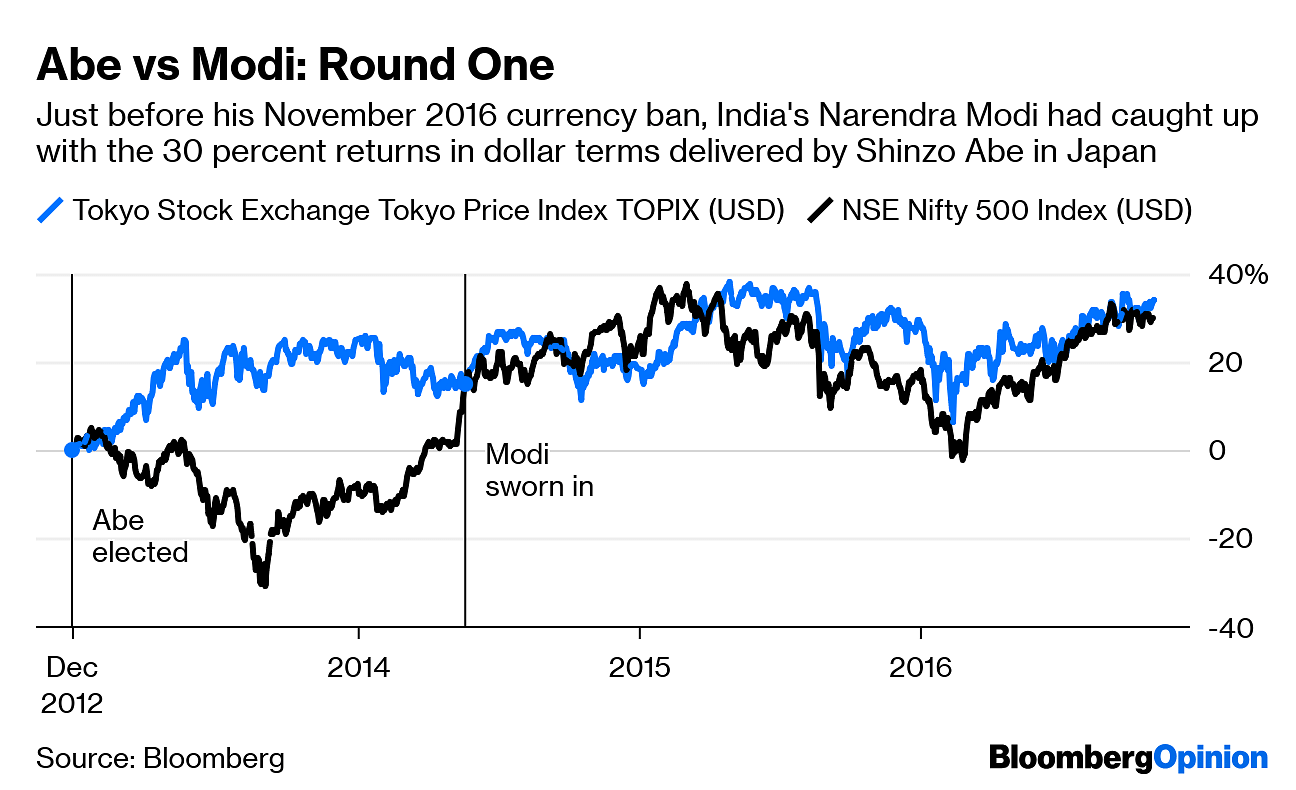

Five years ago, I wrote that Narendra Modi could be India’s Shinzo Abe. I couldn’t have been more wrong.

The chief minister of Gujarat state had just been chosen by his party to become the next prime minister if it won the popular vote. Writing for Reuters then, I predicted he could lift the country’s drooping economy, just as Abe had been attempting to do in Japan.

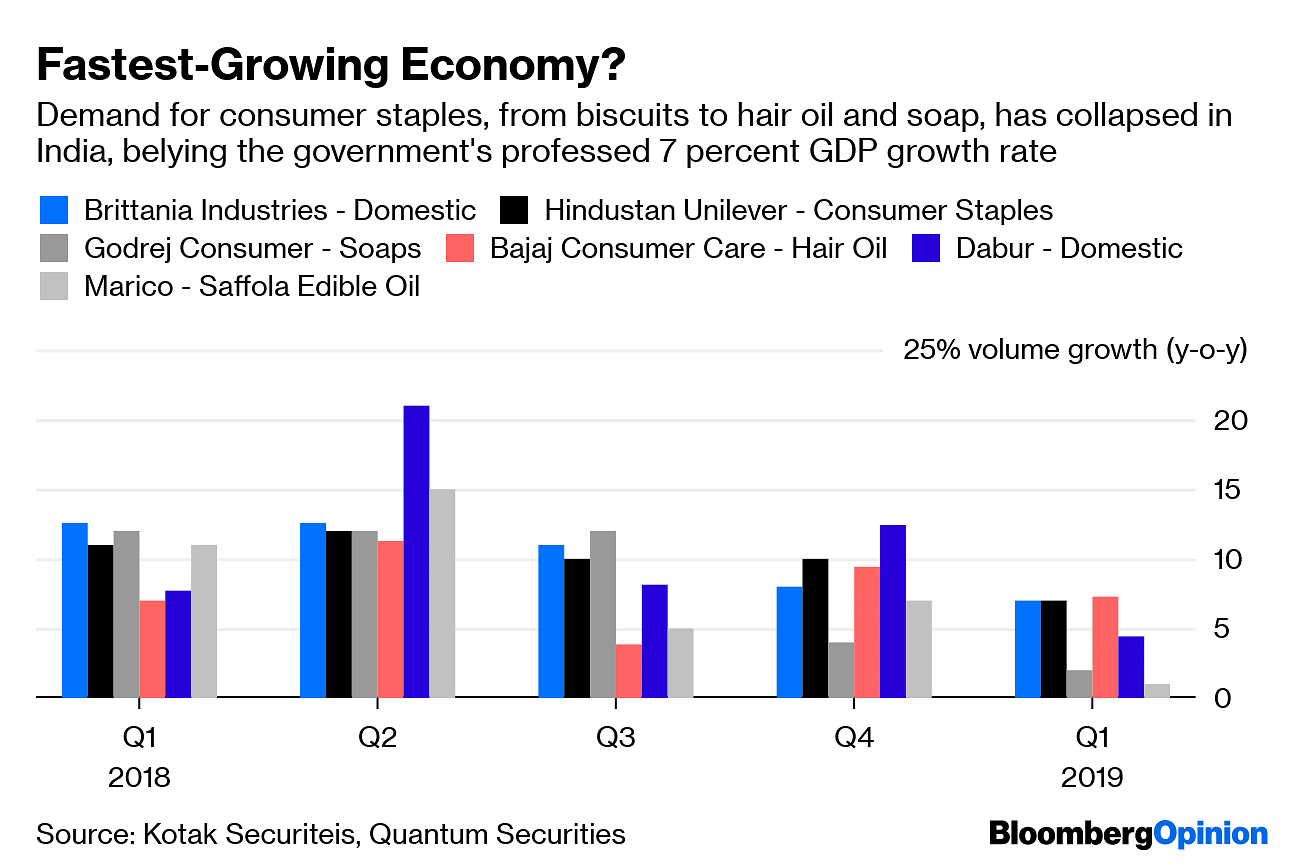

To get an idea of how badly Modi has undershot expectations, look at India’s largest maker of consumer staples. Hindustan Unilever Ltd. recently reported March quarter revenue growth of 7%, the weakest in 18 months. But it was what CEO Sanjiv Mehta said that unnerved investors. Consumer essentials are “recession-resistant but not recession-proof,” Mehta said. “At the end of the day, it depends on money in the hands of consumers.”

Recession? In what Team Modi professes to be the world’s fastest-growing major economy?

From carmakers to toothpaste sellers, Indian firms have had a lousy start to 2019. It’s a performance that belies the economy’s official GDP growth rate of 7%, not to mention its advance to 77th place in the World Bank’s ease of doing business ranking, from an abysmal 142nd four years ago.

In Japan, Abe has presided over what’s possibly the longest economic expansion in its post-World War II history despite the burden of an aging population. The signature piece of his reforms has been unprecedented monetary stimulus to end the country’s deflationary mindset.

For a long time it looked like Modi would catch up with his counterpart, who had a head start of about 18 months after taking office in December 2012. India’s leader certainly had successes. They included a $48 billion reduction in the crippling debt of power distribution companies (so they could be healthy again and pay producers on time). In May 2016, Modi’s government gave India its first modern bankruptcy law, and in August that year, parliament voted in favor of a national sales tax, promising freedom from a bewildering array of state levies.

As late as October 2016 there was nothing to distinguish between the 30% gains (in U.S. dollar terms) delivered by benchmark stock indexes in Japan and India since Abe took office.

But the following month, Modi did something bizarre. He made 86% of the country’s cash illegal. Abe never got around to dropping cash from helicopters to get citizens to spend. Modi succeeded in doing the exact opposite: He froze the purchasing power of an unsuspecting population for several months.

Most people fail to realize that the loss of output India suffered in that two-and-a-half-year-old episode wasn’t temporary. The shadow is visible in Hindustan Unilever’s latest results.

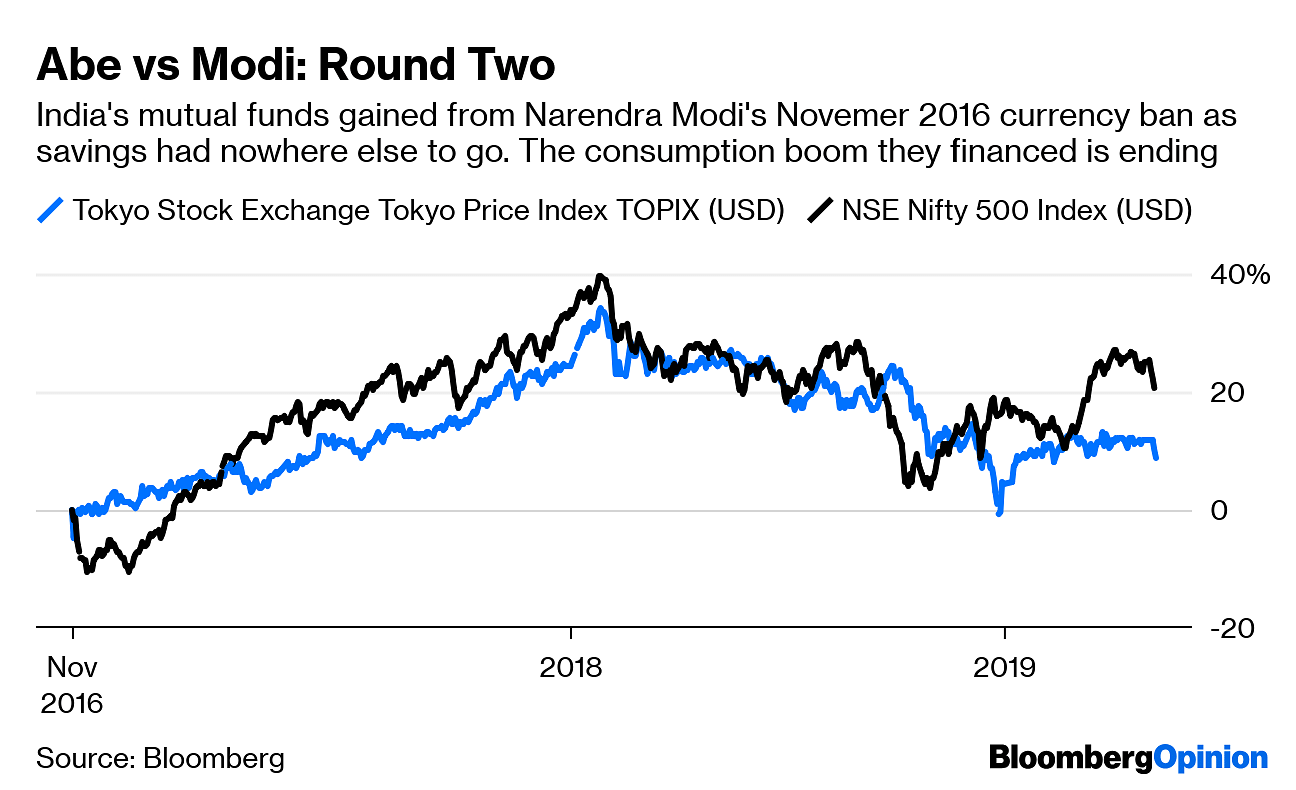

Demonetization forced Indians to pull cash from informal business financing and real-estate speculation and, along with what they had in hand, put it in bank accounts or mutual funds. Property transactions, typically greased by cash that’s not declared to tax authorities, stalled. Even when the supply of new currency became normal, demand didn’t revive. More people chose to spend on consumer goods (like a new motorcycle) instead, as Kotak Securities Ltd. notes, encouraged by nonbank lenders that had no difficulty raising debt from cash-stuffed mutual funds.

This consumption edifice is now crumbling. For one thing, the financing that supported it has keeled over. For another, the spending was erected on incomes that weren’t growing as fast as reflected in dubious GDP data. Rural demand has been hurt by slumping prices of agricultural commodities.

Families cutting back on biscuits and toothpaste? This isn’t how Modi’s five years were supposed to end. In terms of stock-market returns, he’s still leading Abe. That may be because investors are underestimating the consumption slowdown and the dislocation in finance, which I termed India’s mini-Lehman moment last September. Hindustan Unilever may not mean “recession” in the formal sense of two quarters of economic contraction, but its top executives are unlikely to be using the word carelessly.

Modi inherited an economy that had been mismanaged for five years and proceeded to repair it, only to throw it into chaos in the second half of his term. A poorly designed national sales tax has hurt government revenue; crony capitalists have made a mockery of the new bankruptcy law; and the debt overhang for power-distribution companies has become just as grim as before.

Modi didn’t become India’s Abe, but he did preside over half a Japanese-style lost decade.

Andy Mukherjee is a Bloomberg Opinion columnist covering industrial companies and financial services. He previously was a columnist for Reuters Breakingviews. He has also worked for the Straits Times, ET NOW and Bloomberg News.

Also read: Bleak record on economy – the reason Modi’s BJP has returned to communal politics

The sentiment and underlying theme behind this report are correct but the analysis and examples touted are incorrect. He really has messed the SME sector big time which would not be easily captured in any data measuring systems we have and would benefit large companies like a Levers disproportionately. So it’s share price performance has zilch to do with the underlying economy and more to do with depressed raw materials prices and high equity market multiples

First your base is weak Hindustan Uniliver is a private company not a survey on which your report is based. You just want to criticize.

In short I just want to say the editor is an idiot

I hoped for Margaret Thatcher and Ronald Reagan but got a socialist disappointment.

The columnist should not feel sheepish about his lack of clairvoyance. He is in distinguished company. Some, like Ms Rupa Subrahmanya have bailed out. Others, like Ms Tavleen Singh, continue to belt out their columns.

The fact is you guys print any shit and first show as a news which is actually article of some anti modi person, if really want to write write with fact and figures not on speculation, it’s not at all the impact of demo after around 3 years, it’s business India’s import of these product is on rise, who will consider this.

Well It’s not like that, Patanjali products are constantly expanding and their revenue is multiplying so its not at all the fault of Narendra Modi, He is the person because of whom India is shining internationally so atop blaming him.