States’ reliance on market borrowing has increased over the past few years. States now account for nearly a third of the overall borrowings of the government (central and state governments).

In the coming years, market borrowings by states are likely to rise further. However, there is wide variation across states, with some states accounting for a greater proportion of the total borrowings by states year-by-year. On the other hand, there are states whose stock of debt as a share of their size of the economy has been worrisome. Most of the northeastern states feature in the latter category.

While there is a discussion on the states’ fiscal health in general, a more detailed look at the finances of the northeastern states would be desirable, as these states face unique fiscal constraints.

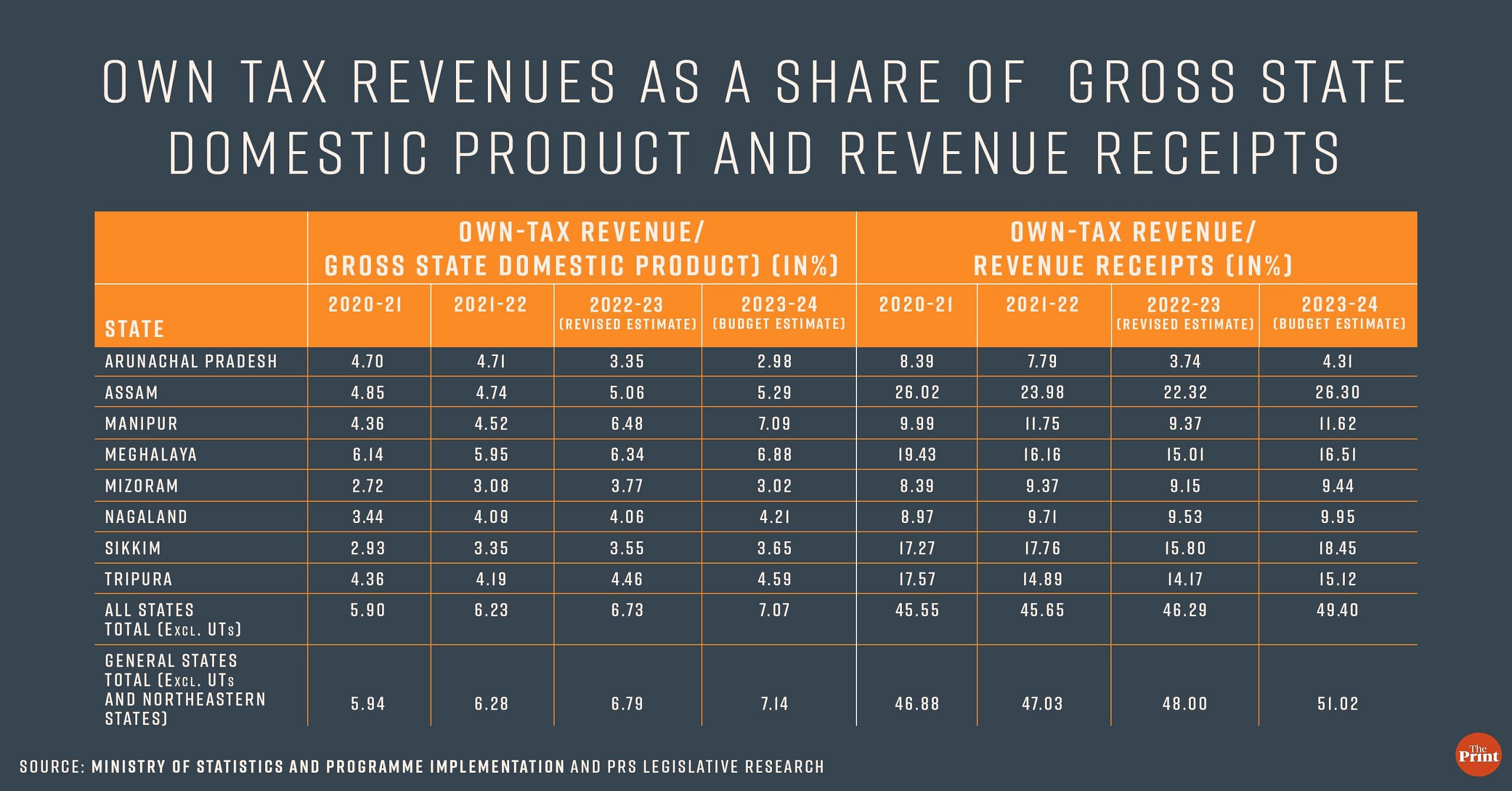

Their own tax revenues as a share of gross state domestic product (GSDP) are seen to be lower than that of the other states and they are heavily dependent on transfers from the central government. A look at their state of finances and their evolution over time would help in assessing the efficacy of fiscal transfers and in designing appropriate instruments for supporting the states with limited fiscal capacity.

Outstanding liabilities as share of GSDP

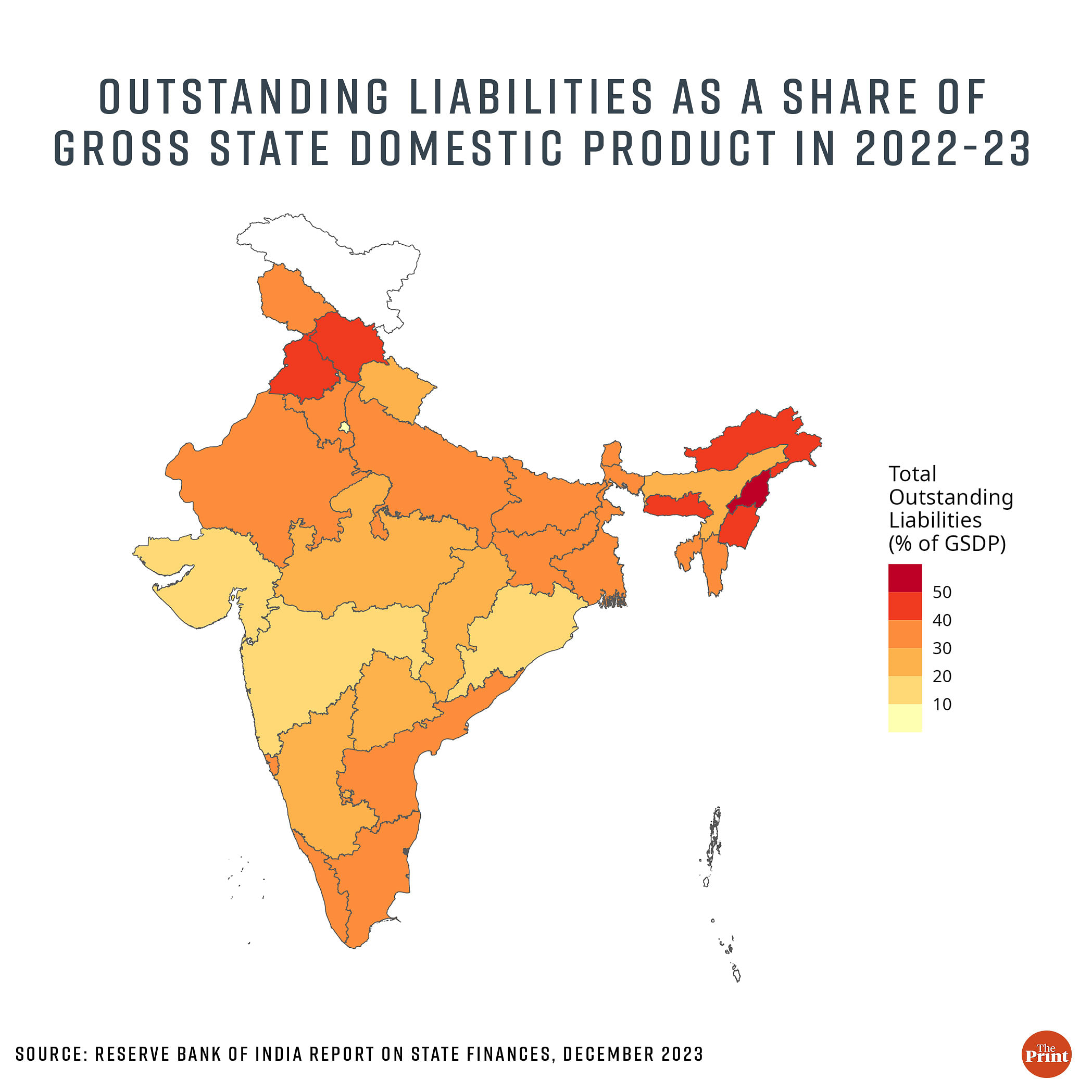

A look at state-wise total outstanding liabilities as percentage of GSDP shows that northeastern (NE) states feature amongst the most indebted states. The map below shows the outstanding liabilities as a share of GSDP for 2022-23.

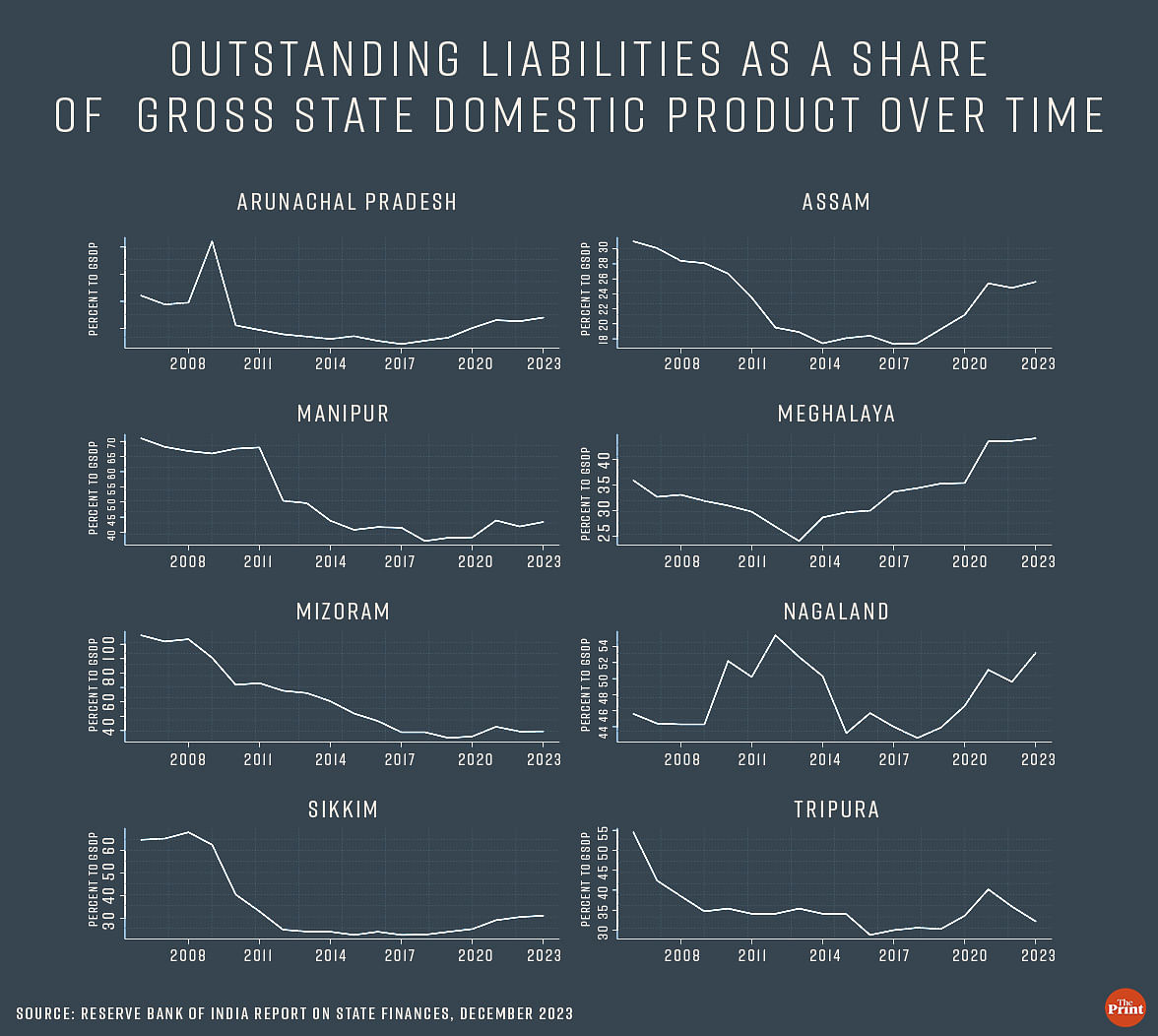

Looking at a longer time frame, while some of the NE states have managed to lower their liabilities as a share of GSDP, states like Meghalaya and Nagaland have seen an increase in their outstanding liabilities as a share of GSDP.

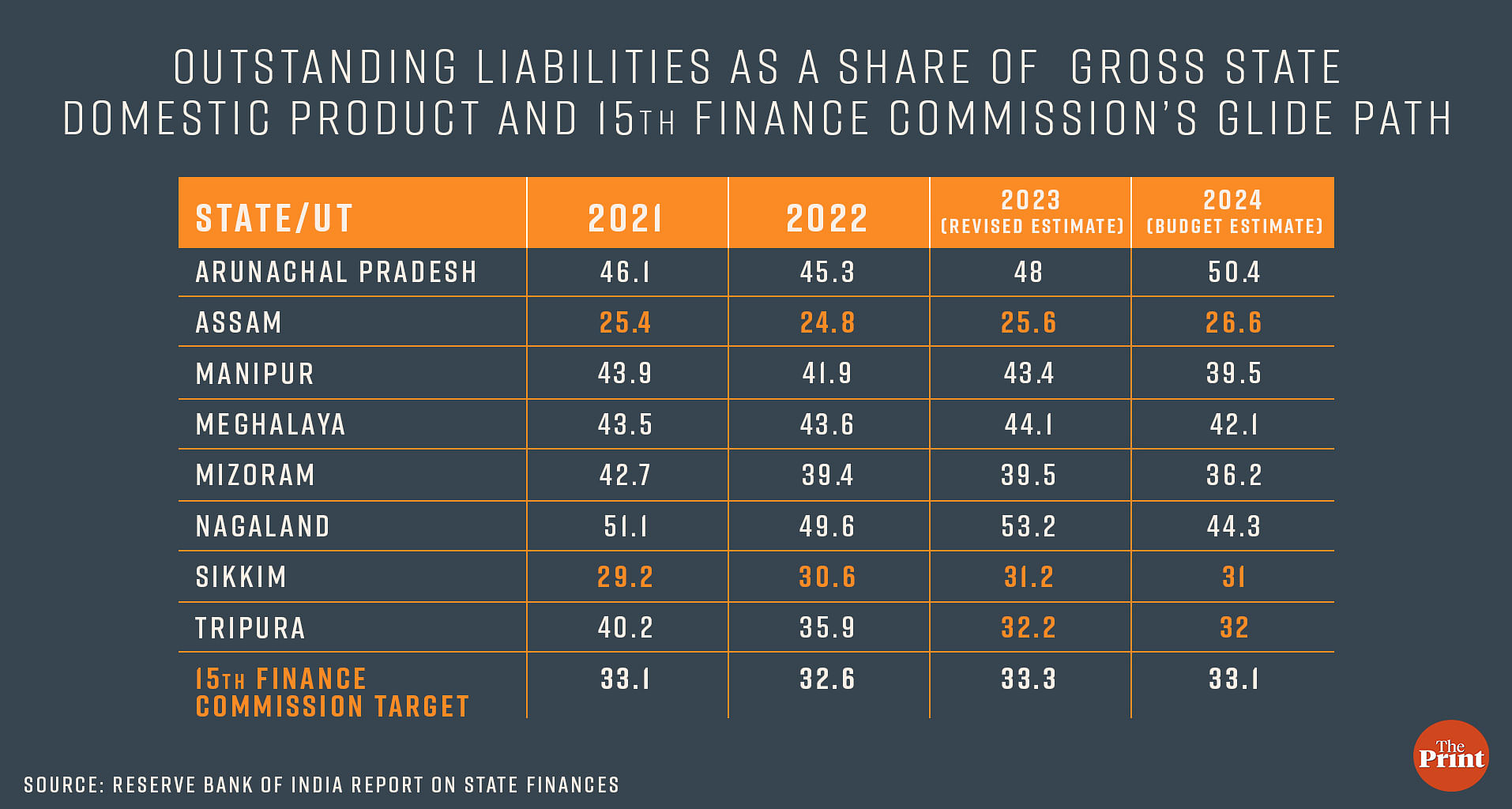

Further, some of these states have deviated from the path of debt reduction laid out by the Fifteenth Finance Commission. The figure below shows that with the exception of Assam, Sikkim and Tripura (for some years), the other northeastern states have deviated from the course of debt reduction laid out by the 15th Finance Commission. These states need to bring down their debt burden in line with the 15th Finance Commission’s recommendations and with their amended fiscal responsibility legislations.

Lower own tax revenues & high dependence on Centre

The own tax revenue to GSDP ratio for northeastern states is far lower than the average of general states. While there is a scope for raising their own tax revenues, the structure of their economies characterised by dominance of agriculture, mining and forestry limits the scope for enhanced revenue generation. Further, growth is volatile as it is driven by mining and forestry.

These states also need to ensure that growth does not result in unsustainable exploitation of natural resources. The industrial sector that has the potential to augment states’ own revenues is weak in these states due to high cost, unfavourable topography, and internal conflicts. This explains the constraints on fiscal capacity and the excessive dependence on the Centre for transfers.

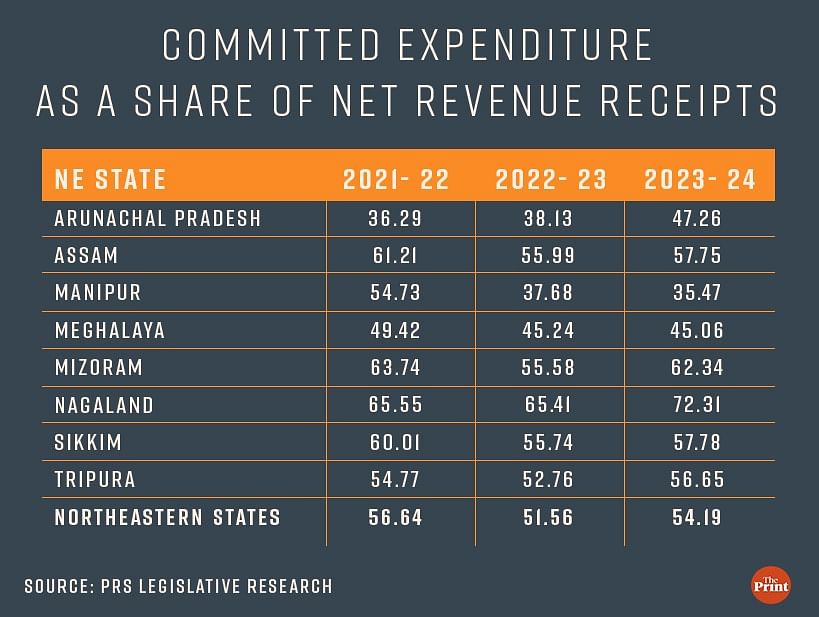

High committed expenditure

Committed expenditure is the sum of expenditure on salaries, pension and interest payments. The northeastern states incur a higher proportion of their expenditure on committed expenditure.

For instance, in the current year, Mizoram is expected to spend 63 percent of its revenue receipts on committed expenditure out of which 40 percent of revenue receipts is estimated to be spent just on salaries.

In Nagaland, 72 percent of revenue receipts is to be spent on committed expenditure in the current year. A higher share of committed expenditure limits the ability of states to spend on capex. As an example, in Nagaland, capital outlay in the current year is expected to contract by 42 percent over the previous year.

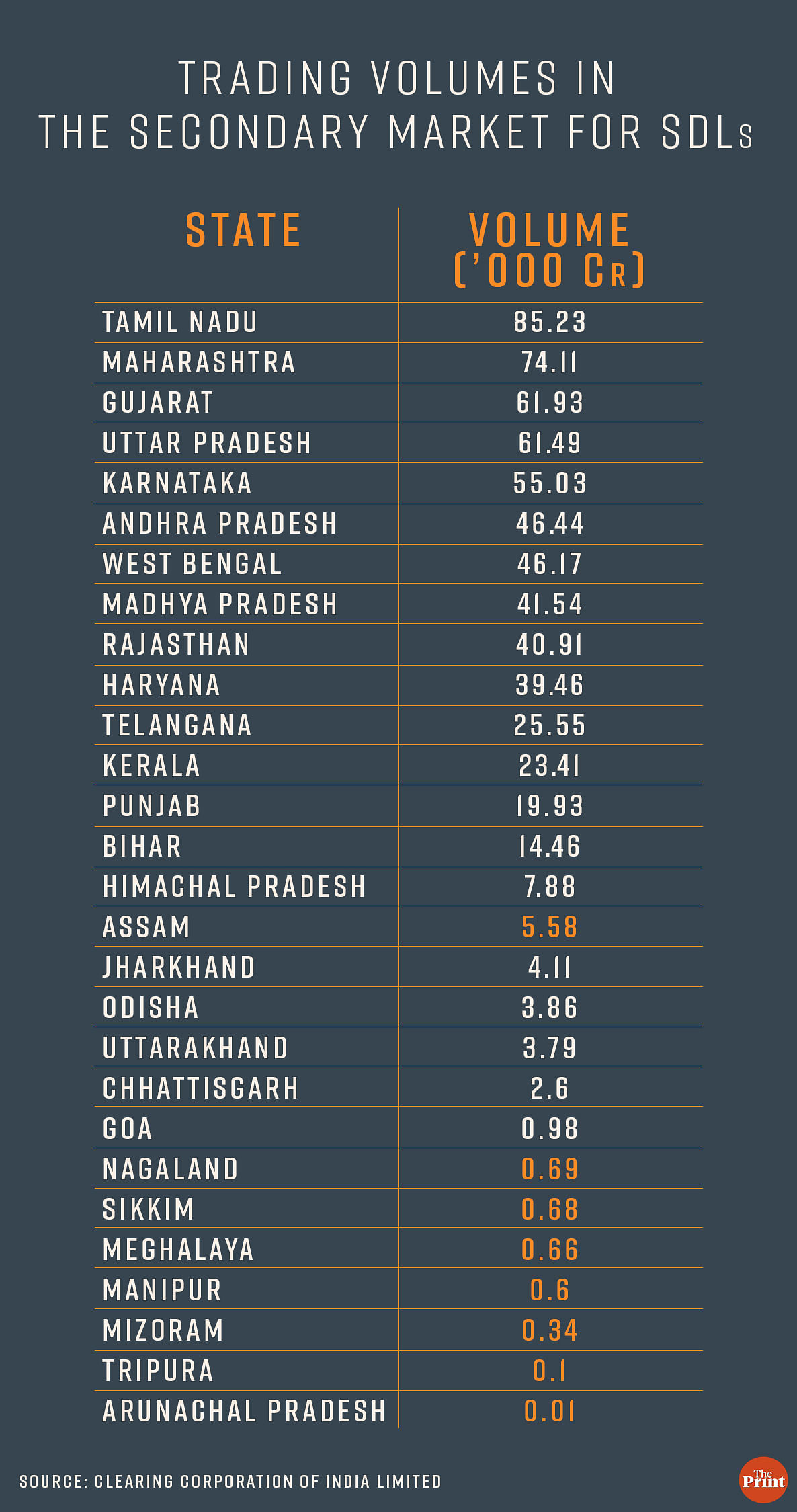

Market infirmities: Lower trading volumes

In general, the secondary market for state development loans (SDLs) is characterised by lower trading volumes. The share of SDLs in the overall government securities market is between 5-6 percent.

Within the SDL market, there is significant disparity across states.

In the previous financial year, the securities issued by Maharashtra, Gujarat and Tamil Nadu accounted for a significant proportion of trading.

The securities issued by northeastern states in particular witnessed sparse trading volumes. This implies that investors have little appetite for the securities issued by northeastern states. Most of the securities of these states are thus held till maturity with very little trading. While there is a considerable variation in the trading volumes, the yields do not capture the difference in states’ fiscal health and debt sustainability.

The ownership pattern of SDLs could explain the relative illiquidity in the secondary market. Most of the state bonds are held by insurance companies and mutual funds who prefer to hold these securities till maturity on account of the higher returns offered by them.

Addressing these market deficiencies will go a long way in inducing fiscal discipline and reducing the debt burden of states.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: Manufacturing, investment drive India’s FY24 growth estimate, but consumption needs to rebound