India’s Gross Domestic Product (GDP) grew at 13.5 per cent for the quarter ending June. A favourable base effect, rebound in private consumption and growth in contact-intensive services amid declining Covid cases have pushed the GDP growth to double digits. While double digit growth for the June quarter was expected, it is lower than the Reserve Bank of India’s projection of 16.2 per cent.

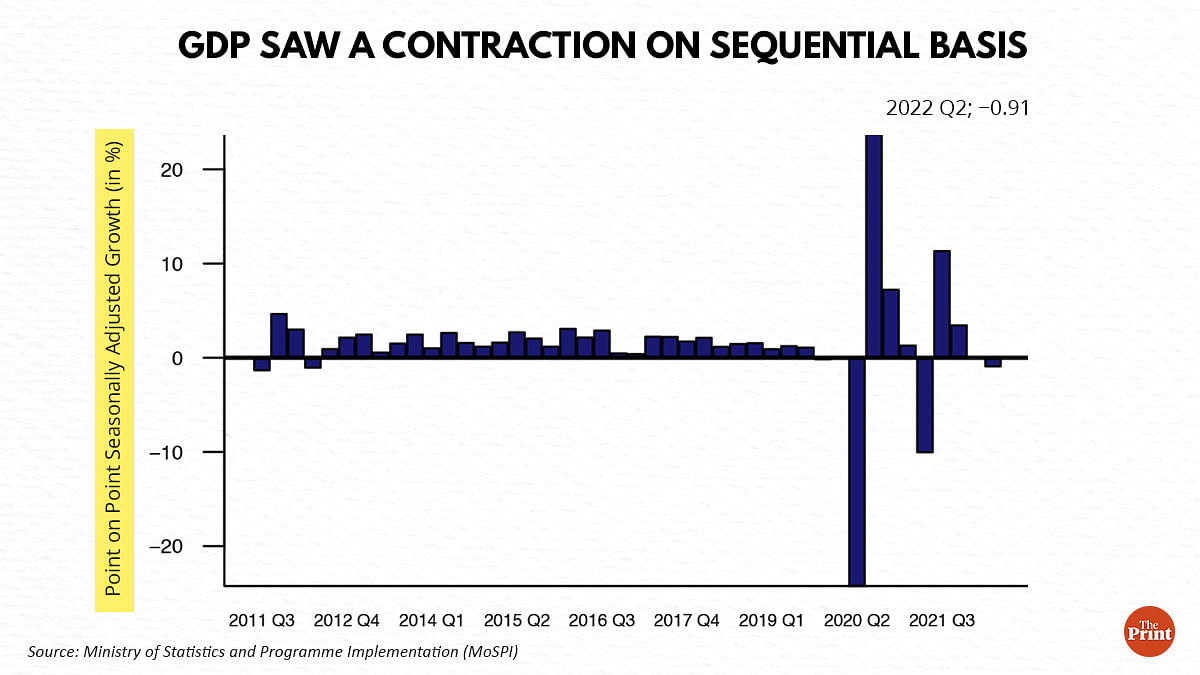

On a sequential basis (quarter-on-quarter basis), GDP registered a contraction. Computation of quarter-on-quarter growth requires adjustment for seasonality. The seasonally adjusted quarter-on-quarter numbers show a mild contraction of 0.9 per cent. The contraction is milder as compared to the corresponding quarter-on-quarter growth for the last years — i.e. growth of April-June over January-March quarter of 2020-21 and 2021-22.

The GDP numbers show an uneven recovery over the pre-pandemic period. Going forward, the consumption and investment look encouraging, the pace of growth is likely to moderate owing to elevated commodity prices, global recession concerns, rising interest costs and uneven monsoon.

Consumption & investment show signs of rebound

Consumption, the mainstay of the economy, constituting almost 60 per cent of the GDP grew by a robust 25.9 per cent in the June quarter. Investment activity has also seen a pick-up in the June quarter. Gross fixed capital formation (GFCF), a proxy for investment activity, registered a growth of more than 20 per cent. Its share in GDP has risen to 34.67 per cent from 32.7 per cent in the same quarter of last year.

‘Trade, Hotels, Transport, Communication & Services related to Broadcasting’ grew by a healthy 25.7 per cent, indicating a pick-up in discretionary consumption spending. Notwithstanding inflationary pressures due to the Russia-Ukraine war, the pick up in consumption and investment indicates resilience in demand.

High-frequency indicators such as Purchasing Managers’ Index (PMI), capacity utilisation, tax collections, vehicle sales point to strong growth momentum in the first few months of the current fiscal. India’s August manufacturing PMI reading was 56.2, little changed from July’s reading of 56.4. Strong growth was supported by pick-up in demand and easing inflation concerns. Strong growth in non-food bank credit also indicates improved demand conditions.

Imports surge on elevated commodity prices & weakening rupee

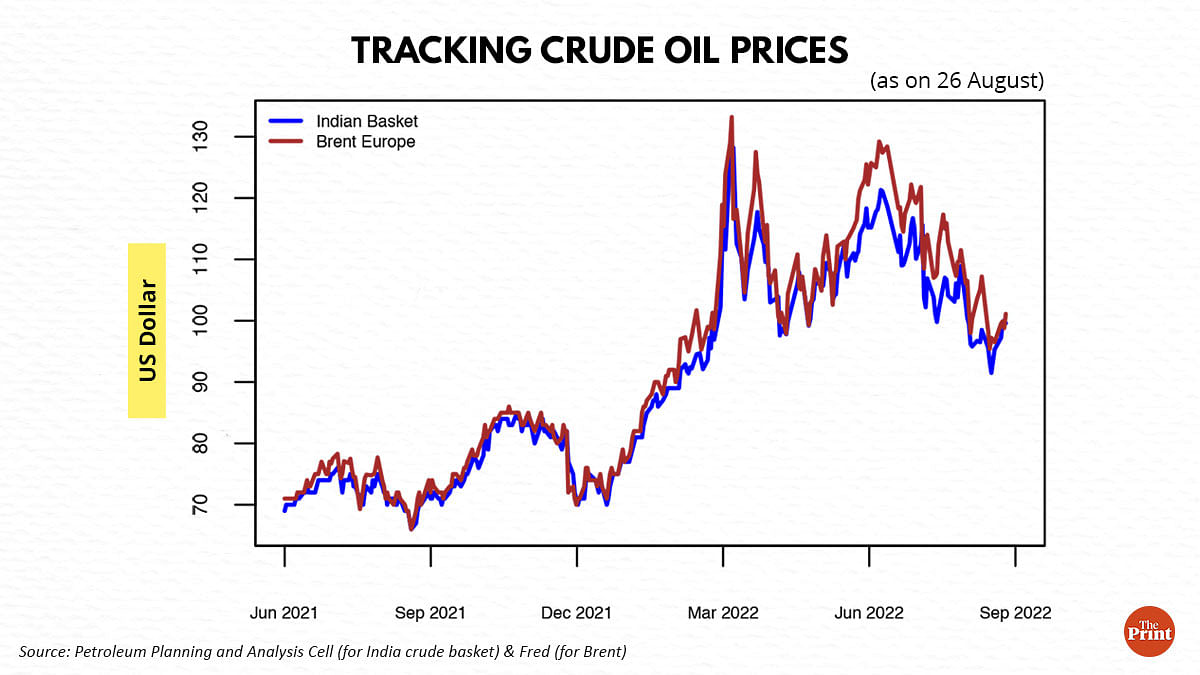

On the flip side, imports surged by more than 37 per cent amid elevated crude oil prices. The growth in imports is more than double the growth in exports. A sharp 7 per cent fall in the value of rupee owing to net outflows of foreign investors has led to increase in the prices of imports and thus, higher imports.

With dollar index likely to strengthen on hawkish comments from the Fed, the rupee is likely to weaken, resulting in higher prices of imports. India’s trade deficit has widened to USD 30 billion on rising imports.

The industrial sector growth was a mixed bag. While construction and electricity posted double digit growth, the performance of the mining and manufacturing sector was relatively subdued. The rise in input costs seems to have dented the performance of the manufacturing sector as it registered a weak growth of 4.8 per cent over the same quarter of last year.

Also Read: Chinese economy has been hit by a perfect storm: Property shock, Zero Covid, climate, Taiwan

Exports could take a hit due to global recession fears

At the recently held Jackson Hole Symposium, US Federal Reserve chair Jerome Powell pledged to fight against record high inflation with sharper rate hikes. He acknowledged that sharp interest rate hikes will bring some pain for households and businesses.

Aggressive rate hikes by advanced economies’ central banks will cause demand destruction leading to slowdown in exports. The US is already under a “technical recession”. China posted a meagre 0.4 per cent growth in the April-June quarter. Exports were a major driver of growth last year; this year, they are likely to see a slowdown.

While exports could suffer due to muted global demand, imports are likely to remain elevated as crude oil prices have edged past USD 100 per barrel after the recent weeks of moderation.

Uneven monsoon and agricultural output

The agricultural sector posted a growth of 4.5 per cent in the April-June quarter, highest in the last eight quarters. This was driven by a robust Rabi harvest and a sharp increase in prices of food crops. Going forward, maintaining high growth in this sector could be a challenge. Owing to uneven monsoon, sowing of Kharif crops has lagged as compared to last year, though the deficit in acreage has narrowed in recent weeks. This could impact agricultural output to some extent.

Uneven recovery compared to pre-Covid levels

If we exclude the pandemic years, and compare the June quarter GDP with the same quarter of 2019-20, growth looks muted at 3.8 per cent. More worryingly, the contact-intensive services: Trade, hotels, transport, communication and broadcasting services have still not recovered and are still below the levels seen in the same quarter of 2019-20. More needs to be done to achieve a medium term growth of 6-7 per cent. Consumption and investment need to grow at a much faster pace to pump-prime growth at a time when external conditions look less supportive.

Radhika Pandey is a consultant at National Institute of Public Finance and Policy.

Views are personal.

Also Read: Why consumer confidence is on the rise in India & how this optimism can be sustained