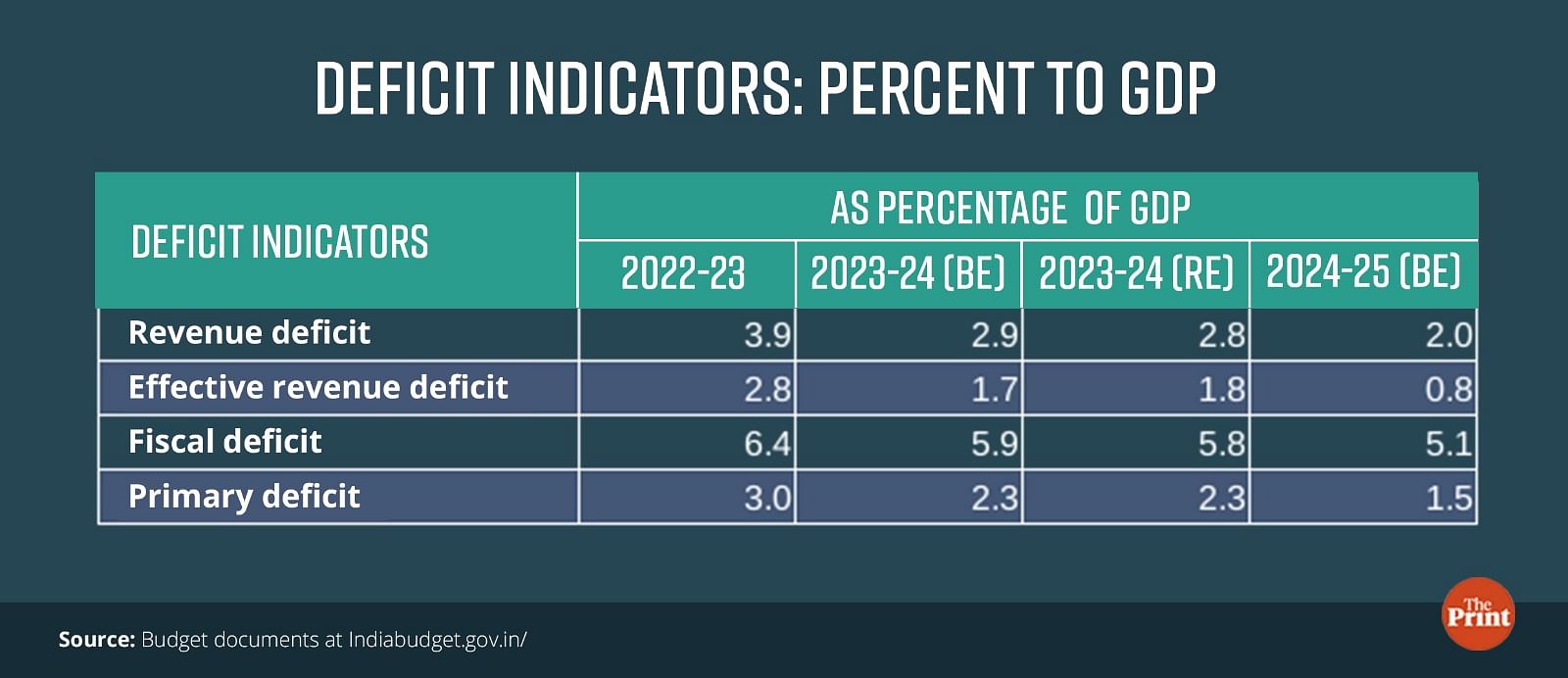

Finance Minister Nirmala Sitharaman announced a responsible budget with no major populist announcements ahead of the general elections. The FM stuck to the theme of fiscal discipline with a lower-than-expected fiscal deficit target of 5.1 percent for the next financial year. For this year as well, the government did better than the budgeted 5.9 percent fiscal deficit.

The focus on fiscal prudence assumes importance in light of India’s elevated liability profile. The government’s total liabilities are estimated to be at an elevated level of 56 percent of GDP in FY 2024-25.

Despite the upcoming elections, the thrust on fiscal discipline cheered the bond markets. The focus on fiscal discipline is particularly welcome at a time when India’s sovereign bonds are set to be included in the global bond indices.

No major sops or transfers were announced for the rural and the farm sector. But the allocation for the rural jobs guarantee scheme has been enhanced by Rs 26,000 crore as a cushion towards rural distress.

Also read: What to expect from interim budget? Big tax breaks unlikely, welfare schemes could see boost

Thrust on capital expenditure with an overall compression in size of budget

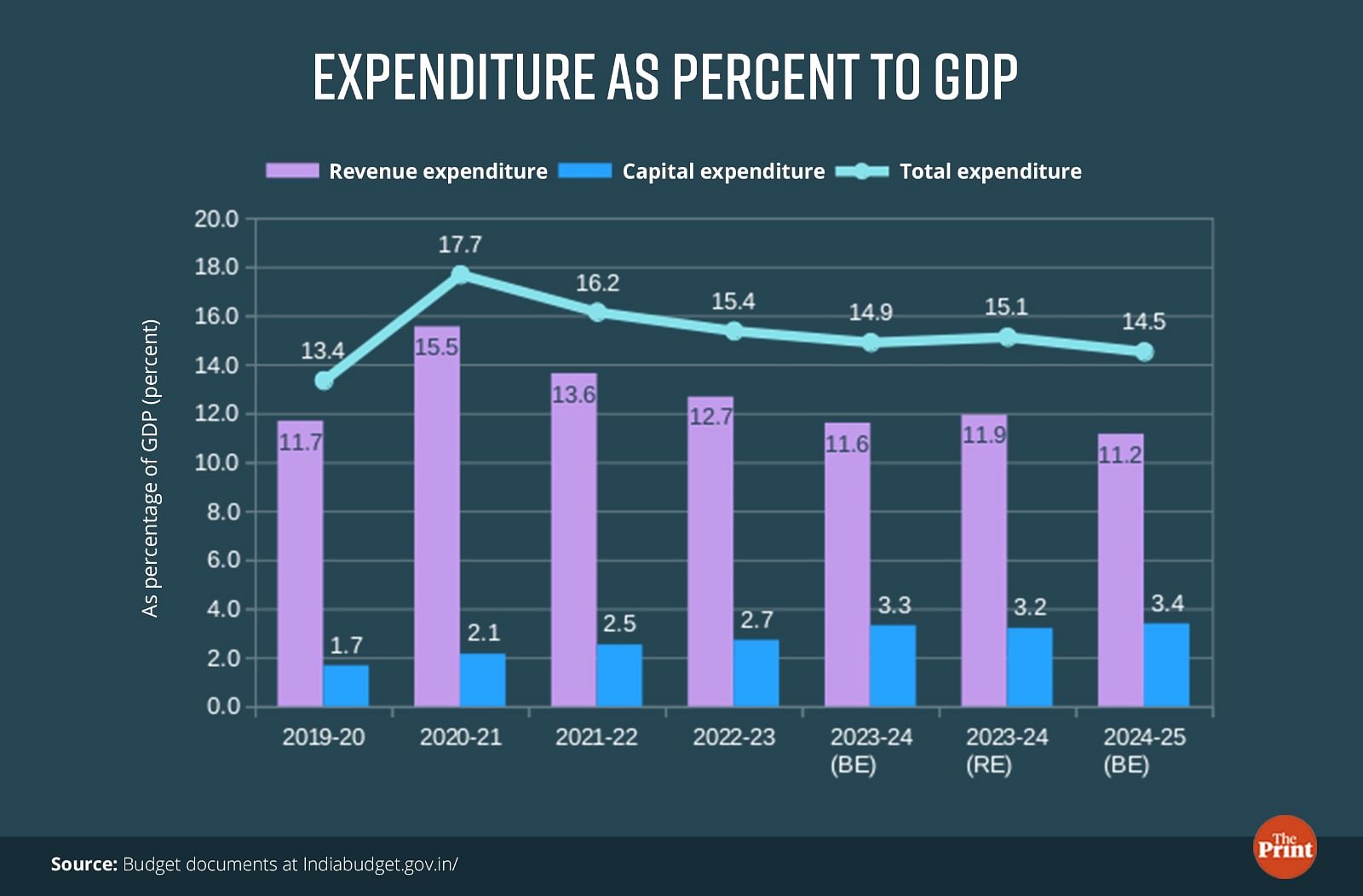

The government continued its focus on capital expenditure in the interim budget. The capital expenditure for next year is pegged at Rs 11.11 lakh crore. The scheme of 50-year interest free loans for supporting capital expenditure by states will also be continued with an unchanged outlay of Rs 1.3 lakh crore.

The revised estimates for the current year fall short of the budgeted capex by roughly Rs 50,000 crore. In absolute terms, the fiscal deficit this year is lower by Rs 52,000 crore. This is primarily on account on reduced expenditure on capex by roughly the same amount. The capital support to oil marketing companies budgeted this year has been deferred to the next year. The scheme for support to states in the form of 50-year interest free loans also did not see full utilisation, resulting in savings on capital expenditure.

The capex for the next financial year is expected to grow by 17 percent over the revised estimates of the current year. Achieving the budgeted scale of capex is achievable but could be challenging given the under-achievement this year.

The ratio of capex to GDP increased to 3.4 percent from 3.2 percent as per the revised estimates of this year, with focus on sectors such as railways and defence. Correspondingly, the share of total expenditure and revenue expenditure in GDP has declined from revised estimates of the current year.

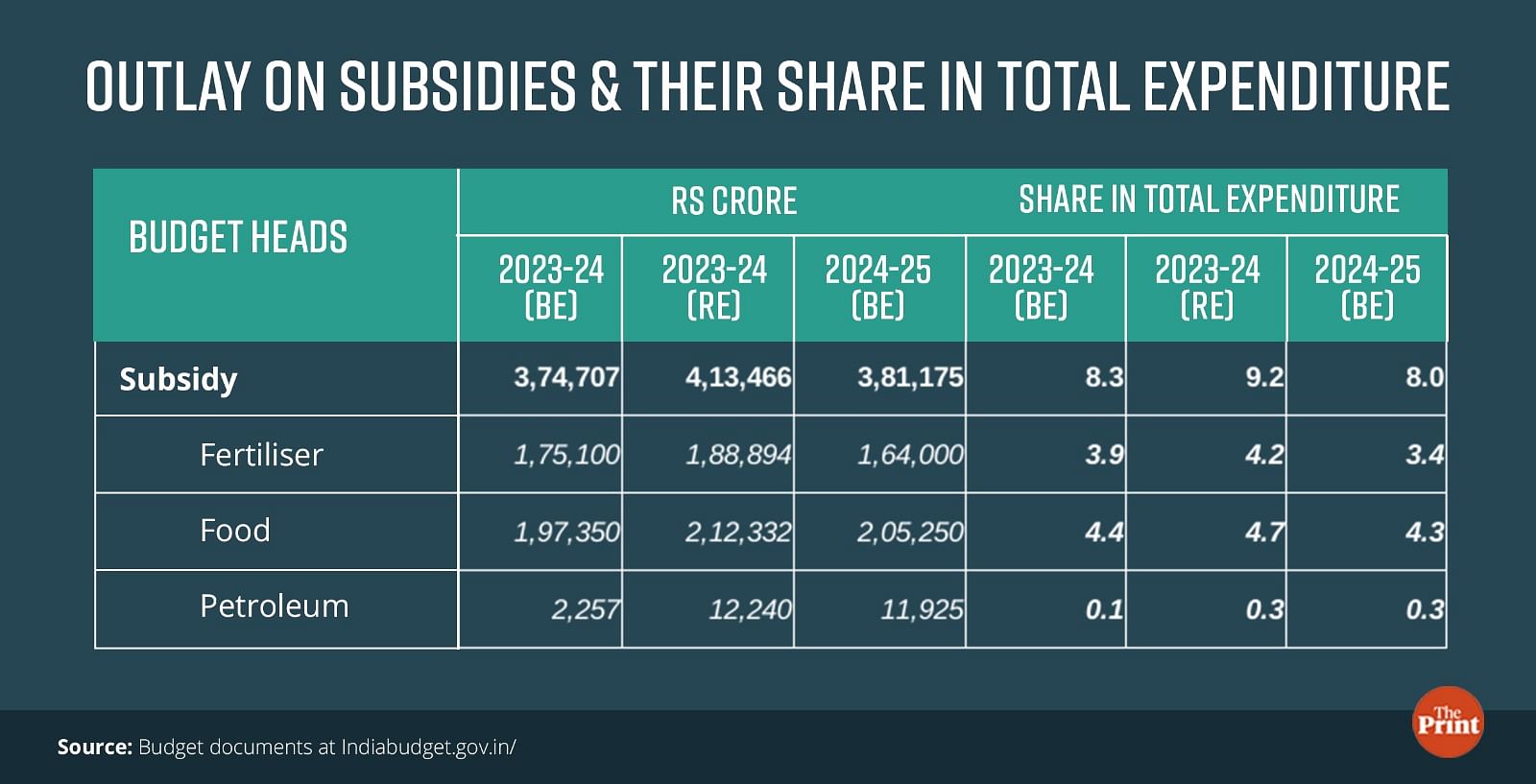

Revenue expenditure: Higher outlay on interest payments, marginally lower on subsidies

On the revenue expenditure front, the government spending exceeded the budgeted estimate for this year. This was expected on account of higher expenditure on food, fertiliser and petroleum subsidy. The total outlay on subsidies increased from the budgeted Rs 3.74 lakh crore to Rs 4.13 lakh crore in the revised estimates. The expenditure on interest payments was however lower than the budget estimate for the current year.

For the next year, the government’s revenue expenditure is budgeted to grow at 3.2 percent. The expenditure on subsidies is estimated to be marginally lower than the revised estimates of the current financial year at Rs 3.81 lakh crore. The allocation for food subsidy is still at an elevated Rs 2.05 lakh crore. This is on account of fluctuations in global prices and extension of the free food grain scheme.

Worryingly, the allocation for interest payment has been increased by Rs 1.35 lakh crore. As a result, in the next financial year, interest payments account for 25 percent of the total expenditure. The rise of interest payments is a worrisome trend and does not bode well for the overall quality of expenditure.

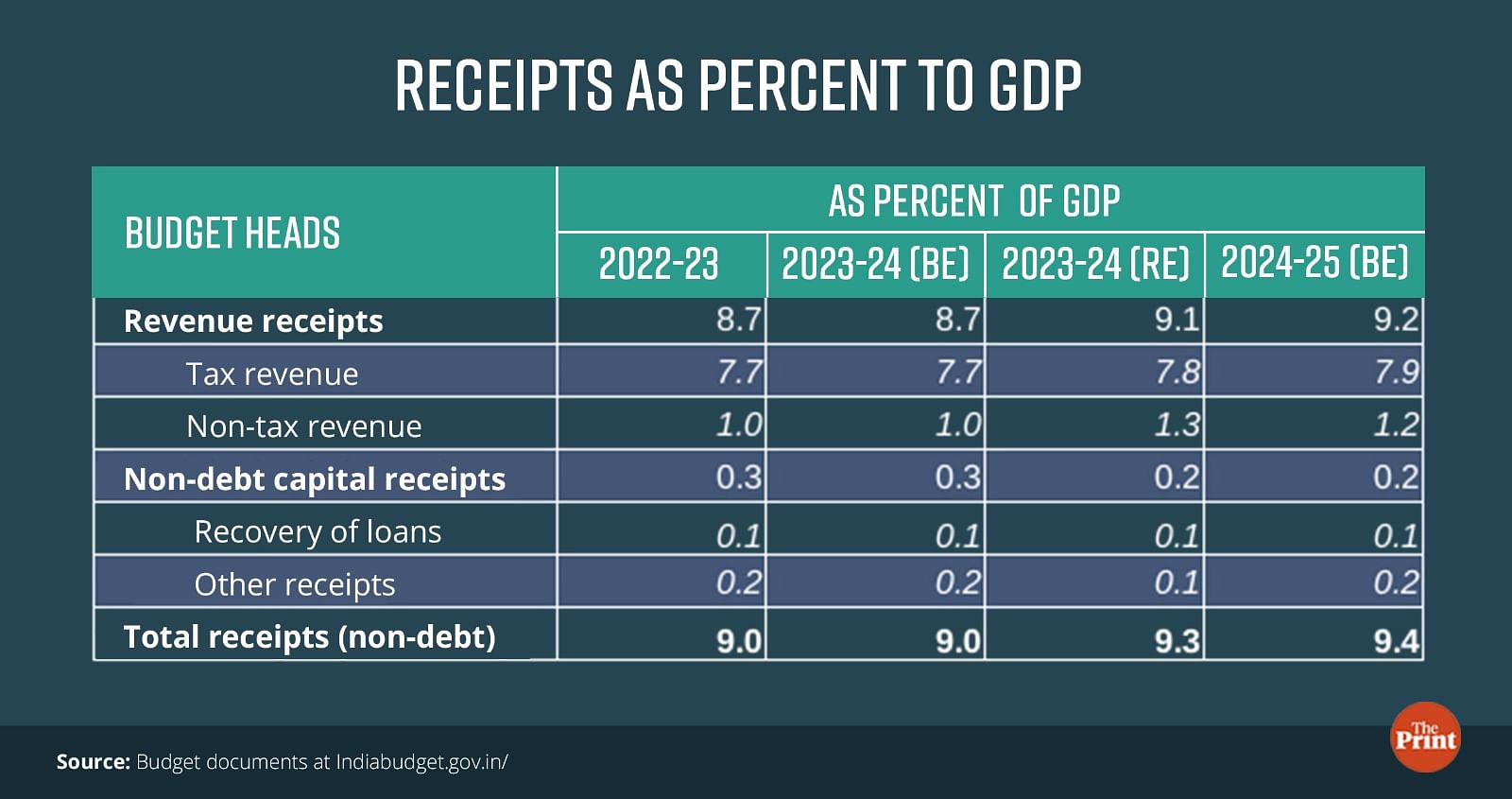

Tax receipts projections are reasonable but ambitious target set for disinvestment

In the current year, tax revenues were broadly in line with the budget estimates. While direct taxes did well, indirect taxes particularly excise and custom duties fell short of the budget estimates. For the next year, fiscal consolidation is to be aided by sharper growth in tax receipts. The gross tax revenues are estimated to grow at 11.5 percent with growth in both income and corporation tax pegged at 13 percent.

Similar to the current year, the earnings from dividends (a key part of the non-tax revenue) are projected at a robust Rs 1.5 lakh crore. A big part of this is the dividend expected from RBI and banks. In other words, the government expects the RBI to transfer healthy dividends this year as well.

Expressed as percent to GDP, the gross tax revenues are stable in the range of 11.6-11.7 percent while the net tax revenues constitute 7.8-7.9 percent of GDP.

The government has again set an ambitious target for disinvestment at Rs 50,000 crore for FY 25. This is a massive 67 percent higher than the revised target of Rs 30,000 crore for this year.

Enhanced allocation for rural jobs scheme and thrust on housing

The government has expectedly enhanced the allocation on MNREGA from Rs 60,000 crore to Rs 86,000 crore for both current and next fiscal. Under PM Awas Yojana (Rural), 2 crore more houses are expected to be constructed beyond the initial target of 3 crore.

The FM also announced a housing scheme for the lower income urban population who stays in rented houses or slums. In addition to providing support to the lower income population, the focus on housing bodes well for employment generation and is also positive for ancillary sectors such as paints, aluminium and cement.

Radhika Pandey is associate professor and Rachna Sharma is a Fellow at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: High debt burdens and dependence on Centre — the unique fiscal constraints of northeastern states