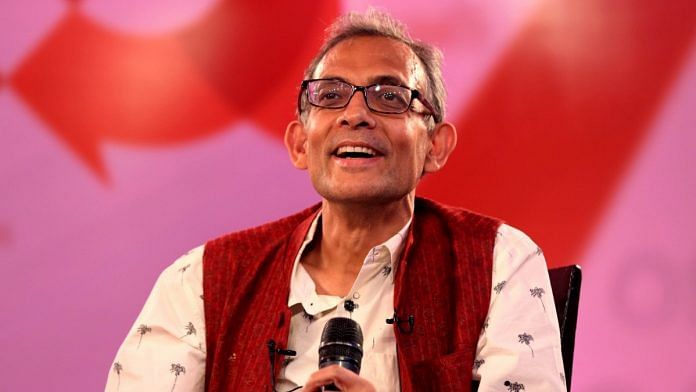

New Delhi: Selling government stake in state-run public sector firms to check fiscal deficit may be a good idea in the short-run, but it is not a long-term solution, 2019 Nobel Prize for Economics winner Abhijit Banerjee said at ThePrint’s Off The Cuff Monday.

In conversation with ThePrint’s Editor-in-chief Shekhar Gupta and Business Standard chairman T.N. Ninan, Banerjee said PSU stake sale is not “how we solve” the problem of fiscal deficit.

“Selling the PSUs is just replacing one form of wealth with another. It won’t be a long-term solution. Today I can sell it, but tomorrow I don’t have it,” he said.

The Nobel winner’s comments come at a time when the Narendra Modi government is looking to sell its stakes in some PSUs to make up for the shortfall in tax collections and rein in the fiscal deficit.

Inflation and loan waivers

In a wide-ranging conversation about the state of the Indian economy, Banerjee attributed aggressive inflation targeting for part of the ongoing rural distress.

“Commitment to have low inflation made it (government) clamp down on support prices and consequently agricultural incomes went down causing distress… We should never have made such stringent commitments to inflation since this doesn’t seem to be in our DNA,” said Banerjee, whose book Good Economics for Hard Times was published earlier this month.

The inflation targeting law in place calls for the Reserve Bank of India’s monetary policy committee to ensure that India’s inflation is maintained at around 4 per cent.

In his comments, Banerjee was also critical of farm loan waivers, calling them distortionary. “Farm loan waivers are what happens when you don’t have a good machinery to transfer money quickly to people. It creates a lot of bad incentives.”

The economist also spoke about the Modi government’s flagship health insurance scheme, Ayushman Bharat, calling it a “good challenge”.

“I like the idea of Ayushman Bharat. When people end up paying a lot for health care, they are forced to sell off their assets. However, there is a huge potential for fraud (in the scheme) and that needs to be fixed,” he said.

Also read: Indian economy heading towards disaster, Abhijit Banerjee said days before winning Nobel

Modi government’s misses

At the event, the Nobel winner praised former Prime Minister Manmohan Singh and called him an “excellent” economist. However, Banerjee was quite critical of the Modi government’s decision to cut corporate tax rates to boost growth.

“(Prime Minister Narendra) Modi seems to have more faith in the corporate sector than I do. This recent tax cut by the Modi government means someone in the Modi administration believes that you need to give corporate sector lot of money to get growth,” he said.

Last month, the Modi government reduced corporate tax rates to an effective rate of 25 per cent from 34 per cent previously.

Banerjee pointed out that much of the investment pattern in the country is driven by domestic demand and India is not competing much with nations like Vietnam.

He added that direct taxes are definitely a better way to fund welfarism than indirect taxes — typically considered to be regressive for being applicable on all individuals at similar rates irrespective of incomes.

Speaking about the manufacturing slump, Banerjee said India may have been too late to take advantage of the shift in the Chinese garment industry.

“Bangladesh and Vietnam were stepping in. We had size restrictions. That was a great manufacturing make or break opportunity. We didn’t take it.”

Highlighting the need to spend more at a time when the economy is slowing, Banerjee spoke about how decision-making has “frozen” in public sector banks over fears of the Central Vigilance Commission going after the bankers. He said bankers opt for the easy way of ‘evergreening loans’ — new loans to help delinquent borrowers — to bail out firms headed towards bankruptcy.

However, the economist was also critical of rating agencies over the rationale of giving India close-to-junk ratings, saying the country has never been close to defaulting.

Also read: Nobel for Abhijit Banerjee and co shows how Economics as a discipline is changing

On personal politics & ‘cuisine’ for Modi

Speaking about his education in India, Banerjee explained how his stint at Jawaharlal Nehru University (JNU) helped him see the “real India”.

“JNU was extremely important for me. In (Kolkata’s) Presidency College, there was no one who wasn’t an upper caste Bengali. But in JNU, I encountered real India. It taught me what India was all about,” he said.

On his politics, Banerjee chose to categorise himself as “welfare Left” and said he sees himself as a “liberal”.

Asked about his voting preferences in US and India, Banerjee said, “I would say I am a Left democrat. Elizabeth Warren seems to be in my sweet spot right now.

“In Indian politics, I would be Left-of-centre as well,” he said, without disclosing his preferred political group. In the run-up to the general elections this year, Banerjee had advised the Congress on its manifesto over the proposed NYAY programme.

Asked about what he would cook for PM Modi if he visits him in Boston, Banerjee, who is also a professor at Massachusetts Institute of Technology, said he would cook what in Bengali is called “widows’ cuisine”.

“It’s vegetarian food that doesn’t use garlic and onions,” he said.

Also read: Now is the time for the Congress to campaign on NYAY

I find this guy totally lost and in barrage of interviews this week, he is saying contrary things.

– In an interview few days ago he said that Ayushman Bharat was not going to show results in short term as money did not reach people directly and now he says that “I like the idea of Ayushman Bharat.”.

– He says “However, there is a huge potential for fraud (in the scheme) and that needs to be fixed,” but this is true with every government scheme including NYAY, MNREGA, etc.

– And as other comments mentioned above, PSU’s hemorrage money.

In my personal opinion, inflation impacts everyone and hurts the poor, middle class & salaried class the most. Without the “clamp down” on support prices, only the rich (large landholding) farmers profit since increase in support price is directly proportional to a farmer yield (farm output) and therefore poor farmers do not get any benefit.

We love the vegetarians, my wife being one, so long as the rest of us are not forced to eat widows’ cuisine.

That privatisation raises resources to reduce the fiscal deficit is itself conceptually wrong. Capital assets are being sold to cover a revenue deficit. Unsustainable, once they are gone. The real reason should be to stop the continuing haemorrhage of resources in the form of losses they incur, made up through bank recapitalisation, for example. The other justification to move the management from government with its political compulsions and bureaucratic procedures to efficient private sector management. One says this a little diffidently because India Inc is throwing up some very dodgy characters as well.

Correct. As long as a company is owned by government there is a greater tendency to bail it out through tax payer’s funds. Right now tax payer’s funds are being siphoned off by private companies through government owned banks. So dodgy characters in the private sector only thrive because they have a cosy arrangement with government owned banks. The solution is for government to get out of running businesses and banks. The primary task of a government is the welfare and security of those in whose name it rules, not running banks and businesses.