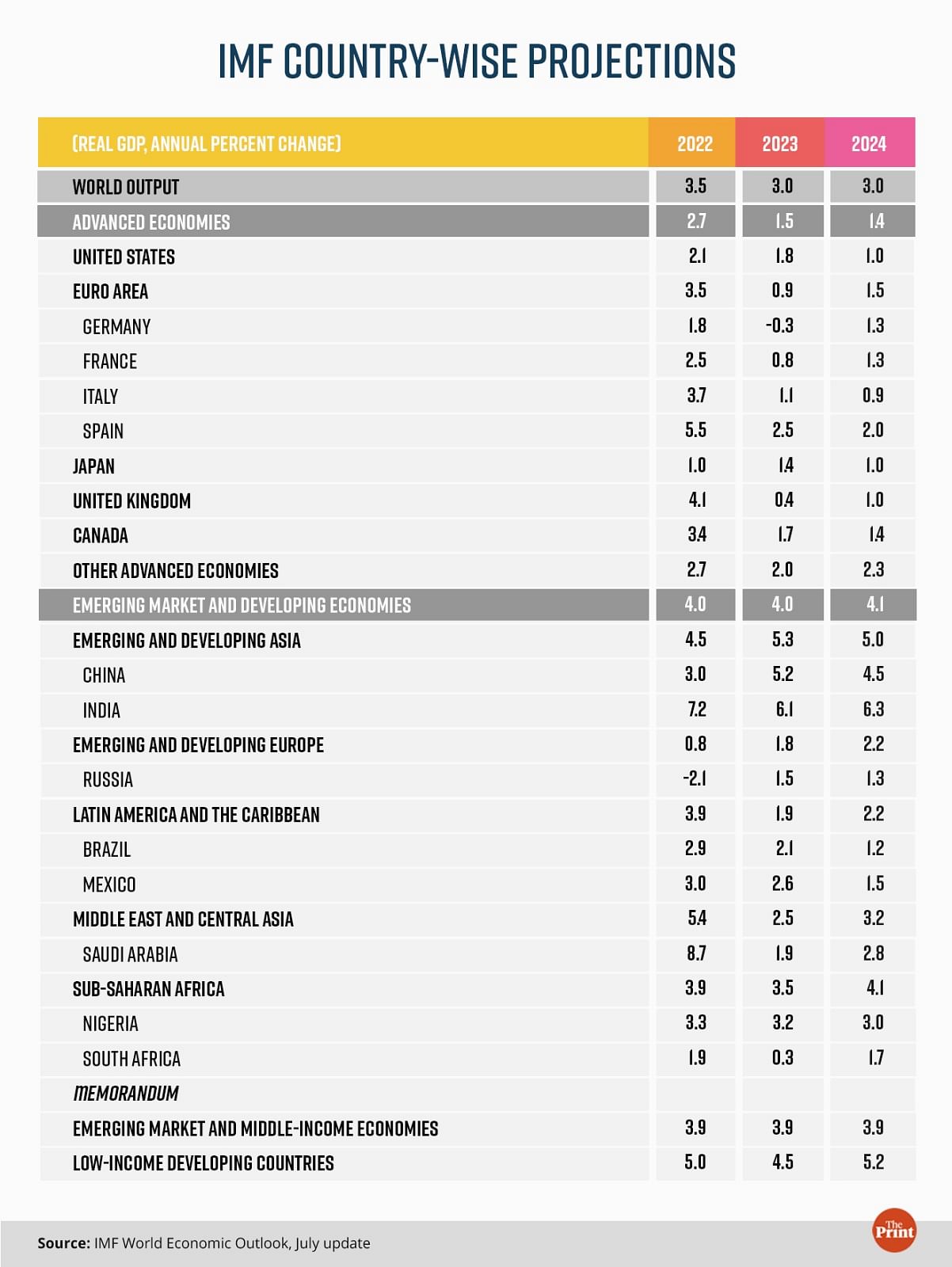

Recently, the International Monetary Fund (IMF) released its World Economic Outlook update which presents its revised outlook for the global economy. While global growth is expected to slow down from 3.5 per cent last year to 3 per cent this year, the IMF is slightly more bullish as it has upped its projection for global growth by 0.2 percentage points for this year as compared to its projection in April, 2023.

The optimism on growth stems from the moderation in headline inflation, the resolution of the US debt ceiling crisis and the banking sector turbulence in the US and Switzerland. While growth projection has been revised upwards, it is still below the long-term average.

There is good news on the inflation front as well, as it is projected to moderate from 8.7 per cent in 2022 to 6.8 per cent in 2023. However, it is too early to celebrate. The synchronised tightening of monetary policy has started to impact growth, core inflation (excluding the impact of energy and food) still remains above the target and China’s growth recovery is losing momentum due to its troubled real estate sector. Rising debt distress amongst developing countries has the potential to drag down growth.

Also read: India wants rupee to go global, but low appetite for the currency & rise of Chinese Yuan obstacles

Growth revised upwards but significant regional variation persists

The slowdown in global growth is mainly driven by advanced economies. Among these, growth in the Euro area is projected to decline from 3.5 per cent in 2022 to 0.9 per cent in 2023. Germany is expected to register a degrowth of 0.3 per cent in 2023 from 1.8 per cent in 2022. The UK is also expected to slow down steeply from 4.1 per cent in 2022 to 0.4 per cent in 2023. This is an upward revision of 0.7 percentage point for 2023, reflecting improvement in consumption and investment owing to fall in energy prices.

For most of the advanced economies except for Germany, growth projections have been revised upwards from April.

There are significant variations among emerging markets and developing economies (EMDEs). While emerging and developing Asia (China and India) is expected to see a strong growth of 5.3 per cent, commodity producers could see a decline in growth due to decline in export revenues owing to the moderation in commodity prices.

India’s growth projection has been revised upwards from 5.9 per cent to 6.1 per cent for 2023 reflecting stronger than expected growth in the fourth quarter.

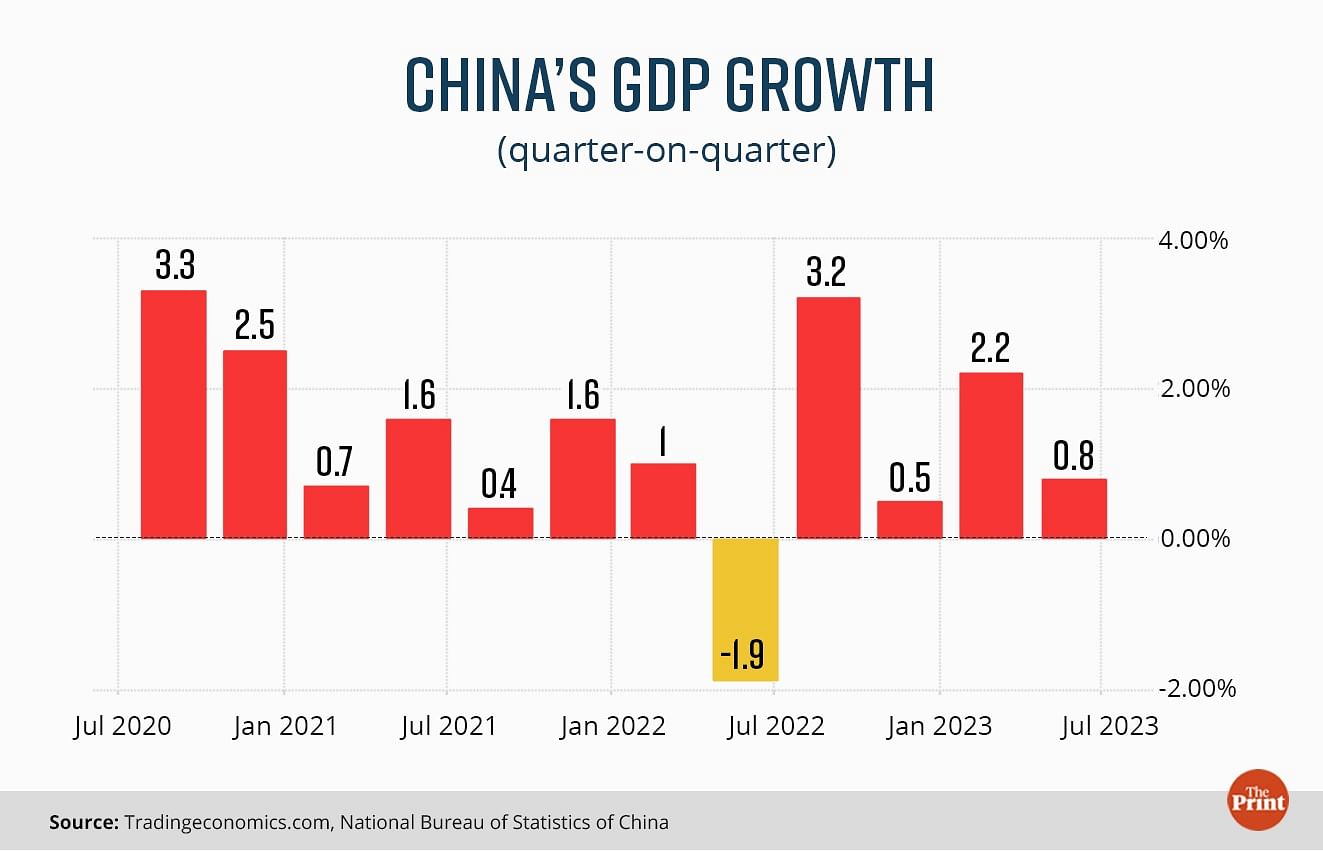

China’s post-pandemic recovery is losing momentum

Growth in the world’s second largest economy is seen to be faltering and could pose a drag on global growth. From a 2.2 per cent quarter-on-quarter growth in the January-March quarter, growth slowed to just 0.8 per cent in the April-June quarter. Rising youth unemployment in China hit a new high of 21 per cent in June-another sign of a faltering post pandemic recovery.

The genesis of the slowdown can be attributed to the weakness in the real estate segment. The property market contributes a quarter of China’s GDP and has been in a crisis since Chinese authorities put a brake on developers’ high reliance on bank loans in 2020.

Constrained access to bank loans resulted in debt defaults and inventory of unfinished projects. On the one hand it resulted in massive losses for the Chinese real estate companies and, on the other, it severely dented consumer confidence resulting in slump in housing prices.

The real estate downturn has resulted in subdued investment. Consumption spending has also slowed down. In a bid to spur consumption, the People’s Bank of China (PBOC) cut the one year and five-year loan prime rates. This will lower borrowing costs for households and industries but more stimulus measures are on the anvil.

Core inflation still elevated, need to avoid pre-maturing easing of policy rates

While headline inflation has eased somewhat, the real challenge lies in the form of elevated and persistent core inflation. The IMF report, therefore, advises policy rate adjustment in response to data.

Many central banks have reverted to policy rate tightening after announcing a pause on rates. The US Federal Reserve announced a 25 basis points rate hike after a pause in the last meeting. The central bank indicated that further rate hikes may be on the horizon as economic growth and the labour market continue to remain resilient.

Major central banks except for China will be in no hurry to cut rates. Demand resilience and climate and geo-political risks could pose upside risks to inflation through surge in food and energy prices.

As central banks are not yet done with interest rate tightening, the IMF report underscored the need to use adequate financial stability tools to provide a buffer against losses on account of rising interest rates.

Rising debt distress calls for fiscal consolidation

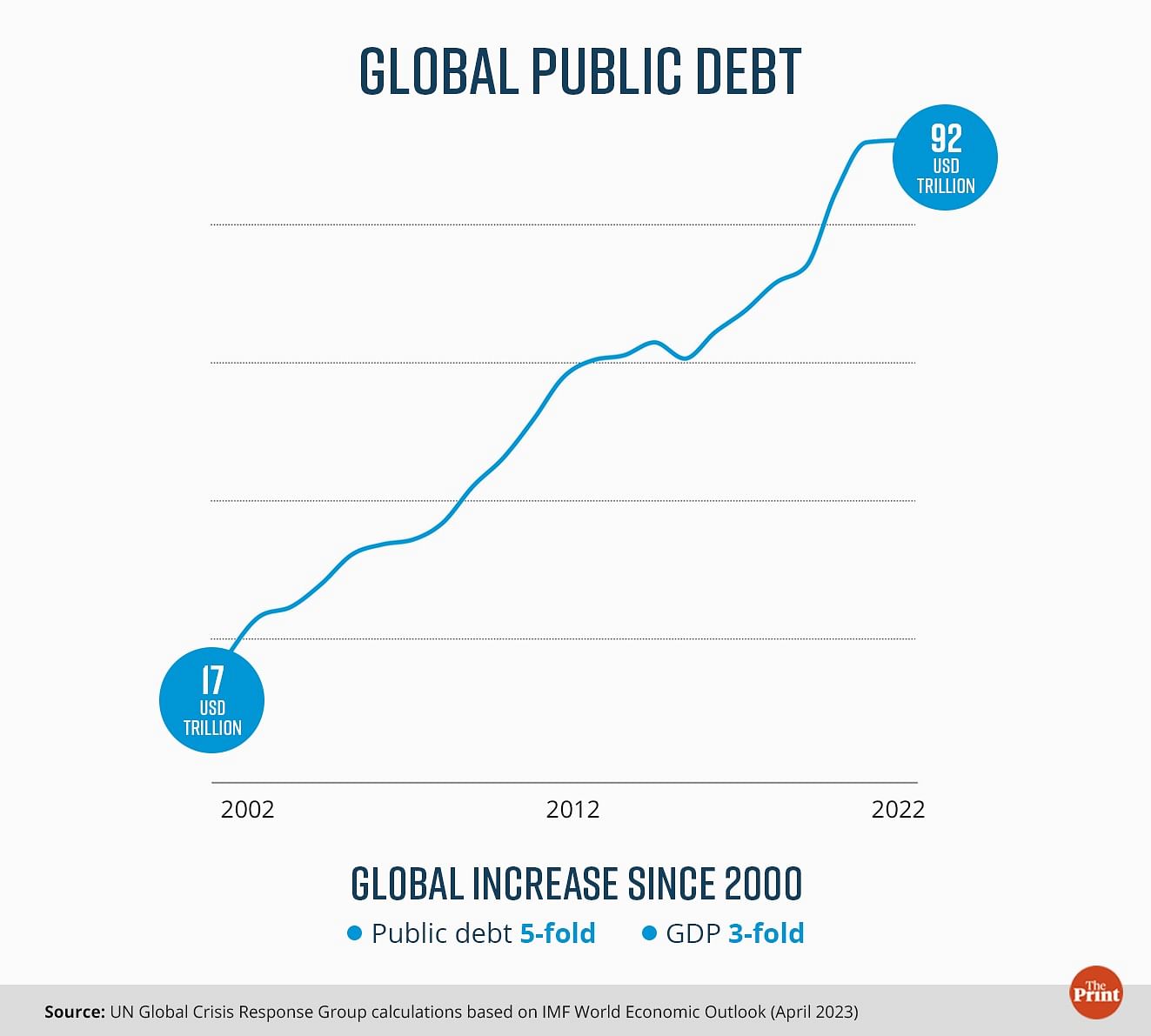

The IMF report has highlighted the issue of rising debt distress particularly among emerging markets and developing economies and has placed fiscal consolidation alongside targeted support as one of the key policy priorities. A recent UN report has also highlighted some disturbing facts about global public debt.

Global public debt has reached a record high of USD 92 trillion in 2022 — a five-fold increase since 2000 and outpacing global GDP growth.

Developing countries owe almost 30 per cent of the total debt, of which 70 per cent is owed by China, India and Brazil. The number of countries facing high levels of debt has jumped from 22 in 2011 to 59 in 2022.

The developing countries find themselves in a challenging position due to their substantial debt burden, having to balance between servicing debt and meeting development needs. Additionally, they are susceptible to currency devaluation and increased borrowing expenses.

The IMF report suggests quicker and more effective collaboration on debt resolution, involving mechanisms like the G20 Common Framework and the Global Sovereign Debt Roundtable.

However, reaching a consensus on debt resolution and restructuring is proving to be a formidable task.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.