India’s gross domestic product (GDP) registered an impressive growth of 6.1 per cent in the January-March quarter, as compared to 4.4 per cent in the previous quarter. Revival in manufacturing after two quarters of degrowth and expansion in agriculture and construction pushed growth in the March quarter. The better-than-expected growth in the fourth quarter led to upward revision in the annual economic growth.

For the full year (2022-23), the provisional estimates peg GDP growth at 7.2 per cent —higher than the second advance estimates released in February. Going forward, with global growth slowing, private consumption needs to pick up and investment growth needs to sustain to maintain the growth momentum.

Hits and misses in the Q4 numbers

The rebound in the manufacturing sector at 4.5 per cent in the fourth quarter is welcome development, as manufacturing activity had contracted for two consecutive quarters amid high global commodity prices and sustained input cost pressures, affecting the profit margins of companies.

Moderation in commodity prices and easing of input cost pressures in recent months have led to a rebound in the manufacturing sector. Reflecting the moderation in commodity prices, the Wholesale Price Index (WPI)-based inflation saw a contraction. Negative WPI has given a boost to manufacturing in real terms.

Going forward, high-frequency indicators such as the Purchasing Managers’ Index (PMI) seem to suggest that manufacturing activity will gather momentum in the 2024 financial year (FY). Construction posted an impressive growth of 10 per cent. Being a labour-intensive sector, strong growth in construction bodes well for India’s employment outlook.

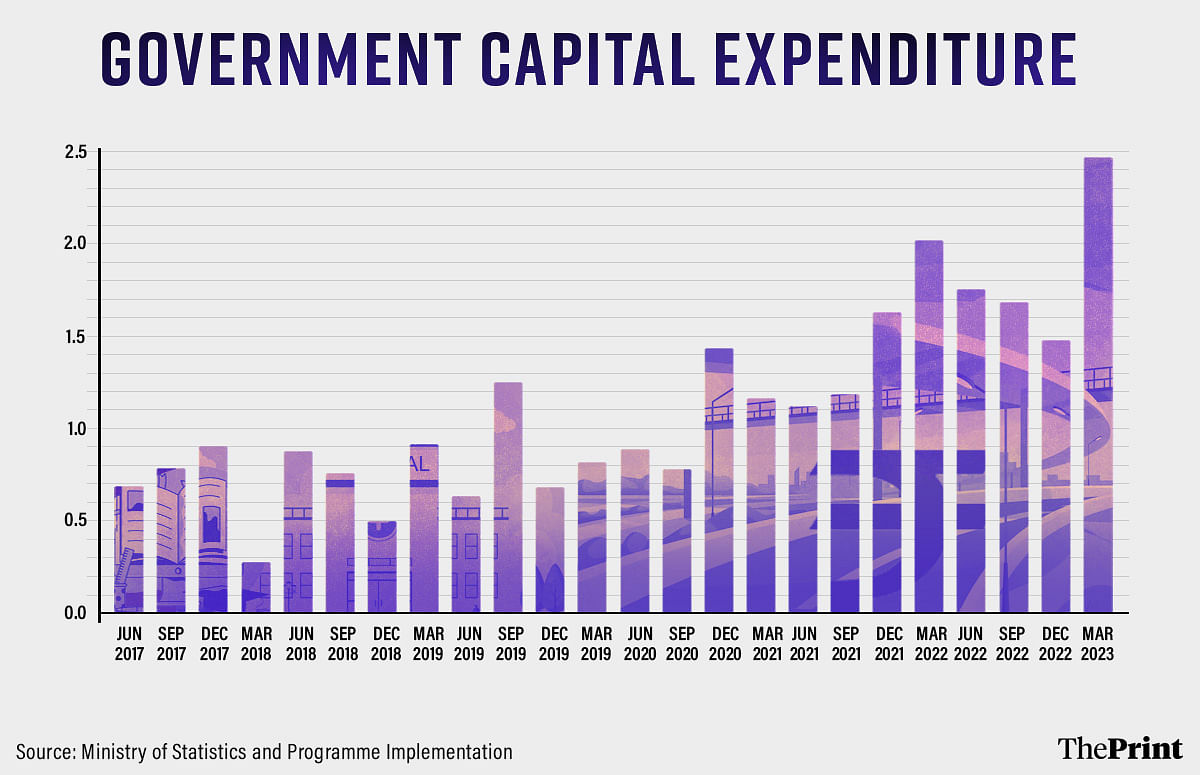

On the expenditure side, investment — measured by gross fixed capital formation (GFCF) — was the key driver, with a growth of 8.9 per cent at constant prices. The share of investment in GDP has gone up from 26.7 per cent in the third quarter (Q3) to 31.7 per cent in the March quarter. Government capex (capital expenditure) registered a strong growth in the quarter which ended in March, with a expenditure of Rs 2.46 trillion as compared to Rs 1.46 trillion in the December quarter.

Consumption, however, is still a worry, with an anaemic growth of 2.8 per cent at constant prices. The share of consumption in GDP has also plummeted. This seems to be at odds with the strong 9 per cent growth in trade, hotels, transport and communication. The estimates also seem to reflect the uneven growth in consumption with rural demand still being muted.

Contrary signals are emerging from high-frequency indicators on rural demand. While tractor sales posted robust growth buoyed by better-than-expected rabi harvesting and high reservoir levels, two-wheeler sales do not show the same optimism about rural demand. Companies in the fast-moving consumer goods (FMCG) sector also have a contrasting opinion on rural demand. Demand for work under the Mahatma Gandhi National Rural Employment Guarantee Act (MNREGA) is still elevated.

Higher interest rates, uneven monsoon, uncertainty on account of El Nino could further pose a drag on consumption in the coming quarters.

Annual numbers: What changed from advance to provisional estimates

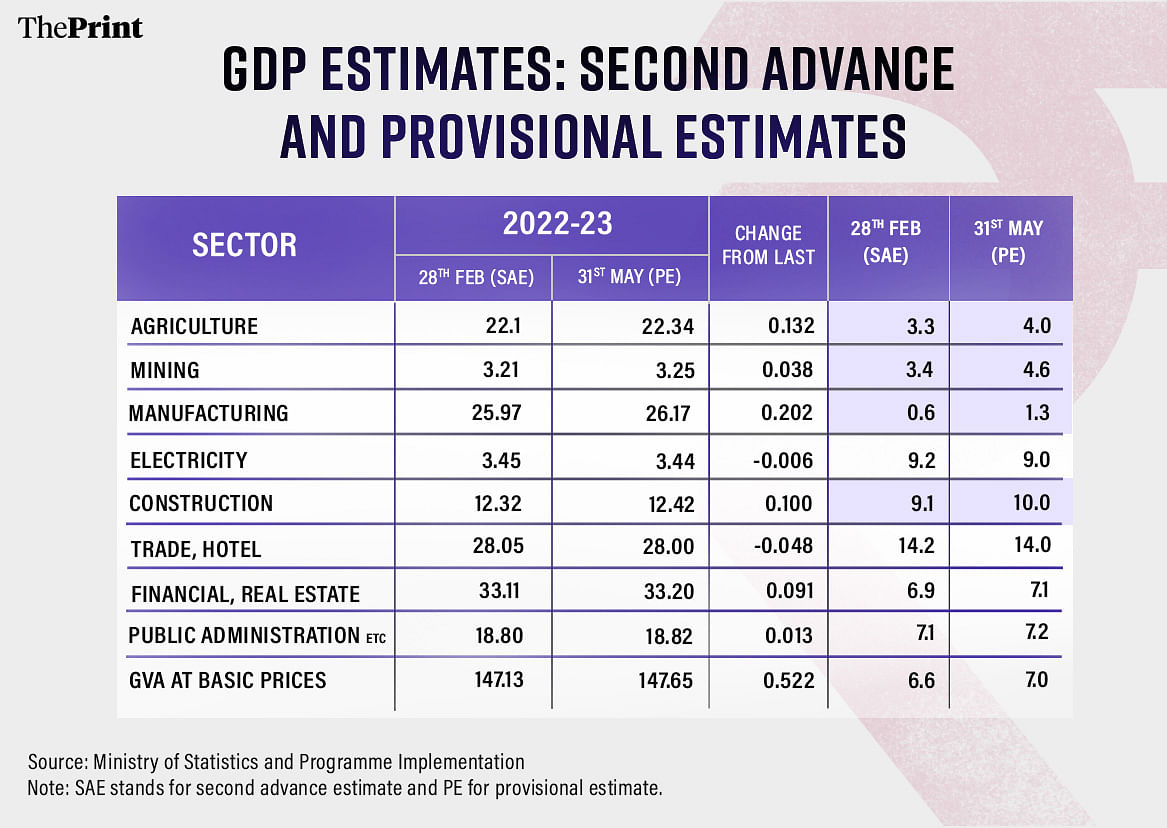

The second advance estimates of GDP released on 28 February had pegged growth at 7 per cent for FY 2023. The provisional estimates surpassed those estimates. The upward revision is mainly owing to better performance of agriculture and manufacturing.

The manufacturing sector saw an improvement, albeit moderate, at 1.3 per cent, as compared to the 0.6 per cent projected in the second advance estimates. Agriculture is estimated to have posted a growth of 4 per cent, as compared to the 3.3 per cent projected in the advance estimates. Record production of main rabi crops such as wheat and mustard led to impressive performance of the agriculture sector.

Within services, better performance of the financial sector seems to have been driven by the robust balance-sheet position of banks.

Also read: US debt ceiling troubles could tarnish dollar’s image as safe currency, impact emerging economies

Investment: a key driver of growth

Investment measured by Gross Fixed Capital Formation (GFCF) posted a growth of 11 per cent at constant prices in FY 2023. As a share of real GDP, GFCF was 34 per cent in FY 2023. These numbers are the highest in nine years and reflect the outcome of the government’s sustained capex push.

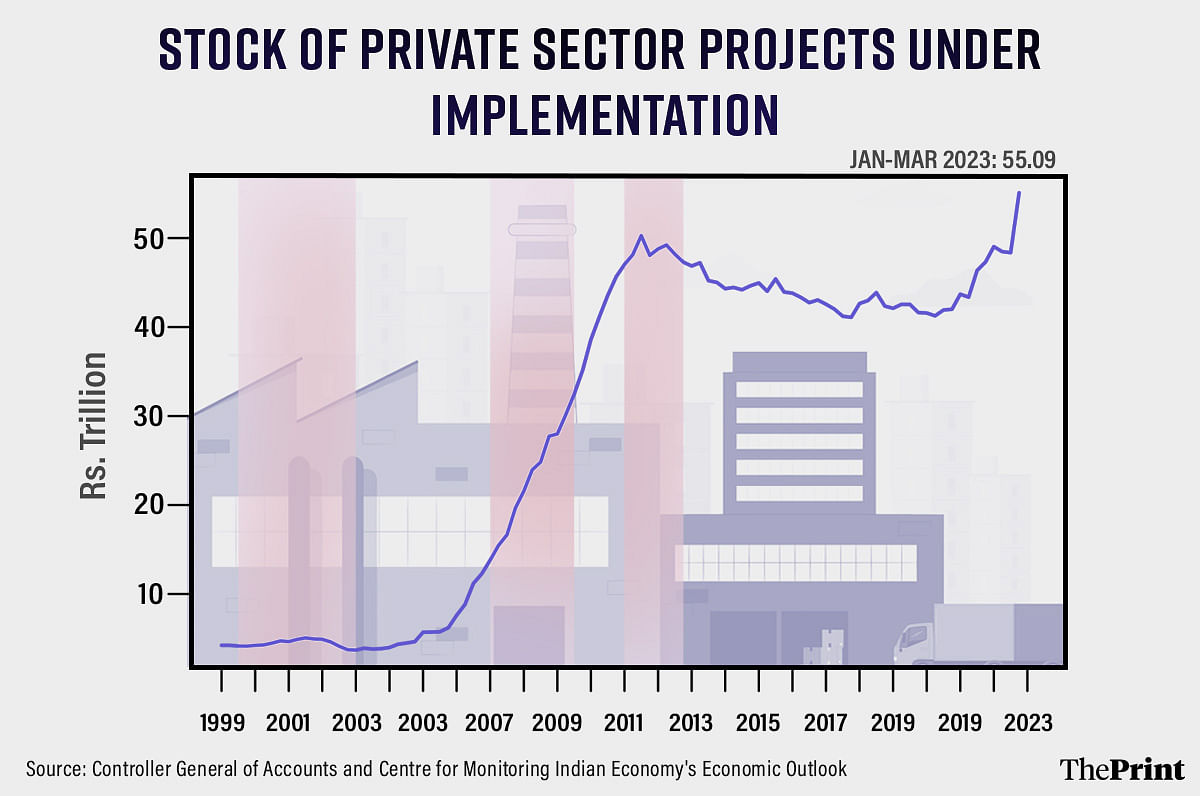

Private investment is also witnessing signs of revival. The Centre for Monitoring Indian Economy’s (CMIE) CapEx database shows that the value of new projects announced saw an upsurge in the quarter which ended in March. The stock of private projects under implementation has seen a sharp uptick in the March quarter. There was a sustained decline in this number since 2011, gradual recovery since 2020 and a sharp rise in the March quarter. It needs to be seen if the upsurge in private projects under implementation is able to trigger improvements in demand and employment generation.

Outlook for 2023-24

Sustained push to capital expenditure by central and state governments will give a boost to growth through multiplier impact on employment and consumption. Unless there are some unanticipated shocks, inflation is likely to moderate in the current financial year. This will give scope for RBI to maintain status quo on rates.

Contraction in exports due to global slowdown and their spillover impact on employment and consumption needs to be seen. The potential impact of El Nino on agricultural output and food prices will also shape the trajectory of consumption in the coming quarters.

Radhika Pandey is an associate professor and Pramod Sinha is a fellow at National Institute of Public Finance and Policy (N IPFP).

Views are personal.

Also read: Inflation may be easing, but near-future upside risks mean RBI should leave interest rates unchanged