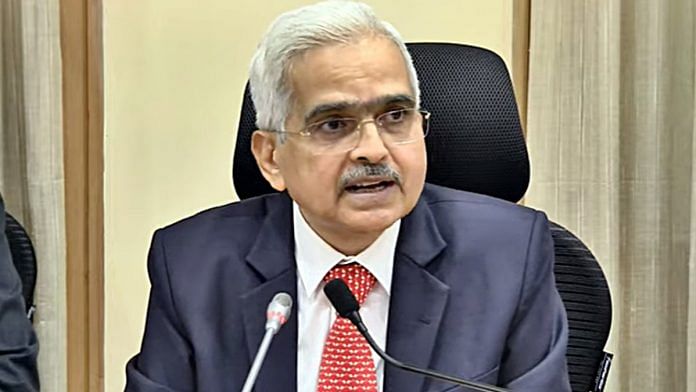

New Delhi: In an off-cycle monetary policy review that surprised financial markets, the Monetary Policy Committee (MPC) headed by Reserve Bank of India (RBI) Governor Shaktikanta Das has unanimously voted to hike the key policy rate by 40 basis points (bps), taking the repurchase or repo rate — the rate at which banks borrow from the central bank — to 4.40 per cent.

The decision was announced by Das in a media address Wednesday.

The committee has maintained an accommodative stance while focusing on withdrawal of accommodation so that inflation remains within the target of 2-6 per cent going forward while supporting growth.

“Our monetary policy actions today — aimed at lowering inflation and anchoring inflation expectations — will strengthen and consolidate the medium-term growth prospects of the economy,” Das said.

Explaining the rationale for Wednesday’s rate action, Das noted that “globally, inflation is rising alarmingly and spreading fast”.

“Geopolitical tensions are ratcheting up inflation to their highest levels in the last 3 to 4 decades in major economies while moderating external demand,” he said.

“The global crude oil prices are ruling above $100 per barrel and remain volatile. Global food prices touched a new record in March and have firmed up further. Inflation-sensitive items relevant to India such as edible oils are facing shortages due to conflict in Europe and export ban by key producers… These developments would have ominous implications for emerging economies including India.”

Das also said that the strengthening of inflationary impulses in sync with the persistence of adverse global price shocks poses upward risks to the inflation trajectory presented in the April MPC resolution.

The RBI has also hiked the Cash Reserve Ratio (CRR) by 50 basis points to 4.5 per cent of net demand and time liabilities, effective from the fortnight beginning 21 May. This would suck out Rs 87,000 crore from the banking system, Das said.

The CRR is the share of a bank’s total deposit that they are mandated to maintain with the RBI as reserves in the form of liquid cash.

Also Read: Ignoring inflation may bite back, it will not purchase India extra growth

US monetary policy review tonight

Das’s statement comes ahead of the monetary policy review by the United States’ Federal Open Market Committee (FOMC), which will announce their resolution Wednesday at 11.30 pm IST and is widely expected to hike their policy rate — Fed Funds Rate — by half a percentage point.

The FOMC is also likely to lay out a road map for trimming the size of the Federal Reserve’s balance sheet, which had more than doubled its asset portfolio to support the US economy and its financial markets. The Fed has increased its asset basket by buying treasury and mortgage securities of $9 trillion.

In April, the RBI had kept the repurchase rate unchanged at a record low of 4 per cent and maintained the accommodative stance.

But the Monetary Policy Committee (MPC) unanimously voted to focus on “withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth”.

India’s retail inflation measured by the Consumer Price Index (CPI) rose to a 17-month high of 6.95 per cent in March, on account of rise in prices of edible oils and fuel. March was the third straight month of the headline inflation rate breaching the upper bound of the RBI’s medium-term target range of 2-6 per cent.

With international commodity prices elevated, the RBI expects the retail inflation to be even higher than the 7 per cent seen in April.

The RBI projected inflation to average 6.3 per cent in the first quarter of 2022-23, before falling to 5.8 per cent in the July-September quarter. It raised its inflation projection for 2022-23 to 5.7 per cent from 4.5 per cent estimated in February.

‘Well-timed’ decision

Aditi Nayar, chief economist at investor service company ICRA Limited, described the “surprise repo rate and CRR hikes” as “very well-timed, as our own CPI inflation projection for April 2022 is an eye-watering 7.4 per cent”.

“By advancing the rate decision by approximately one month, the MPC has focused on preventing inflationary expectations from unanchoring in an increasingly uncertain environment,” she added. “The committee has displayed its nimble-footedness and clearly completed the pivot back to inflation management.”

She said while “a back-to-back hike in the June 2022 policy is not yet certain, we do foresee an additional 35-60 bps of rate hikes in the remainder of H1 FY2023 (April-September)”.

“If a de-escalation in geopolitical tensions cools commodity prices, then we expect a pause to reassess the impact on growth, followed by another 25-50 bps of rate hikes in CY (calendar year) 2023,” she added.

Rahul Bajoria, chief India economist at the multinational bank Barclays, said the the “large inter-meeting hike from the RBI indicates that tackling inflation risks is now front and centre”.

“Looking ahead, given the hawkish rhetoric and high likelihood of an elevated inflation print for April, the RBI will be front-loading further hikes,” he added.

“We expect the RBI to now deliver at least a 50bp rate hike in the June policy meeting. We see the RBI raising policy rates to 5.15 per cent by August, and expect it will reassess macroeconomic momentum to gauge the need for further hikes beyond that. We also believe the RBI would look to reduce liquidity in a calibrated manner, and may deliver another CRR hike of 50bp in the next MPC [meeting], but applicable only from a later date.”

This report has been updated with additional information

(Edited by Sunanda Ranjan)

Also Read: India inflation surges to eight-month high in February amid supply snarls