Fitch Rating has downgraded the US government’s credit rating from AAA to AA+ following concerns about the state of the country’s finances and debt position.

The rating agency cited likely fiscal deterioration over the next three years, a high and growing general government debt burden and erosion of governance over the past two decades that has resulted in repeated debt limit stalemate and last-minute resolutions.

While the markets across the world including India slumped in response to the downgrade, the impact is likely to be short-lived. However, financial markets in India are likely to witness volatility due to multiple factors including rise in oil prices, recent measures to boost the Chinese economy and the consequent rebound in metal prices and the upcoming RBI monetary policy amid a rebound in domestic inflation.

Also read: India wants rupee to go global, but low appetite for the currency & rise of Chinese Yuan obstacles

Sovereign rating analysis

Rating agencies typically have a sovereign rating model that captures the willingness as well as the capacity of the sovereign to meet its debt obligations in full and on time. For instance, Fitch’s assessment is based on four pillars — structural features of the economy that render it vulnerable to shocks; macroeconomic performance including growth prospects and economic stability; public finances including sustainability of debt; and external finances including current account deficit, capital flows and external debt.

Rising general government deficits and debt

General government deficit and debt are the keenly watched indicators to assess the sovereign credit worthiness of the economy. Fitch projects the general government deficit to rise from 3.7 per cent of GDP in 2022 to 6.3 per cent of GDP in 2023, 6.6 per cent of GDP in 2024 and a further widening to 6.9 per cent of GDP in 2025.

Higher deficits will also lead to higher interest burden. According to the rating agency, the interest to revenue ratio is likely to swell to 10 per cent by 2025. While presenting the projections, the agency has highlighted that these numbers are much higher than the median numbers for the AAA rated and AA rated peer economies.

Fitch has projected a rise in the general government debt over the next three years. While the debt-GDP ratio has come down from the peak of 122 per cent in 2020 to 112.9 per cent this year, this is expected to rise to 118 per cent by 2025. Again, these ratios are significantly above the median debt-GDP ratio of AAA and AA rated peer economies.

The rating agency sees the US economy slipping into a mild recession due to tighter credit conditions, slump in consumption and a weakening business sentiment. This is, however, at odds with the recent assessment of the US Federal Reserve which considers the economy to be resilient and no longer forecasts a recession.

Impact of the downgrade on the US markets

Sovereign credit ratings are relied upon by institutional investors to assess the credit worthiness of the economy. In any economy, ratings downgrade reflects the inability of the economy to meet its debt obligations, resulting in higher borrowing costs and surge in bond yields.

The downgrade did not have a major impact on the US bond market. The immediate response of investors was to pull out of equity and invest in US government bonds and the dollar. A day after the Fitch downgrade, the yield on the US 10-year bond rose by 10 basis points to rise above 4 per cent, the highest since November 2022. But the rise in yield was on account of an excess supply of government bonds.

For the ongoing quarter, the US treasury has revised upwards its borrowing requirement to USD 1 trillion from the earlier estimate of USD 733 billion to address its rising fiscal deficit. The flood of government bonds spooked investors and led to rise in yields.

Fitch’s move came two months after it placed the ratings on negative watch in May. While the downgrade is unlikely to have a substantial immediate impact on the US treasury yields due to its position as a safe haven asset, it does raise concerns on the sustainability of debt metrics of the world’s largest economy.

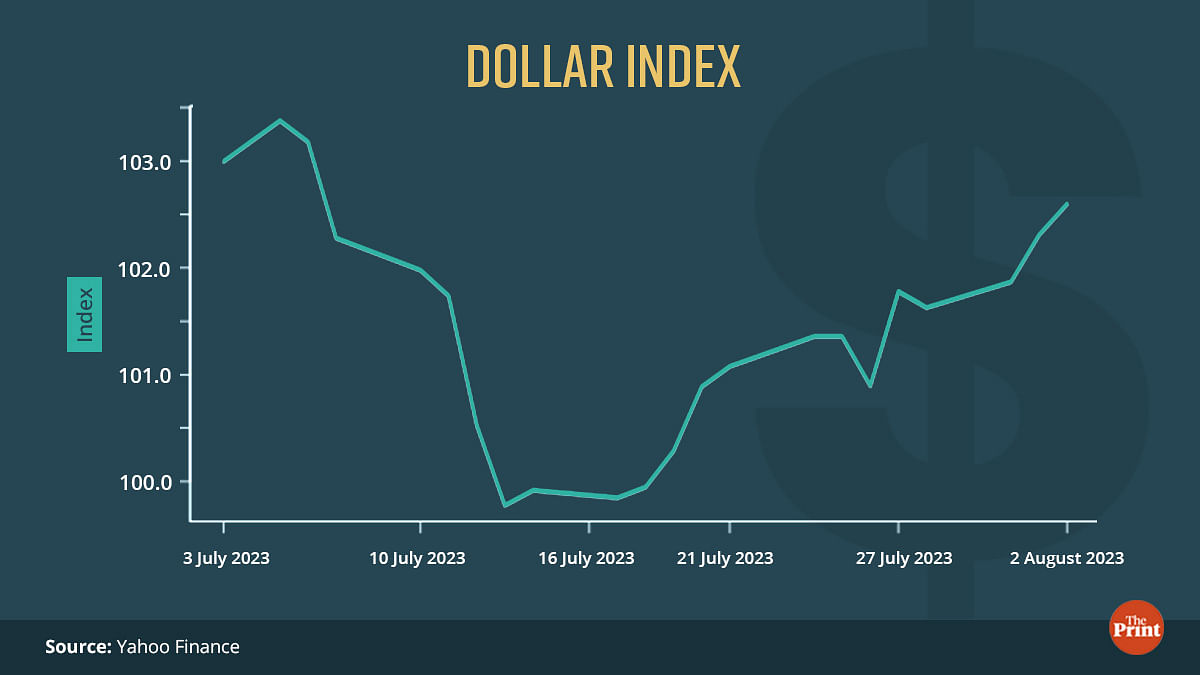

The dollar rose as investors pulled back from equity underscoring the status of the dollar as safe haven assets. So while the major stock market indices such as S&P 500 and Nasdaq edged lower, the dollar index recorded an uptick. The expectation of resilient jobs market data has also imparted strength to the dollar.

Brace for volatility in markets but Fitch downgrade not the only factor

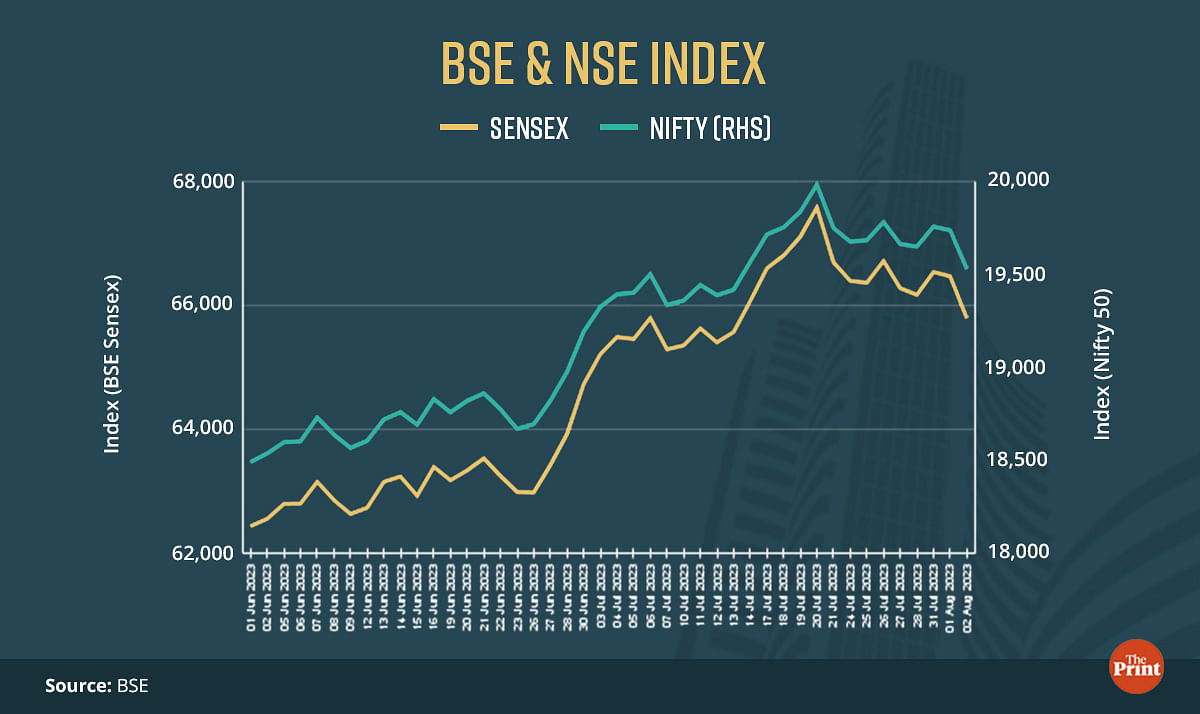

The ratings downgrade triggered a risk-off sentiment in the stock markets. Both the Sensex and Nifty slumped by more than 1 per cent following the ratings downgrade.

Stocks of technology firms, which depend on the US markets, were impacted the most. The knee-jerk reaction from the Fitch factor is likely to be short-lived. But there are other factors at play.

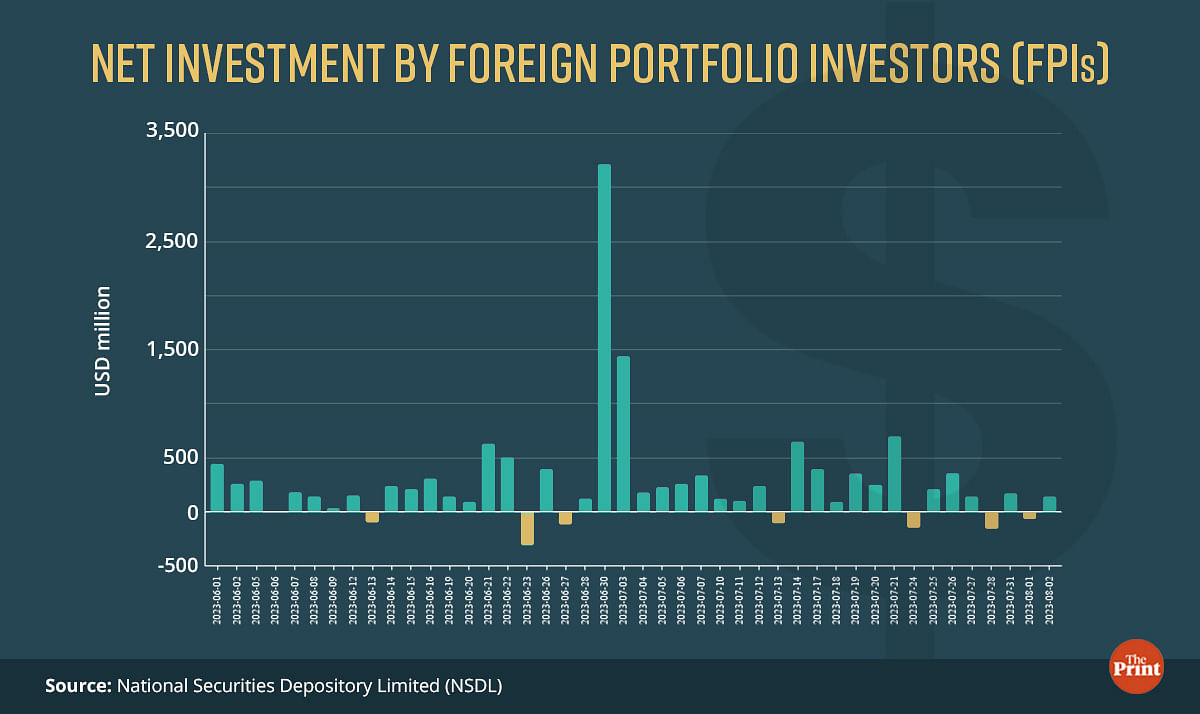

Indian equity markets have been showing signs of weakness for the past few days. Foreign Portfolio Investors (FPIs) turned net sellers in the last week of July, reversing their buying streak. Stimulus package to revive the Chinese economy has shored up demand for Chinese stocks and given a boost to the Chinese stock market. The possibility of rise in commodity prices have impacted the bullish sentiments in the Indian markets.

The resurgence in crude oil prices last month and the likely extension of 1-million-barrel oil supply cut by Saudi Arabia into September have also dented the rally in the Indian equity market. These factors are likely to keep the markets on edge in the coming few weeks.

The upcoming RBI’s monetary policy, inflation data for July and the financial performance of companies for the April-June quarter would also shape investors sentiments and market performance.

The rupee depreciated and settled at a one month low as the downgrade triggered demand for safe haven currencies. But the depreciation pressure was visible even before the Fitch downgrade due to rebound in oil prices and strengthening of the US dollar.

Moving ahead, the trajectory of markets and currency will be determined by multiple factors — the Fitch factor is just one of them.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: An optimistic IMF has upped its projection for global growth, but don’t celebrate just yet…