Prime Minister Narendra Modi’s official state visit to the US presents a significant opportunity to deepen India-US economic engagement. While in the past few years, rising trade and capital flows reflect increasing economic ties between India and the US, their common concern about China’s coercive actions could further strengthen their economic and strategic relations.

On the trade front, both countries will benefit from trade diversification initiatives. India would try to deepen its trade ties with the US to reduce its exposure to China. While India enjoys a trade surplus with the US, China is India’s second largest trade partner and the main source of its deficit.

For the US, India provides huge trade opportunities, as it is one of the largest consumer markets and the fastest-growing market economy. The US would also like to strengthen its ties with India amid rising tensions with China.

China’s spy balloon in American territory and the latter’s growing support to Taiwan have led to the two superpowers locking horns at several international forums.

Also read: Fiscal health check — how India’s 4 big poll-bound states stack up

India-US merchandise trade

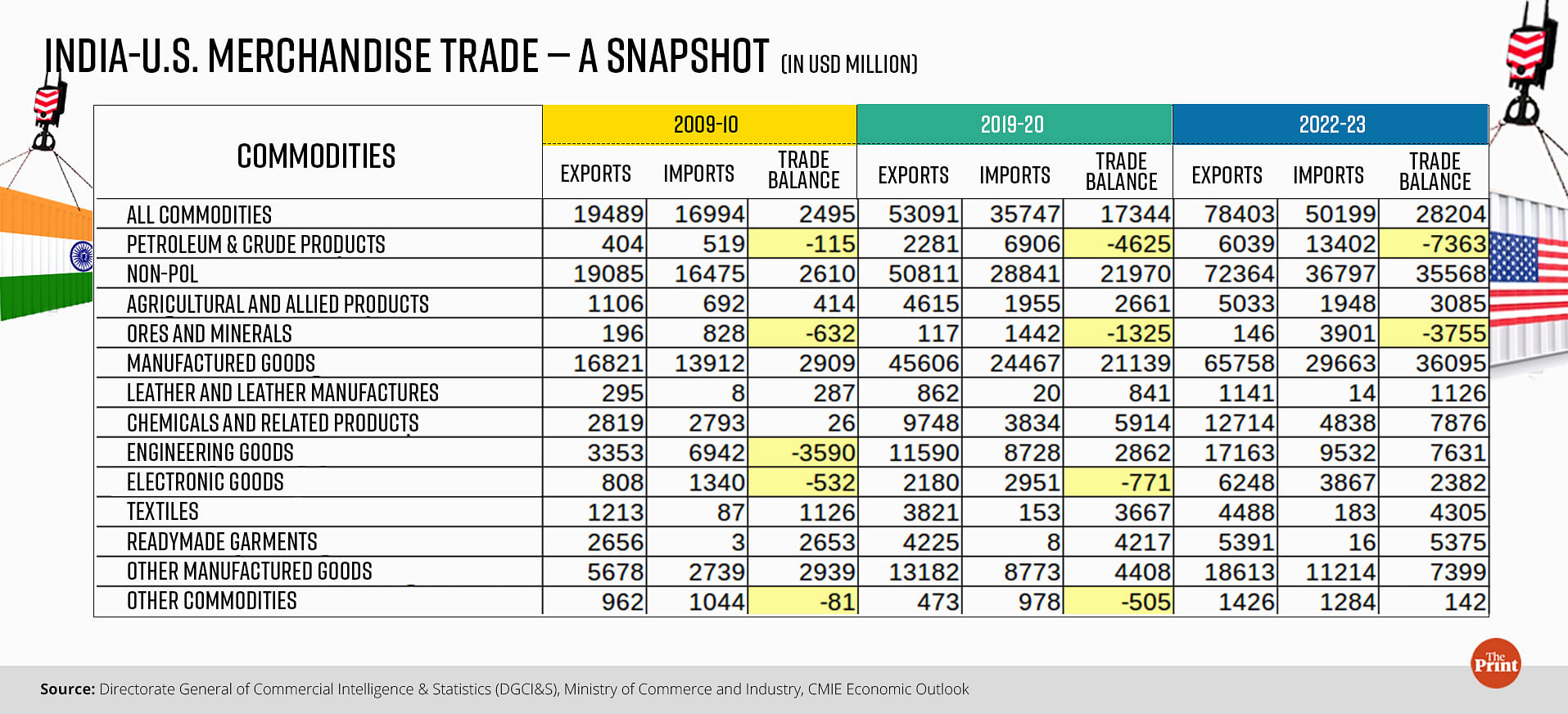

India’s outbound shipments to the US have been rising at a brisk pace. India’s trade surplus with the US was USD 2.5 billion in 2009-10. This rose to USD 17.3 billion in 2019-20 and further to USD 28.2 billion in 2022-23.

India’s exports to the US surged by almost 48 per cent from 2019-20 to 2022-23. The US accounts for more than 17 per cent of India’s overall merchandise exports.

The composition of trade has turned favourable for India over the last few years. In 2009-10, India had a trade deficit with the US on engineering goods and electronic goods, implying that India’s imports of engineering and electronic goods exceeded India’s exports of the same. By 2022-23, India has a trade surplus with the US on engineering and electronic goods.

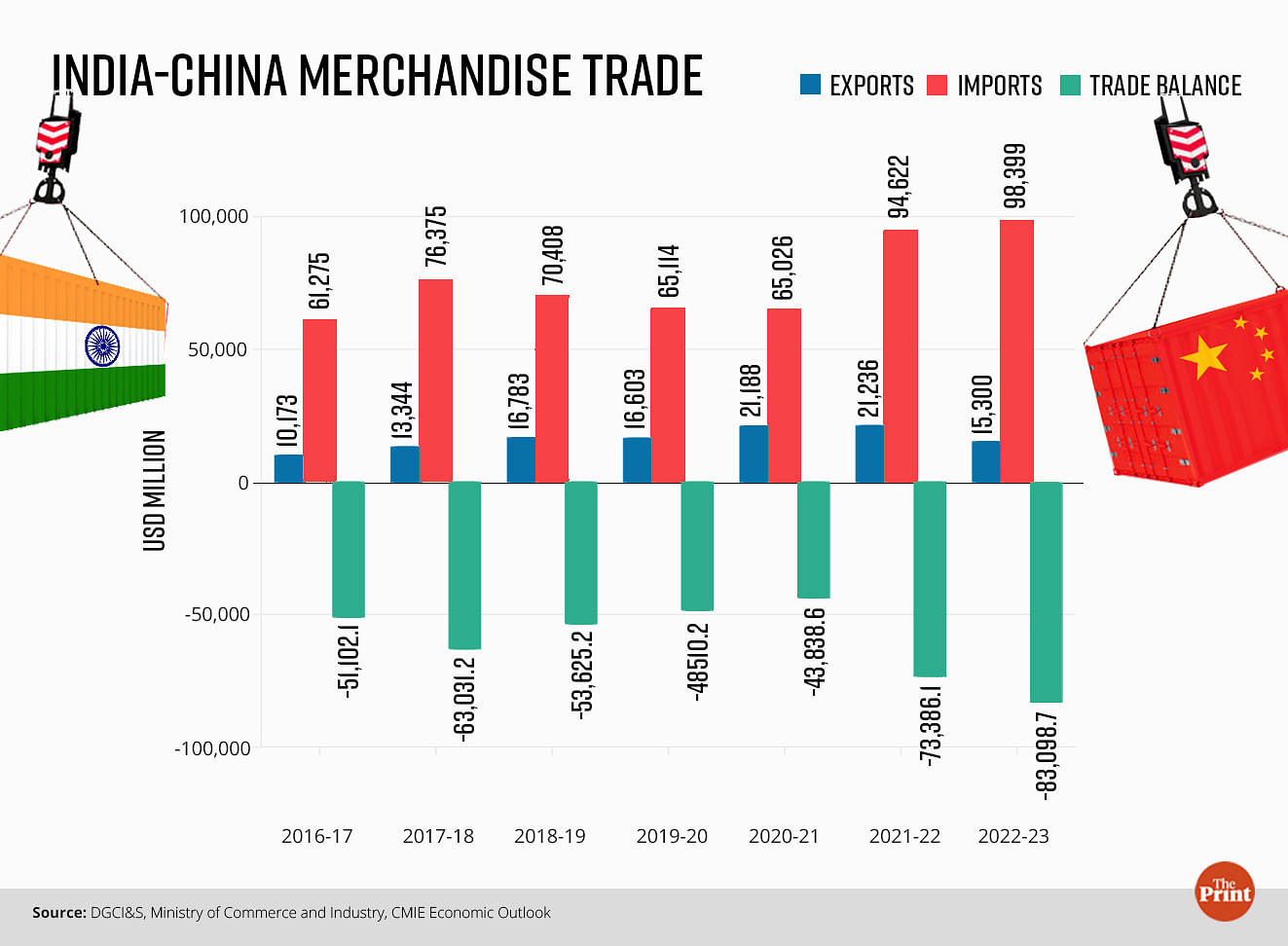

In contrast, India’s exports to China dipped by about 28 per cent to USD 15.32 billion in 2022-23, while imports widened by 4.16 per cent to USD 98.51 billion in the last fiscal. The trade gap widened to a record high of USD 83.2 billion in FY23 as against USD 72.91 billion in 2021-22.

Inbound and outbound investments

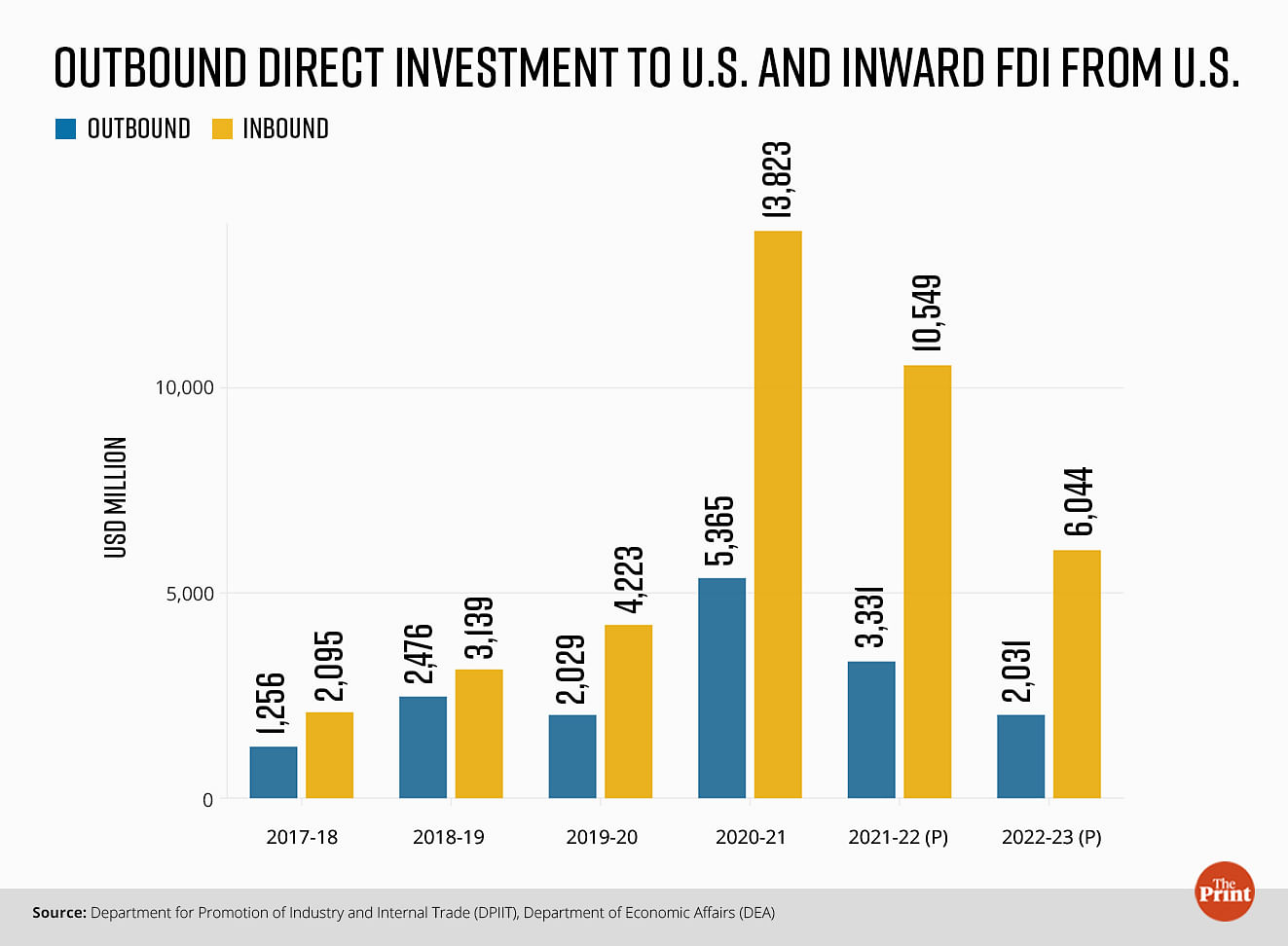

The US also features as one of the prominent sources of foreign direct investment (FDI) in India. However, the pattern of FDI equity inflows has been uneven.

Inflows from the US were USD 1.8 billion in 2014-15. These surged to USD 13.8 billion in 2020-21. In 2021-22, the FDI equity inflows from the US moderated to USD 10.5 billion. In 2022-23, the overall FDI equity inflows into India declined to USD 46.03 billion in FY23 from USD 58.77 billion in FY22. A key reason for the decline in FDI inflows was the slowdown in inflows from the US which fell to USD 6 billion in 2022-23.

The growing economic ties between India and the US is also reflected in growing outbound investment by Indian companies in the US. According to the latest edition of the Confederation of Indian Industries (CII) report on the Indian industry’s footprint in the US titled Indian Roots, American Soil, 163 companies have invested USD 40 billion through all 50 US states.

Indian companies have employed more than 4,25,000 people across states where they have tangible investments. Their sectors of operations cover pharmaceuticals and healthcare; information technology and telecommunications; manufacturing; services (including financial, legal, logistics, design); automotive; food and agriculture; tourism and hospitality; energy among others.

The previous edition of the report, released in 2020, said that 155 companies had invested USD 22 billion and created 125,000 jobs. While eight new companies have made investments since 2020, a large part is also driven by existing companies increasing their scale of operations in the US.

Earlier this year, Air India announced the purchase of more than 200 Boeing aircraft — a historic deal that US President Joe Biden said would “support over one million American jobs across 44 states”.

According to the factsheet on overseas direct investment published by the Ministry of Finance, Indian companies made an aggregate outbound direct investment of USD 13.2 billion in 2022-23. Of this, the US received an investment of more than USD 2 billion. Investments in the US accounted for 17 per cent of the total outbound direct investment between April 2021-May 2023.

Overseas flows in the form of foreign portfolio investments in Indian capital markets are also dominated by the US. The total assets under custody (AUC) of the US investors across equity, debt and hybrid instruments amounted to Rs 20.8 lakh crore as of May 2023. The total assets under custody by all FPIs amount to Rs 52.95 lakh crore.

Also read: Inflation eased, but here’s why RBI’s unchanged policy repo rate is likely to stay for some time

Initiatives on critical and emerging technologies

The initiative on critical and emerging technologies (iCET) launched by the National Security Advisors of the two countries serves as a framework for collaboration between the US and India on critical and emerging technologies.

Under this umbrella framework, there is a potential for deepening ties in areas such as quantum communications, building a semiconductor ecosystem in India, accelerating defence collaborations, exploring commercial space opportunities, and catalysing existing and forging new research opportunities and partnerships.

In march, the two countries signed a memorandum of understanding (MoU) on strengthening semiconductor supply chain resilience. This has an upside for India, particularly in the context of the USD 10 billion incentive scheme of the government to boost semiconductor manufacturing in the country.

The PM’s visit could further explore opportunities for attracting investments and business ties in this space.

The US has been keen to deepen ties with India to counter the growing influence of China. The US has been nudging India to fast-track the deal involving the purchase of 30 armed drones. The deal will cost India around USD 3 billion and will help in enhancing India’s surveillance machinery.

Some contentious issues remain

The US has expressed concerns on India’s protectionist trade policies and reversal of the policy on trade liberalisation. The US would like to see a commitment from India on easing trade and investment restrictions. The US will also likely nudge India to join the trade pillar of the US-led Indo-Pacific Economic Framework (IPEF) — a 14 nation bloc.

India has signed up for three pillars of the IPEF on resilient supply chains, tapping clean energy opportunities, and combating corruption but has opted out of the trade pillar for its discomfort on binding commitments on issues like environment, labour and public procurement.

India is of the view that the commitments on environment and labour may discriminate against developing countries. Free access to agricultural markets is also something India is opposed to under the trade pillar.

The two nations would like to see more technology orientation in their trade and investment relations. It remains to be seen how the two countries will balance their domestic interests with the need to foster international co-operation amidst the fast-changing geo-political environment.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: Manufacturing revival, agriculture & construction expansion — what’s behind 7.2% GDP growth