With the currency losing more than 11 per cent to the dollar, India will need to pay an extra $9.5 billion when repaying the short-term debts.

Mumbai: Oil isn’t the only headache for India as the rupee slides.

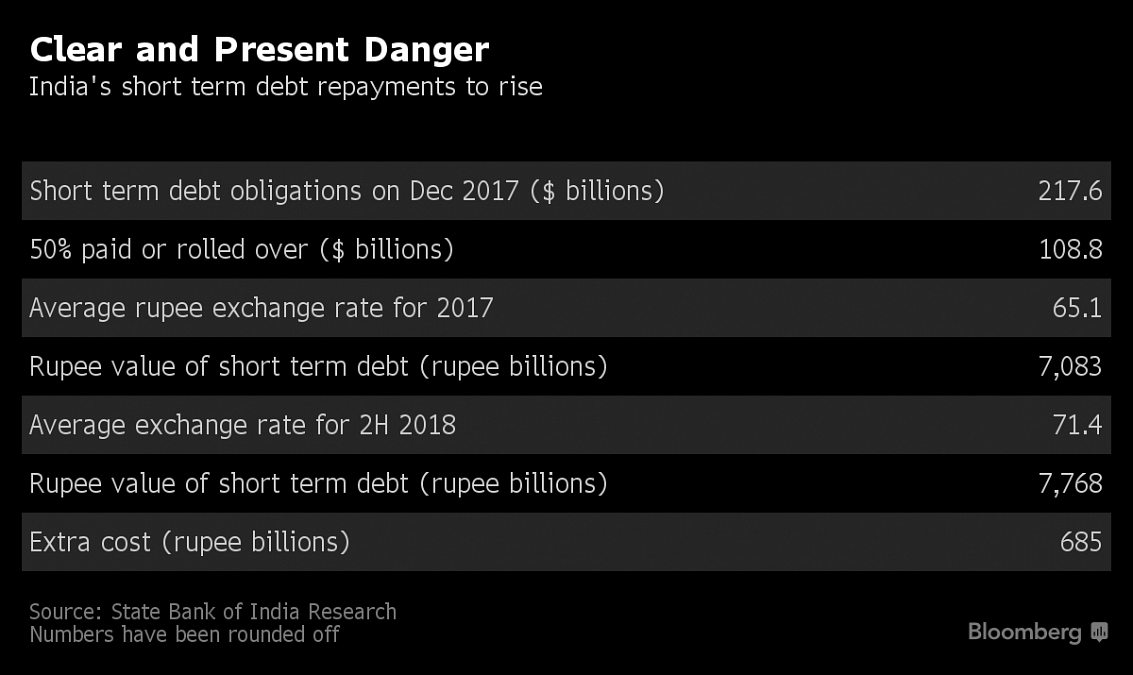

Add external debt to the list. With the currency losing more than 11 per cent to the dollar this year, the country will have to shell out an extra 685 billion rupees ($9.5 billion) when repaying the short-term debt in the coming months, according to numbers arrived at by the State Bank of India.

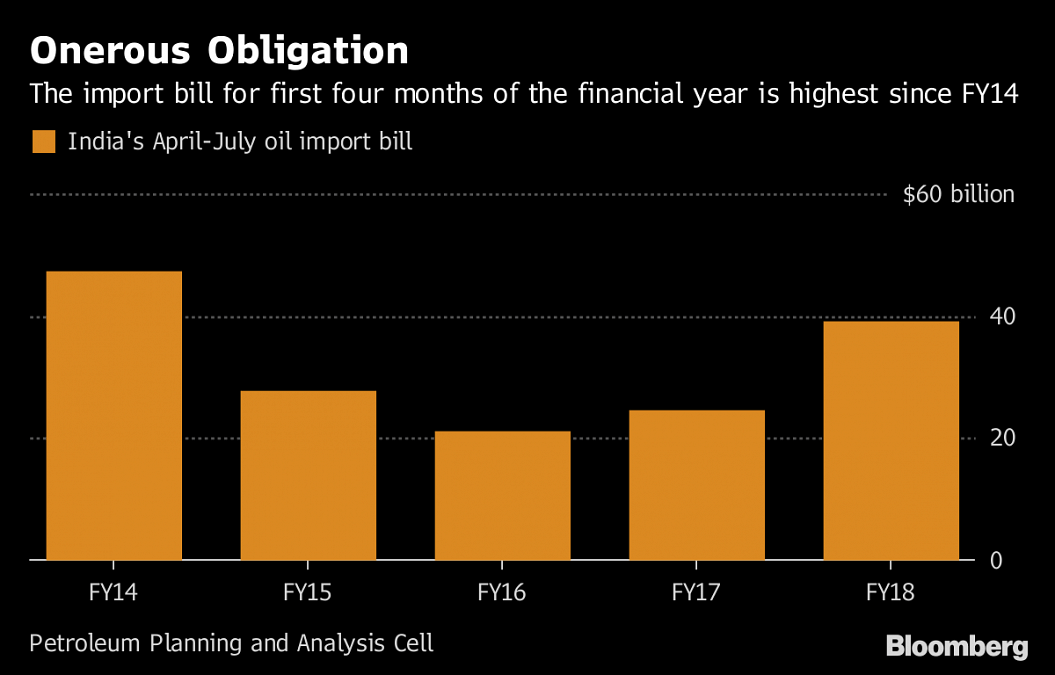

The rupee fell past 72 per dollar to a record low on Thursday, amid a deepening emerging market contagion and the risk of a wider current-account deficit. If the rupee averages 73 to a dollar this year and crude oil, India’s biggest import, averages $76 a barrel for the remaining half of 2018, that could see the country’s oil bill rise by 457 billion rupees, Soumya Kanti Ghosh, chief economic adviser at the State Bank, wrote in a note Thursday.

India’s short-term debt obligations, which included non-resident deposits as well as overseas commercial borrowings by companies, totalled $217.6 billion in 2017. Assuming 50 per cent has either been paid in the first half of 2018 or was rolled over to next year, the remaining amount to be repaid in rupees would be 7.1 trillion rupees computed using the average exchange rate of 65.1 per dollar in 2017.

“For the second half of the year, assuming that rupee depreciates to an average value of 71.4 per dollar, the debt repayment amount would be 7.8 trillion rupees,” he wrote. That would implying an extra cost of nearly 700 billion rupees. The analysis did not give details of hedging, if any.

Here are other risks Ghosh listed:

Increasing bond yields could add to the government’s fiscal costs, which is estimated at up to 0.7 per cent of gross domestic product. A 10 per cent depreciation in the rupee could add up to 50 basis points to inflation, as per Reserve Bank of India estimates, besides pushing the oil import bill higher.- Bloomberg

How about common man daily needs likely to affect their pockets due to increase in cost of living. Gold global rates are declining whereas rupee nosedive against dollar increase bullion rates in our country around the festival season. From roadside layman to corporate sector badly affected.

Some really good people are required in the economic team. While that is the government’s prerogative, at least while appointing senior folk, whether economists or mandarins, the bar of competence and intellectual integrity should be set so high, it should not matter which person is appointed by which administration.