The more you live from paycheck to paycheck, the more you need to be sure that the paychecks won’t stop coming.

In finance theory, it’s usually assumed that people care not just about how much wealth they have, but about how much their wealth is likely to fluctuate year to year. For example, many finance professors will teach the concept of mean-variance utility, meaning that people weigh the amount their bank account goes up on average with the amount that it randomly bounces around.

This partly explains why risk is bad. At some point, you’ll have to take money out of your account. Maybe you’ll need to pay for something, like your son’s wedding, or your daughter’s college education, or a big medical bill. If nothing else, you’ll eventually retire and have to sell at least some of your investments. In other words, risk is bad because of liquidity needs — those incidents of life that force you to cash out.

If risk is scary for the rich, think how much more terrifying it is for the poor. The kind of event that causes a low-income American to suddenly need money isn’t a wedding or college or a comfy retirement — it’s coping with an eviction, or getting robbed, or a broken pipe in their house, or their car breaking down. The life of a poor American is a nonstop sequence of sudden disasters and looming threats. If you don’t understand this, read “Evicted: Poverty and Profit in the American City” by Matthew Desmond. For a middle-class American, the situation is less awful, but big medical bills and other surprise expenses are still a very significant risk, and many Americans have little savings in the bank to cushion the blows life throws at them.

Given the risks of life in America, and the paucity of savings, a consistent income is very important. The more you live paycheck to paycheck, the more you need to be sure that the paychecks won’t stop coming — and that their size will be relatively constant from month to month and year to year. Unfortunately, during the past 40 years, income volatility has risen for the average American.

Many studies have documented rising income volatility. A new paper by economists Robert Moffitt and Sisi Zhang reviews these studies, and presents updated results through 2014. Their finding confirms that U.S. income volatility rose in the late 1970s and early 1980s, plateaued from the mid-’80s through the late 1990s, and then began to rise again:

Moffitt and Zhang also create a mathematical model to separate income volatility into short-term (“transitory”) and long-term (“permanent”) income components. They find that both components have become much more volatile. The increased variation in long-term income is particularly worrying, since it means that American workers are suffering an increased number of unpredictable changes in the long-term trajectories of their careers.

What could be causing this increase in income volatility? Unemployment obviously plays a big part. The biggest rises in income volatility were in the early 1980s and the late 2000s, when big recessions put lots of Americans out of work:

But it’s noticeable that after the 1980s recessions, unemployment drifted back down, while income volatility never returned to the placid level of the 1970s. That implies other, more structural changes have taken place in the U.S. economy.

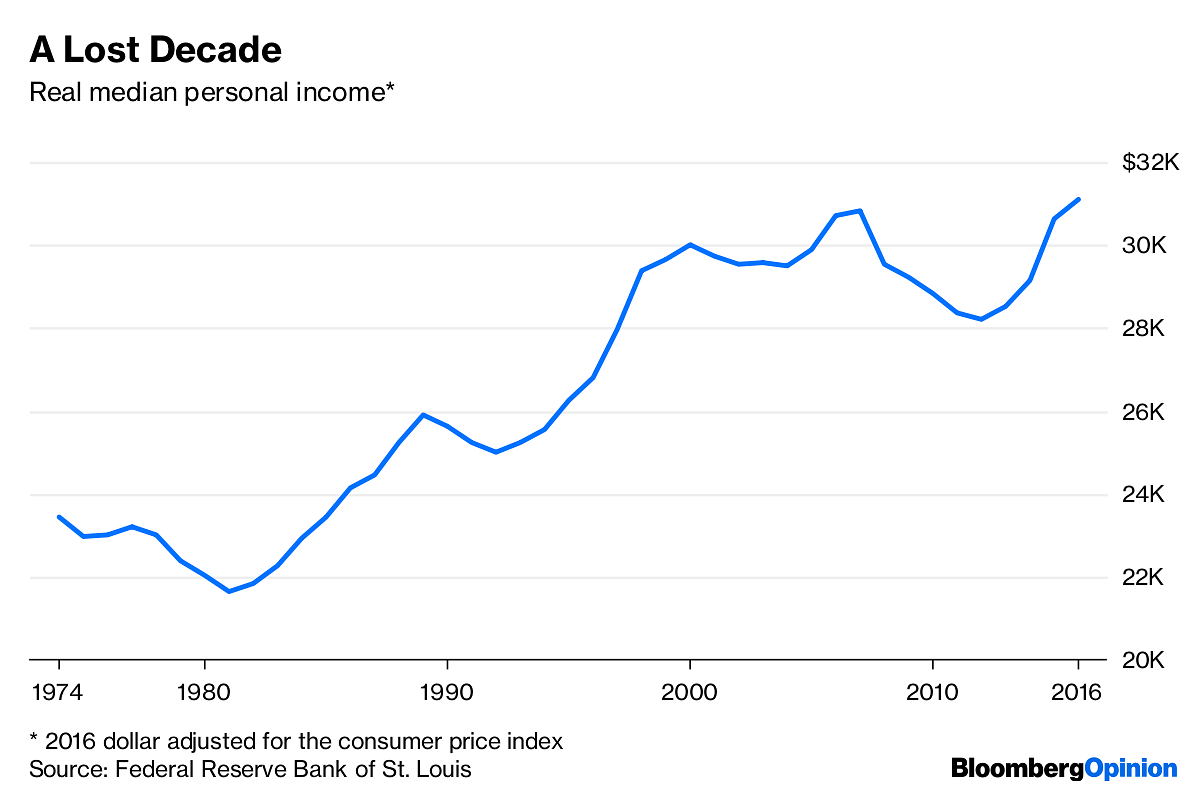

Ever since the Great Depression, job tenure has been falling in the U.S. (though it has leveled out recently). When wages were rising quickly, this wasn’t too bad — it meant people were increasingly switching between jobs that were mostly paying more and more. But since the 1970s, wage increases have become much more gradual, or even nonexistent in some time periods. That means that losing your job now means a chance of getting stuck in a job that pays less.

Why are people more at risk of losing their jobs? The decline in unionization might be part of it, as could the rise of outsourcing and contingent-work arrangements. The increasing financialization of the American economy might also play a role — companies are increasingly vulnerable to buyouts by private-equity firms that often cut employment costs by firing lots of workers. Also, increased global competition might be a big factor — economists have found that lots of manufacturing workers were displaced by sudden surges of Chinese imports in the 2000s, and that many of these workers never regained their previous levels of income.

Whatever the reason, it’s clear that many or even most American workers have been on the losing end of what political scientist Jacob Hacker calls “The Great Risk Shift.” This has happened even as real income growth has slowed down:

And now we return to the concept of mean-variance utility. Growth in Americans’ mean incomes has decelerated, while the variance has risen. No wonder the economy feels like it hasn’t been good in decades, despite low unemployment.

So what’s to be done about income volatility? A big part of the job, of course, is avoiding repeats of the Great Recession. Beyond that, financialization, especially private equity’s practice of taking over companies and imposing mass layoffs, has to be thoroughly reexamined. And it may also be useful to encourage the creation of new kinds of work contracts that offer more long-term stability. In any case, though, it seems clear that income volatility is a problem that has received too little attention. -Bloomberg