The Reserve Bank of India will form a panel to study the transfer of its surplus reserves to the government.

Mumbai: India’s central bank signaled a compromise with the government by agreeing to study its demands, including the transfer of surplus reserves — an issue that had triggered a public spat between the monetary policy makers and their political bosses.

The Reserve Bank of India will form a panel to study the transfer of its surplus reserves to the government, Sachin Chaturvedi, one of the members of the 18-member board, said in an interview to Bloomberg News. The board, which met for a little over nine hours on Monday, will convene again on Dec. 14, he said.

“Both the RBI governor and the finance ministry walked the extra mile,” Chaturvedi said. “They were flexible on several issues.”

The government and the RBI have been sparring over how much capital the central bank needs and how tough its lending rules should be. For a nation that relies on imported capital to fund investment, the reaching of a middle ground is key to retaining investor confidence in the world’s fastest-growing major economy.

The rupee advanced and bonds rallied Monday before the meeting concluded, and amid optimism a common ground will be reached. The currency gained 0.4 percent to 71.6575 against the dollar, while the benchmark 10-year bond yield fell 3 basis points to 7.79 percent.

The Agenda

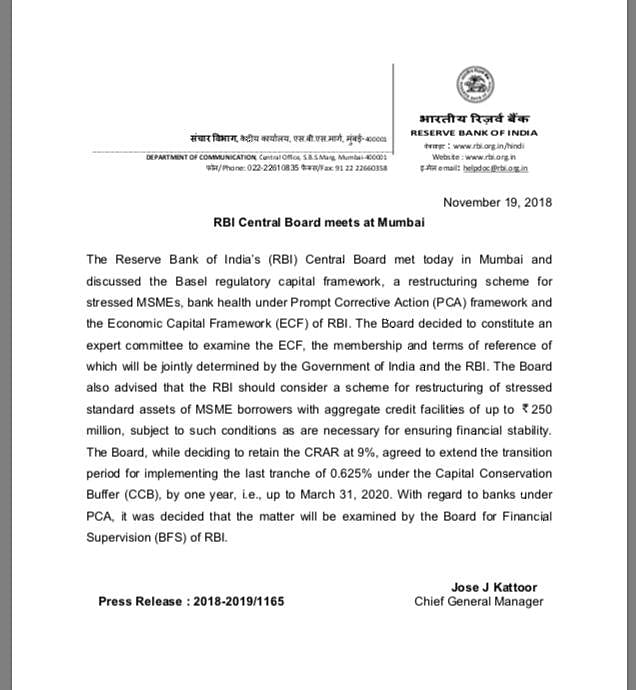

Rules pertaining to transfer of the central bank’s surplus funds to the government, a key point of conflict between the two, was among the matters listed for discussion Monday, people familiar with the matter said before the meeting. Other proposals on the agenda included a dialogue on capital and risk weight norms for Indian lenders — considered more stringent than the Basel guidelines, and restructuring of some loans availed by small businesses, they said.

Getting the RBI to agree to its demands will help Prime Minister Narendra Modi’s government meet budget goals by using a part of the central bank’s reserves, and kick-start lending by weak banks to keep the economy firing ahead of an election next year.

The fiscal math is not adding up. Since 2013 – 14, each year’s surplus is being fully transferred to the government. The whole object of the exercise is to access the accumulations of the past, to bridge one year’s gap. Apart from the oil bonanza, cash rich organisations like ONGC have been made net borrowers from the banking system. LIC is being regularly drained of liquidity – not profits – to underwrite disinvestment targets and large loans to Indian Railways, whose Operating Ratio is now 118. The state governments are borrowing upto their gills, often to pay salaries. Intuition suggests tax buoyancy is low, the economy is more feeble than acknowledged. After the general election, a comprehensive review of public finances – Centre / states / PSUs, especially discoms/ local authorities – would be necessary.