The Indian economy posted an impressive 7.2 per cent growth in the financial year ended March 2023. What is the latest evidence on the growth momentum? As the first half of the calendar year 2023 has come to a close, we look at how some of the segments of the economy are faring?

Banking sector in good health but areas of concern remain

The health of the banking sector has witnessed an encouraging turnaround. The gross non-performing assets ratio has fallen sharply from 11.5 per cent in March 2018 to 3.9 per cent in March 2023.

The net non-performing assets ratio has also seen a similar improvement during this period. Banks have managed to report healthy profits driven by increase in net interest margins (NIM). The combined net profits of 32 listed private and public sector banks (PSBs) are up 40.56 per cent in 2022-23 to close to Rs 2.29 trillion. Particularly, the combined net profit of public sector banks surged to more than Rs 1 trillion in the financial year ended March 2023. This is a sharp turnaround as compared to a total net loss of Rs 853.9 billion in 2017-18.

Alongside, their capital position measured by capital to risk-weighted assets ratio (CRAR) is at historical high of 17.1 per cent. Strong capital position alongside improvement in provisioning coverage ratio has strengthened the banking sector’s ability to withstand shocks.

Stress tests by the Reserve Bank of India (RBI) suggest that the asset quality of the banking sector is likely to improve further. The gross non-performing assets ratio is likely to fall to 3.6 per cent by March 2024. The improved health of the banking sector has bolstered its capacity to advance loans.

Growth in non-food bank credit has been above 15 per cent in each of the six months of the current calendar year. The key drivers of credit growth have been personal loans and loans to services. Credit to industry has been growing at a muted pace. In particular, the outstanding bank credit to large industries has seen a decline in each of the five months of 2023 except for April.

The slowdown in credit to industry is also visible when compared with the size of the economy. Credit to large industries as a share of GDP has seen a consistent decline from 18.2 per cent in 2013-14 to 9.1 per cent in 2022-23.

While at an aggregate level, the banking sector is in good shape, there are emerging signs of stress that warrant continuous monitoring. This is important as the regulatory forbearance measures and restructuring schemes introduced as support measures during the Covid period have now ended.

According to the RBI’s Financial Stability Report, while the overall NPAs in the personal loans segments are low, 6.1 per cent of the education loans advanced by public sector banks and 18 per cent of credit card receivables have turned into non-performing assets.

Credit growth to micro, small and medium enterprises can be attributed to the emergency credit line guarantee scheme (ECLGS) but about one sixth of accounts and one-twentieth of amounts under the Emergency Credit Line Guarantee Scheme have turned non-performing with stress seen in micro, services and the trade segment.

Also read: India-US trade ties deepening, but Modi may need to commit to easing protectionist policies

Gains in private investment seen in early 2023 need to be sustained

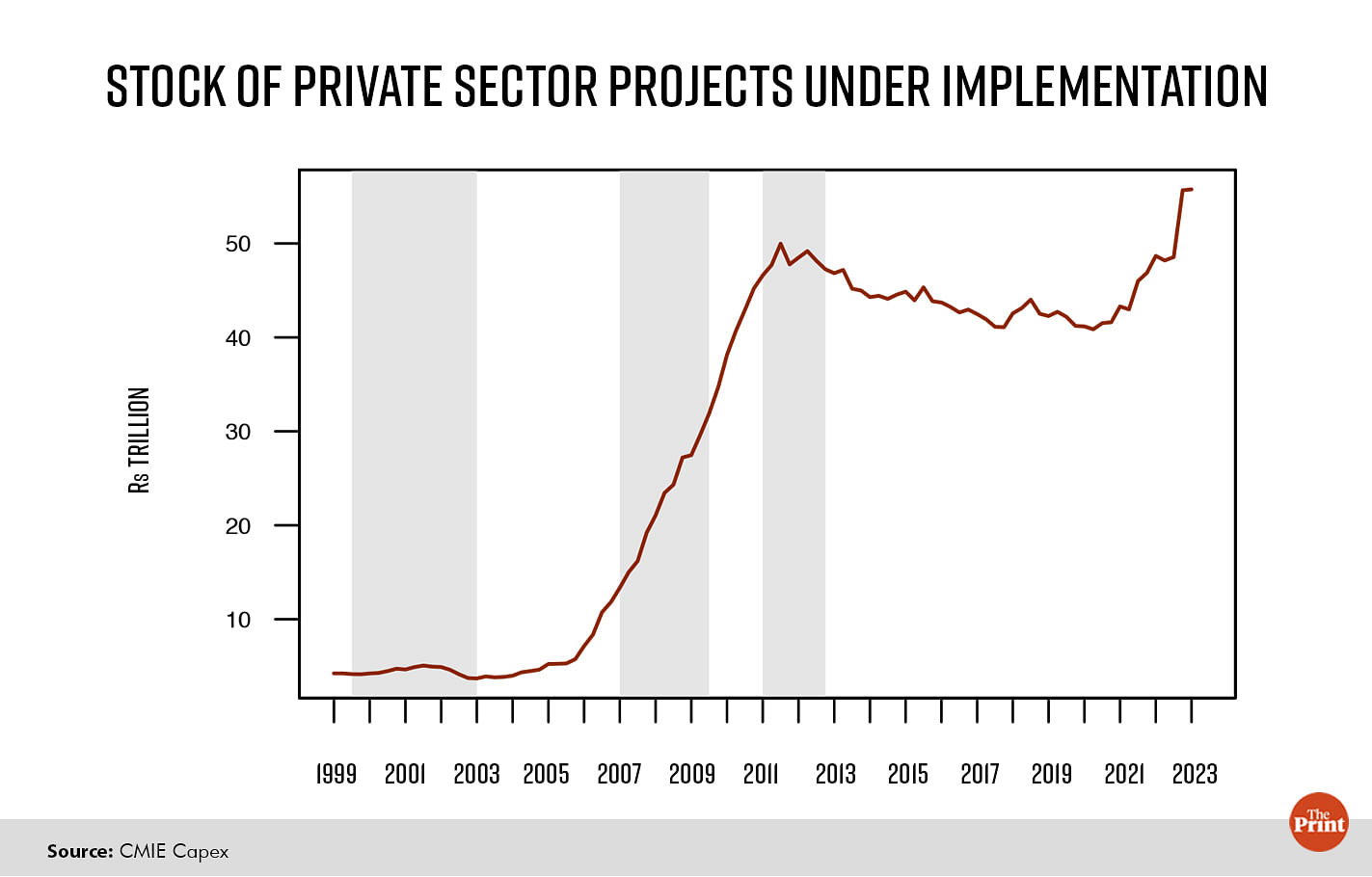

A useful measure of the state of private investment is the stock of under-implementation projects in the private sector provided by the CMIE’s Capex database. This series peaked in 2011-12 and had seen a sustained decline since then.

This series bottomed out in 2020 and saw a big surge in January-March 2023, with the value of private projects under implementation picking up from Rs 48 trillion in the quarter ended December to Rs 55 trillion at March end quarter.

In the June quarter, the growth was flat as the value of private projects under implementation was at roughly the same value as the previous quarter.

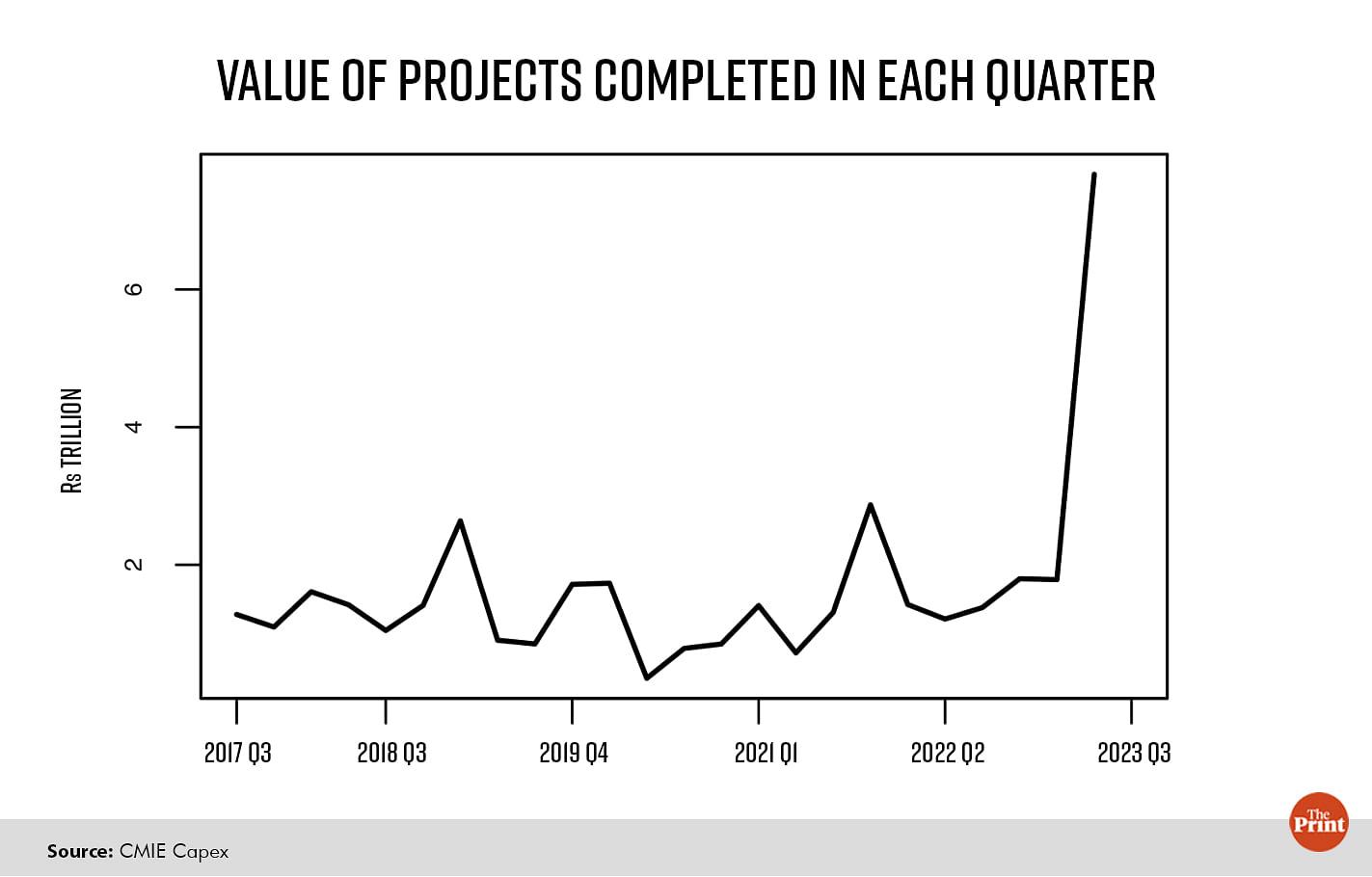

The overall stock of projects under implementation is the sum of government and private sector projects. It is seen that while the March quarter saw a jump in the aggregate stock of projects under implementation, in the June quarter, the increase was not sustained. The stock of projects under implementation rose from Rs 145.6 trillion to Rs 155.6 trillion in the quarter ended March. In the June quarter, the stock of projects under implementation fell to Rs 149.5 trillion. The decline was due to a slowdown in projects under implementation in the government sector.

A welcome development was that the value of projects completed touched a record Rs 7.7 trillion in the June quarter from Rs 1.78 trillion in the March quarter. The project completion is mainly being driven by the government with projects worth Rs 6.8 trillion being completed during the June quarter.

Financial markets buoyant

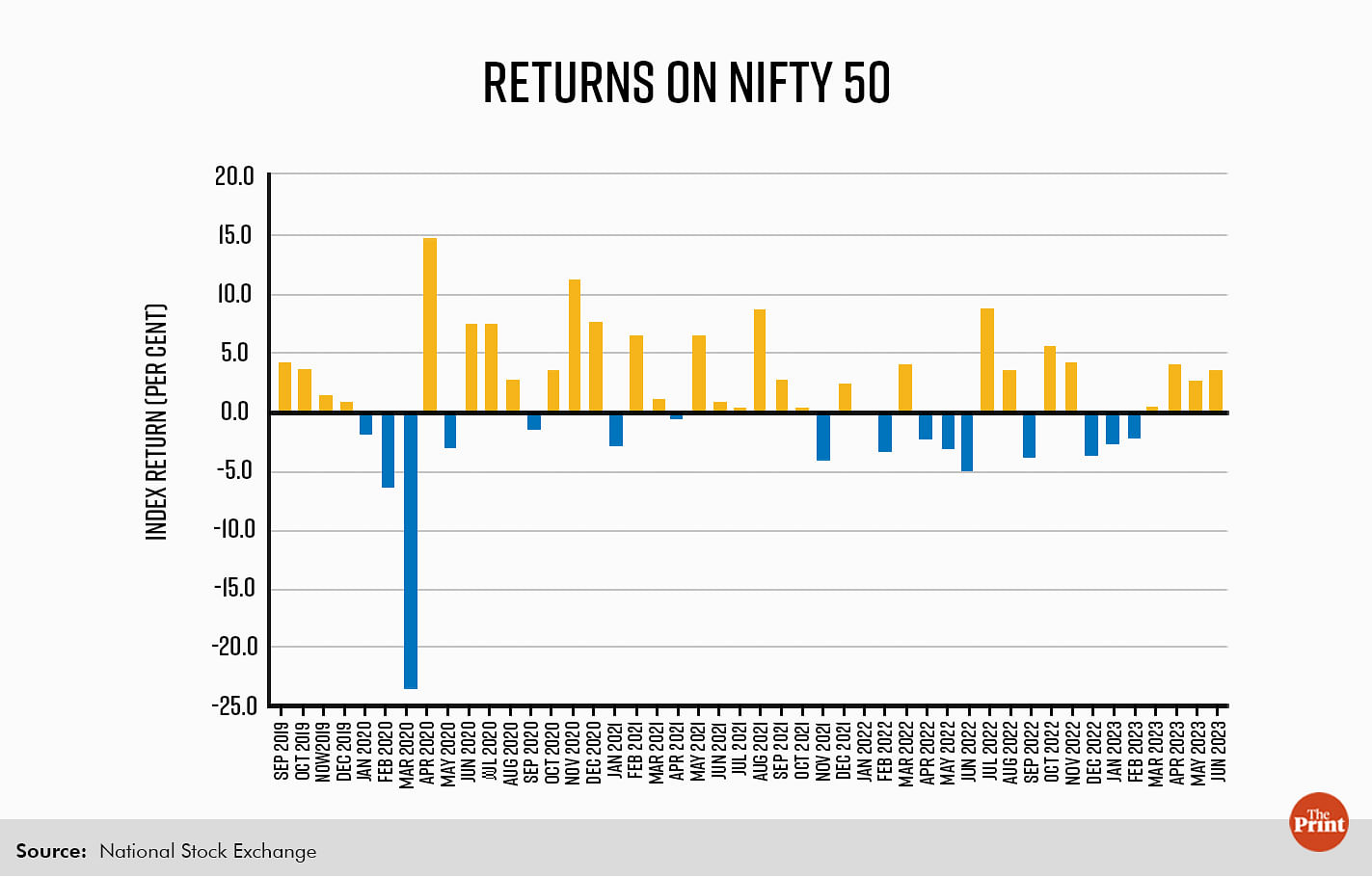

After witnessing a turbulent phase in the first two months of the calendar year, markets have generated positive returns.

In the initial months of 2023, markets were impacted by the banking crisis in the advanced economies. Uncertainty over the US Fed’s actions also dented the investor sentiment. Since then, markets have been buoyant due to heavy investments by foreign portfolio investors (FPIs).

Moderation in inflation, favourable macroeconomic indicators and optimistic growth outlook have attracted foreign investors to Indian markets.

Another reason for attracting higher foreign fund inflows is that China’s economic growth momentum is seen to be losing steam after showing initial spurt post the relaxation of Covid restrictions.

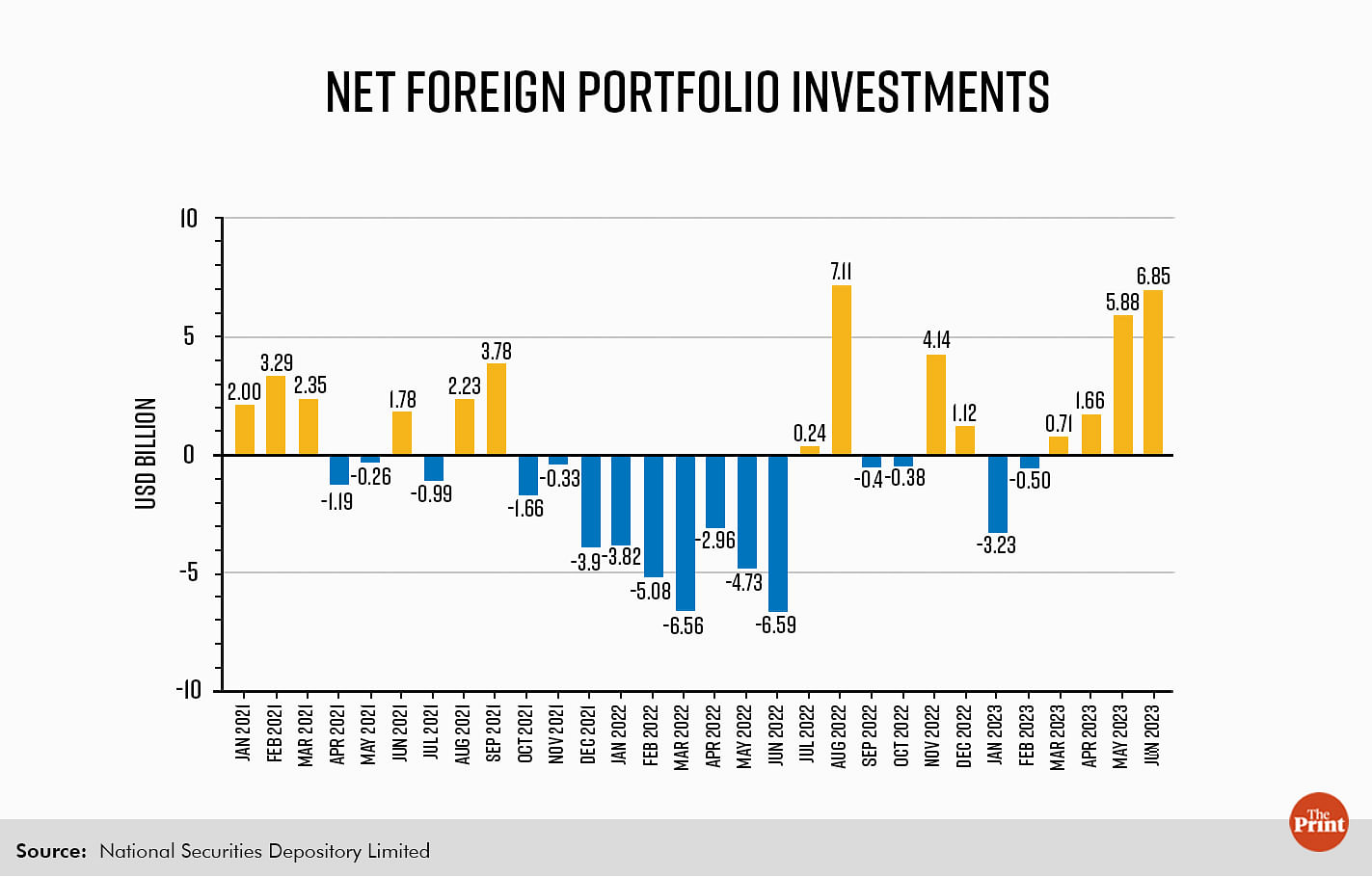

In the first half of 2023, FPIs and mutual funds have been net buyers.

Foreign portfolio investors have been net buyers for the fourth month in a row in June. They invested USD 6.8 billion in June after investing USD 5.8 billion in May.

Strong portfolio flows also caused the rupee to stage an appreciation of 0.16 per cent in the first six months of the calendar year after depreciating by 10 per cent in 2022. However, in the coming months, the rupee could weaken again due to a stronger dollar.

Dollar could strengthen on the back of monetary policy tightening by the US Federal Reserve.

Export slowdown due to monetary tightening but moderation in oil prices will help

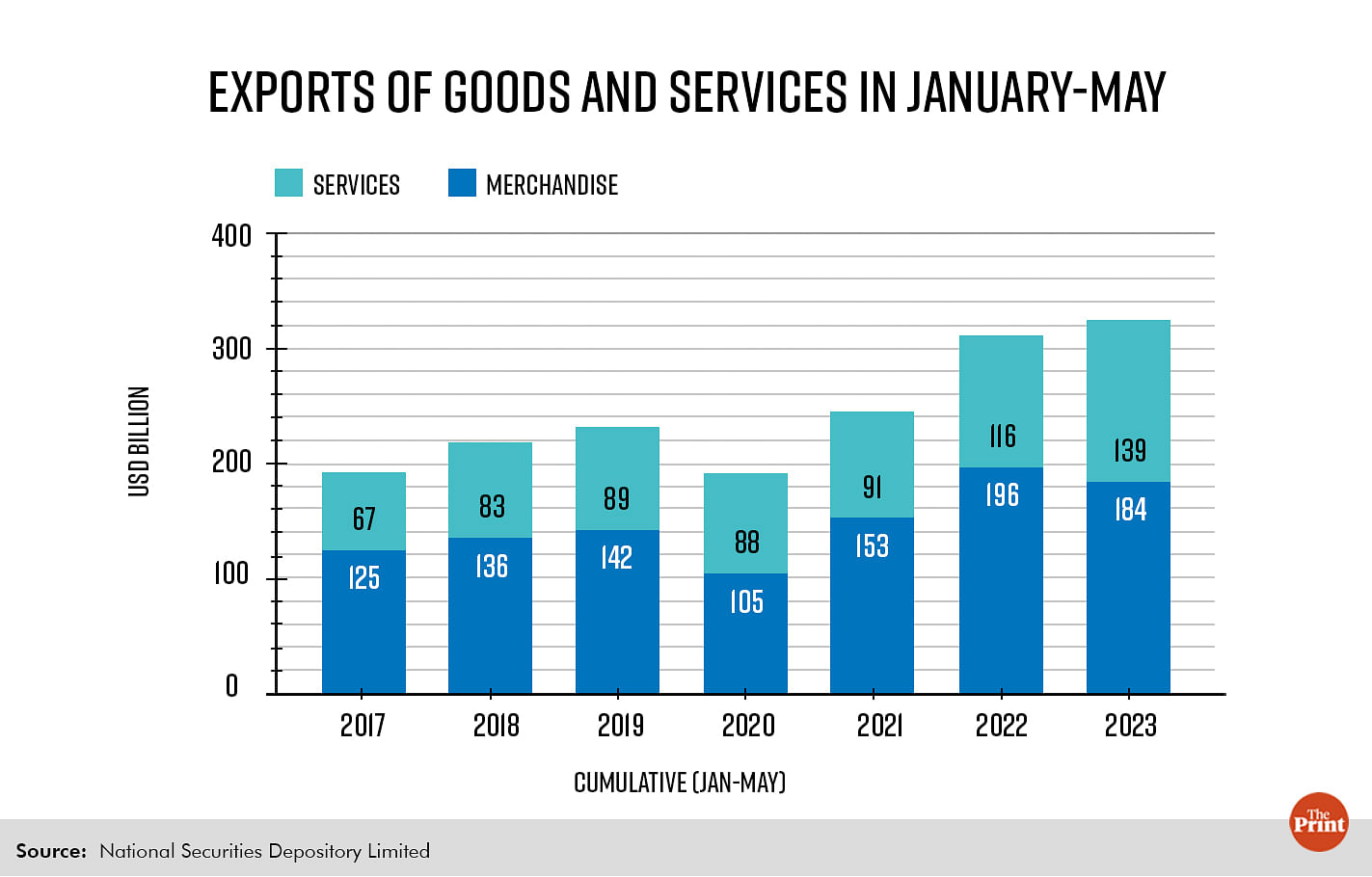

Under the influence of monetary tightening and slowdown in demand, India’s merchandise exports registered a contraction from February to May 2023.

According to the recent data available for May, goods exports slipped 10 per cent as recessionary conditions in the West continued to hurt export demand.

Imports contracted by 6.6 per cent in May, though on a sequential basis, imports widened from USD 50 billion in April, 2023 to USD 57 billion in May 2023.

Slowdown in exports has led to widening of trade deficit.

Trade deficit widened to a five-month high of USD 22 billion in May 2023.

However, a surge in India’s services exports have compensated for the fall in good exports. While exports of telecommunications, computer and information services constitute the bulk of services exports, professional services provided by India’s skilled workforce to multinational corporations played a significant role in increasing services exports.

Gains in services trade and remittances helped in reigning India’s current account deficit (CAD) to 0.2 per cent in the January-March quarter of FY 2022-23.

Overall, CAD stood at 2 per cent for the financial year 2022-2023, higher than 1.2 per cent in the previous financial year due to elevated commodity prices during the first half of the financial year 2022-23.

While remittances may decline in the current financial year, moderation in crude oil prices and sustained growth in services exports would likely limit the deficit on the current account further in the current year.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: Heatwave & heavy rainfall or typical annual spike? What’s causing tomato prices to skyrocket