Assembly elections are scheduled to be held in five states — Rajasthan, Madhya Pradesh, Telangana, Chhattisgarh and Mizoram — later this year before the general elections in 2024.

So, how are these states faring on their finances? Were they able to deliver what they committed to in their budgets of last year? Are their committed expenditures accounting for a bigger pie of their revenues? Do they have the fiscal space to commit additional spending? How are these states faring on various debt servicing indicators?

We look at some of these metrics to assess the fiscal health of the four big poll bound states.

Also read: Manufacturing revival, agriculture & construction expansion — what’s behind 7.2% GDP growth

Madhya Pradesh — priority on capex and a revenue surplus

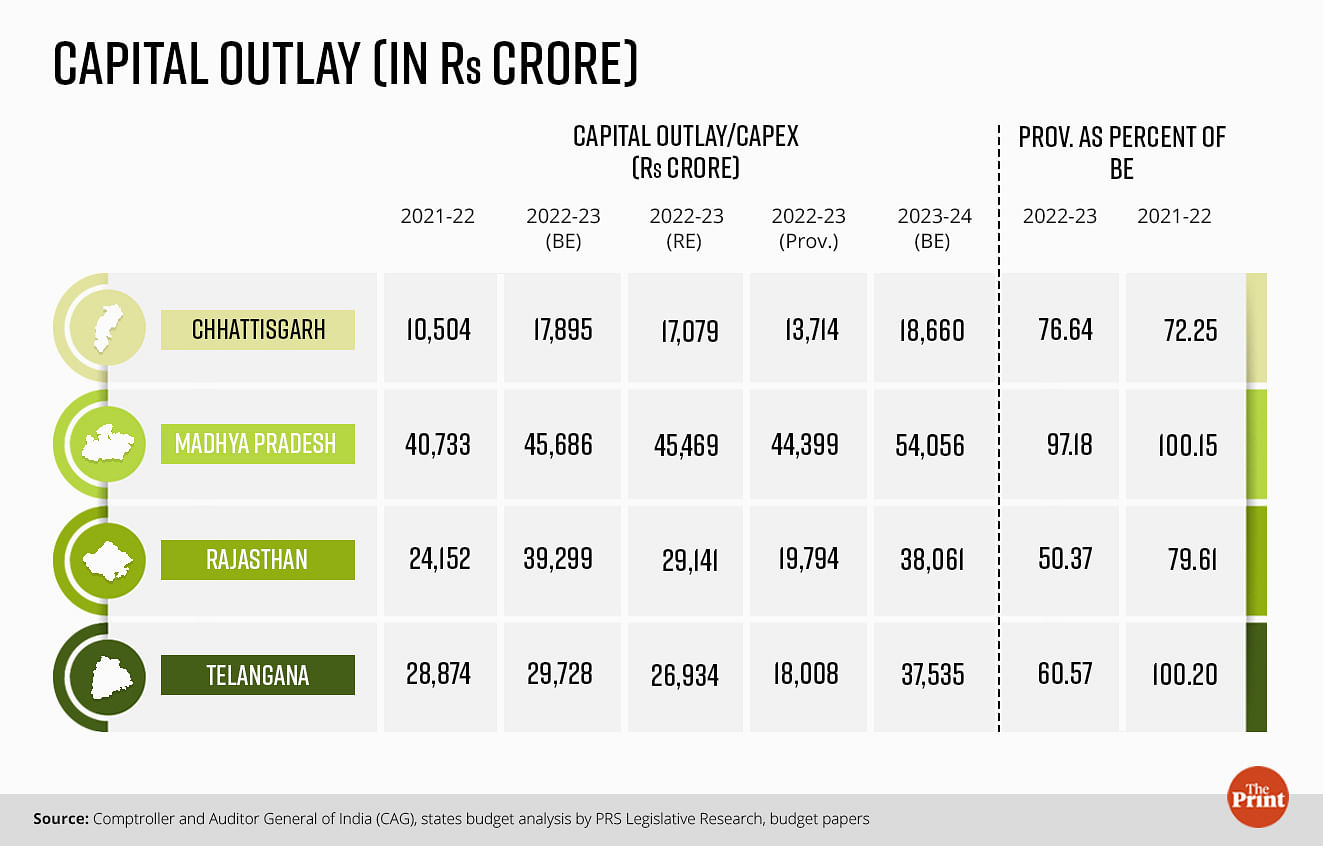

Capital spending is seen to have a stronger impact on growth. Higher capital outlay is key to maintaining fiscal sustainability and containing inflationary pressures. A key ratio to assess the quality of expenditure of states is the share of capital expenditure to total expenditure.

On this metric, Madhya Pradesh has shown an impressive performance with capital expenditure, accounting for 18 per cent of the total expenditure according to the provisional actuals released by the Comptroller and Auditor General of India (CAG) for 2022-23.

For FY 2022-23, the budget had projected a capital expenditure of Rs 45,685.98 crore. The state has managed to spend more than 97 per cent of the budgeted capital expenditure. For the current fiscal year as well, the state has budgeted more than 19 per cent of the total expenditure to promote capital spending and asset creation.

Another positive feature of the fiscal framework of the state is that it has been able to achieve a surplus on its revenue account. The budget for 2022-23 had estimated a revenue deficit of Rs 3,736 crore, the revised estimates had estimated a revenue surplus of Rs 1,499 crore. The provisional actuals suggest that Madhya Pradesh has done better and has managed to achieve a surplus of Rs 1,829 crore on its revenue account.

With a revenue surplus, even the fiscal deficit has come lower than projected in the budget of the last financial year. The budget for FY 2022-23 had projected a fiscal deficit of Rs 52,511 crore. According to the revised estimates, the fiscal deficit was pegged lower at Rs 47,339 crore. The provisional figures show that the actual fiscal deficit of the state is Rs 43,425 crore.

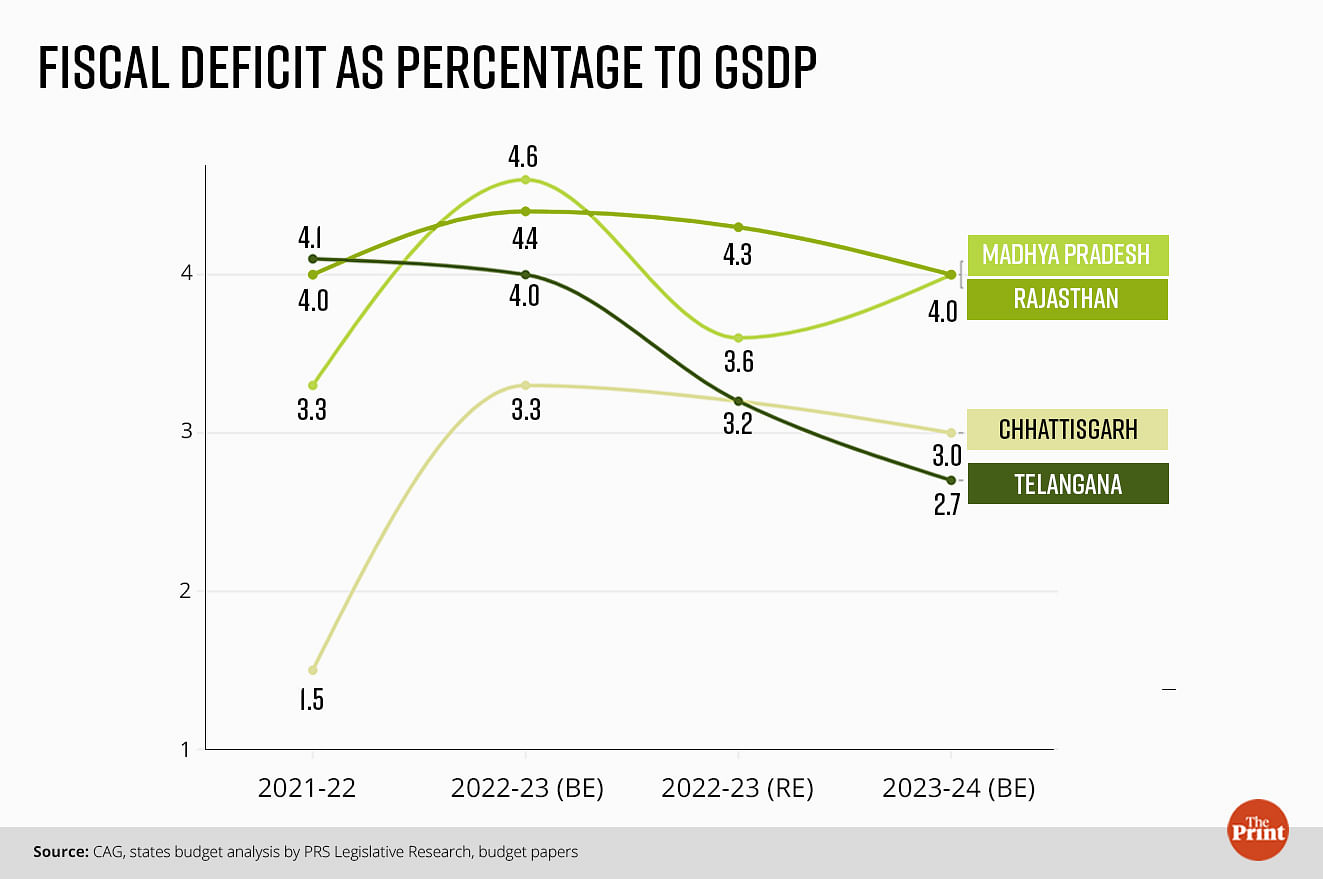

The Fifteenth Finance Commission has proposed a glide path to bring down the fiscal deficit of Central and state governments. For states, it recommended the fiscal deficit limit as percentage of Gross State Domestic Product (GSDP) of 4 per cent in 2021-22, 3.5 per cent in 2022-23, and 3 per cent during 2023-26. The government has allowed an additional fiscal deficit of 0.5 per cent of GSDP upon undertaking power sector reforms.

Madhya Pradesh’s fiscal deficit at 3.6 per cent of GSDP was closer to the 3.5 per cent cap in 2022-23 but for the current year, the state has projected fiscal deficit at 4 per cent of GSDP. The statements released as part of the state’s Fiscal Responsibility and Budget Management legislation suggests that the fiscal deficit target of 4 per cent includes an estimated Rs 9,500 crore as loans from central government for capex.

Rajasthan — cut in capital expenditure and elevated fiscal deficit

Capital expenditure by Rajasthan accounted for a meagre 8 per cent of the overall expenditure according to the provisional figures for 2022-23.

Moreover, the actual capital expenditure of Rs 19,794 crore accounted for just half of the budgeted capital expenditure of Rs 39,299 crore. The state has also cut its revenue expenditure as compared to the budget estimates for 2022-23. The actual revenue expenditure as per the provisional figures is 87 per cent of the budgeted revenue expenditure.

As a result of a moderate cut in revenue expenditure and a sharper cut in capital expenditure, the state has been able to reduce its fiscal deficit from Rs 78,850 crore as per the budget estimates to Rs 49,182 crore as the provisional actuals.

Similar to Madhya Pradesh, Rajasthan has also projected a fiscal deficit of 4 per cent of GSDP for the current year. Even for the previous financial year, its fiscal deficit was elevated at 4.3 per cent of GSDP. Looking at other indicators such as debt to GSDP ratio and revenue deficit, Rajasthan features as one of the highly stressed states according to the Reserve Bank of India’s (RBI) analysis of state finances.

Chhattisgarh — fiscal deficit within target

Out of all the four big poll-bound states, the allocation for capital expenditure is the lowest for Chhattisgarh. For the previous financial year, the state had budgeted Rs 17,894.91 crore for capital spending but managed to spend 77 per cent of the budgeted amount.

The actual capital spending amounts to roughly 14 per cent of the provisional actual figure for total expenditure. Similar to Madhya Pradesh, Chhattisgarh also recorded a surplus on its revenue account of Rs 8,000 crore, implying that the provisional actual revenue receipts surpassed the revenue expenditure. For the current financial year as well, the state targets to achieve a revenue surplus.

The emphasis on fiscal prudence is evident from its fiscal deficit to GSDP ratio. The state has pegged its fiscal deficit to GSDP ratio at 3.17 per cent for the previous financial year. For the current financial year also, the state has projected a fiscal deficit of 3 per cent of GSDP. The medium-term fiscal policy statement of the state suggests adherence to the fiscal deficit target of 3 per cent of GSDP for the next two years as well.

Also read: Inflation may be easing, but near-future upside risks mean RBI should leave interest rates unchanged

Telangana — higher committed expenditure leaves little scope for enhancing productive expenditure

Telangana is seen to have lagged on capital expenditure. According to the provisional figures, the state has managed to spend just 60 per cent of its budgeted allocation for capital spending. Its capital expenditure is just 10 per cent of its overall expenditure in 2022-23.

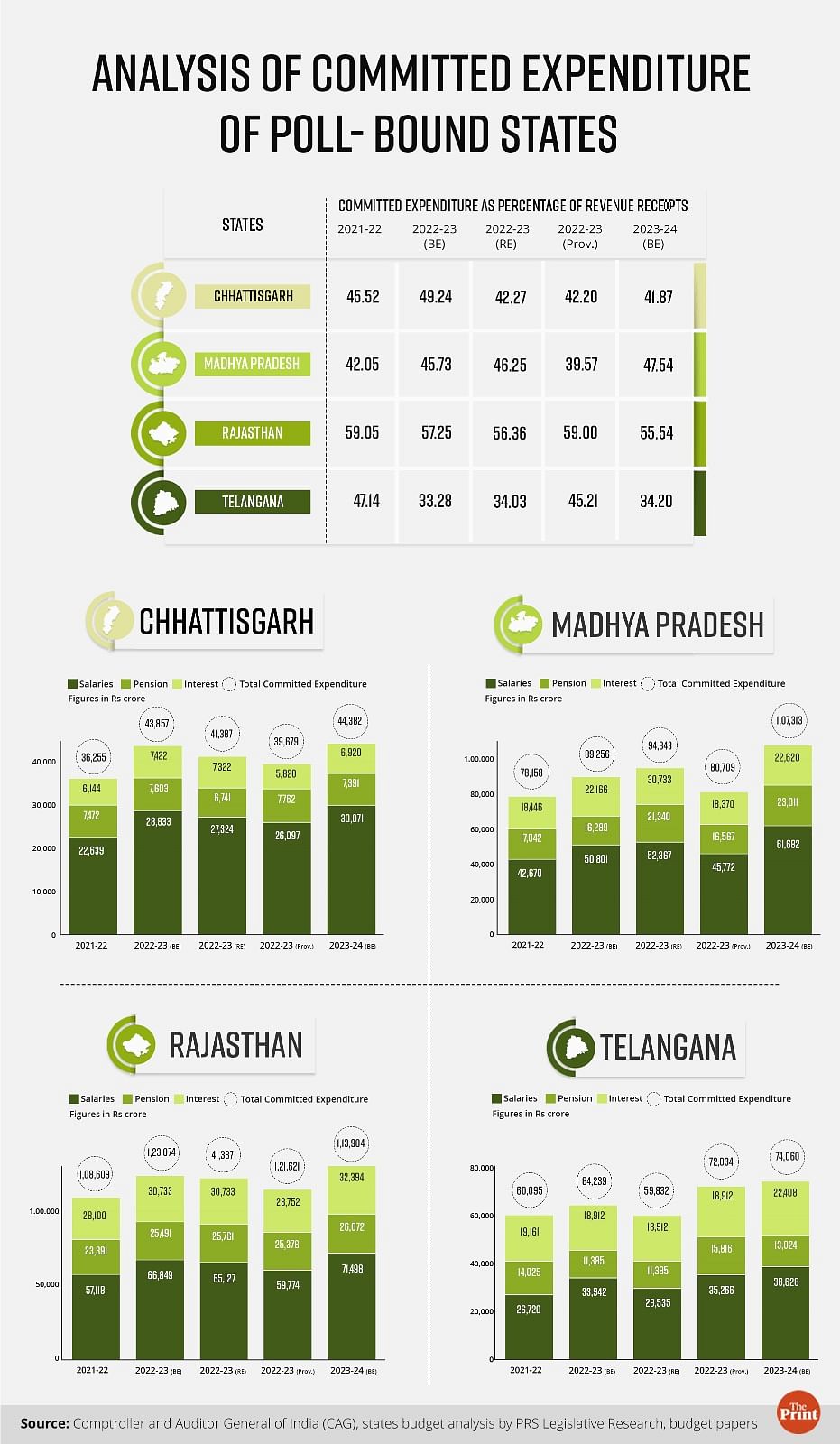

The remaining 90 per cent is accounted for by revenue expenditure. Within the revenue expenditure, committed expenditure which typically includes expenditure on payment of salaries, pensions, and interest is a sizable chunk. The expenditure on salaries, pensions and interest outpaced the budgeted expenditure for the previous financial year.

Rest of the three poll bound states have broadly managed to limit their expenditure on the committed heads as compared to the budgetary allocations in the last financial year. Particularly, the spending on interest payments is lower than the budgeted amount for Madhya Pradesh, Rajasthan and Chhattisgarh.

Committed expenditure as a percentage of revenue receipts: How do the states fare?

In addition to looking at the absolute levels, it is critical to assess the share of committed expenditure in the revenue receipts of states.

Out of the four states, Rajasthan has the highest share of committed expenditure in revenue receipts. In 2022-23, the provisional estimates suggest that 59 per cent of the revenue receipts were spent on salaries, pensions and interest payments. Higher share of committed expenditure in revenue receipts leaves little scope for enhancement of productive expenditure.

Telangana also saw the share rising from 33 per cent (budget estimate) to 45.2 per cent according to the provisional estimates.

Rise of outstanding liabilities: How do the states fare?

From the viewpoint of debt sustainability, the accumulation of total outstanding liabilities of states merits consideration. Outstanding liabilities of states include state development loans (SDL), borrowings from National Small Savings Fund (NSSF), borrowings under the UDAY scheme, borrowings from financial institutions and central government.

The four states differ in their trajectory of outstanding liabilities.

Rajasthan has seen a sustained and steep build-up of outstanding liabilities since 2014-15. The outstanding liabilities were Rs 1.48 lakh crore in 2014-15, these swelled to more than Rs 4 lakh crore by FY 2021-22.

Telangana saw a sharp surge in 2016-17 and since then has a uniform pace. Chhattisgarh has the most gradual pace of accumulation of outstanding liabilities. Madhya Pradesh’s outstanding liabilities show a surge only in the post-Covid period.

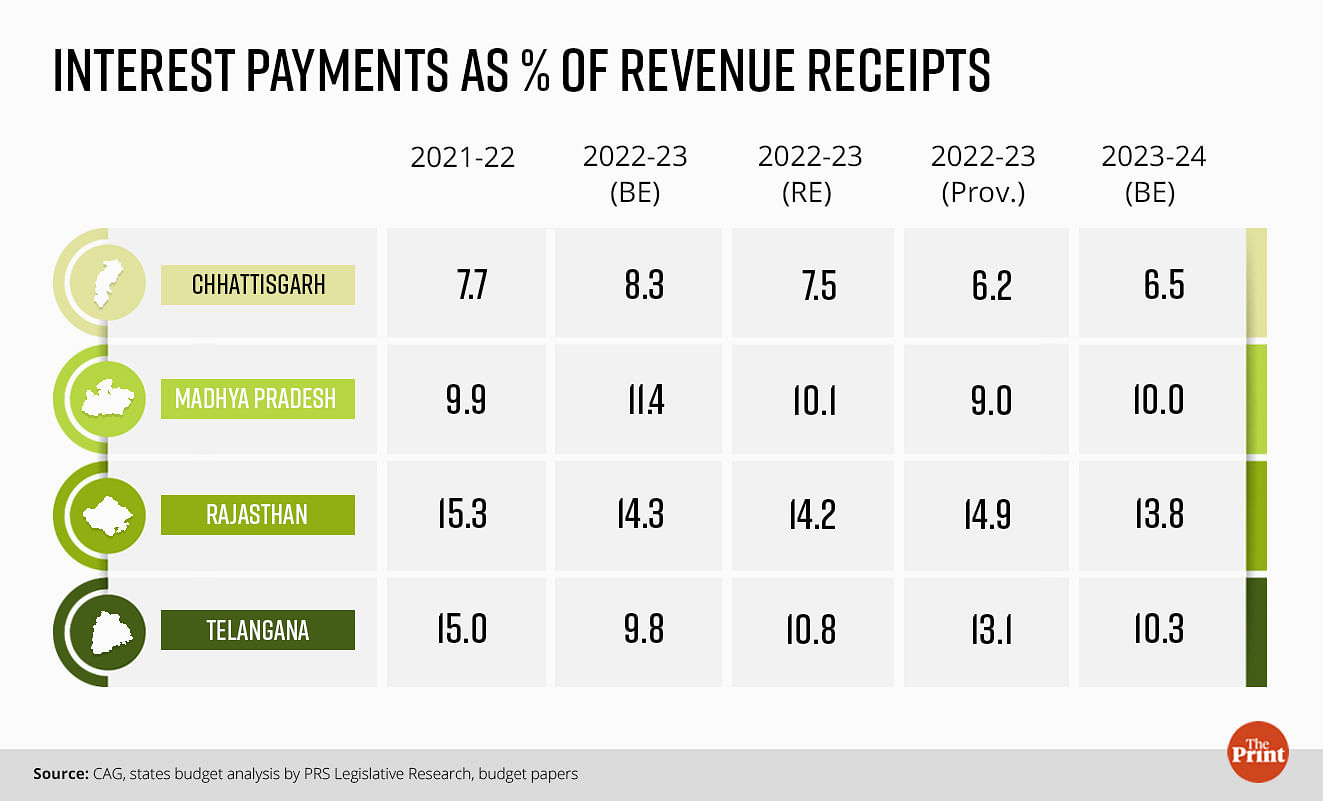

The accumulation of liabilities results in a higher share of revenue receipts being allocated for interest payments. The Fourteenth Finance Commission regards a 10 per cent limit as tolerable.

For Rajasthan, interest payment to revenue receipts (IP-RR) ratio, a measure of debt servicing burden on states’ revenues, has been hovering around 14-15 per cent.

Chhattisgarh has the most encouraging ratio at 6 per cent for 2022-23, according to the provisional estimates.

Radhika Pandey is an associate professor and Rachna Sharma is a Fellow at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: Inflation eased, but here’s why RBI’s unchanged policy repo rate is likely to stay for some time