In an expected development, the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) decided to keep the policy repo rate unchanged at 6.5 percent. The repo rate is the rate of interest at which RBI lends to other banks.

The stance was also maintained at withdrawal of accommodation to ensure that inflation progressively aligns with 4 percent target, while supporting growth.

The spike in vegetable prices amid an uneven distribution of rainfall, the resurgence in global crude oil prices and recent upward pressures on global food prices have led to an upward revision in inflation projection, from 5.1 percent to 5.4 percent, for the current financial year.

The inflation projection for the second quarter has been revised upwards by 100 basis points. The projections assume normal monsoon and might undergo a change in the event of a below-normal monsoon.

The upward revision in inflation forecasts suggests that the policy repo rate will remain higher for longer and a cut in interest rate can be expected only in the second quarter of the next financial year.

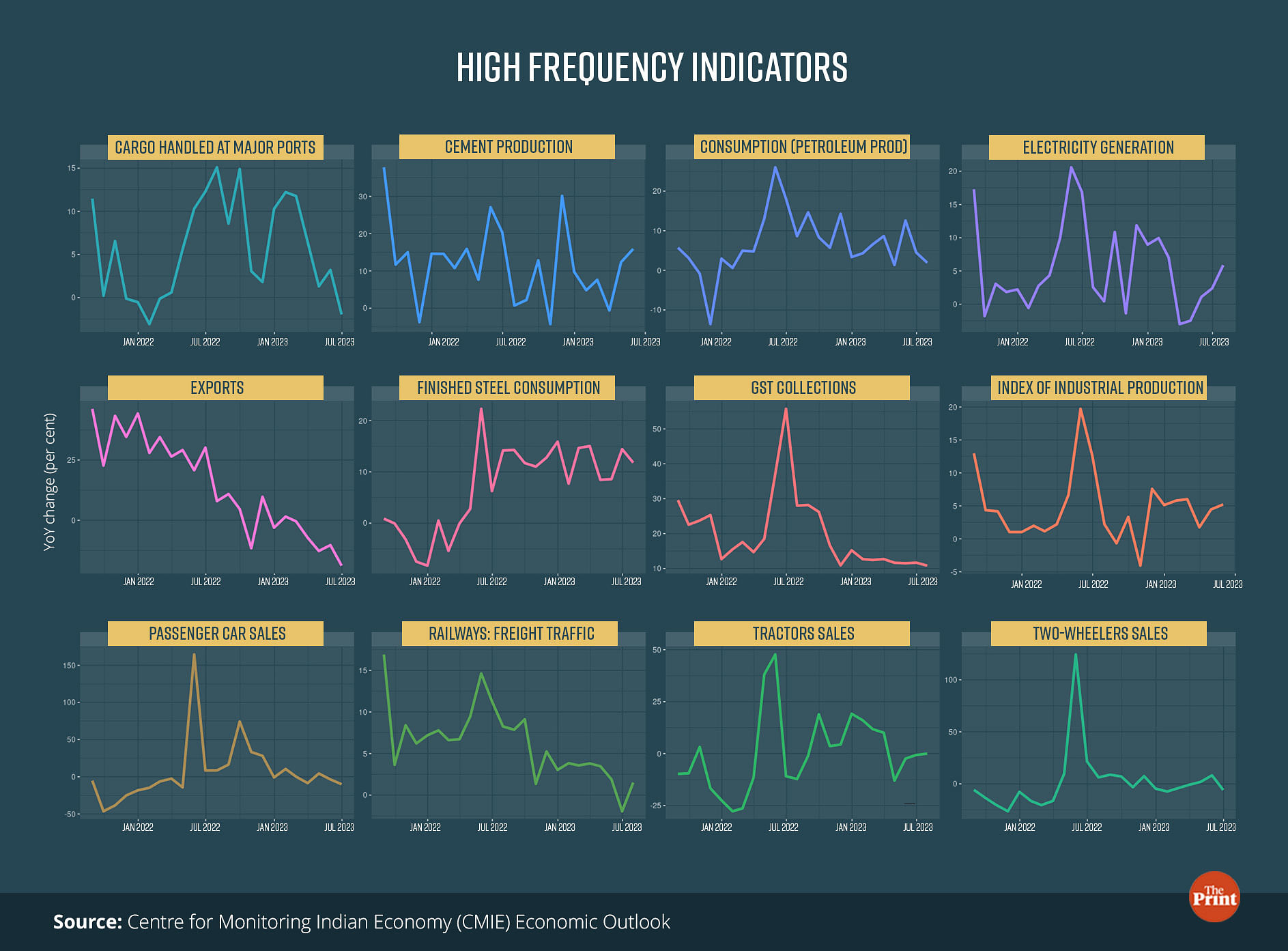

On the growth front, the RBI seemed less worried, as most of the high-frequency indicators present a picture of resilient economic activity. The RBI retained its growth forecast at 6.5 percent for the current financial year with no change in quarterly projections.

Also read: It’s China & upcoming RBI monetary policy that India is concerned about, not US ratings downgrade

Fresh upside risks to inflation

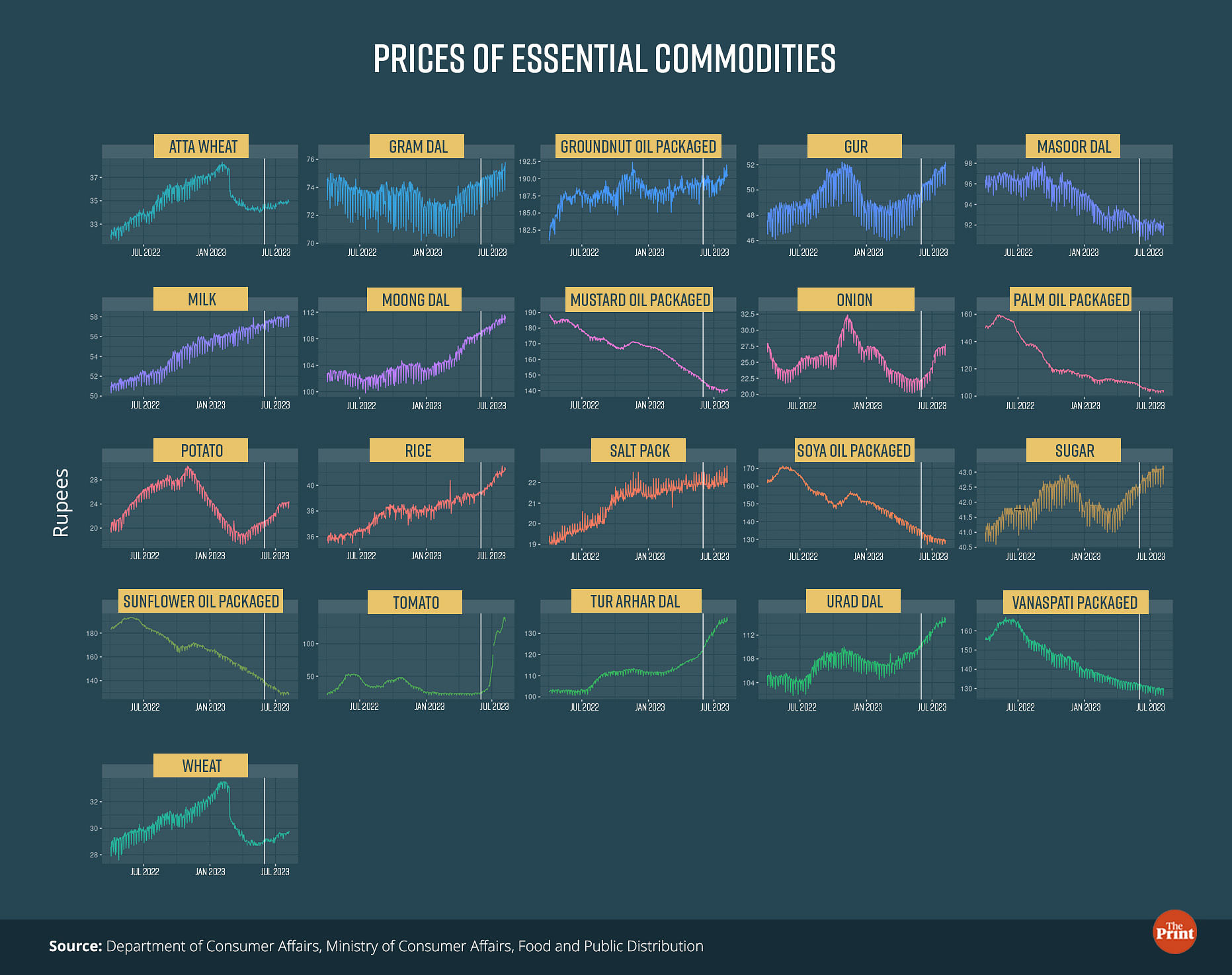

Since the MPC meeting in June, the near-term outlook on food inflation has worsened. Prices of food items have been on an upward trajectory. The escalation in prices is not just limited to tomatoes; prices of other vegetables, wheat, rice, pulses, spices and now vegetable oils have seen an uptick in recent weeks.

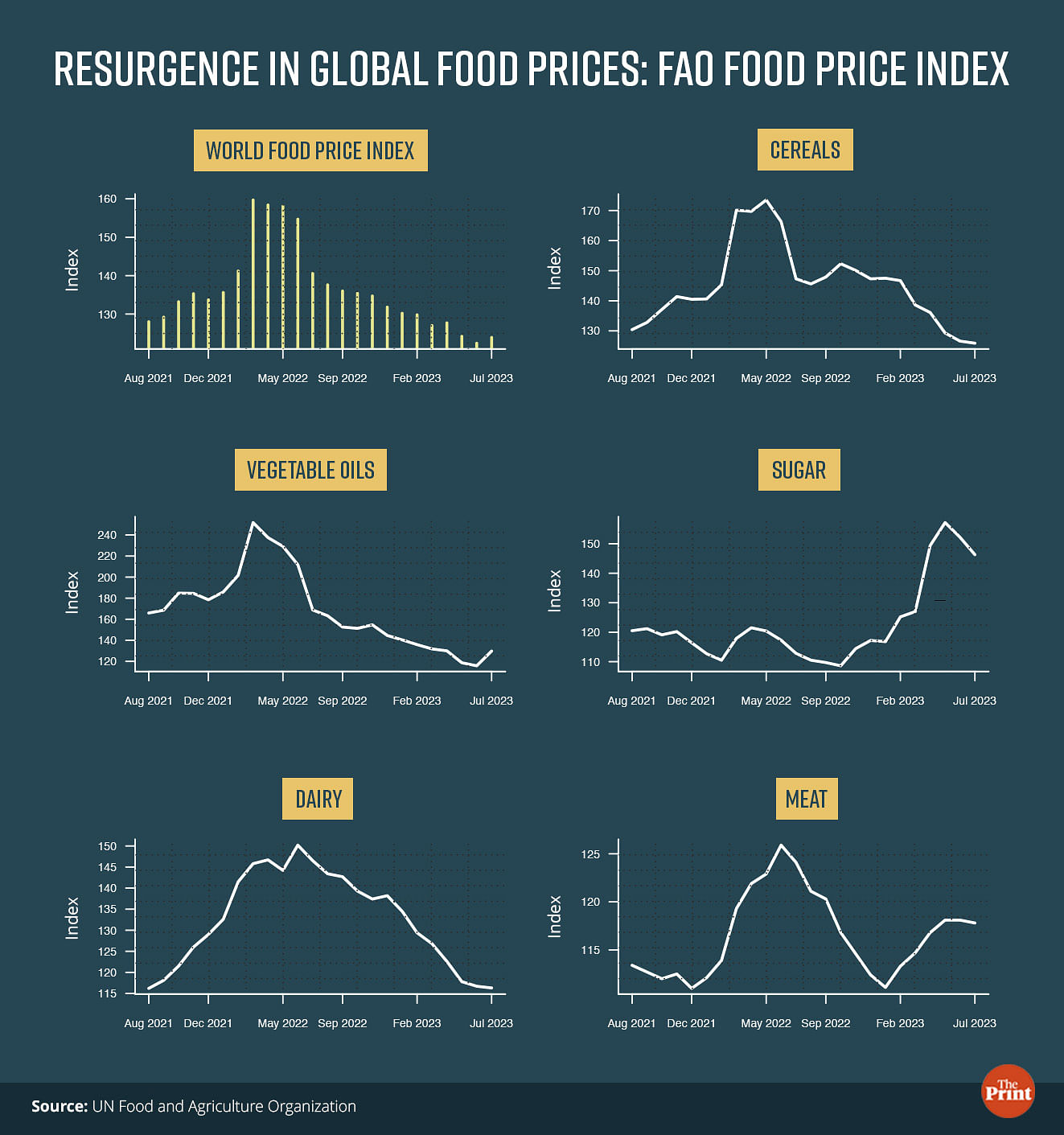

Globally, food prices have seen a rebound. The FAO Food Price Index, a gauge of international prices of a basket of commodities, rebounded in July.

This rebound was led by a rise in prices of vegetable oils. The vegetable oils sub-index was up 14 points from June, registering its first increase after seven months of consecutive decline. International prices of sunflower oil have rebounded due to Russia’s decision to terminate the implementation of the Black Sea Grain initiative.

Last year, the UN and Turkey had got Russia to agree to the initiative to allow safe passage of exportable supplies from Ukrainian ports. Russia has now decided to withdraw from the deal, causing upward pressure in prices of grains and vegetable oils.

Resurgence in global crude oil prices

The average global crude oil prices have edged higher in July as compared to the previous month. Saudi Arabia decided to cut oil production by 1 million barrels per day in July.

Later, the Saudi Energy Minister decided to extend the daily cut to August.

Russia has also decided to cut production by an additional 500,000 barrels a day. Production cuts have led to an almost persistent rise in oil prices in July.

Domestic food inflation is turning broad-based

Data released by the Department of Consumer Affairs (DCA) and Ministry of Consumer Affairs shows that in addition to tomato prices, onion prices have also picked up. Pulses, cereals and milk prices are also seen to be elevated. Wheat and rice prices have increased by more than 6 and 10 percent, respectively, in the past one year.

In response to the sharp surge in cereal prices, the government has decided to offload 5 million tonnes of wheat and 2.5 million tonnes of rice in the open market. Government has also imposed restrictions on export of rice to cool prices.

Economic activity remains resilient

High frequency indicators suggest that growth has remained steady for now. Indicators of economic activity such as cement production and steel consumption have shown strong growth.

Growth in passenger car sales have moderated, however, tractor sales and electricity generation have improved.

Exports have understandably slowed due to global headwinds. Bank credit growth is strong with household credit exhibiting double-digit growth.

Overall, barring risks from global growth slowdown and geo-political tension, the RBI seems less concerned on growth trajectory.

Surprise move on liquidity

The banking system liquidity has been in surplus over the past month. This is also reflected in strong growth in credit despite a 250-basis hike in the policy rate.

The RBI has been conducting variable rate reverse repo (VRRR) auctions to absorb liquidity. But the response of banks to the VRRR auctions has been lukewarm.

They have not fully subscribed to the auctions and have preferred to keep funds with them or deploy in other instruments such as certificate of deposits (CDs) and commercial papers (CPs).

To absorb the surplus liquidity, the RBI has now introduced a blunt tool: the incremental cash reserve ratio (ICRR). From 12 August, all banks are required to maintain an incremental CRR of 10 percent on the increase in net demand and time liabilities between 19 May and 28 July.

The move is intended to absorb surplus liquidity due to various factors including the deposit of Rs 2,000 currency notes. Though a temporary measure, the announcement came as a surprise as it had not been introduced since demonetisation.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: An optimistic IMF has upped its projection for global growth, but don’t celebrate just yet…