Broadly in line with expectations, the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) voted unanimously Thursday to keep the policy repo rate unchanged at 6.5 per cent. The stance of the policy was also left unchanged to focus on withdrawal of accommodation to ensure that inflation aligns with the target, while supporting growth.

Repo rate is the rate of interest at which commercial banks may borrow from the RBI.

While the RBI acknowledged that inflation has moderated, it is likely to remain above the 4 per cent target. Given the uncertainty on inflation outlook and an upbeat growth outlook, a tight monetary policy is likely to stay for some time. The RBI has maintained the growth projection for the current financial year at 6.5 per cent, while the inflation forecast was marginally revised downwards from 5.2 per cent to 5.1 per cent.

Also read: How hyperinflation, economic turmoil is pushing people to adopt crypto in several emerging economies

Globally central banks are not yet done with rate hikes

There has been a broad-based easing of headline inflation, but it still continues to remain elevated. There has been a shift in demand from goods to services, reflecting higher services inflation.

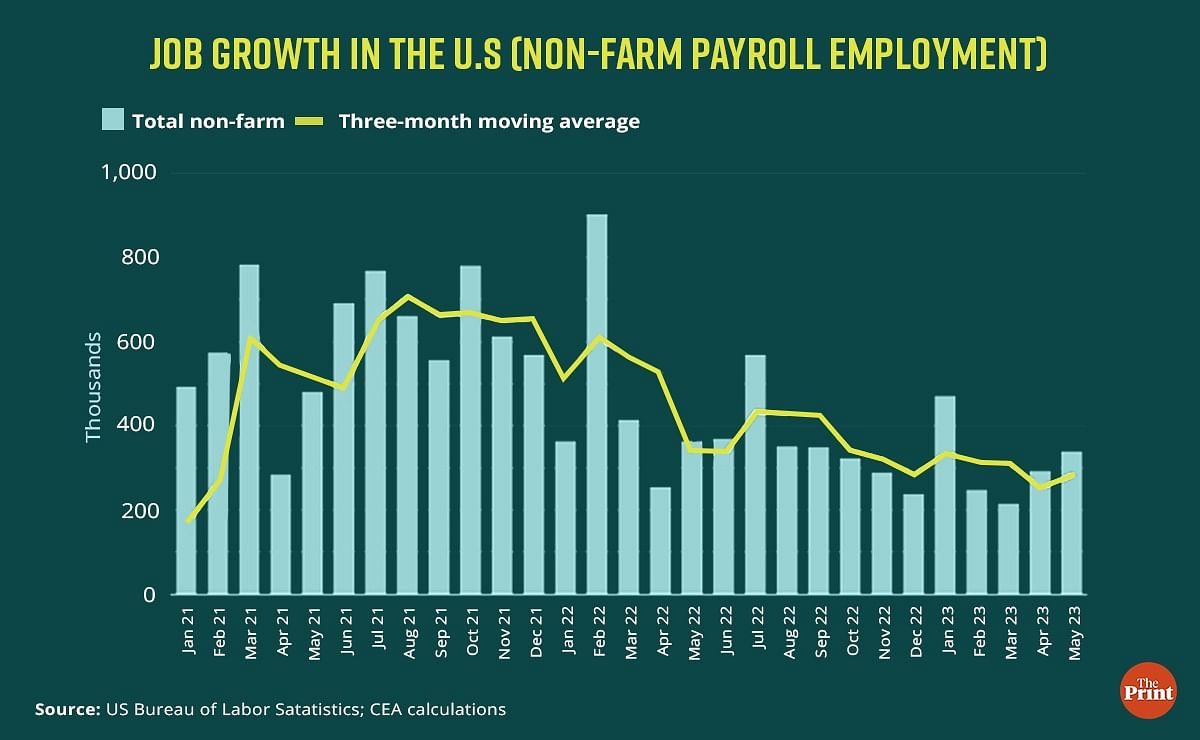

Labour markets, particularly in the U.S., remain resilient despite high-interest rates and elevated inflation. Employers added 339,000 jobs in May. Over the past three months, average job addition has been 283,000, a pace consistent with a tight labour market.

Wages have also held steady in May. The unemployment rate, though it rose from 3.4 per cent in April to 3.7 per cent in May, still remains quite low.

In May, the Federal Reserve lifted rates by a quarter percentage point. There are indications that the Fed seems inclined to keep rates unchanged in its upcoming June meeting, but could resume tightening in July if economic data continued to exhibit strength.

The European Central Bank (ECB) also raised interest rate by 25 basis points in their May meeting. ECB President Christine Lagarde hinted at more rate hikes to curb inflation and bring it closer to the target.

The Reserve Bank of Australia is the latest to hike interest rate by 25 basis points. The bank further removed reference to the term “medium-term inflation expectations remain well anchored”, signaling a more hawkish outlook and further rate hikes. In fact, the Reserve Bank of Australia and Bank of Canada have returned to hiking rates after a brief pause.

Domestic inflation has eased but uncertainties persist

Headline inflation in India eased to 4.7 per cent in April from 5.7 per cent in March. The forecast of a normal southwest monsoon by the India Meteorological Department (IMD) augurs well for the kharif crops. However, fresh upside risks to inflation outlook are emerging.

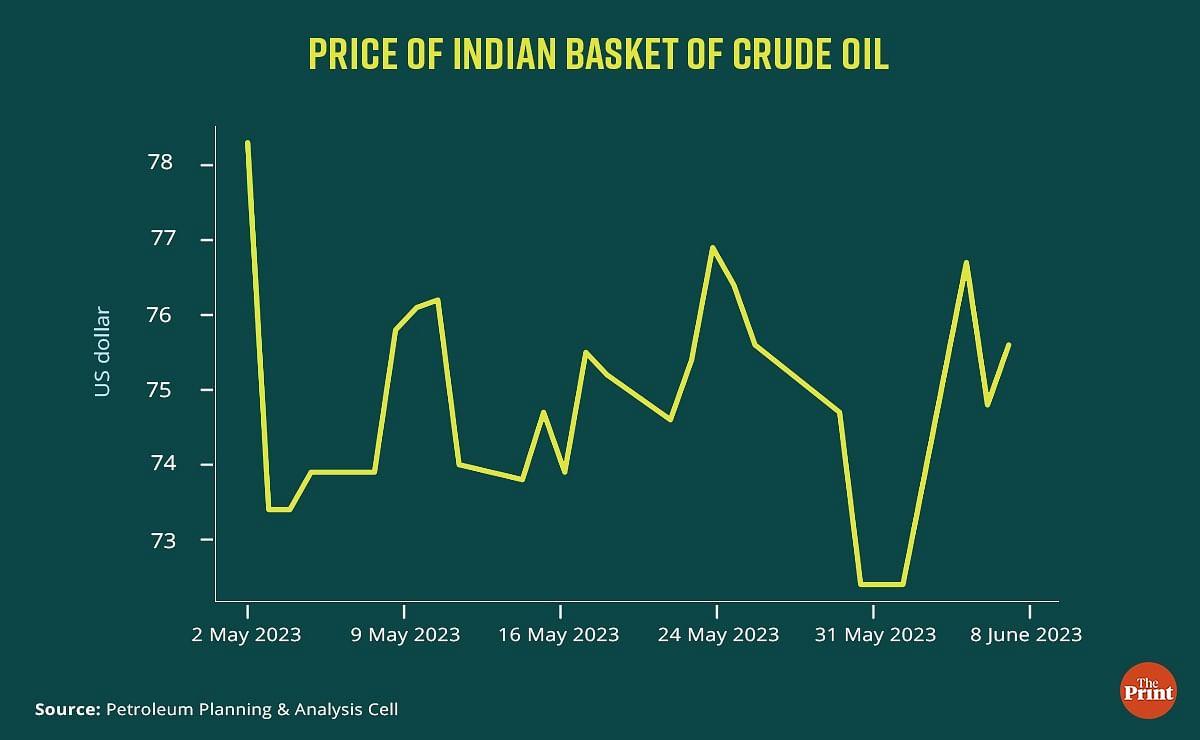

Uncertainties remain on the distribution of monsoon and on the potential impact of El Nino on food prices. Volatility in crude oil prices also pose an upside risk to the inflation outlook. Oil prices have moved northwards since Saudi Arabia decided to cut production by a further 1 million barrels per day from July. The decision to slash output is on top of a broader deal by the Organization of the Petroleum Exporting Countries (OPEC) and allies, including Russia, to limit supply of oil to boost prices.

The Purchasing Managers’ Index (PMI) while signalling a resilient services sector also warned against intensification of input costs and output charges. Reserve Bank’s surveys also expect hardening of input costs and output prices.

Stance on liquidity signals a tight monetary policy

While the status quo on rates was widely expected, there was a difference of opinion on stance. There was an expectation by some commentators and analysts that “withdrawal of accommodation” may be softened. Some argue that with the recent easing of inflation, the “withdrawal of liquidity” stance seemed inconsistent and should be softened to suggest a “neutral” stance.

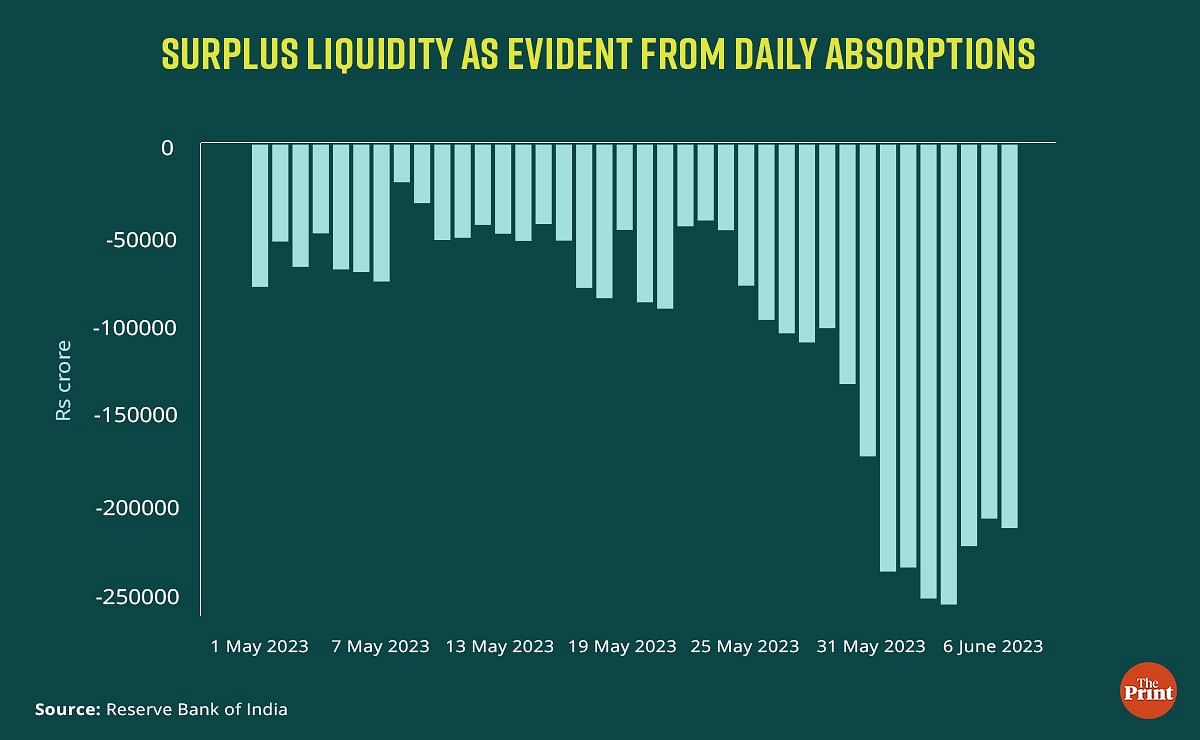

However, the RBI made no change to its stance. This seems a prudent move. Liquidity in the banking system is still in surplus, as reflected in average daily absorptions of Rs 1.7 lakh crore in May.

There was some pressure on liquidity in April due to the maturing of the Targeted Long-Term Repo Operations (TLTROs). These were introduced to step up liquidity during the Covid period.

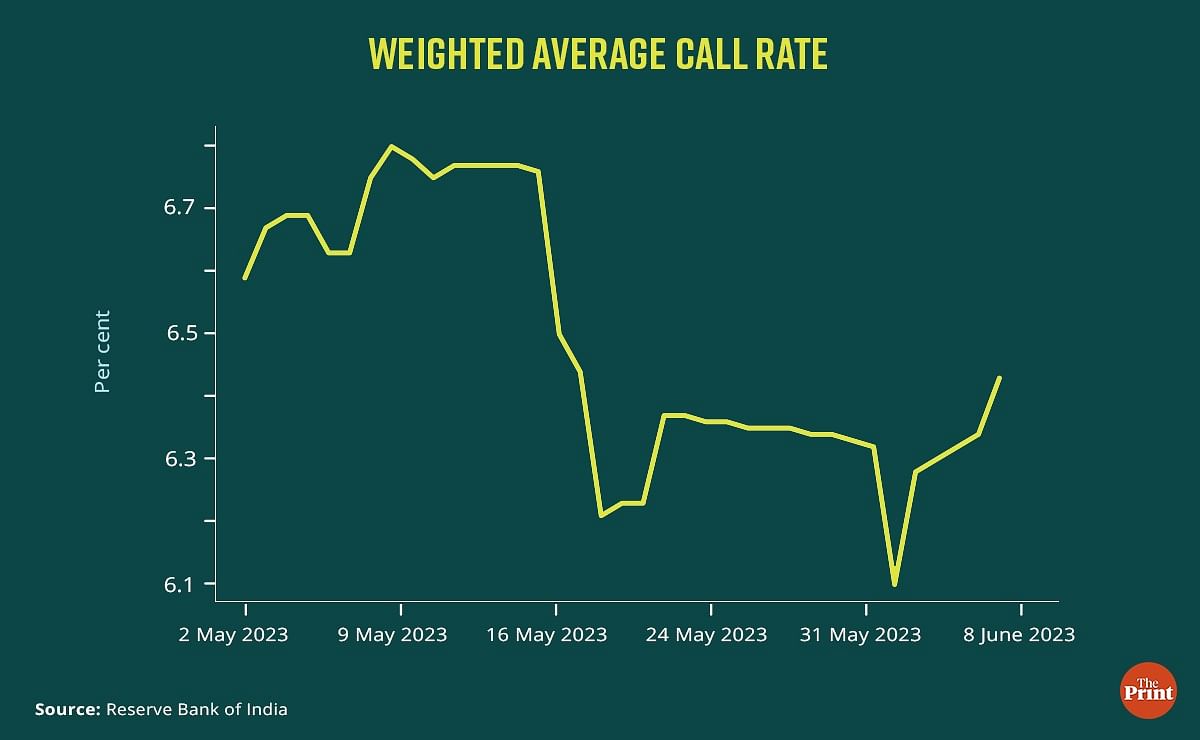

Since the third week of May, inter-bank liquidity has risen owing to an increase in government spending and the return of Rs 2,000 rupee notes to banks. The surge in liquidity has resulted in the inter-bank call rate (the rate at which banks borrow from one another overnight) to moderate from the highs seen in April and early May.

In this backdrop, retaining the “withdrawal of liquidity” is a correct strategy. The RBI has rightly committed to remain nimble in its liquidity management, resorting to Variable Rate Reverse Repo (VRRR) auctions to absorb liquidity and Variable Rate Repo (VRR) auctions to infuse liquidity.

Through its liquidity management operations, the RBI would like to align the call rate to the repo rate.

4% is the inflation target

Recognising the recent moderation in inflation, the RBI has revised downwards its forecast for the April-June quarter from 5.1 per cent to 4.6 per cent. However, for the second half of the year, inflation projections have been left broadly unchanged.

The RBI has rightly adopted a cautious approach towards inflation and has clearly communicated that the inflation target is 4 per cent rather than 2-6 per cent. All its policy actions will be guided towards achieving the 4 per cent target while supporting growth.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: Manufacturing revival, agriculture & construction expansion — what’s behind 7.2% GDP growth