Consumer confidence is seen to be recovering in recent weeks after a prolonged period of subdued growth since the onset of the Covid-19 pandemic. Both the Reserve Bank of India’s consumer confidence index and the Centre for Monitoring Indian Economy’s (CMIE’s) consumer sentiments index showed a marked improvement in July. Improved perception about employment, household income and spending led to an improvement in consumer confidence. The improved perception needs to be sustained.

Indicators of consumer demand such as retail sales, car sales, credit card spends and retail credit have seen a turnaround after months of muted demand. The initial signs of easing of inflation, opening up of the contact-intensive services sector, onset of the festive season and better agricultural prospects should give a boost to consumer confidence. For consumer confidence to sustain in a durable manner, consumers need to become more confident about their jobs, flow of income and inflation outlook.

Recovery in consumer sentiments

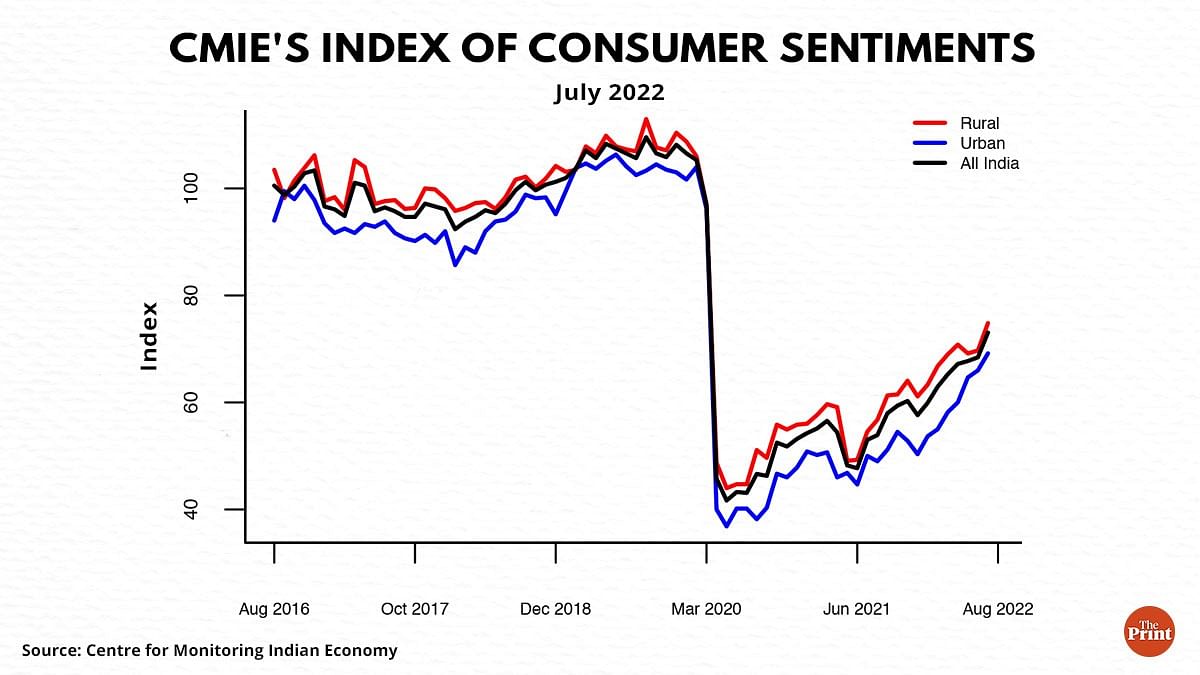

The CMIE’s consumer sentiments index and Reserve Bank of India’s consumer confidence index, showed an improvement in July. Both present an assessment of the current conditions and expectations about future conditions.

The CMIE’s index of consumer sentiments rose from 68.44 in June to 73.05 in July, registering a growth of 6.7 per cent over the previous month. This was a sharp improvement from the 1 per cent growth seen in June. The sentiments of rural consumers registered a strong growth of above 7 per cent in July. The improved prospects of the agricultural sector due to encouraging advancement of southwest monsoon in July seemed to have propelled the sharp turnaround in the sentiments of rural consumers.

The sentiments of urban consumers also grew by a decent 4.8 per cent in July. Consumer sentiments showed a broad-based improvement across all occupation groups, with farmers and daily wage labourers showing a relatively sharper improvement in consumer sentiments as compared to salaried employees and businesses.

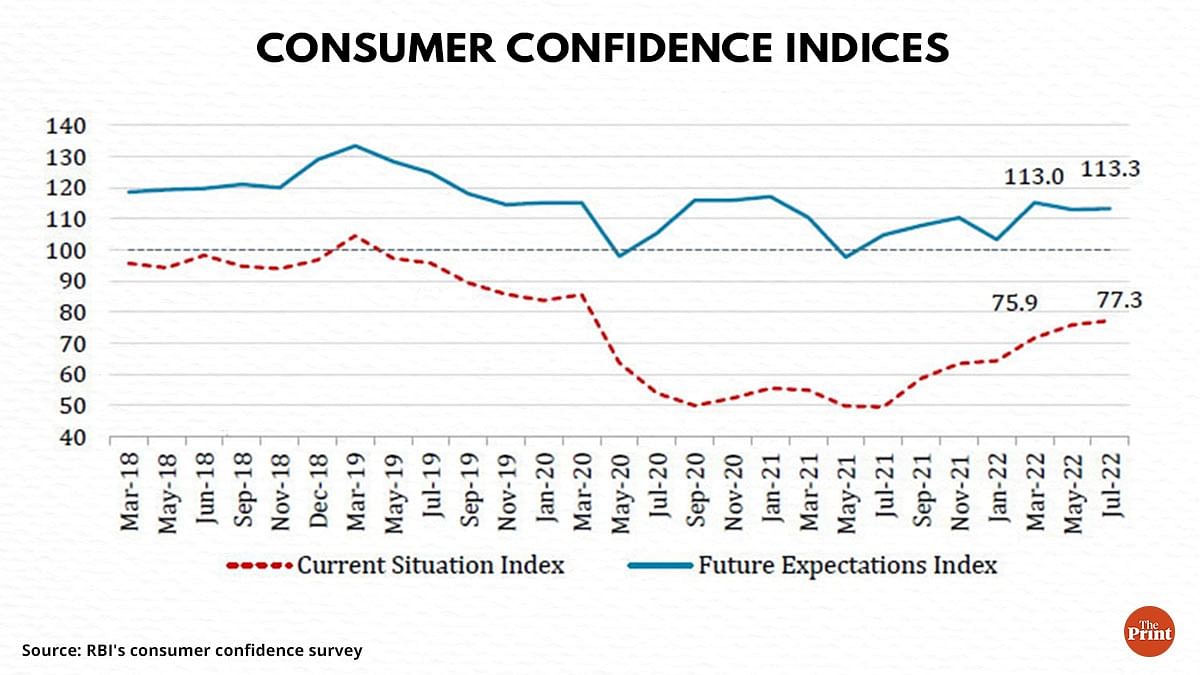

The Reserve Bank of India’s bi-monthly consumer confidence survey also shows a recovery, although modest in July. The survey presents an assessment of the current perceptions and the one year ahead expectations on general economic conditions, employment scenario, price situation and household income and spending. Households reported a rise in their current spending and expect that the trend will continue.

The survey shows that consumers are optimistic about the economic situation and spending over the next one year, though their outlook on employment, prices, and income growth is less optimistic as compared to the previous round of the survey.

The RBI’s Household Inflation Expectation Survey shows a moderation in the inflation perception of households. If the initial signs of inflation are sustained, consumer confidence will see a marked turnaround. As an example, with the recent cooling of inflation in the US, the University of Michigan’s consumer sentiment index has reversed its course. The preliminary August reading shot up to to 55.1 from 51.5 in July

Consumer demand showing signs of pick-up

Consumer demand — the mainstay of the economy, slowed to 1.8 per cent in the January-March quarter from 7.4 per cent in the October-December quarter. While private consumption in 2021-22 has surpassed the pre-Covid levels (2019-20), the recovery has been sluggish. Economic uncertainty, elevated price level adversely impacted consumer sentiments and demand.

However, since the ebbing of the third wave, revival of the contact-intensive services and easing of supply chain bottlenecks, some indicators of consumer demand are showing a rebound. Retail sales last week have surpassed sales seen in the corresponding week in the pre-Covid period. Passenger vehicles witnessed record sales in July, partly also owing to easing of raw material supply challenges. Vehicle registrations, number of daily flights, number of passengers flying, retail and recreation visits have risen in the recent weeks.

Indicators of rural demand have remained muted for long, but green shoots of recovery are visible in recent months. While two-wheeler sales saw a record pick up in July, tractor sales still need a sustained pick up. Higher crop prices, improvement in economic activity resulting in migration of workers to urban areas should ease the stress in the rural economy.

Early signs of easing of stress in rural labour market

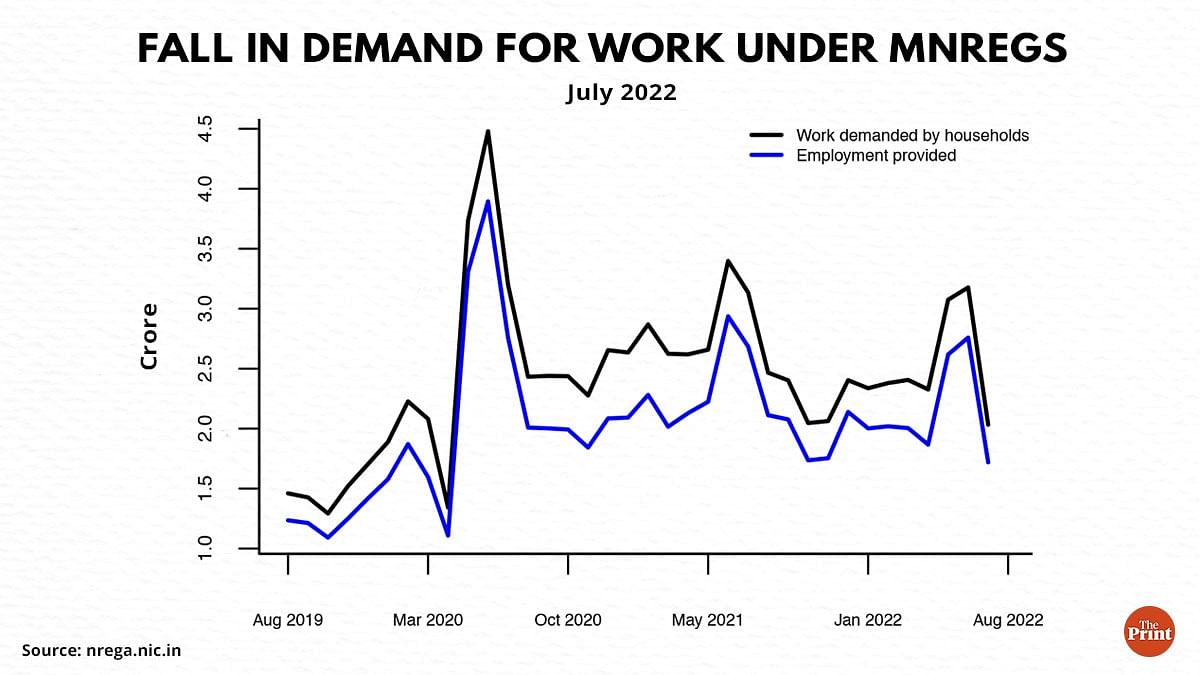

Demand for work under the government’s flagship Mahatma Gandhi National Rural Employment Guarantee Scheme (MNREGS) surged during the pandemic. The scheme emerged as a critical source of employment for the labourers who returned to rural areas during the lockdown. Surge in the demand for work under MNREGS indicates stress in the rural economy as jobs are sought under the scheme in the absence of other job options. Demand fell post the peak of the pandemic, though it still remains above the pre-pandemic level.

In July, work demanded under the MNREGS fell to nearly half as compared to the prior month. Pick up in agricultural and non-agricultural activities and return of labourers to urban areas led to fewer labourers seeking work under MNREGS. Policy push to public works programmes in rural areas should further ease the stress in the rural labour market.

Overall, mixed signals are emerging on the jobs front. According to estimates by the CMIE, uptick in agricultural activity and a better monsoon led to a 6-month drop in the unemployment rate in July. The drop in joblessness is primarily attributed to pick-up in economic activity in rural areas. Urban areas, in contrast, saw an increase in the unemployment rate in July.

Pick up in retail credit

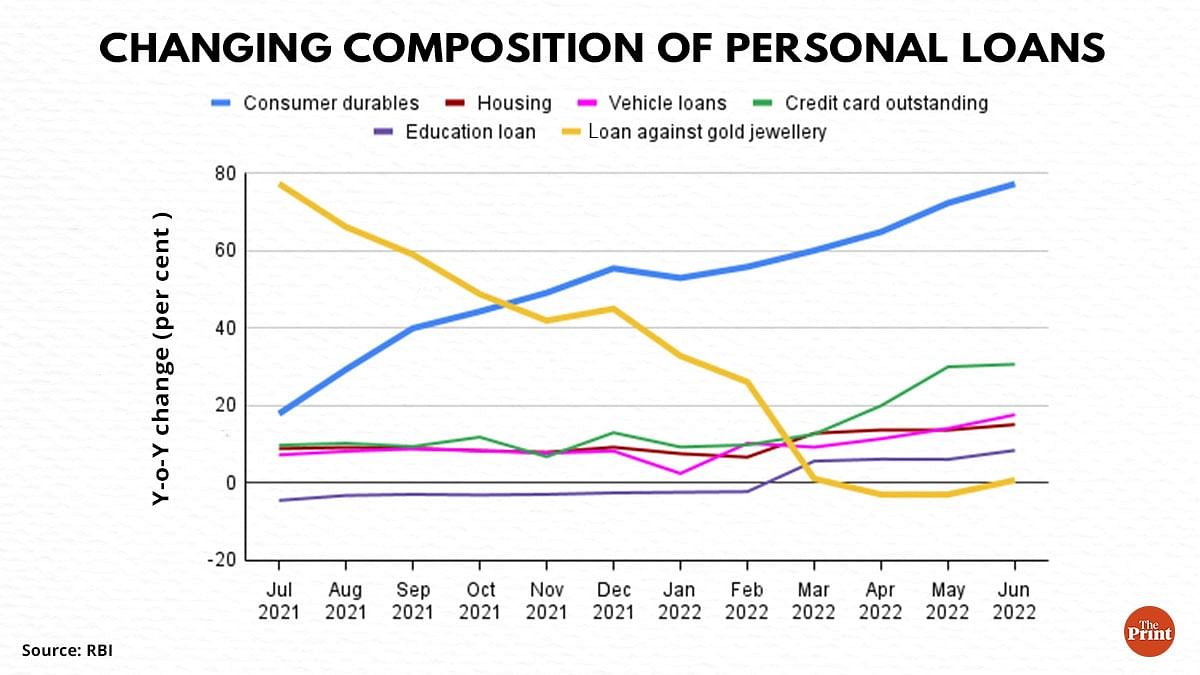

Pick up in consumption spending is also reflected in growth in the personal loans segment. Personal loans grew by a robust 18 per cent in June. Housing loans, which account for more than half of personal loans, registered more than 15 per cent growth in June. This would give a boost to housing sales.

Loans for consumer durables have also seen a sharp turnaround, signifying an increase in discretionary spending. Latest data showed a 77 per cent jump in loans for consumer durables. This is in contrast to the pandemic period where loans against gold jewellery had seen a massive rise.

Radhika Pandey is a consultant at National Institute of Public Finance and Policy.

Views are personal.

Also Read: 10% in Telangana, 5.4% in Kerala — why some states are feeling inflation heat more than others