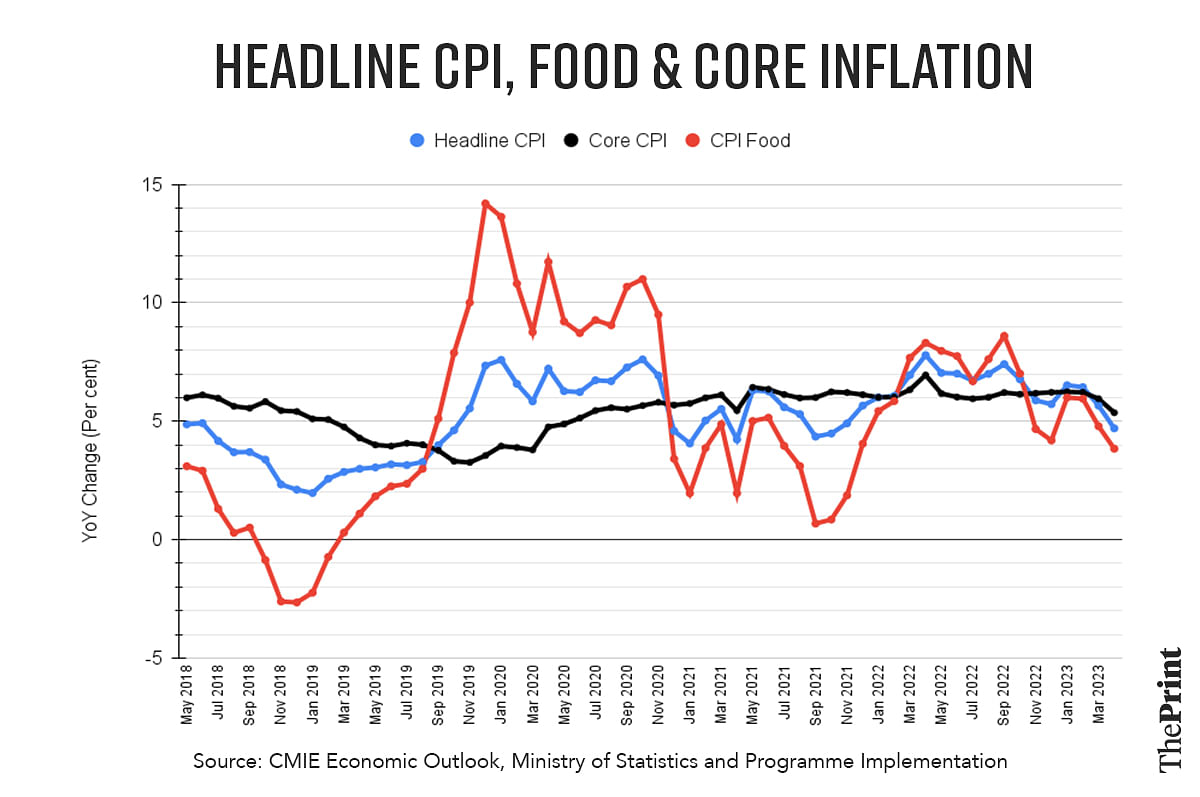

Headline inflation measured by the year-on-year change in consumer price index (CPI) moderated to 4.7 per cent in April from 5.7 per cent in March. Inflation fell below 5 per cent since November 2021. Food inflation fell to 3.8 per cent and encouragingly, core inflation which was hovering around the 6 per cent mark for several months finally dropped to 5.4 per cent in April.

The base effect led to a significant decline in the April CPI inflation and will likely have a moderating influence on the May inflation figures as well.

While the Reserve Bank of India’s (RBI’s) recent report on the state of the economy noted that inflation momentum is softer than anticipated, resurgence of upside risks to inflation needs to be monitored.

Several factors such as unfavourable weather conditions, uncertainty over oil prices, demand from China’s re-opening and intensification of geo-political conflicts could pose an upside risk to the inflation outlook. In this uncertain backdrop, the RBI should keep the repo rate unchanged at 6.5 per cent and wait for more durable signs of inflation control.

Also read: How hyperinflation, economic turmoil is pushing people to adopt crypto in several emerging economies

Inflation: the specifics

The food component, which holds a weight of almost 40 per cent in the CPI basket, fell to 3.8 per cent in April from 4.79 per cent in the previous month. While inflation in “vegetables” and “oils and fats” saw a contraction, inflation in other sub-components saw a broad-based decline in April.

Notably cereals which hold a weight of 9.67 per cent saw a moderation in inflation from 15.27 per cent in March to 13.67 per cent in April. The open market sale scheme (OMSS) of the government did help in cooling wheat prices.

Core inflation, which was persistent at around 6 per cent, fell to 5.36 per cent in April. The decline in core inflation was attributed to “clothing and footwear” and “miscellaneous” components.

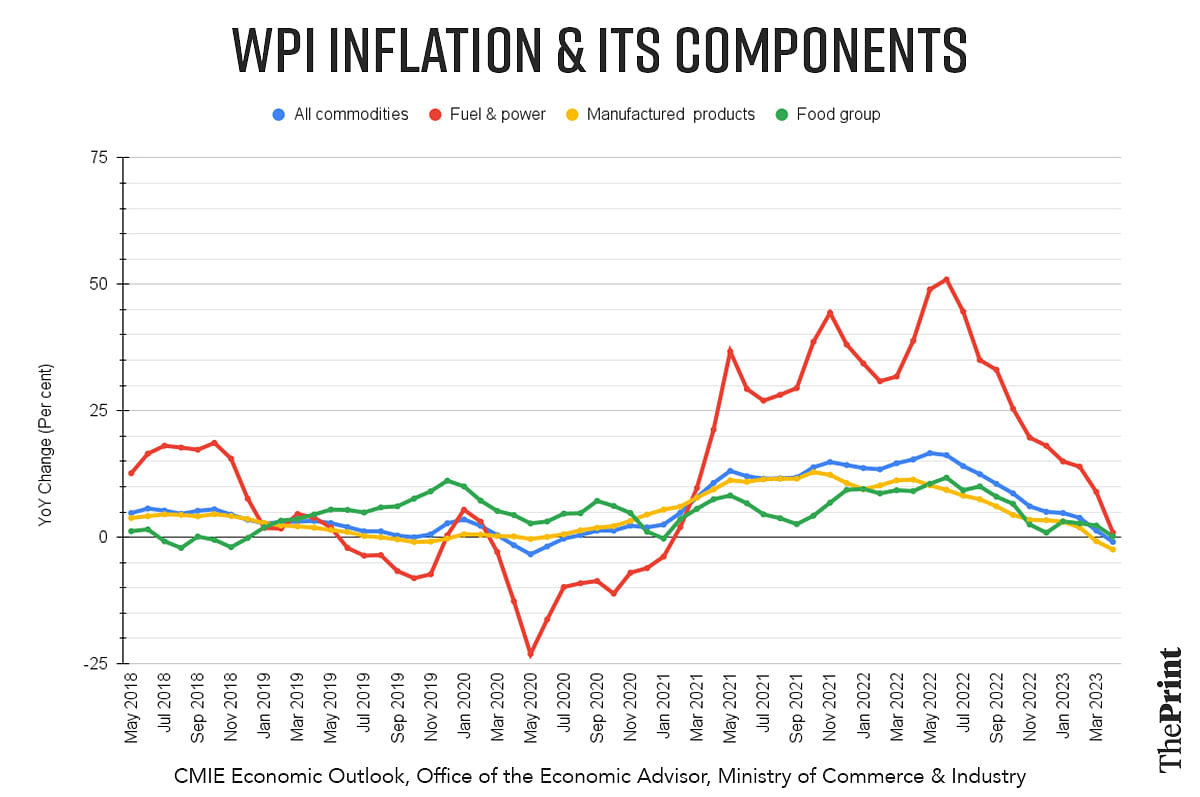

The Wholesale Price Index (WPI) based inflation declined to a 34-month low of -0.9 per cent in April 2023. Again, the high base effect was at play. WPI based inflation was 15.38 per cent in April 2022.

The manufacturing component with a weight of 64.23 per cent in the overall WPI saw a deflation of 2.42 per cent in April 2023. Fall in prices of basic metals, food products, mineral oils, textiles, non-food articles, chemical & chemical products, rubber & plastic products and paper & paper products were the major drivers of deflation in April 2023.

Risks to inflation outlook

While inflation has eased in April, the outlook of a benign inflation could be subject to risks. The decline in milk prices in April was primarily due to the base effect. Milk prices have risen in May, according to price data from the Department of Consumer Affairs. The recent cases of lumpy skin disease infecting cattle in different states could pose an upside risk to milk prices in the coming months.

The FAO Food Price Index, which tracks the most globally traded food commodities rebounded in April for the first time in a year. The index averaged 127.2 points in April against 126.5 for March. The rebounded index was on account of higher prices for sugar, meat and rice, which offset decline in the cereals, dairy and vegetable oil price indices.

The Purchasing Managers’ Index (PMI) for April 2023 while showing a surge in manufacturing sector activity, indicated a re-acceleration of input cost inflation. The survey participants of PMI services also noted that input costs and output charges in April have risen at faster rates than their long-run averages. This could generate inflationary pressures as demand for services tend to be less interest-rate sensitive.

There is uncertainty on oil price outlook as well. In April, the members of the OPEC+ (Organisation of the Petroleum Exporting Countries) announced surprise production cuts to their oil production that came into effect from this month. The collective output cut by the nine members of OPEC+ totals 1.66 million barrels per day. During the last few weeks, oil prices have been fluctuating, driven by positive and negative factors. The uncertainty over the debt ceiling in the US has impacted the trajectory of oil prices in the last few days.

Oil prices have edged up in the recent few days after Saudi Arabia’s energy minister’s statement fuelled speculation of further production cuts by the OPEC+ at their meeting on June 4. The minister warned those betting that prices will fall that they should “watch out” for pain. There are supply concerns driven by a steep fall in oil inventories in the US over the past week. The peak travel season in the US beginning 29 May could further squeeze the supply of oil.

The impact of El Nino on the course of inflation is still uncertain. El Nino could lead to erratic monsoon which could result in lower agricultural output and higher prices. The RBI Governor in his recent address rightly emphasised that the war against inflation is not yet over as the central bank needs to see how the El Nino factor plays out.

Market optimism on inflation and resurgence of services-driven inflation

The recent easing of inflation in advanced and emerging economies has fuelled optimism amongst markets that central banks would start cutting rates later this year. This optimism may be premature. Overall, the early flash PMI data suggests that the composition of inflation has undergone a shift. Globally, while goods prices are falling, prices for services continue to rise at an accelerated pace as post-pandemic demand outstrips supply. Resilience of the services sector would add pressure on central banks to keep rates elevated for longer.

Improvement in growth momentum

High frequency indicators show an improvement in growth momentum. The PMI for manufacturing was at a four-month high in April. Services sector PMI also expanded at a fast pace. Green shoots of recovery are also visible in investment related indicators. During the March quarter, the Centre for Monitoring Indian Economy (CMIE) reported the announcement of new projects valued at Rs 11.9 trillion. Completion of projects gathered pace in the quarter ended March. Strong GST collections and air passenger traffic also reflect strong economic activity.

With growth impulses improving and in view of the emerging upside risks to inflation, the RBI should hold interest rates steady in its June policy.

Radhika Pandey is a Senior Fellow and Pramod Sinha is a Fellow at National Institute of Public Finance and Policy (N IPFP).

Views are personal.

Also read: US debt ceiling troubles could tarnish dollar’s image as safe currency, impact emerging economies