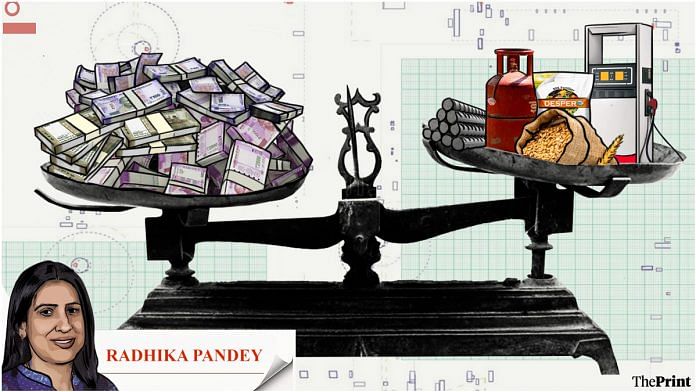

Last week, the central government announced a series of measures to control retail inflation, which had surged to an eight year-high of 7.79 per cent in April. The Wholesale Price Index-based inflation has risen to more than 15 per cent in April.

The fiscal measures include a reduction in excise duty on petrol by Rs 8 per litre and on diesel by Rs 6 per litre, along with reduction in customs duty for raw materials of plastics and steel, and an increase in export duty on iron ore and steel. Additionally, over 90 million beneficiaries of the Pradhan Mantri Ujjwala Yojana will be given a subsidy of Rs 200 per LPG cylinder in a year.

To cushion the impact of rise in global prices of fertilisers, the government announced an additional subsidy of Rs 1.10 lakh crore over and above the Rs 1.05 lakh crore provided in the budget. Steps are also being taken to improve the availability of cement through better logistics. These follow the ban on wheat exports and slashing duties on edible oils announced earlier.

While these measures are imposed to insulate the domestic market from higher international prices, they could have unintended consequences such as denying a favourable market and reducing the incentives for producers to expand production in the long run.

Also Read: Modi govt won’t borrow extra this year to fund tax cuts, inflation target to stay at 4%

Impact on inflation

The steps announced by the government will help in moderating inflation. Particularly, the excise duty cuts on petrol and diesel could lead to a moderation in inflation by 0.2-0.3 per cent. In addition to the direct impact, the reduction in the price of diesel will have an indirect impact such as on reducing truck rentals and freight costs. The impact of these measures will trickle down to other categories also. The doubling of fertiliser subsidy will help in easing input cost pressures for farmers and lowering food prices.

While the government’s measures will ease inflation from the record spike seen in April, the retail inflation is likely to remain outside the RBI’s upper threshold of 6 per cent in the coming few months. This will prompt RBI to raise interest rates to counter inflation.

Globally, price pressures still persist. Crude oil, while below the levels of USD 135 per barrel seen in mid-March, is still hovering between USD 105 and 110 per barrel. Global food prices measured by the Food and Agriculture Organisation’s (FAO’s) Food Price Index have retreated from the all-time high registered in March, but still remain elevated.

Fiscal implications

There are indications that the government might announce more duty cuts and relief measures if global inflationary pressures stay elevated. While these measures will provide some relief on inflation, they will have significant fiscal implications.

The revenue implications of the excise duty cuts on petrol and diesel will be somewhere close to Rs 1 lakh crore. The doubling of fertiliser subsidy will lead to a revenue loss of another Rs 1 lakh crore. The subsidy on gas cylinders and extension of the free food grain scheme will also lead to revenue losses. These measures could widen the fiscal deficit by at least Rs 2 lakh crore. The lower than expected dividend from the RBI could pose further pressure on the government’s finances.

The extent of deviation from the budgeted fiscal deficit target will depend on the trajectory of tax revenues in the coming months. There are indications that tax revenues might surpass the budgeted tax revenues.

The duty cuts and subsidies will add to the borrowings of the government. Bond yields that are already elevated could rise further. Since the RBI is likely to maintain its prime focus on inflation control, it will have to allow the bond yields to rise. Any direct intervention by the RBI to lower bond yields will make its mandate of managing inflation complicated.

Protectionist measures

As the Russia-Ukraine war continues, many countries are resorting to protectionism to safeguard local supplies and tackle inflation. Such decisions, though helping in the short run to cool inflation, harm the prospects of producers by denying them the opportunity to reap the benefits of rising prices.

For instance, while the export duty on steel has been imposed to improve domestic supply and cool inflation, it could impact the profitability of steel companies. The measure could dampen the capacity expansion plans of steel companies to benefit from rising international steel prices. The decision seems to be at odds with the government’s policy initiatives to boost exports and the Production Linked Incentive Scheme (PLI) that aims to make domestic producers part of the global supply chain.

The sudden decision to ban exports of wheat hit farmers and sent confusing signals to India’s trading partners. The decision was in response to the lower procurement of wheat by the government due to buoyant exports and lower harvest due to the unusual heat wave in March. The move could hurt farmers who had stocked their wheat produce and were hoping to benefit from higher international prices.

Last year, India achieved USD 50 billion export target in agriculture. Policies should be geared towards sustaining the impressive growth in agricultural exports.

Radhika Pandey is a consultant at National Institute of Public Finance and Policy.

Views are personal.

Also Read: RBI raises repo rate to 4.4% on elevated inflation outlook, governor cites ‘global price shocks’