In recent years, there have been discussions about exploring the usage of non-USD currencies in trade invoicing and settlement as a means to deepen regional economic cooperation. The imposition of sanctions on Russia and other recent geo-political developments have heightened the urgency in finding alternative currencies that could be used for invoicing international trade and could be held as foreign currency by monetary authorities.

In this backdrop, the RBI appointed panel on rupee internationalisation is a welcome step. The panel has put forward a range of short-term, medium-term, and long-term measures aimed at expediting the process of making the Indian rupee more globally recognised and used in international transactions.

More broadly, the panel recommends a review of India’s restrictive trade and capital controls framework. For the rupee to become truly international, all building blocks need to be in place: freer convertibility, certainty of policies governing inflow and outflow of capital, sophisticated financial markets and a bigger share in global trade.

Impediments to settlement of trade in rupees

In the short-term, the group has recommended adopting a standard approach towards examining the proposals on bilateral and multilateral trade arrangements for invoicing, settlement and payment in INR and local currencies, encouraging opening of rupee accounts for non-residents, integration of Indian payments system with countries and operationalising swap arrangements to facilitate local currency trade.

Other short-term measures include rationalising the Foreign Portfolio Investment regime and facilitating inclusion of government securities in global bond indices.

The internationalisation of the rupee gathered steam after the RBI enabled an arrangement for invoicing, payment and settlement of trade in INR through a circular on 11 July, 2022. Under this mechanism, overseas banks are allowed to open special rupee accounts in local banks.

Recently, India and the UAE entered into an agreement to promote Local Currency Settlement System to promote the use of rupee and Dirham bilaterally. While a number of banks have opened special rupee accounts with 18 countries to promote the role of rupee in cross-border trade, progress so far has been limited.

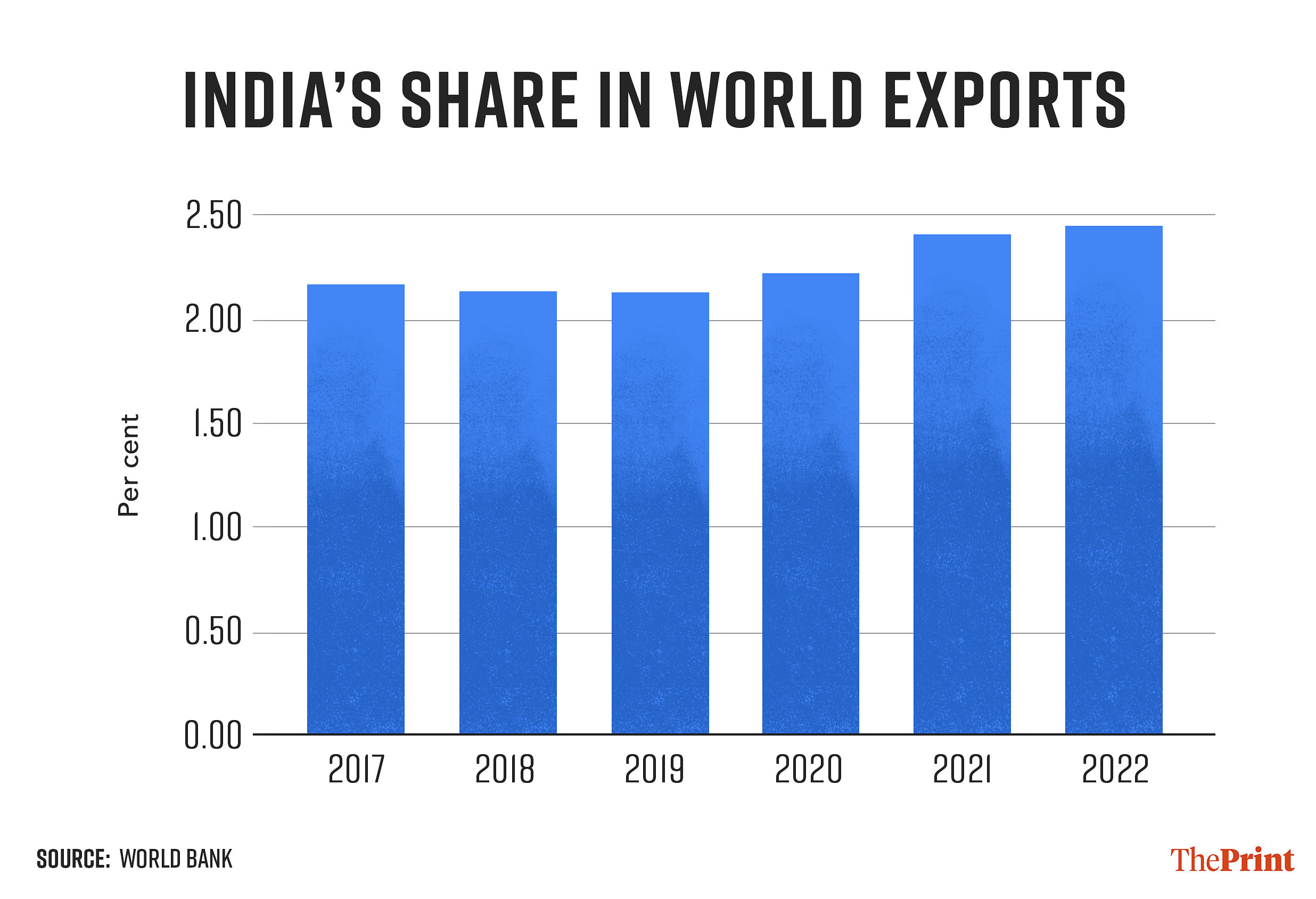

India’s tight capital controls, management of the rupee and, most importantly, a smaller share of global exports run counter to the aspirations of making the rupee an international currency.

The challenges towards rupee internationalisation emerged when Russia asked India to make payments for the discounted Russian oil in Yuan.

Rupee payments to Russia were not working because of a lack of substantial imports from India. While India’s exports to Russia have fallen slightly, imports from Russia have surged since the Russian invasion of Ukraine. Russian authorities are not comfortable holding rupees.

On the other hand, China’s exports to Russia surged during the first three months of the calendar year. Demanding payments in yuan from India gives them an avenue to spend the yuan for Chinese imports.

China’s efforts towards currency internationalisation

Even though China has strict capital control measures in place, it has been trying to push for the international use of Renminbi.

One obvious advantage is that China has a trade surplus with most countries. It is further propelling the use of Renminbi through signing of bilateral currency swap arrangements. Literature shows that signing swap lines with China could boost bilateral trade and increase Chinese share in aggregate trade. Moreover, swap lines exert a greater, positive influence on countries that do not have sufficient foreign exchange reserves.

The Renminbi was included in the International Monetary Fund’s Special Drawing Rights (SDR) in 2016. In 2022, the Renminbi’s weightage in the SDR was raised from 10.92 per cent to 12.28 per cent, implying greater role in international trade and finance.

According to the RBI’s panel, efforts towards institutionalising and standardising local currency trade and bilateral/multilateral swap arrangements should run in parallel. Countries with which India has a trade surplus should have access to rupee liquidity so that they can pay in rupees.

Similarly, countries that have surplus piles of rupee should have a suite of avenues to invest the rupee in government and corporate bonds, FDI, and interest-bearing deposits etc. This would require a fundamental review of capital control measures, and other measures such as opening of offshore INR accounts for non-residents, treatment of INR exports at par with exports in other currencies.

Review of capital control measures to encourage the use of INR

India has made substantial progress in easing the restrictions on inflows and outflows of foreign capital but more needs to be done. Particularly, the Group recommends recalibrating the regime for foreign portfolio investment in debt.

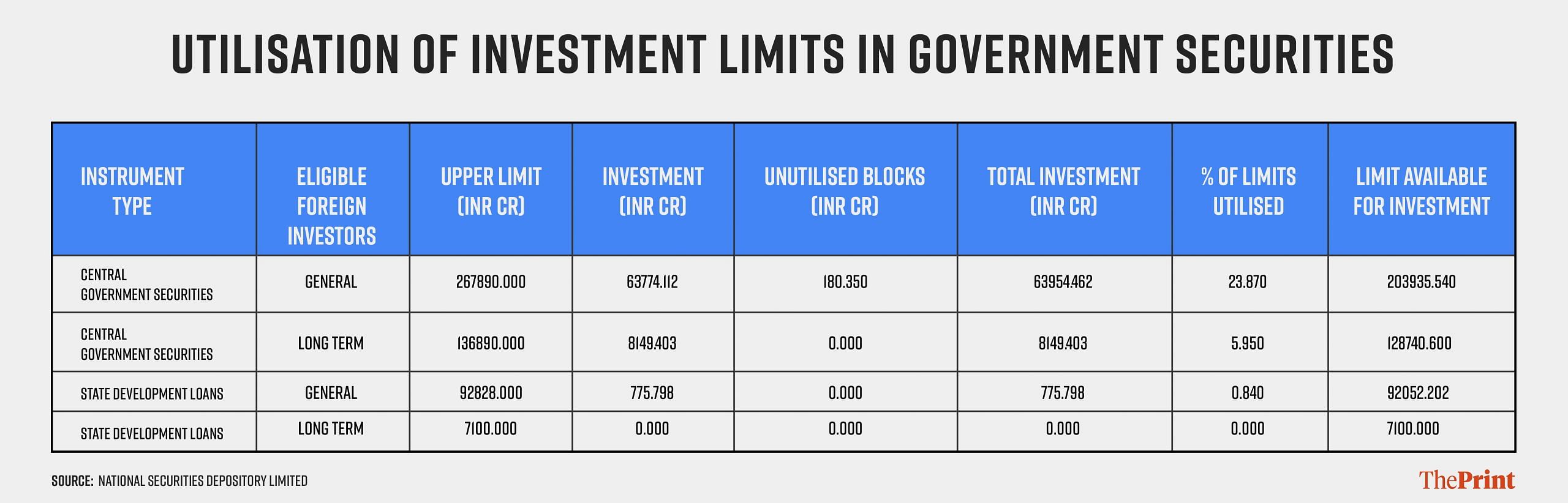

Foreign Portfolio Investment (FPI) in debt is allowed through various channels: Medium Term Framework, Fully Accessible Route and Voluntary Retention Route.

The multiplicity of channels has made the investment regime complex. This is also reflected in lower utilisation of investment limits by FPIs. The RBI report has recommended measures to simplify the regime for foreign investments in both government and corporate bonds.

Issuance of local currency bonds overseas is an important element of currency internationalisation. In the Indian parlance, rupee denominated bonds, called the Masala Bonds, are issued outside India by Indian entities. The Group recommends the review of the 5 per cent withholding tax on Masala Bonds as this makes the instrument unattractive for foreign investors. In addition, limited avenues for hedging credit and exchange rate risk could limit the appeal of the instrument for foreign investors.

Leveraging payments system for greater internationalisation

One of India’s big achievements in this space is its payments systems. These need to be expanded to partner countries. Linkages of payments systems could enable more cost-efficient transfer of cross-border remittances and pave the way towards internationalisation of the rupee.

In February 2023, the RBI and the Monetary Authority of Singapore (MAS) linked Unified Payment Interface (UPI) and PayNow to enable cost-efficient transfer of remittances for residents of both countries. Recently India and France have agreed to use UPI in France. Some of the other overseas markets accepting UPI payments include Malaysia, UAE, Nepal and UK.

Increasing the footprint of banking services in INR through offshore branches

Banks should be permitted to provide a full array of banking services in offshore markets. There is a need to revisit the regulatory framework to enable greater role for the rupee in international financial transactions.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.