It’s rare for any government to claim an economic success story uncluttered by ifs and buts—there are always some qualifiers to that success. However, the Narendra Modi government has come as close to achieving an unqualified success in the banking sector as is reasonably possible. Whether you look at non-performing assets (NPAs), profits, growth in credit, or resilience to external shocks, the Indian banking sector is significantly stronger today compared to just five years ago.

It is also rare to be able to pinpoint a clear source of an entire sector’s problems. Usually, a combination of factors weigh a sector down. With the banking sector, though, it’s pretty clear that its problems began due to the profligate lending practices ‘encouraged’ during the UPA government’s tenure.

There’s more than enough anecdotal evidence to show that the quality of bank lending went from bad to worse during the UPA period, with huge loans being given to government-friendly corporates without proper due diligence regarding the necessity of such loans or the borrowers’ ability to repay them.

Back in 2015, a former chairman of the National Highways Association of India (NHAI) had lamented privately about the situation.

What used to apparently happen was that NHAI would award a contract to a company to build a stretch of a highway, say, for Rs 300 crore. That company would approach the banks and ask for a loan of twice that amount. The banks, without doing due diligence, and often encouraged by political leaders, would issue the loan. At the best of times, it takes decades for developers to recover their investments in highway projects. With loan sizes double the cost of the project, it was naturally only a matter of time before they turned sour.

And this was just one sector. This kind of lending was taking place across sectors.

If you’re wary about taking my word for it, maybe listen to two former RBI governors, one appointed by the UPA and another by the Modi government. Raghuram Rajan, when asked by a parliamentary committee on why bank NPAs had risen so sharply, had said in 2021 that “a larger number of bad loans originated in the period 2006-2008”. He added that too many loans had been given to “well-connected promoters who have a history of defaulting on their loans”. Damning words.

His successor at the RBI, Urjit Patel, was not much kinder to the UPA. In a book published in 2020, after he left office, Patel wrote that the UPA government “didn’t question risk controls in government banks even as it received significant dividends”, and also blamed the RBI for not having done rigorous enough stress tests.

Gross bank credit grew a whopping 20 per cent in 2012-13 and another 14 per cent in 2014-15. This in itself wouldn’t have been a problem if the quality of the loans were good. But this wasn’t the case.

NPAs

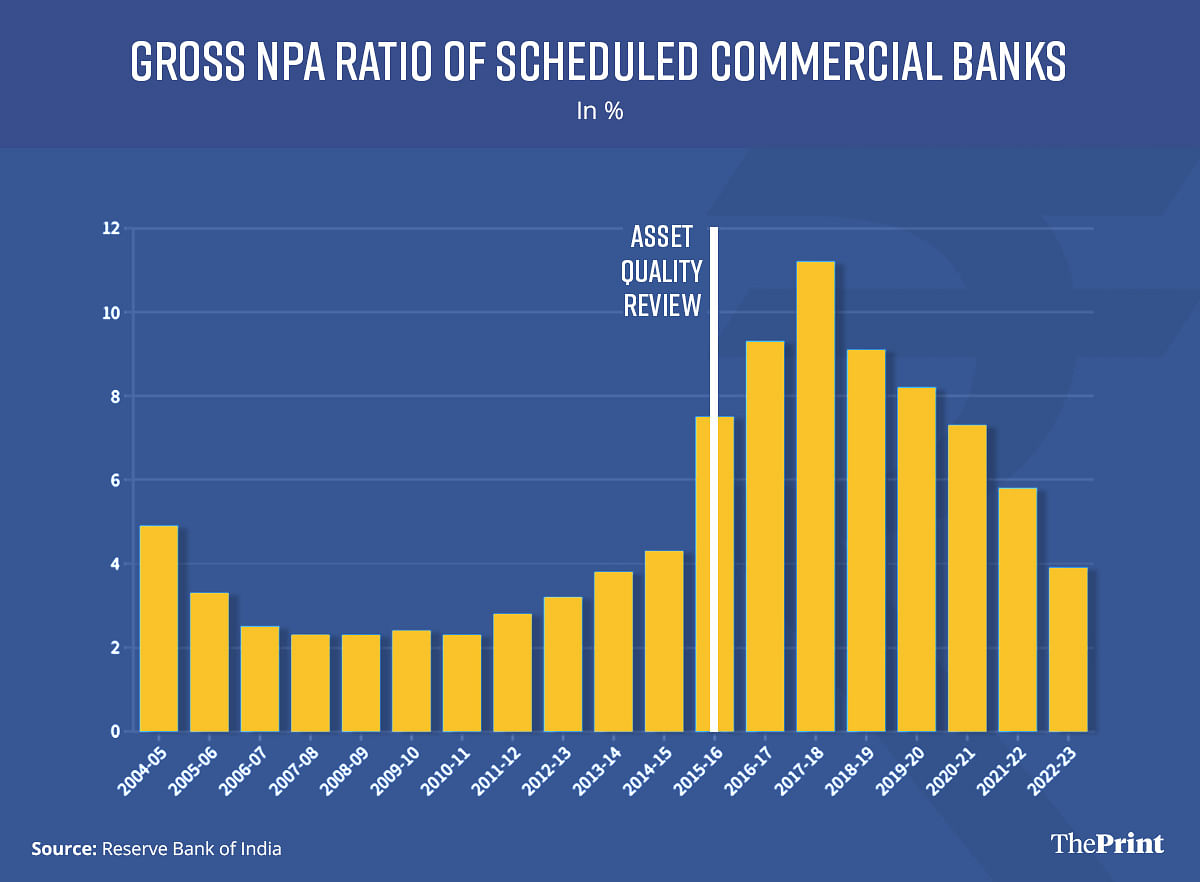

Gross NPAs had already started climbing in 2011-12, but this quickened in the next few years. The ratio of gross NPAs rose quickly from 2.8 per cent in 2011-12 to 3.8 per cent in 2013-14, the UPA’s final year. It didn’t stop there, as more and more loans started turning bad, raising the ratio of bad loans to 4.3 per cent in 2014-15.

It was at this time that the RBI—with Rajan still at the helm—and the government began to realise the seriousness of the problem. They began an Asset Quality Review, which was completed in 2015 and brought to light the scope of the problem.

Just the act of recognising all the previously undetected bad loans caused the gross NPA ratio to soar to 7.5 per cent within a year.

The next few years were spent bringing more and more bad loans into the official NPA category, which meant that by March 2018, the NPA ratio had risen to an eye-watering 11.2 per cent. And that’s when the cleanup began in earnest.

One of the steps was to consolidate the banking sector by merging weaker public sector banks with stronger ones. So, where there were 20 public sector banks at the end of 2017, there are now just 12. Work also began on cleaning up the banks’ balance sheets, including writing off a significant number of loans.

Now, write-offs are not loan waivers. The loan recovery process continues, unlike with waivers. They are just taken off the balance sheet so that fresh lending can continue.

Write-offs are a technical requirement under RBI rules that have been in place well before the Modi government came to power. Although the recovery rate of written off loans is admittedly poor, the alternative would be to leave them on the balance sheet—fiscal cholesterol clogging the arteries of the banking system.

It’s this thinking that has led to the compromise settlement system the RBI has come up with. Recovering what you can is far better than having your dues locked up in legal procedure. Separating the financial from the criminal when it comes to loan defaults is the right way forward.

The second thing that happened was the slowdown in loans taken by big corporates. Various bankers have unofficially said that banks had become wary of lending to large corporates, for fear of these loans becoming NPAs. Instead, they chose to lend to smaller companies and households, both of whom have a much better track record of repayment.

Simultaneously, large corporates also began to seek fewer loans as the economic slowdown began impacting their investment plans. So, in short, banks didn’t want to give big loans, and companies didn’t want them anyway. This gave banks the breathing room to further clean up their mess. Throughout, managerial and regulatory reforms continued apace.

So, now we have a situation where gross NPAs have been falling every year since 2018-19, and are back to 3.9 per cent as of March 2023.

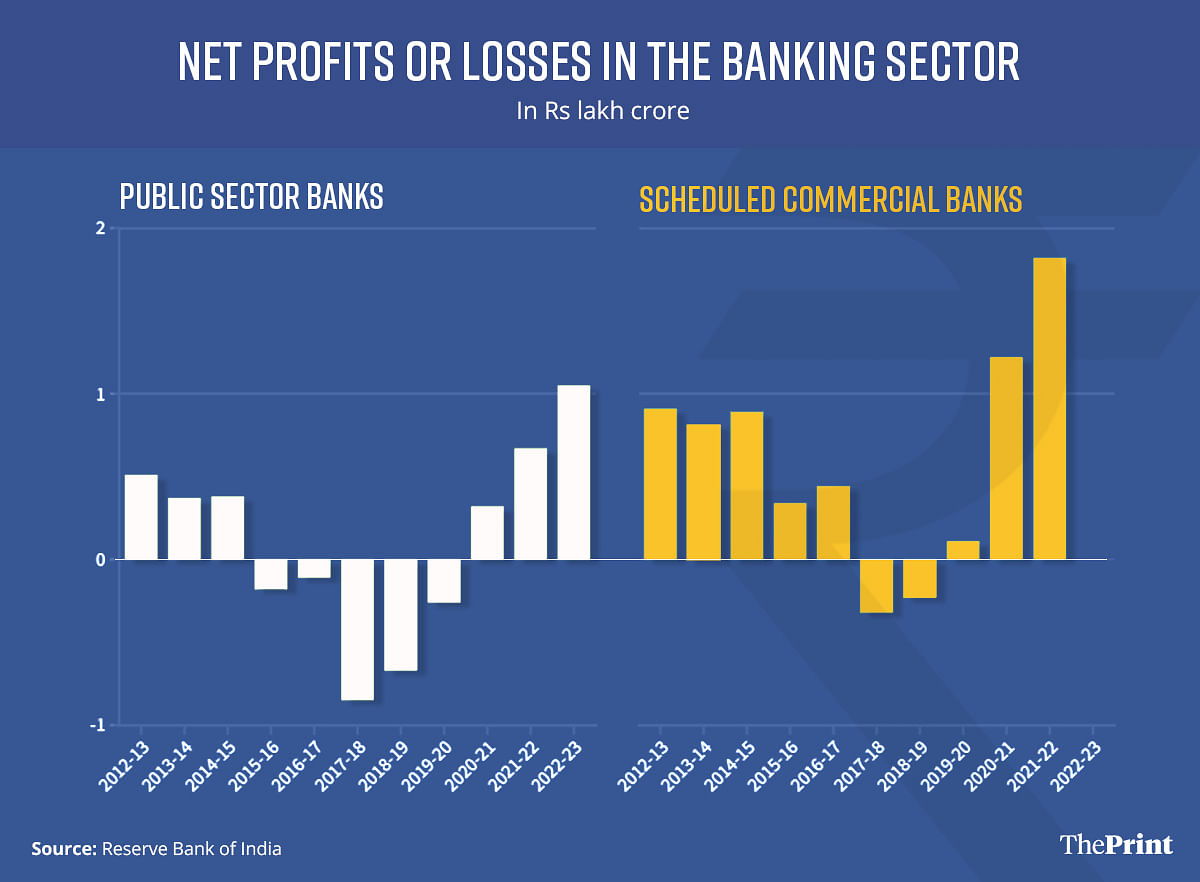

This would have been an impressive enough achievement on its own. Add in the fact that public sector banks are now back to making huge profits, and the overall improvement in the banking sector looks almost unbelievable.

Profits of public sector banks & scheduled commercial banks

As the NPAs started to rise, banking profitability began to fall. Public sector banks fell into losses in 2015-16, and were soon followed by the sector as a whole by 2017-18. The public sector banks remained in losses for five years, before they emerged into profitability in 2020-21, as the balance sheet clean up took effect. Since then, profits have touched Rs 1.05 lakh crore in 2022-23, a 57 per cent increase from the previous year.

All of this while the public sector banks have been pushing towards the target of providing every adult Indian a bank account, including in deep rural India.

The turnaround isn’t just in the public sector banks, either. Private banks have seen their profits grow, and we now have HDFC and HDFC Bank having merged to form the world’s fourth-largest bank by market capitalisation. IDFC and IDFC First Bank have also announced a similar merger.

There’s a reason Indian banks, regulators, or even investors in Indian banking stocks weren’t worried when crises began exploding in the US and European banks earlier this year. They were confident that the Indian banking system would not be affected. This resilience has been a long time coming, and hasn’t arrived a moment too soon for the Indian economy.

Views are personal.

(Edited by Prashant)