As of late last year, official data suggested India was the fastest growing major economy in the world. But serious doubts have begun to emerge about the true state of the economy. The head of the government’s own think tank has expressed alarm at a liquidity crisis that he called “unprecedented in the last 70 years,” and analysts are debating the causes and depth of an ongoing economic slowdown.

Nobody was surprised earlier this month when the World Bank lowered its 2019 growth projection for India to 6 per cent from 7.5 per cent just four months earlier, and the IMF followed suit, dropping its 7 per cent forecast from July down to 6.1 per cent.

But given the state of affairs in India’s economy to date in 2019, the immediate question for the World Bank and IMF isn’t why they lowered their forecasts, but why they still remain so high.

The dramatic slump in non-GDP indicators

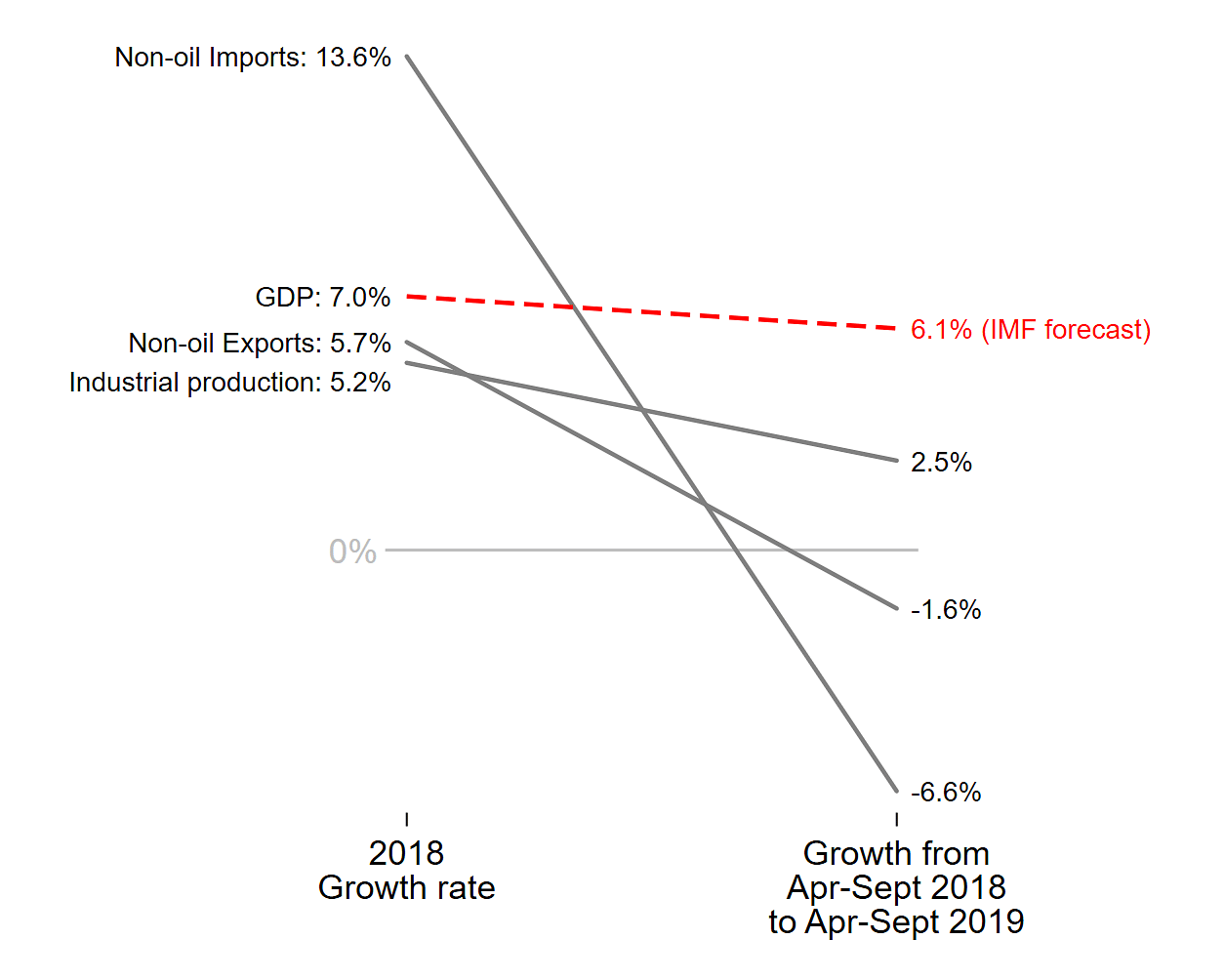

We looked at the growth of leading economic indicators from official Indian government sources for April to September 2019, which corresponds to the first six months covered by the IMF’s new forecast.

Several key indicators are not just slowing, but in absolute decline, including non-oil imports (-6.6 per cent in current dollars), non-oil exports (-1.6 per cent in current dollars), and the index of production of capital and infrastructure goods (-3.5 per cent up to August 2019).

Other indicators show positive growth, but far below the 6 per cent benchmark that the World Bank and IMF project for the economy as a whole: the aggregate index of industrial production is up just 2.5 per cent, the index of manufacturing output up just 2.1 per cent, and receipts from the goods and services tax are up just 1.6 per cent in real terms. Growth in toothpaste sales is slowing, car sales have declined for 11 consecutive months, and reports suggested declines in underwear sales.

India: IMF growth forecast versus early 2019 indicators

The IMF’s 2019 growth forecast for India looks optimistic given other key indicators for the first half of the fiscal year

The failure of GDP to track imports has been cited as evidence of manipulation of official growth rates, particularly in the case of China. A recent paper by John Fernald, Eric Hsu, and Mark Spiegel of the San Francisco Fed shows that the correlation between GDP and imports is higher in countries with better statistical systems (0.9 for the US), and that imports—which can be verified using the export data of third parties—are a better predictor of other leading economic indicators than is GDP in China’s case.

In India’s case it is not just imports, but also exports, industrial production, tax revenues, and the banking system all pointing in the same downward direction.

Also read: India’s economic slump is structural, not just cyclical

New data, new doubts

The latest indicators from April to September 2019 reinforce doubts about India’s official GDP that made a big splash in Delhi earlier this year.

In June, Arvind Subramanian, former Chief Economic Advisor to the government of India and our former colleague here at the Center for Global Development, published a Harvard working paper (and a follow-up paper) suggesting that technical changes in national accounts methodology in 2011 had led India to significantly exaggerate its official GDP growth rate ever since. Rather than 7 per cent growth from 2011-12 through 2016-17, Subramanian suggested the true rate might have been closer to 4.5 per cent. That discrepancy is, as they say, big, if true.

Official government of India sources dismissed Subramanian’s analysis out of hand, and some independent analysts have questioned whether the recent divergence of GDP growth from growth in other indicators was a sufficient basis to abandon the official figures. But other analysts have looked at the data and reached broadly similar conclusions as Subramanian. Whichever numbers you believe, the core mystery posed by Subramanian remains: How is India growing so fast if, as the government’s own statistics show, a long list of other major economic indicators have slowed or even reversed?

Also read: Trade deal or no deal, India’s economy needs systemic changes to stop under-performing

Any errors in India’s data are baked into IMF and World Bank forecasts

Suppose, just for the sake of argument, that Subramanian’s concerns are justified, and that actual growth has been considerably slower than reported growth. Wouldn’t independent analysis by the World Bank and IMF serve to ’fact check’ the government of India’s numbers?

It seems not.

The problem is that, rather than examining independent indicators of economic activity, the Bretton Woods’ forecasts appear to be based primarily on (a) extrapolation of the official growth figures, and (b) some subjective adjustment based on staff’s assessment of policy changes.

The details of the IMF’s growth forecast methodology are not publicly documented, but in response to a query, the IMF noted that the India forecast takes into account data from the first quarter of 2019—i.e., an official growth rate of 5 per cent—combined with the IMF staff’s assessment of recent policy moves, including more accommodating monetary policy from the Reserve Bank of India and a cut in the corporate income tax rate.

While reasonable on its face, this approach is extremely vulnerable when confronted with erroneous official numbers. If the growth series up to 2019 is mismeasured, then all those errors are going to be directly baked into the IMF forecast as well.

With trade volumes shrinking and indicators of real economic activity slowing to a crawl, it might be time for the IMF and World Bank to ask some harder questions. India no longer relies on the Bretton Woods institutions for any meaningful share of its financing needs, but if these DC institutions have one thing to offer Delhi, it should be an impartial, technically sound perspective on economic reality.

That reality suggests that Indian growth is in barely positive territory, while the IMF-World Bank forecasters appear too timid to tell the emperor he has no clothes—not to mention cars, toothpaste, or underwear.

Justin Sandefur is a senior fellow and Julian Duggan is a research assistant at the Center for Global Development (CGD), Washington DC. Views are personal.

This article has been published with permission from Center for Global Development.

https://www.moneycontrol.com/news/business/top-countries-with-the-highest-inflation-first-place-ahead-by-astronomical-margin-4451401.html

All big talks by some are baseless. In households when you run out of funds people go and sell their possessions like gold , copper vessels etc. Similarly Modi govt is selling off PSU’s left right and centre to augment funds for running the country. Rs. 72000 crores of NPA of captialist written off as bad debts. Ambani spends Rs 2 crore on his daughters wedding blouse but can’t repay the captial back to bank. At this rate the country cannot improve its GDP.

Babu,

Your figures & logic are absurd, lets start with your household, how much gold / copper have you sold? The rotting banking system which shows 72000 cr Npa will rise further because suppressed NPAs are now being declared. The IBC law brought by present govt has ensured repayment of 80,000 crores of NPAs. Mukesh Ambani has setup a strong business on strong principles, none of his loans are NPA, hope you are not aware of this fact. He did not spend 2 cr on his daughter’s wedding by over 200cr. It was his, taxpaid, legitimately earned money.

There is no real way to “analyse” a “modern” economy by using “data”. Data cannot “measured or gathered” using the methods which cannot help in any. Nobody knows anything what it is to be really “happy” and “healthy”. All these “economists” from “big” instituitions will simply base their analysis on what has been studied in the west and cannot make any allowance for our country. Obviously all these “theories ” are broken and outdated. The world is tickling itself by ignoring data fromour country by being jaundiced in its analysis.

The real reason for the so called MANDI in the Indian Market is because of the mind blockade of ordinary Indian consumer to spend his hard made official or white money. Barring the service class, the normal business community, big or medium or small, are habitually accustomed to spending in cash, normally unaccounted cash. An ordinary shopkeeper, earning 50/60 thousand per month, declares his income below 3 lakh, never pay tax, and this file money is never touched, only keeps increasing regularly. In the present scenario, with GST and requirement of PAN for various transactions, people are unable to spend their cash for high value transactions. Unable to deposit the cash in his bank account, as it is unaccounted. GST is not properly adhered to, go to any market, you will be given a choice of GST or NON-GST transactions, and why one will pay GST if the alternate is available, with benefit, and comfort of cash payment. How the GDP increase will reflect for the above transactions. A very very big amount of transactions go unreported, as they are done on kacha slips, and the Government have to wield the iron hand for strict implementation of the GST and Digital payment systems, to actually see the country’s GDP increasing.

The arm chair economists cast doubt on figures when the level of economic activity don’t suit their story. Earlier thsee guys were happily “reporting” that the GDP growth is less than 4%.

Indian Economy from 2014 SUNK by Arun jetley, Lawyer and not a Economist , with GROWTH UNFRIENDLY ACTS like NOTE – BANDI (Demonetisation), Snatching Indian Manufaturing Jobs from PSU like HAL – 126 Rafael Manufacturing given to France at the behest of Reliance Anil Ambani kabaria. Now he has kicked the bucket- who will correct these Economic Blunders? Modi – Matric neither has Knowledge to revive Economy nor does he like Economic Nobel Prize winners like Amartya Sen, Abhijit from Bengal to give him advise on Economic Revival. Modi is only expert in Bulding Statues of Ballab – bhai Patel to glorify a dead corpse from Gujrat.

I read with interest and an open mind your article about the current state of our Contry’s Economy. Yes, it’s true that our Economy has slowed down but not so alarming as being projected . This slow down is cyclical and the trend shall definitely change towards upward in another couple of months. This I state because I am catering to the needs of Engineering Industries, mainly Automobile and from the second week of September my Business has started showing signs of improvements and now I am assured of good Business for another 5 months with firm Orders backed by advance payments. I humbly request you not to paint an alarming and bleak/false future for our Country’s Economy. God is great and He shall definitely guide us to safer Shores

Mere development of car industry and its ancilleries, mere choked traffic in Bangalore,

Ur own business flourishment cannot be the indicators of good economic health of India, look at the dying and starving people at large, growing unemployment,banks npa whitewashing in the name of merger, devastating effects on telecom industry by wiping down bsnl, cutting down of jobs of several lakhs of able of employees speak volume of the worthlessness of our Govt and their stooges,putting party on their eyes n considering the public blind like them

India’s dollar reserve, dollar to Indian rupee exchange rates are all in much better shape than what we had in 2012-2013. These indicators show Indian economy is on rise since 2014. Just compare data between 2009-2014 and 2014-2019

Every year by august harvard economist cry and shut up by January

I dont know why India a best performer( fasest growing major economy) is treated like a failing student, Bangalore is choking in traffic , where are you going to dump if auto industry is booming

It is time that we should agree that Indian economy is undergoing a sort of structural slow down not cyclical by any measure. It is clear that major eight to ten key sectors like automobiles, oil, cement,steel leave alone consumer durables are experiencing a serious slow down. Secondly, the concomitant effect of unemployment has been visible and effective demand is lacking.

More importantly the cut in corporate tax rate has not given positive impact as it has benefited a bunch of individuals leading to a great financial loss to the economy.

The need of the hour is to create effective demand through job creation, enhancing public investment in sectors like agriculture and MSME sector and bring back the money from NPAs but not to write off which is a dangerous sign.

Do not allow arm chair commentators to do something with our economy.

Our government has done fine things to stabilize our economy. Certainly our economy will flourish like anything in the years to come.

1. Stopped the growth of illegal money.

2. Watching illegal investments on real estate.

3. Moving to locate investments on gold.

More and more Indians should be encouraged to make their investments in Indian stock markets. Why do we look for FIIs to come and invest in our stock market?

We Indians all of us come forward and invest in our stock market. You can see the wonders withing short span of time.

Rakesh Junjhunwala, our ace investor, has remarked once ” Poor ( financially disadvantaged) have not been benefited when our BSE Index rose from 100 to 40000.

That is the truth. That is great advice we should all listen to.

Country need to pull up socks to beat the slump

I’m not a economist but it’s stupid say just because oil imports and exports down so economy is in decline, article doesn’t give full explanation. Now people don’t wanna believe IMF and World Bank data too.

And auto sector is not just down in India it’s in all over world including Germany see the recent economic data of Europe economy.

Libtards

Under the skin, both IBRD and IMF are banks, with a thriving business of debt. Would any lender afford to antagonise any of it’s best borrowers??

That is the calibre of BJP. Demonitation, BJP convince public that they are after rich and introduce Rs 2000. Were ever illegal cash find it was in 2000 or 500. Hurriedly implemented GST still they are struggling, FM soaps were absorbed by black holes so nothing is coming out

Any criticism treat him as

Our PM is fine that is the only credit

available with BJP

Not an economist myself, but keeping up with the trends and in one of recent piece I had gone through, the author argues India’s unique situation as per the contents of its economy: 12-15% in its organized sector including the corporates, 20-30% in the semi organized band of partnership/family ventures and the remaining bulk in the unorganized sector. GDP forecast in India does not comprehensible covers all these sectors, mainly the unorganized chunk. The result is that GDP growth rate is rather on the low side.

Your comments are welcome.

But I found your piece interesting.

Regards,

Indian economy is on a decline. So why are IMF and World Bank’s growth forecasts so high ? Because there are no nobel winners in IMF

Bretton Woods!! Bunch of leisure-loving diplomats, who would rather enjoy India’s hospitality than have to disagree with PMO.

All it takes is one phone call.