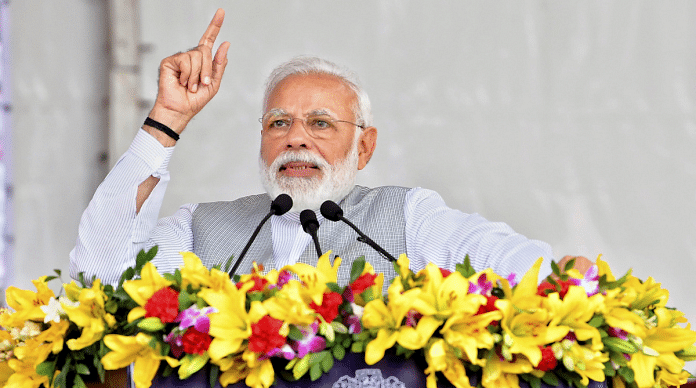

There have been many controversies regarding job growth. Are there more jobs now as claimed by the Narendra Modi government or have millions of people lost their jobs as claimed by private entities?

The answer is, both may be correct because they are measuring two different things. While the government is measuring job growth in the formal sector, the Centre for Monitoring the Indian Economy (CMIE), an independent think tank, is measuring whether individuals in households have paid employment. These jobs may or may not be in the formal sector. So, if there is a disruption in the informal sector, data collected through households would show a fall in the number of jobs, while the formal sector employment data, measured through provident fund or enterprise surveys, could show an increase. These two differing scenarios are likely the reason why there could be such contradictory trends.

First, the questions and definitions

When is a person considered employed?

There is no single measure of employment. An individual can be engaged in a variety of paid or unpaid work, or domestic work, and home farm production. A person is considered employed if she is part of the labour force and engaged in paid labour. She is considered as part of the labour force if she is of working age and either employed or looking for a job. Workers may be employed for parts of the year. Agricultural workers may especially fall into this category. They have work, but not every day.

So, who is called employed?

The answer depends on what we ask from them — whether they worked that day, or whether they work in general. The measure of employment used by the National Sample Survey Office (NSSO), the traditional source for employment data in India, is usual status unemployment, which measures what the employment status of an individual who is available and willing to work for most part of the year, while the Annual Labour Force survey measures current daily status, which looks at whether the individual has work on the day the surveyor appears.

Who do we ask?

Estimates of employment variables can be made using (1) household surveys, (2) surveys of businesses/enterprises, (3) administrative sources, and (4) data from government schemes. The data will differ depending on who we ask.

Also read: BJP’s promise vs delivery — it’s a mixed bag for Modi govt on black money, jobs & more

Enterprise surveys

Enterprise surveys are useful ways to capture employment patterns for contract and full-time employees, the industries the workers are concentrated in, and the wages they earn. However, these surveys are not useful in understanding the overall distribution of workers. We will not be able to find unemployed individuals, and we will learn little about farm workers and self-employed while gaining limited information on informal sector enterprises.

Enterprise surveys are typically focused on formal establishments (with more than 10 workers). This is a small percentage of firms and contain a fraction of the number of workers. In India, 98% of firms either consist of workers who are self-employed or comprise small, informal enterprises (with less than 10 workers).

In terms of numbers, the 2011-2012 NSSO’s Employment and Unemployment Situation in India population-based survey estimates there are around 47 crore workers in India. Out of these, only 2.77 crore non-agricultural workers are covered if we use the 2013-2014 economic census of establishments. Though there are additional informal sector and MSME surveys, these are erratic and can’t be followed over time.

Using administrative sources and government schemes has the same problem – we leave out many of the self-employed and small, informal enterprises. Such sources will help us learn about the industry distribution of workers, wages, etc. but will not give us information about aggregate employment. In addition, these datasets are infrequent, they don’t track the same workers in subsequent surveys, and come out with reports that are not up to date, thus reducing their usefulness in estimating current employment status or predicting future trends.

Recent academic and government reports using data from the Employees’ Provident Fund Organisation (EPFO) warrant a comment on the use of administrative datasets and government schemes to get a picture of the Indian employment situation. As is the case with enterprise surveys, these are partial in their coverage of Indian workers and miss out on the pool of informal workers and the unemployed. In addition, this data has jumps – for example, if a firm with 19 employees adds one more staff to its organisation, it will reach the threshold for mandatory enrollment with the EPFO. However, when the government looks at the pool of EPFO workers for its employment data, it counts 20 workers when there has only been an increase of one worker.

Also read: Why there has been no big social unrest in India to reflect inadequate job growth

Household surveys

The universally-accepted dataset that measures employment in India comprehensively is by the NSSO, which conducts the employment and unemployment survey of households roughly every five years. Its reports are the most commonly used source on employment and unemployment situation in India, and are representative of the population and more comprehensive for studying employment and wages relative to enterprise data. However, these surveys are infrequent as well as not up to date.

From 2004-05 to 2011-12, the NSSO conducted the survey four times and then did not release any report for the next five years.

In 2010, following the Great Recession, there was a greater focus on better measurement of unemployment. This pushed the Labour Bureau to start conducting the Annual Labour Force Survey, a household survey that was very similar to the NSSO’s surveys. However, this data has not yet been released.

A private dataset that has emerged and is able to give up to date measures of the employment situation in India is the CMIE’s Consumer Pyramids Household Survey (CPHS), which started in 2009. This survey includes household demographics, member identities, education, health and financial literacy; household income and its composition, household expenses and its composition, and household ownership of assets and amenities among others. This dataset helps provide numbers for employment and unemployment and labour force participation, besides having questions that measure the “despondency” of workers dropping out of the labour market.

Demonetisation (in November 2016) and the implementation of the Goods and Services Tax (in July 2017) led to a disruption in India’s informal sector. The job loss in this sector is reflected in the CMIE’s data on employment for 2018. On the other hand, changes in rules and government contributions have increased the number of members enrolled with the EPFO. To capture what happens in the informal sector where bulk of Indians work, the Indian Statistical System needs to undertake household surveys to measure job growth and loss.

The author is a Professor at the National Institute of Public Finance and Policy.

Jobs computation is flawed over the years. Many industries and offices outsource production and minial works. The workers employed are not factored whereas they are part of wealth creation. NITI ayog is right

Informative article on the job measurement techniques. In the YouTube interview, the author refers to host of policy initiative required for turnaround in the private investments to have meaningful impact on job growth. However, she does not specifically lists which are those policy measures which could improve private sector investments and why she feels Modi government did not or could not implement them, knowing fully well that such policies would be helping its cause in May 2019? Analysis of the issue and possible textbook remedies are fine but we need to understand what it takes to implement them. Beyond routine politics and Modi (bashing), which may of great interest to Jyoti and ThePrint, a general reader is also interested in the possible solutions to the problems from knowledgeable economists like Ila.

what exactly is the purpose of this article other than to let us know how to calculate whatever. It seems India is confused. Cannot figure out whether there are jobs or not