There is a price to pay, of course, for not falling in line with the government, writes D Subbarao.

My refusal to fall in line had evidently upset Chidambaram enough to do something very unusual and uncharacteristic—to go public with his strong disapproval of the Reserve Bank’s stance. In his ‘doorstop’ media interaction outside North Block about an hour after the Reserve Bank put out its hawkish policy statement expressing concern on inflation, he said: ‘Growth is as much a concern as inflation. If the government has to walk alone to face the challenge of growth, we will walk alone.’

Sure enough, Chidambaram’s ire at having been abandoned to ‘walk alone’ created quite a flutter in the media. I was on notice therefore for the first question put to me in the scheduled postpolicy media conference later that afternoon. Clearly reluctant to fan controversy during a difficult economic period, I papered over the differences, saying: ‘The government and the Reserve Bank have shared goals. Both of them want high growth and low inflation. Differing perceptions on how to achieve these goals are common across many countries in the world.’

Chidambaram and I were together in Mexico less than a week after that for a G20 meeting. The ambassador of India in Mexico, Sujan R. Chinoy, graciously hosted a dinner for the Indian delegation to provide an opportunity for the finance minister to meet some of the leading public figures and businesspersons of Mexico. When Chidambaram arrived, he greeted everyone, but pointedly ignored me all through the evening, leaving me with an uncomfortable feeling.

Even though this public show of disagreement was a one-off, tension between the government and the Reserve Bank persisted even after that. One particularly contentious disagreement arose in the context of the mid-quarter policy of June 2013 when Chidambaram was of the view that the Reserve Bank should cut the CRR to stimulate bank lending. This was at a time when the rupee was under intense pressure because of the taper tantrums. Any monetary easing in this situation, no matter how carefully explained, was sure to accentuate the downward pressure on the rupee and undermine the credibility of our exchange rate defence. He called me up and we had our usual disagreement. Showing once again that he wouldn’t give up so easily, he fielded his entire team of officers and advisers to canvass the government’s case. I stayed with my decision, and as later events would prove, this was well advised as less than three weeks later, we had to actually tighten policy in order to arrest speculation on the rupee.

Why Do Governments and Central Banks Differ?

Maybe, it will be instructive to step back a little and reflect on why indeed governments and central banks have differences. They differ mainly because they see the growth–inflation balance differently, as I said earlier—and this has to do with differing horizons. Governments are typically swayed by short-term compulsions whereas central banks are expected to take a longterm perspective. Central banks can do so only if they are free of political compulsions.

Surely, the autonomy of a central bank on monetary policy cannot be boundless. After all, the source of that autonomy is the mandate granted by politicians. There is wide agreement that it is the government that should set the inflation target, but having set the target, leave it to the central bank to determine the strategy for achieving the target. In other words, a central bank cannot have goal independence; it has to defer to the inflation target set by the government. At the same time, a central bank should have instrument independence; the government should not meddle in how the central bank goes about achieving the inflation target.

It is, in fact, a muted understanding of this principle that was at the heart of a widely reported public spat in early 2013 between the Government of Japan and the Bank of Japan. The Bank of Japan resisted the doubling of the inflation target by the government from 1 to 2 per cent even though the government was well within its right to do so. The Abe government, on its part, was widely seen as having transgressed the principle of separation of powers by not only setting the inflation target, but also prescribing that the Bank of Japan resort to quantitative easing to achieve that target.

The Price to Be Paid for Asserting Autonomy

There is a price to pay, of course, for not falling in line. The government has several ways of showing its displeasure, and the way it chose to do so with me was by going against my recommendations in the reappointment of deputy governors in the Bank.

As the head of the Reserve Bank, enjoined with a public responsibility, the governor should have the privilege of selecting his team just as the prime minister has the prerogative of choosing his Cabinet. There is no question, of course, that under law, it is the government that has the authority to appoint the governor and deputy governors of the Reserve Bank. There are rules about eligibility and tenure, which have to be complied with, and the system of selection has to be fair, transparent and contestable. Within that framework, a healthy convention should be to defer to the governor’s recommendation on the appointment of deputy governors. That privilege was denied to me.

Usha Thorat, whose term as deputy governor was expiring in October 2010, was eligible for reappointment for another two years in accordance with the convention followed till then of reappointing deputy governors till they attained the age of sixty-two years. Even as I was planning to formally write to the government recommending and requesting her reappointment, the secretary of the Department of Financial Services, R. Gopalan, called one evening to say that the finance minister had approved the constitution of a committee to select Usha’s successor. I was pained that even if the government had decided to deviate from the standard practice of consulting the governor on the reappointment of an incumbent, they had not even told me about it before constituting a selection committee. There was speculation that Pranab Mukherjee was irked by some regulatory decision taken on Usha’s watch which, of course, came on top of his general unhappiness with me.

I sought a meeting with Pranab Mukherjee—incidentally one of only two occasions when I met him one-on-one—and requested that Usha be reappointed because of her competence, track record and because she met the eligibility criteria for reappointment. He knew that he could not call into question Usha’s competence or track record; it would have been presumptuous on his part to override my judgement on this issue with his own. He pleaded rules instead, but I was prepared for that point. I told him that the government had reappointed Shyamala Gopinath, another deputy governor, an identical case, under the same rule, and added for effect that he was the finance minister who had approved it. He didn’t budge and Usha became a part of the price we had to pay for asserting the autonomy of the Reserve Bank.

We had a replay of the same story in the case of reappointment of Subir Gokarn whose three-year tenure as deputy governor was expiring in December 2012. By this time, Chidambaram had returned as finance minister. As early as in August 2012, I requested Chidambaram to reappoint Subir for two more years and told him and that I would send a formal recommendation accordingly. I reiterated the request in October 2012. Chidambaram was clearly disinclined to accede. The reason he gave was that all of us who entered the Reserve Bank laterally had become hostage to the technocrats in the Reserve Bank and the government felt it necessary to bring some fresh thinking into the Reserve Bank. He was firm that we should go through a de novo selection process.

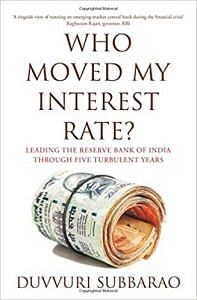

This excerpt is from the book ‘Who Moved My Interest Rate?’ and has been written By D Subbarao. It was published in 2016 by Penguin India.

This excerpt is from the book ‘Who Moved My Interest Rate?’ and has been written By D Subbarao. It was published in 2016 by Penguin India.