The domestic economy continues to show resilience as reflected in the robust growth projections for the coming year. However, global challenges could pose headwinds to India’s growth outlook.

The Israel-Hamas conflict resulting in a resurgence in global crude oil prices poses an upside risk to domestic inflation.

The disruptions to trade and rise in freight costs due to the ongoing military stand-off along the Red Sea route, the statement by the US Federal Reserve that there is no urgency for rate cut, the higher-than-expected inflation in the US and continued deflation and patchy recovery in China are some of the sources of risks facing the Indian economy.

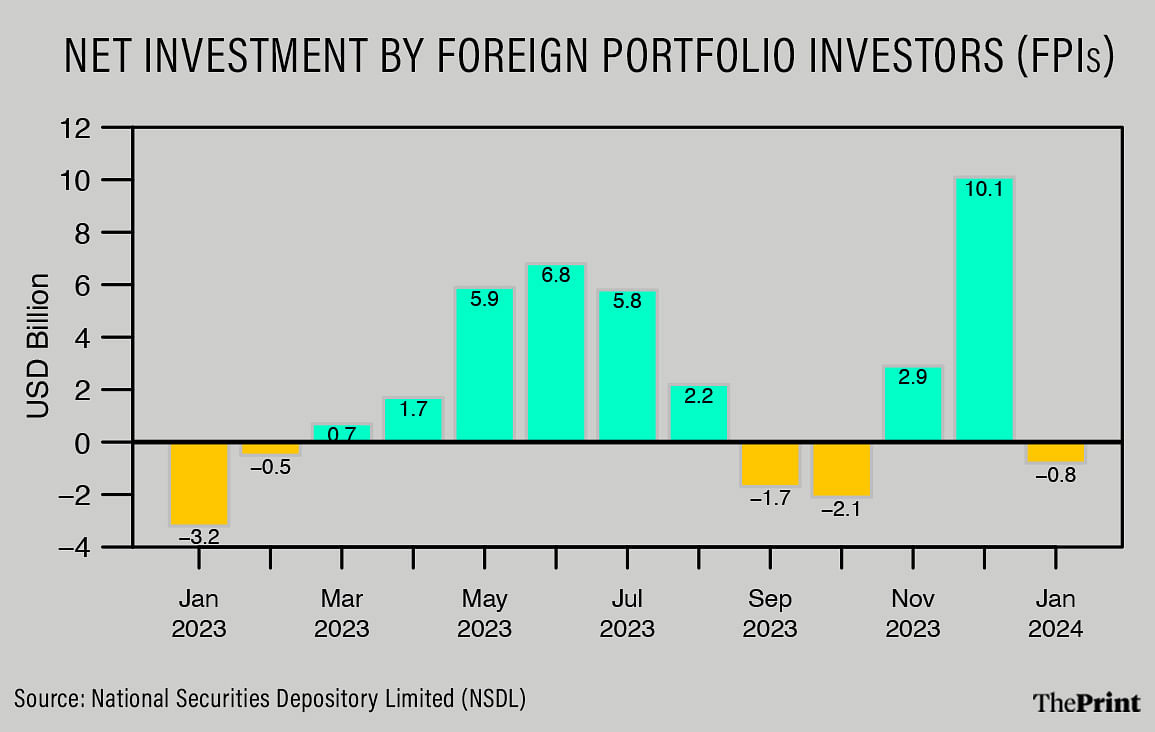

The fresh challenges on the global front have started impacting financial markets. Indian equity markets witnessed a pause in January after two months of strong performance. Foreign Portfolio Investors turned net sellers in January after being net buyers in November and December.

Also read: Interim budget continues govt’s focus on capex, allocates more for MNREGA to ease rural distress

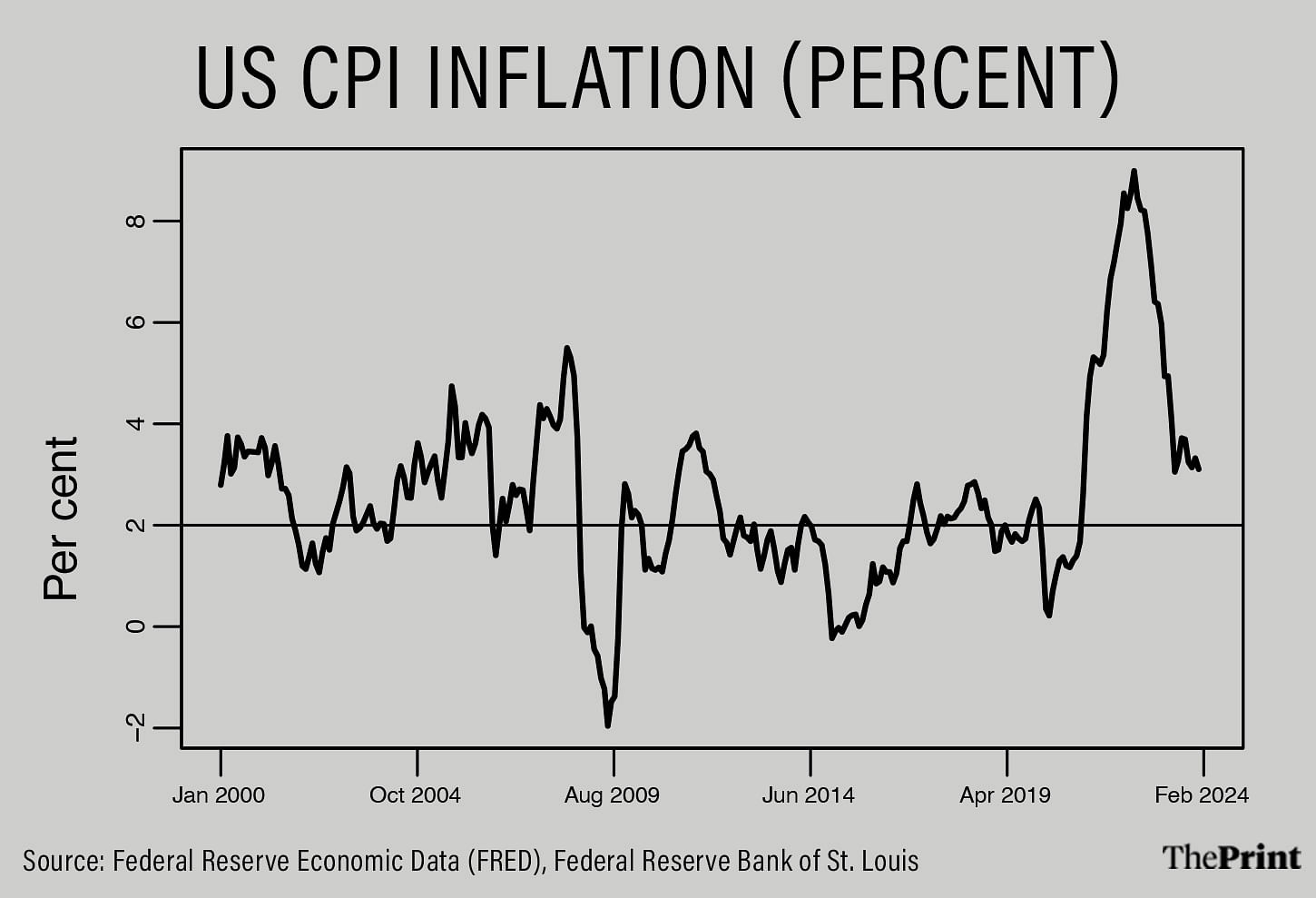

US inflation still remains elevated

The consumer price index (CPI) based inflation rose by 3.1 percent in January, higher than the consensus estimate of 2.9 percent. On a month-on-month basis, inflation rose 0.3 percent against expectation of a 0.2 percent rise. Excluding volatile food and energy prices, core inflation was 3.9 percent in January, unchanged from December. With inflation coming in stickier than expected, the narrative of ‘higher for longer’ rates is back.

At the beginning of the year, there was a high probability of a rate cut in March, that probability has dwindled and the possibility of rate cuts have been pushed to the second half of the calendar year.

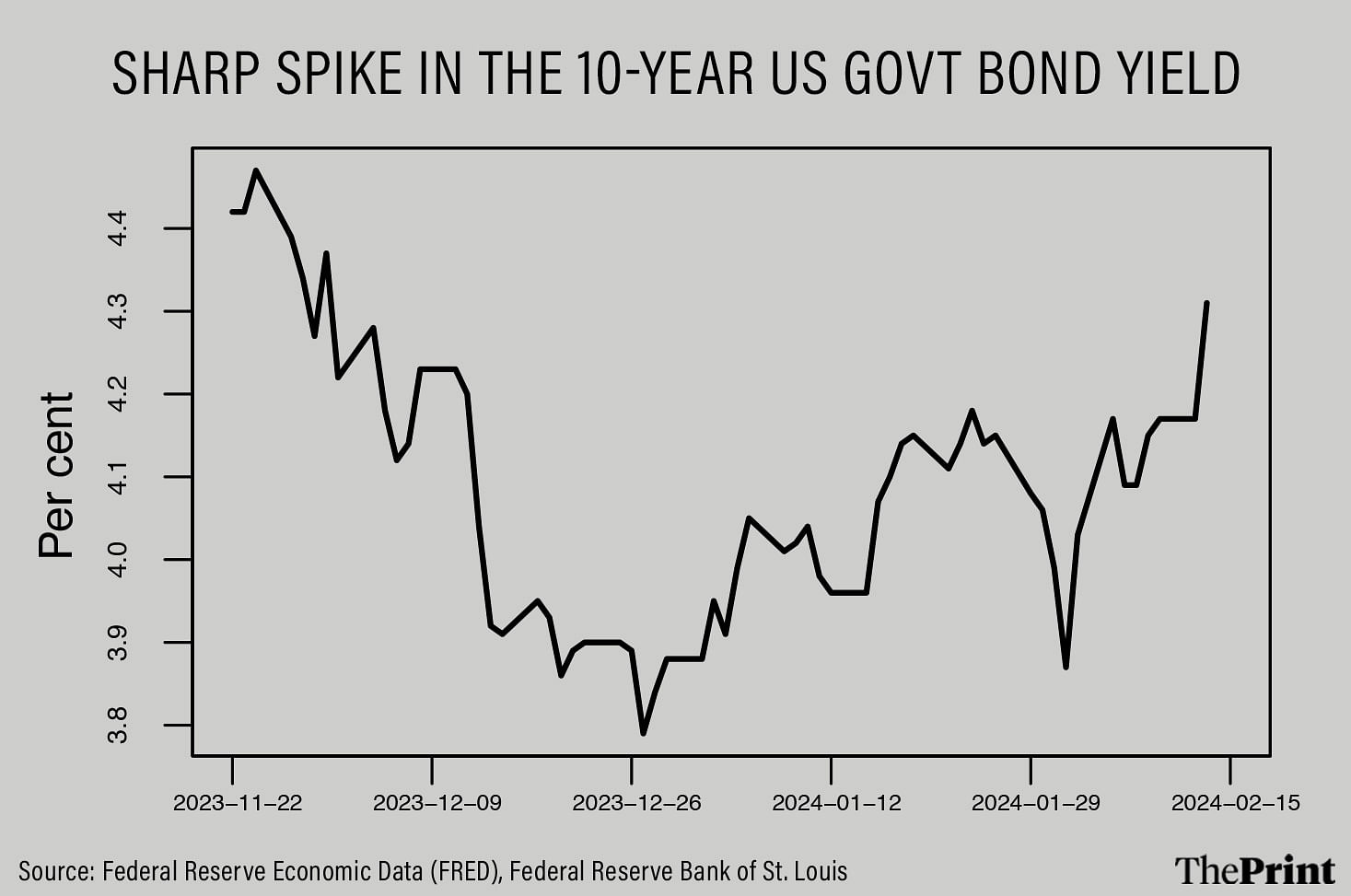

A small deviation from the expected inflation trajectory led to a sharp spike in the US government bond yields. The rise in US bond yields makes the US bonds more attractive, leading to risk-off flows and selling by the FPIs. This makes the Indian markets vulnerable to movements in the US bond yields.

China’s protracted slowdown & impact on India-China trade

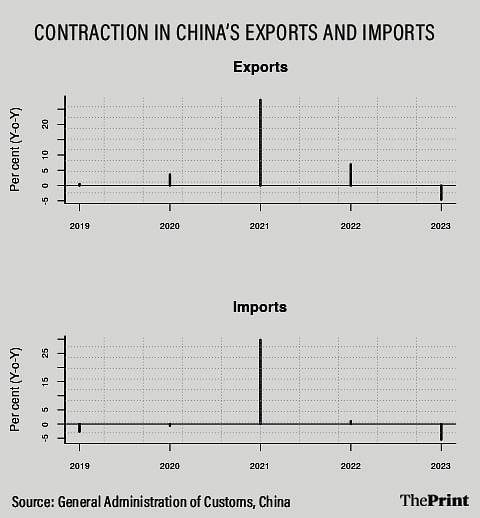

China’s economy grew by 5.2 percent in 2023. In 2022, China’s economy grew by just 3 percent as a result of the prolonged Covid restrictions. Even though the economy recovered from the lows of 2022, there are concerns about the growth momentum amid the lingering property crisis, record youth unemployment, low consumer and business confidence and dwindling trade.

China’s property woes began in August 2020, when the authorities rolled out a “three red lines” policy to control the housing bubble and reduce the economy’s over reliance on property. Under the policy, Chinese real estate developers were required to limit their debt-to-equity ratio to be able to borrow from banks and financial institutions. It turned out that many developers were burdened with enormous debt. Unable to access loans under the new rules, they suffered a cash crunch. This resulted in a series of debt defaults by real estate companies including the infamous default by Evergrande — one of China’s biggest developers. This, in turn, had a spiralling impact on home buyers’ confidence as cash strapped companies could not complete projects on schedule.

Despite a series of supportive policies for real estate developers, housing sales continue to remain muted. According to the IMF’s assessment, growth in 2024 is projected to slow to 4.6 percent as property sector challenges continue to weigh on demand and confidence.

Continued economic weakness has impacted China’s labour market. Particularly, the unemployment among the youth reached 21.3 percent in June 2023, up from around 10 percent in 2018. Exports, a key driver of growth, has been languishing. Exports contracted by 4.6 percent in 2023. There are concerns about the Chinese government’s debt and deficits, prompting the credit rating agency Moody’s to issue a negative outlook on the government’s financial health.

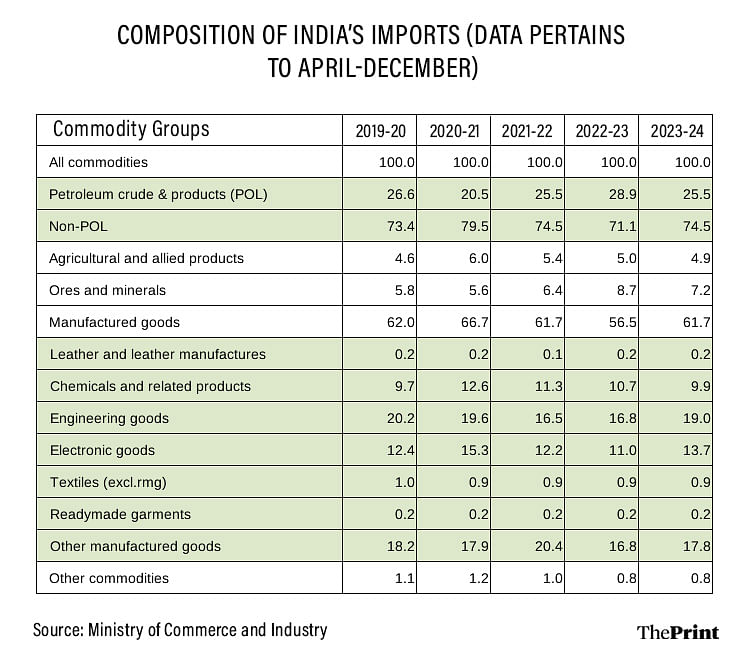

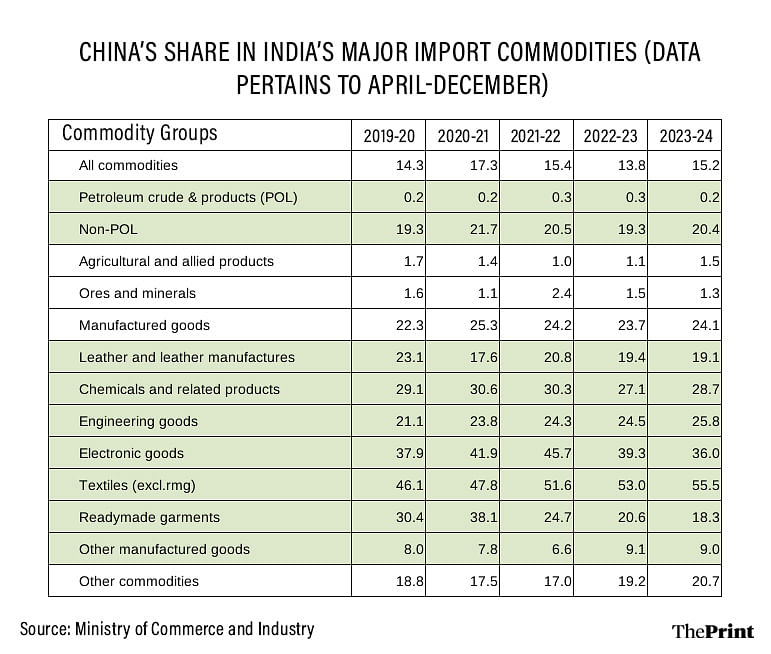

Despite the multiple challenges, China continues to remain a major trading partner for many countries, and India is no exception. Roughly 15 percent of India’s imports are sourced from China.

Among the manufactured goods, India is a significant importer of chemicals and related products (including pharmaceuticals), engineering goods and electronic goods. And, for these commodity groups, a sizable chunk of imports are sourced from China.

As an example, more than 25 percent of our imports of engineering goods are from China. China accounts for almost 30 percent of our imports of Chemicals and 36 percent of our imports of electronic goods. India needs intermediary goods to fuel its expansion. While in the medium term, India can hope to cut its reliance on China through structural reforms, in the short-term, it needs the steady supply of raw materials to fuel the manufacturing sector. China is also a big market for India’s exports-featuring amongst the top four markets for India’s exports. In this context, China’s growth weakness may not be good for India.

Disruptions on Red Sea & impact on trade, corporate sector

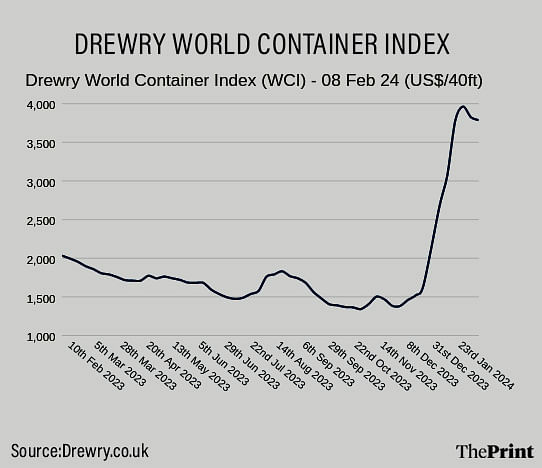

Owing to the crisis in the Red Sea, freight charges have escalated as containers are re-routed through longer routes. An indicator of container freight rates, the Drewry World Container Index is currently 167 percent more than the average of the pre-pandemic rate. The sharp escalation in freight costs may eventually impact India’s exports and imports. Rise in freight cost could translate into higher import prices, spurring inflation pressures.

A study by India Ratings and Research Private Limited shows that sustained disruption in the Red Sea could impact cash flow position of companies, thereby resulting in increased borrowings. The impact would be more pronounced for sectors such as iron and steel, chemicals and textiles and small and medium enterprises.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: Uncertainty over food & oil prices — why India, like other countries, held its policy rates steady