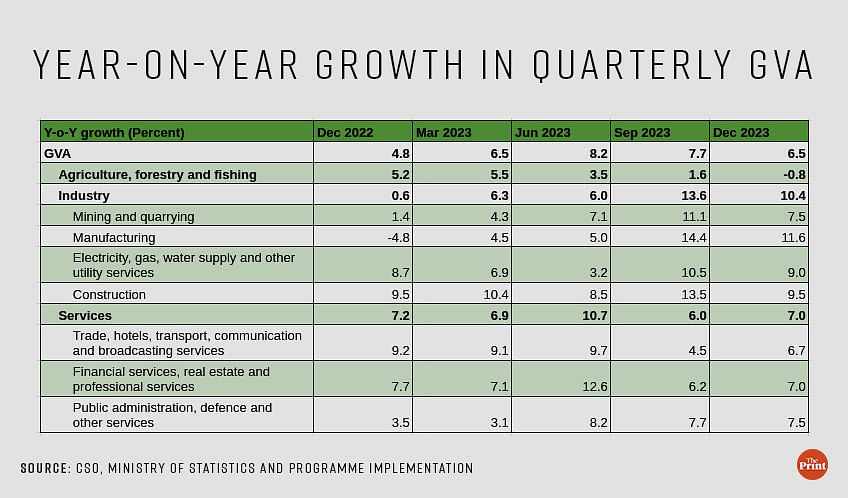

Surpassing all expectations by a wide margin, India’s GDP growth surged to 8.4 percent in the December quarter. The growth in Gross Value Added (GVA) however eased to 6.5 percent from 7.6 percent in the previous quarter. Higher tax collections and slower rollout of subsidies led to the wedge between GDP and GVA in the December quarter. While the agricultural sector posted a contraction of 0.8 percent, strong showing by the industrial sector and recovery in the services segment boosted growth in the December quarter.

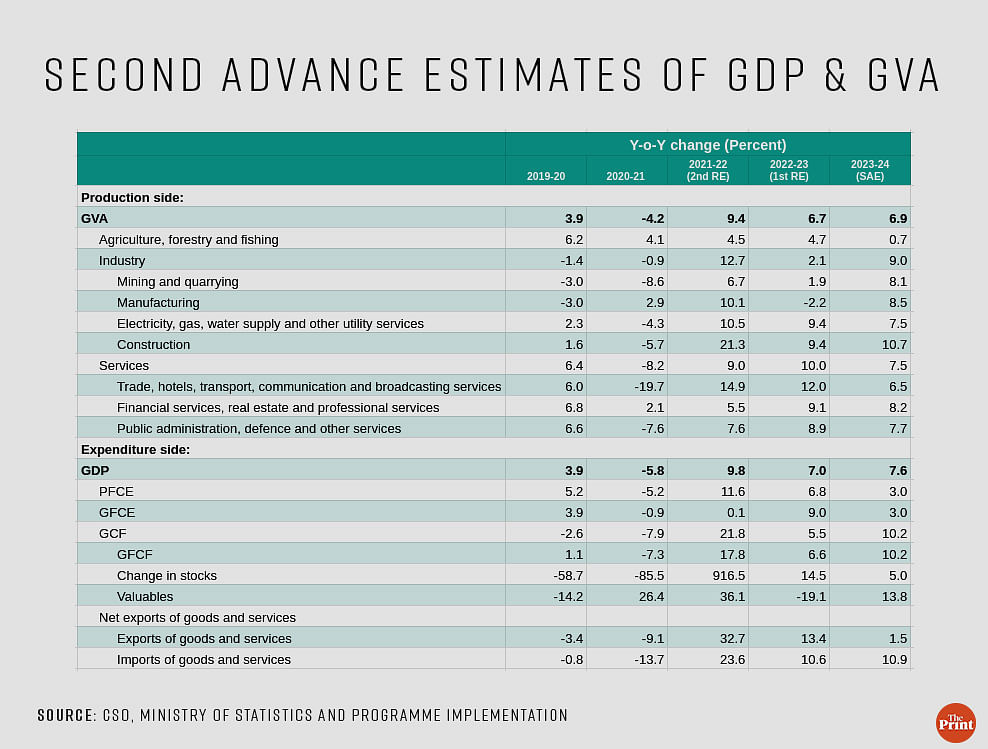

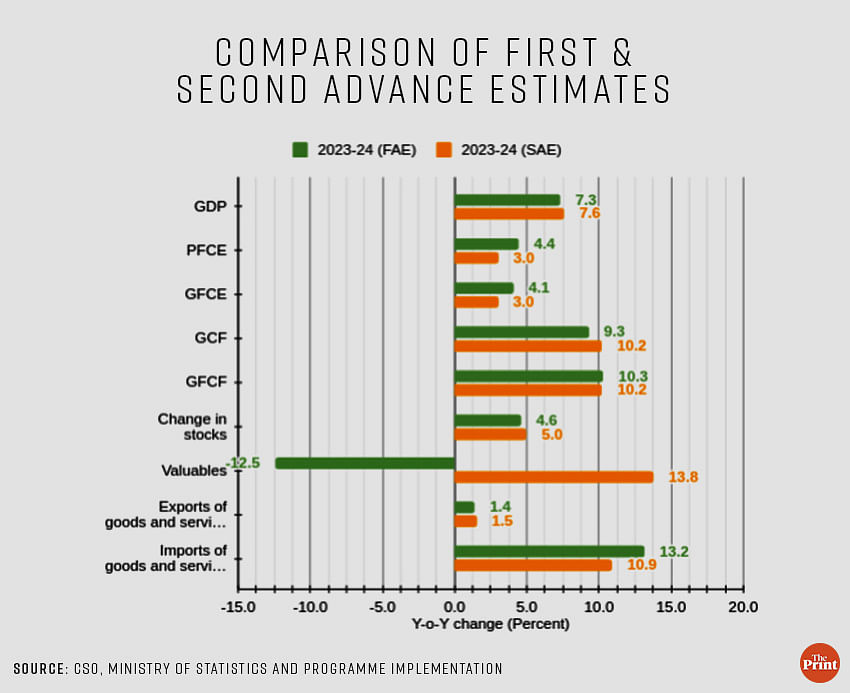

The National Statistics Office, in its Second Advance Estimates, pegged the country’s growth at 7.6 percent, higher than the 7.3 percent growth projected in its First Advance Estimates. Double-digit growth in construction (10.7 percent), and a decent 8.5 percent growth in manufacturing boosted the annual growth estimates. Downward revision in previous year’s growth also contributed to a spurt in growth for this year.

Also read: Subdued growth in household consumption & rural sales but companies optimistic of gradual pick-up

Q3 growth: Marginal decline but industrial growth still in double-digits

The industrial sector growth grew at 10.4 percent in the December quarter from 13 percent in the previous quarter. There is also a favourable base effect at play as the corresponding quarter of last year had seen a contraction in industrial growth. All the sub-segments of the industrial sector posted a lower growth as compared to the previous quarter. The manufacturing sector grew at 11.5 percent, lower than 14.4 percent in the previous quarter.

The manufacturing sector was expected to slow down in the second half of the year due to the normalisation of commodity prices. In the second quarter, the sector got a boost due to decline in commodity prices.

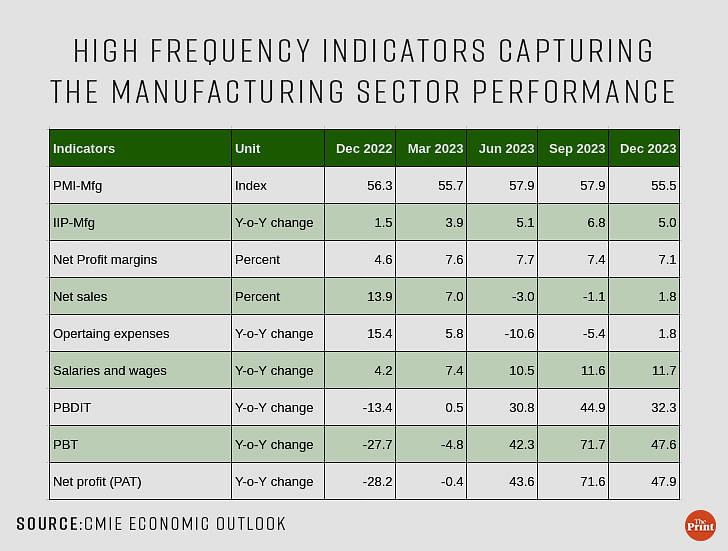

High frequency indicators present a mixed picture of the sector’s performance. The volume of production captured by the Index of Industrial Production (IIP) slowed to 5.9 percent in the December quarter as compared to 7.8 percent in July-September.

Moderation is also seen in the Purchasing Managers Index for the manufacturing sector. In contrast, the corporate sectors’ profits continue to remain buoyant, although a marginal slowing in growth is visible in the December quarter as compared to the previous quarter. After two quarters of contraction, there is a pick-up in the operating expenses of manufacturing sector companies, owing to rise in raw material costs. Going forward, the profitability of companies may see a further moderation.

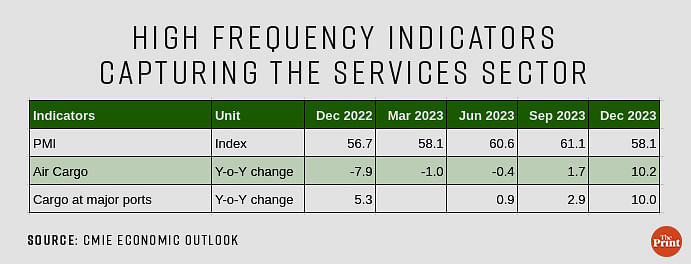

Q3 growth: Improvement in services sector performance while farm sector saw a contraction

The service sector growth improved in the December quarter due to the festival season. The “trade, hotels and transportation” segment also got a boost from India hosting the 2023 cricket ICC World Cup in October-November. In addition, some of the high frequency indicators such as cargo at airports and at major ports reported a strong growth during this period.

The farm sector’s growth slipped in the contraction zone owing to the decline in output across all major Kharif crops. Owing to the subdued performance of the sector in the December quarter, the estimates for the full years have also been revised down to 0.7 percent from 1.8 percent pegged earlier.

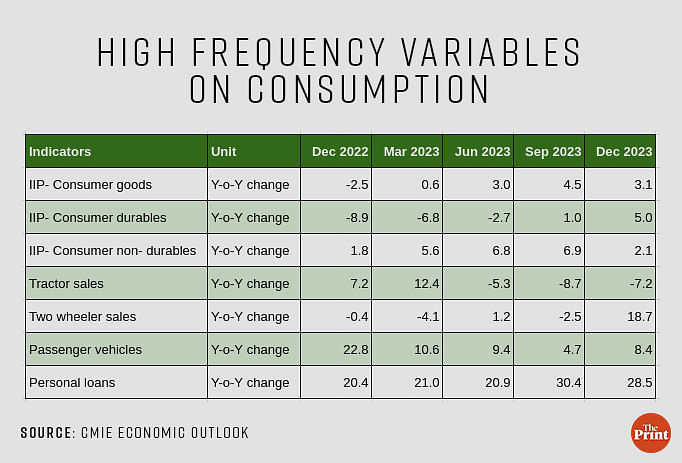

From the expenditure side, growth in private final consumption expenditure improved to 3.5 percent from 2.4 percent in the previous quarter. The consumption story for the December quarter continues to show a mixed picture with some indicators, such as the production of consumer non-durables, reporting a weaker growth while sales of passenger vehicles showing a significant jump from the previous quarter.

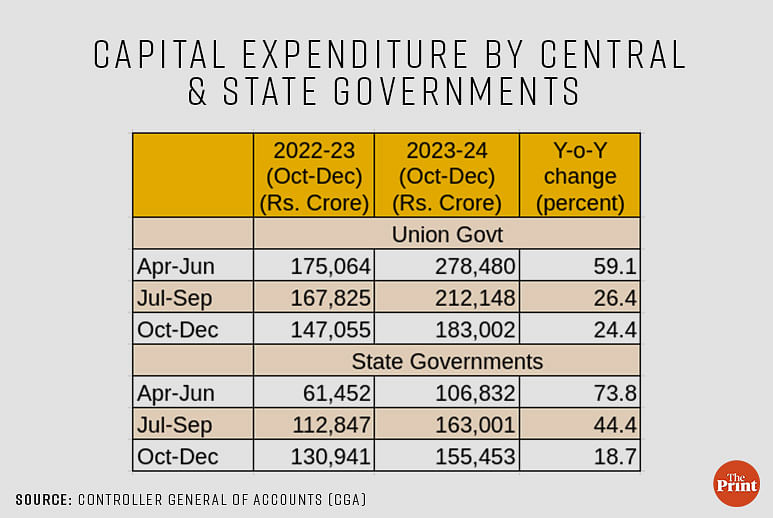

Gross fixed capital formation posted a double-digit growth in the second consecutive quarter due to strong push to capex by the central government. The capital expenditure of the central government grew by 24.4 percent in the December quarter. However, there was a marked slowdown in the growth of capital expenditure by states.

Annual growth: Construction, industry & capex key drivers while consumption remains weak

With an impressive third quarter performance, the estimates for the full year have been scaled upwards to 7.6 percent in the second advance estimates. The strong growth is driven by a robust construction and industrial sector performance. On the expenditure front, the government’s capex continues to provide a strong support to growth. The recent estimates shows that net exports have been less of a drag on growth as compared to the first advance estimates.

On the flip side, private final consumption expenditure continues to remain a pain point. Consumption is now estimated to grow at 3 percent in the current year as compared to 4.4 percent growth estimated earlier. Rural consumption continues to face challenges. This is reflected in the muted sales of companies in the fast-moving consumer goods (FMCG) segment. Some of the key items of mass consumption have reported a contraction in production in the period up to December of this year.

High food inflation and a greater share of income going towards payment of interest have dented the demand for items of mass consumption.

Radhika Pandey is associate professor and Rachna Sharma is a Fellow at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: India’s resilient economy faces risks from Red Sea, higher US inflation & patchy recovery in China

This analysis reiterates the numbers released by the Statistics ministry. The numbers do not align with the narrative. It would be helpful if the professor provides analysis and puts things in perspective.

Why government changed the Q1 andQ2. Gdp numbers they are at7.2 and7.6 now above 8 please give full brief details about it on upcoming print vedio