In a widely expected move, the Reserve Bank of India’s Monetary Policy Committee (MPC) kept the policy rate unchanged at 6.5 percent for the sixth time. The MPC also decided to retain the stance at withdrawal of accommodation to ensure that inflation aligns with the target, while supporting growth.

The decision seems to be prudent in light of the uncertainty on the food inflation outlook, volatility in oil prices amid the geo-political disruptions and the resilient domestic growth. Globally also while inflation has edged down, rate cuts by central banks do not seem to be on the radar in the short-term.

Status quo on rates by global central banks

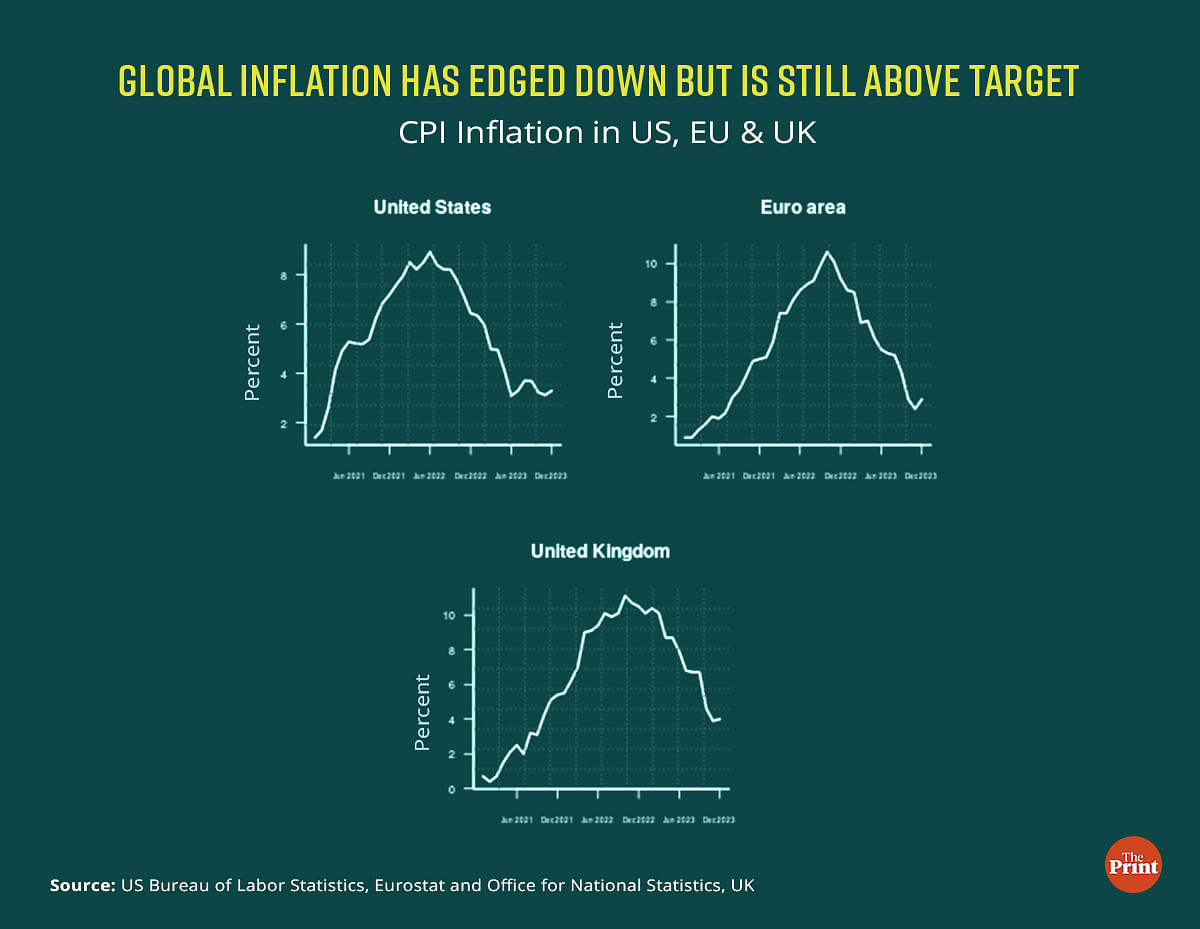

At the recent monetary policy meetings, most of the global central banks have held the policy rate steady. Though they acknowledge a considerable easing in inflation since the highs of 2022, it still remains above the target.

For instance, the US Federal Reserve in its meeting held in January indicated that it is done raising interest rates but made it clear that it is not ready to start cutting. The rate setting panel of the Federal Reserve, the Federal Open Market Committee (FOMC) stated that it will not be appropriate to reduce the target rate until there is greater confidence that inflation is moving sustainably towards the 2 percent target. The Committee also signalled that a rate cut in March is unlikely.

The Bank of England’s MPC also voted to maintain the policy rate unchanged at 5.25 percent with a majority of 6-3. Interestingly, there was a dissent to increase as well as reduce interest rate. Two members preferred to increase the policy rate by 0.25 percentage points, to 5.5 percent. One member preferred to reduce the policy rate by 0.25 percentage points, to 5 percent.

Inflation in the UK has eased from a peak of 11 percent in October, 2022 to 4 percent in December 2023 but is still above the target. Similarly, the European Central Bank (ECB) decided to keep its key interest unchanged in its latest review of monetary policy and decided to keep the rates unchanged for as long as necessary to bring inflation back to the 2 percent target.

Domestically inflation outlook is still uncertain

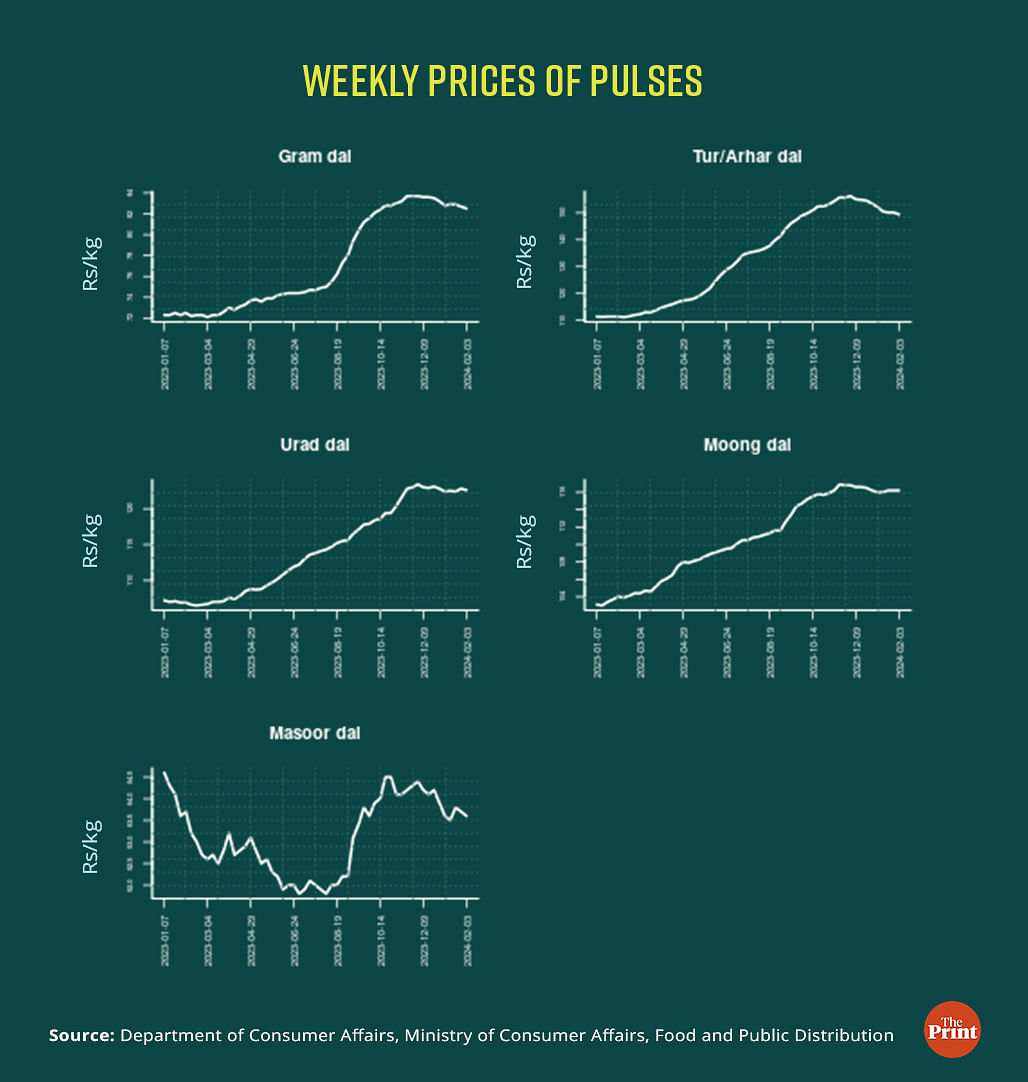

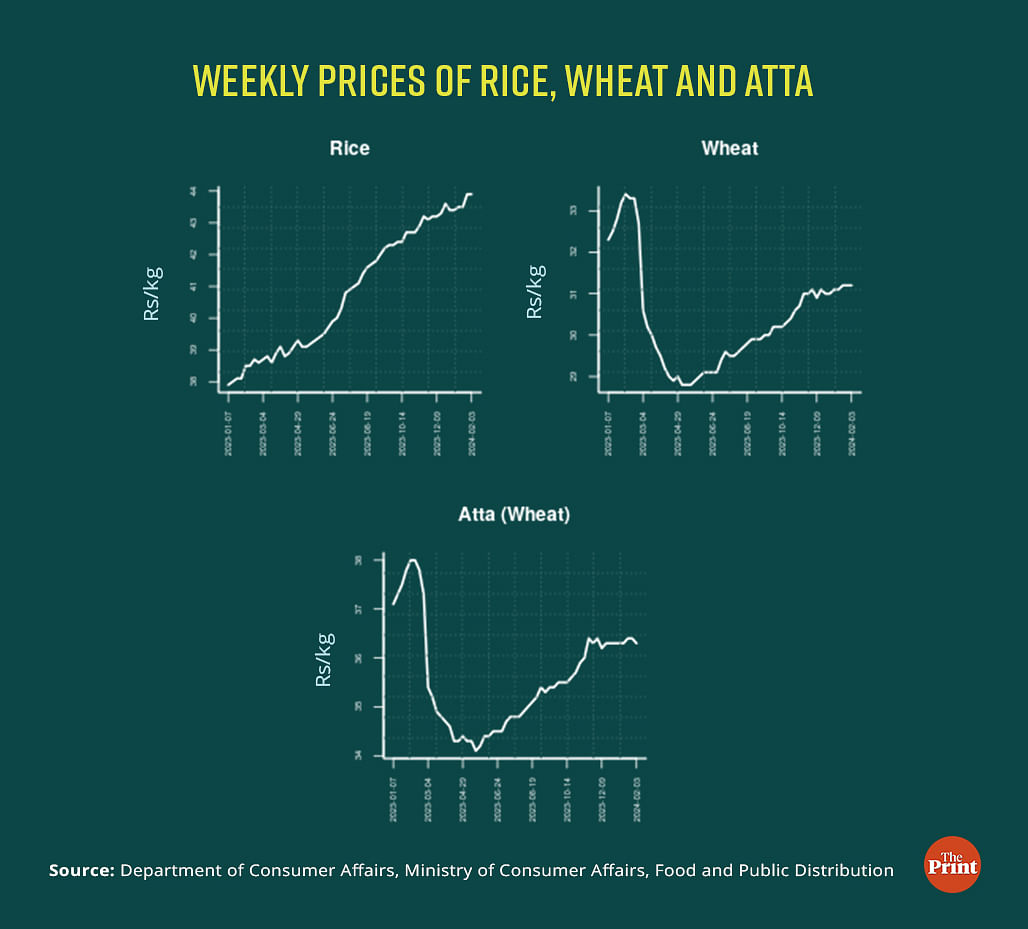

Premature easing is not warranted as domestic inflation trajectory continues to remain uncertain. After easing to 4.9 percent in October, inflation edged up in November and December, driven by elevated food prices. While sowing of Rabi crops has improved with acreage of wheat and oilseeds exceeding the last year’s level by 0.7 percent and 1.1 percent, respectively, considerable uncertainty still persists on the food inflation trajectory owing to adverse weather conditions.

While there is a seasonal moderation in vegetable prices, the prices of cereals and pulses still remain elevated.

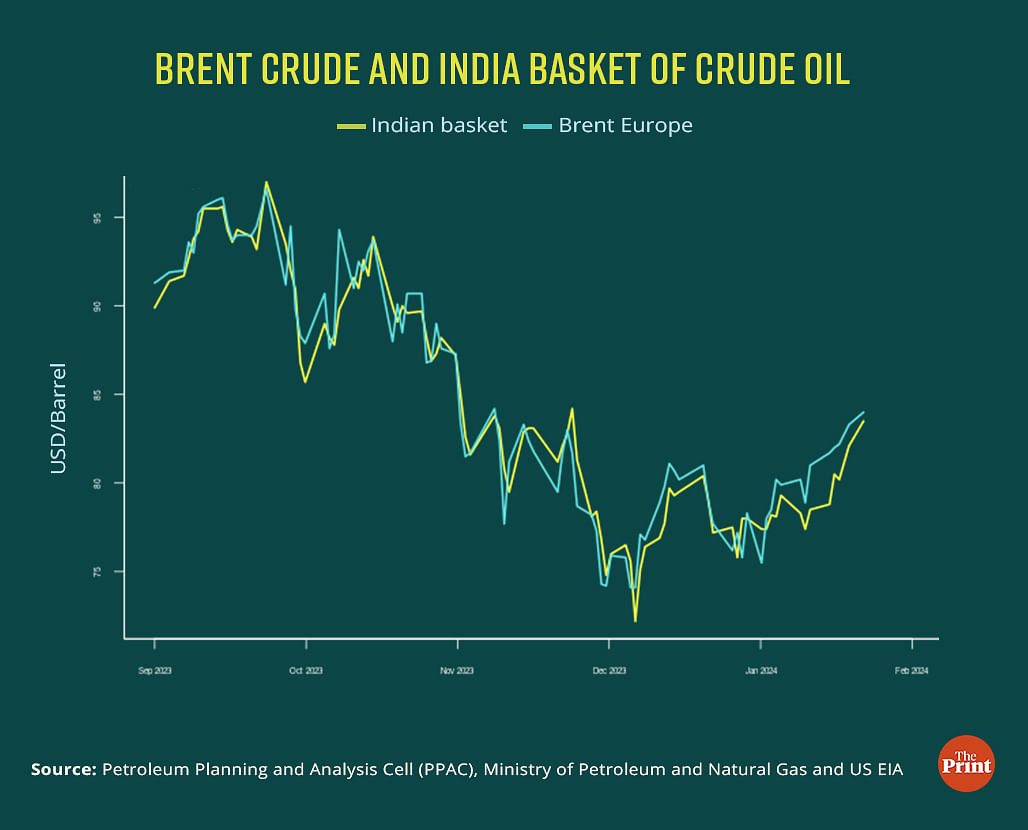

Recent disruptions on the geopolitical front also pose an upside risk to inflation, even though the non-food, non-oil inflation continues to remain benign. Global crude oil prices have inched up in recent weeks amid stronger US growth and signs of Chinese stimulus boosting demand conditions. Military attacks by the US in the Middle-East have also led to an uptick in oil prices. These conditions warrant a continuous vigil on inflation.

For the current year, the projection for inflation is left unchanged at 5.4 percent. For the next year, inflation is projected to moderate to 4.5 percent assuming a normal monsoon.

Withdrawal of accommodation keeping the overnight rates above the repo rate

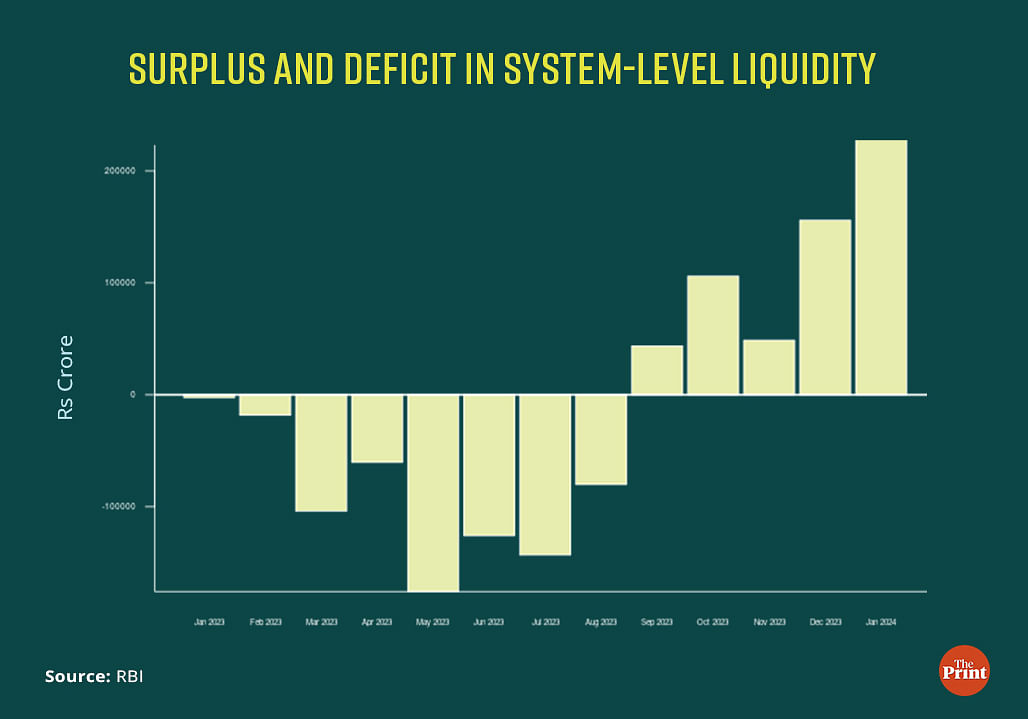

While the policy rate is at 6.5 percent, the overnight rate or the weighted average call rate has been hovering closer to the upper end of the Liquidity Adjustment Facility (LAF) corridor. This was because the liquidity in the banking system has been in the deficit mode since September. Subdued government spending and slower deposit growth compared to growth in credit contributed to the system-level deficit. While the RBI did conduct variable rate repo auctions (VRR) to help ease the deficit, the system-level liquidity still remained in deficit.

GRAPHIC: Surplus and deficit in system-level liquidity

In the first week of February, post the budget, the liquidity deficit dropped due to pick up in government spending. This led to a drop in the weighted average call rate. The RBI undertook Variable Rate Reverse Repo (VRRR) auctions to drain out liquidity. This implies that the RBI would like to maintain a system-level deficit and is comfortable with call rates remaining above the repo rate, but may not be happy with the call rate inching below the repo rate.

Government’s aggressive fiscal consolidation roadmap bodes well for the conduct of monetary policy

Elevated public debt, particularly in advanced economies, could weigh on global growth prospects. Particularly, for advanced economies, the gross debt to GDP is likely to be above 100 percent in 2024. In an environment of high interest rates, this could raise debt sustainability concerns, could emerge as a new source of financial stress and complicate the task of monetary policy.

India’s commitment to lower its fiscal deficit to 5.1 percent of GDP next year and to 4.5 percent of GDP in FY 2025-26 bodes well for reduction in debt. In a scenario where the government is focussed on fiscal consolidation, monetary policy can focus on inflation management without worrying too much about lax fiscal policy induced expansion in demand.

Radhika Pandey is associate professor and Madhur Mehta is a research fellow at the National Institute of Public Finance and Policy (NIPFP)

Views are personal.

Also read: What to expect from interim budget? Big tax breaks unlikely, welfare schemes could see boost