Finance Minister Nirmala Sitharaman will present the interim budget for financial year 2024-25 on 1 February. The interim budget is necessary for authorisation of expenditure, and provides an initial outlook for the next fiscal. After the formation of the new government, a full Budget will be presented in July.

The interim budget is likely to maintain focus on fiscal consolidation along with a thrust on capital expenditure, although at a moderated pace.

The first advance estimates of GDP for the current year indicated a slowdown in consumption, and warrant budgetary support to boost consumption, but the government will likely wait for the full budget to announce significant changes to the taxation regime.

Nevertheless, the existing welfare schemes could see enhanced budgetary allocation to support the weaker segments of the economy.

Focus on the path of fiscal prudence

One key variable of interest would be the government’s fiscal consolidation roadmap.

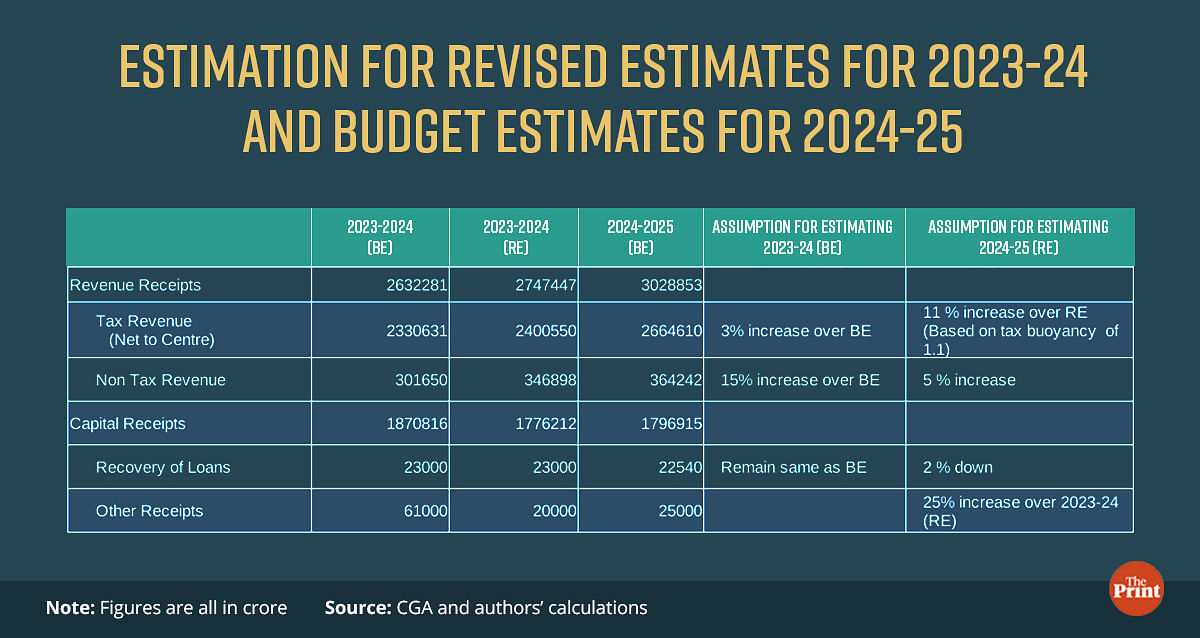

The interim budget may peg the fiscal deficit at 5.4 percent of the GDP. For FY24, the government had budgeted the fiscal deficit at 5.9 percent of the GDP. Despite a lower nominal GDP growth of 8.9 percent as against the budgeted 10.5 percent, the government is likely to meet its deficit target owing to buoyant direct tax collections, better-than-expected non-tax revenues, and expenditure savings by some ministries.

The government has committed to reduce its fiscal deficit to 4.5 percent of the GDP by 2025-26. This would require an aggressive 1.4-percentage-point reduction in fiscal-deficit-to-GDP ratio in the coming two years. Such an aggressive fiscal consolidation seems difficult and would require a nominal GDP growth of around 15-16 percent.

Alternatively, it could entail aggressive expenditure cuts, which may not be desirable at a time when domestic consumption is weak and the economy is subject to multiple global headwinds.

Also Read: Manufacturing, investment drive India’s FY24 growth estimate, but consumption needs to rebound

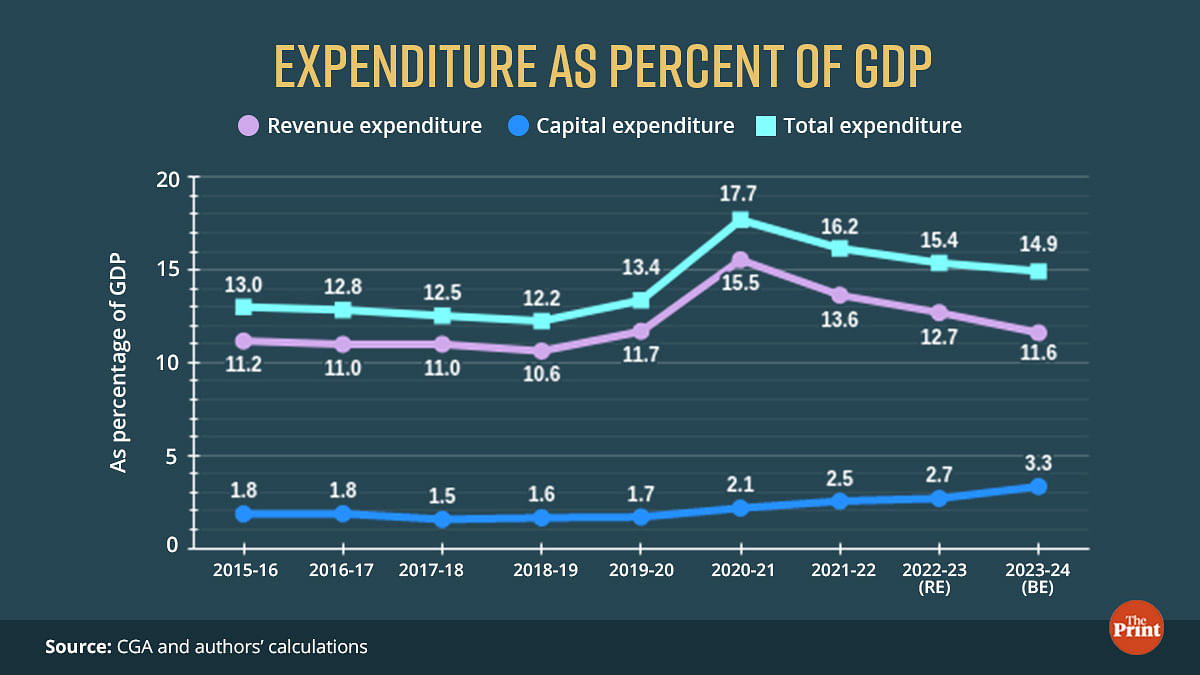

Focus on public capex to continue albeit in moderation

The focus on capital expenditure is likely to continue. In FY24, capital expenditure was budgeted to grow by 37 percent over the Revised Estimates of FY23.

While the support in the form of public capex is likely to continue, its rate of growth may see a moderation. Capex may be budgeted to grow in the range of 12-15 percent in the next year. With a 15 percent growth, the government’s capital expenditure could be pegged at Rs 11.5 lakh crore. A part of the overall capex could involve extension of interest-free loans to boost the capital expenditure of states.

In addition to the aggregate level of capex, the composition of capital expenditure, i.e. the allocation of budgetary resources for capital spending, to various sectors is an equally pressing policy question. Greater flow of resources to defence for purchase of armaments may not be growth enhancing. Similarly, greater allocation of capex for railways may not lead to a significant multiplier impact on growth.

Direct tax collections could see healthy growth next year

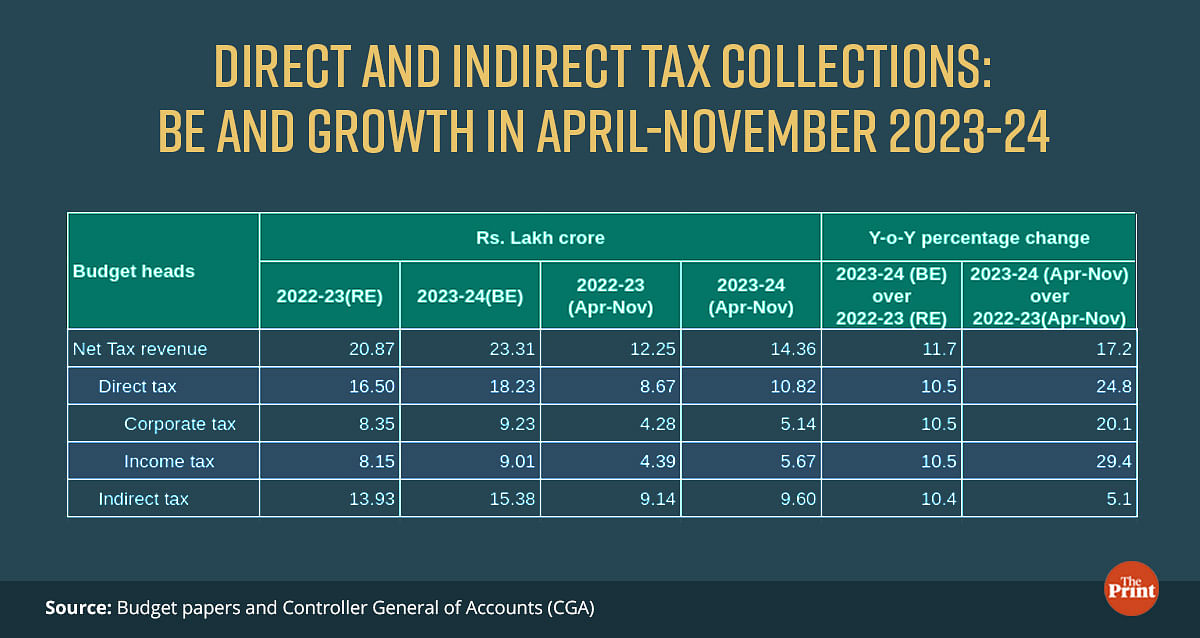

Recent trends show that the government’s direct tax collections are running far ahead of Budget Estimates. Against a budgeted growth of 10.5 percent in FY 24, in the period till November of the current year, direct tax collections have grown by almost 25 percent.

Both income and corporate tax collections have witnessed growth of above 20 percent in April-November.

However, indirect tax collections grew by just 5 percent against the budget estimate of 10 percent. Overall, net tax collections have grown at 17 percent against the budgeted 11.7 percent.

Going by the current trends, the net tax revenues are likely to surpass the Budget Estimates by 3 percent. For the next year, the government could budget 11 percent growth over the Revised Estimates.

In contrast, the disinvestment receipts present a dismal picture. As against a budgeted estimate of Rs 61,000 crore, the government has managed to garner around Rs 12,000 crore. The Revised Estimates for the current year could at best reach Rs 20,000 crore. Given the consistent under-performance of the disinvestment receipts, the Budget for next year may likely allocate a more realistic target for disinvestment receipts.

Higher spending on rural & farm sector to augment revenue spending

The government’s subsidy bill for the current financial year stood at Rs 3.74 lakh crore. Additional allocation for food, fertilizer and petroleum subsidies through supplementary demand for grants led to an increase in the overall subsidy bill to Rs 4 lakh crore. The next year could also see a similar allocation for subsidies. Higher allocation for food subsidy could be offset by lower spend on fertilizer subsidy as global commodity prices are likely to remain soft in the coming year.

There could be higher allocation to support the distressed rural and farm sector. Overall, the government’s revenue expenditure could see an increase of 6-7 percent in the coming year.

Will the government loosen its purse strings?

The finance minister has already stated that the interim budget will not have any spectacular announcements. But the overall performance of the revenue and expenditure position does give some scope to the government to enhance spending on some of the existing welfare schemes that could make voters happy.

The interim budget could continue its focus on low-cost housing. The Budget for FY24 enhanced the allocation for its flagship housing scheme, Pradhan Mantri Awas Yojana, by a massive 66 percent to Rs 79,000 crore. The focus is likely to continue in the interim budget.

There could be enhanced allocation on the rural jobs guarantee scheme. The allocation could be enhanced from Rs 60,000 crore to cushion the distress in the rural economy. The cash handouts under the Pradhan Mantri Kisan Samman Nidhi programme could also be enhanced from Rs 6,000 to Rs 8,000.

Some tweaks are also expected in the government’s flagship Production-Linked Incentive Scheme (PLI). The incentives could be expanded for sectors that have employment-generating potential and those relating to green technologies.

Radhika Pandey is associate professor and Rachna Sharma is a fellow at National Institute of Public Finance and Policy, New Delhi. Views are personal.

Also Read: High debt burdens and dependence on Centre — the unique fiscal constraints of northeastern states