The Indian banking sector had a stellar run in the last financial year, with both public and private sector banks reporting net profits of more than Rs 1 trillion. The robust performance continued in the first quarter of the current financial year. Public sector banks’ profits more than doubled to Rs 34,774 crore for the quarter ended June. Large private sector banks, such as HDFC, ICICI and Axis, posted strong double-digit growth in profits.

Healthy loan growth momentum contributing to higher net interest margin (difference between what banks earn on loans and what they pay to the depositors) coupled with comfortable capital position and lower provisioning for bad assets have led to the improved health of the banking sector.

Credit growth in recent times is mainly driven by personal loans and loans to services. While the overall health of the banking sector looks good, there are some incipient signs of stress in the form of shrinking net interest margins and build-up of bad loans in the retail segment that need to be monitored in the coming quarters.

The rise in the share of unsecured retail loans could also impact the asset quality of the banking sector. These concerns are leading to a visible shift in the composition of bank loans.

Also read: RBI less than worried on growth front, but spikes in food & oil prices still loom

Bank credit: Key trends and compositional shift

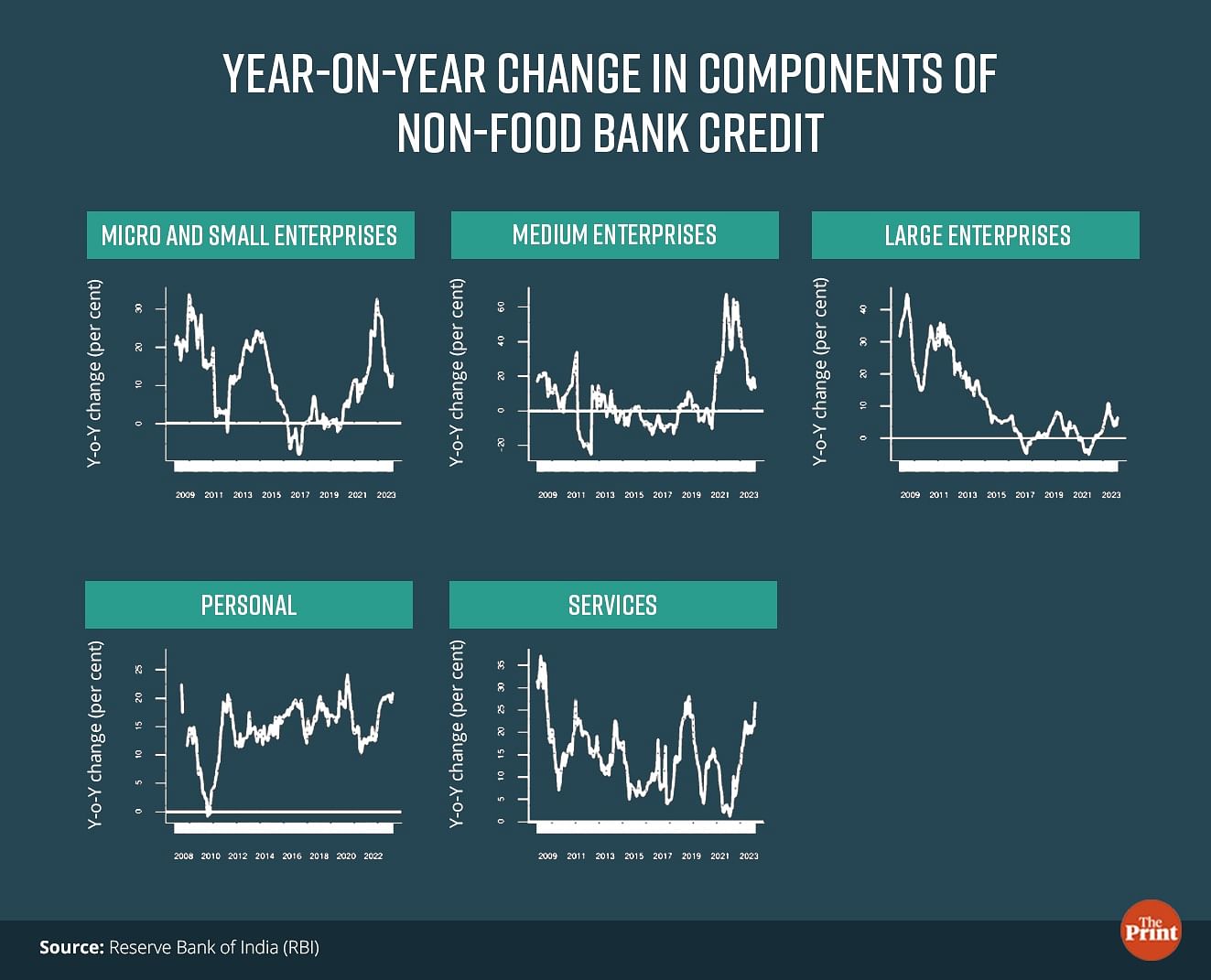

The outstanding non-food bank credit grew by more than 15 per cent in the last financial year after three years of tepid growth. In the first quarter of the current financial year as well, the non-food bank credit grew by more than 16 per cent. While the overall growth in bank credit is robust, there are stark variations in the credit growth to the various sectors. While credit to industry grew by a modest 8 per cent in June, 2023, personal loans and loans to services grew by 20.9 and 26.7 per cent, respectively.

The composition of non-food bank credit has also undergone a noticeable change over the past few years. In a span of two years, the share of industry has declined from 26.8 per cent in July 2021 to 23.8 per cent in June 2023. Particularly, the share of large industry in the outstanding non-food bank credit has slid sharply from 21.2 per cent to 17.6 per cent during the same period. The categories of personal loans and services have seen an increase in their share in this period.

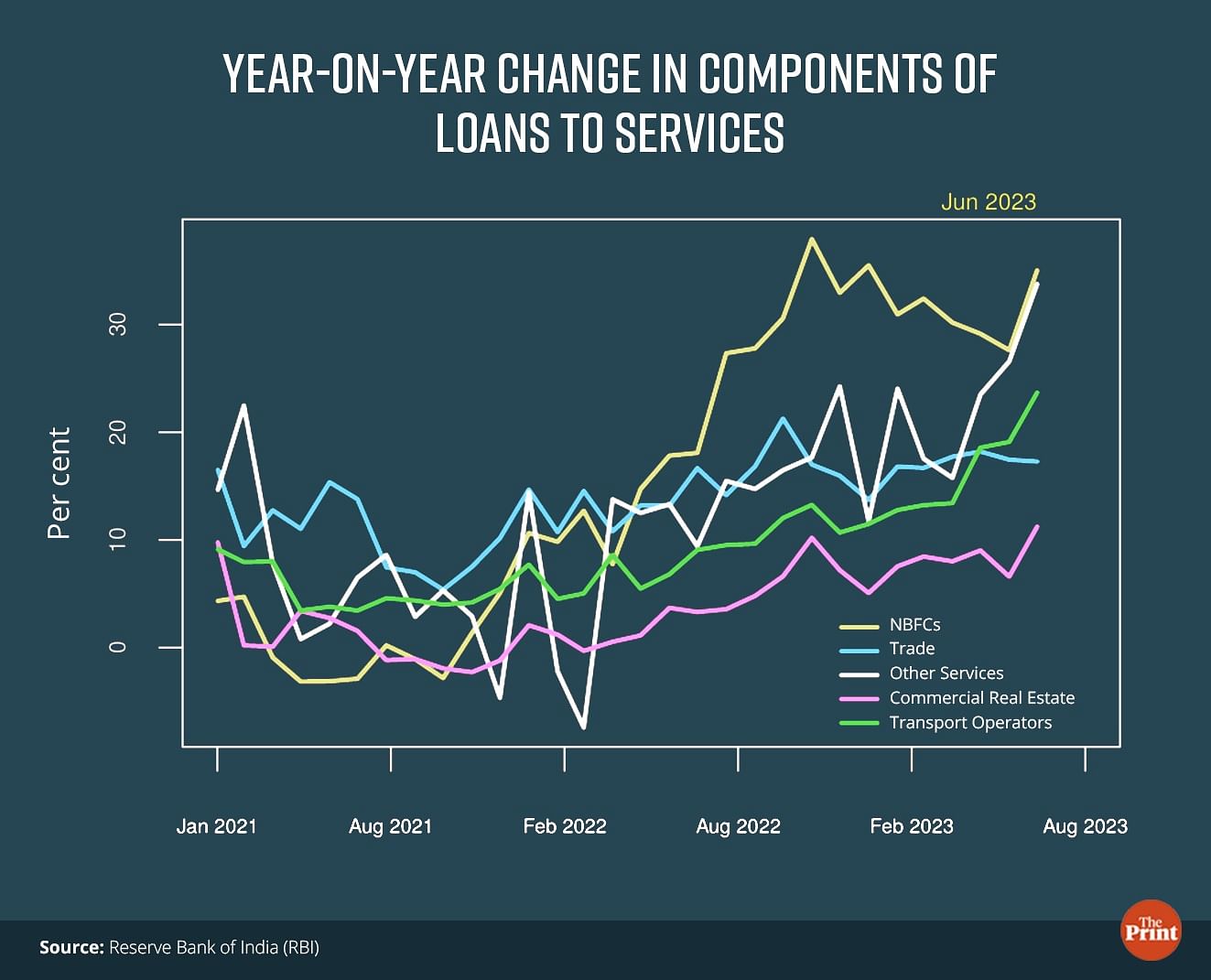

Further delving into the components of services shows that loans to non-bank financial companies accounts for almost 37 per cent of credit to services. Over time, the reliance on NBFCs on bank credit has increased as other sources of NBFC borrowing, such as Mutual Funds (MF) investments in the bonds and Commercial Papers (CPs) of NBFCs, have seen a decline. In fact, bank lending to NBFCs jumped 35 per cent to Rs 14.2 trillion in June, 2023.

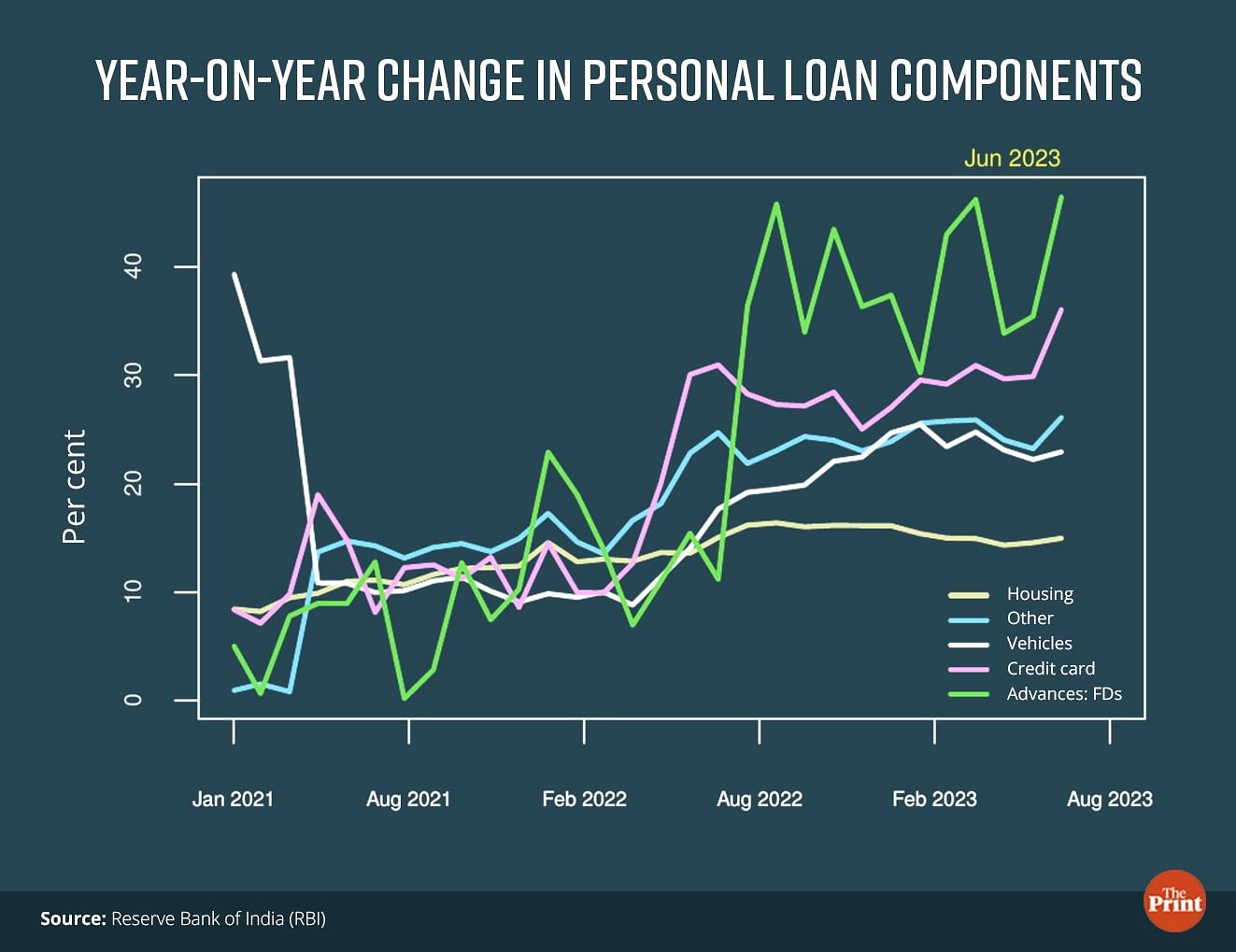

Within the personal loans category, while housing loans with a share of 47 per cent and vehicle loans with a share of 12 per cent are the two dominant categories, noticeably it is the smaller components that have witnessed an extraordinary growth in the past few months.

One such category, advances against fixed deposits, have increased sharply by 46.4 per cent as of June 2023. Banks are favouring this product as it is a secured option and customers are inclined as they are able to access loans at lower rates of interest.

Another component of personal loans that has witnessed an increase is the credit card loan exposure. Loans under this segment grew by more than 36 per cent at end June and have been rising in the past few months.

Early signs of risk that warrant monitoring

The RBI’s report on financial stability released in June highlighted the rise in the proportion of unsecured loans within the retail loans category from March 2021 to March 2023.

Further the first quarter financial results of banks highlight some fresh sources of risks.

While banks have managed to keep non-performing assets (NPAs) in control, their net interest margins have seen a sequential dip. Simply put, the gap between the interest earned on advances and interest paid on deposits is seen to be shrinking. While interest on loans get re-priced when RBI raises its policy rate, the impact on deposits is seen with a lag. Banks need to now raise their deposit rates to attract more customers, which is putting pressures on net interest margins.

As an example, for State Bank of India (SBI), the net interest margin on domestic operations declined from 3.84 per cent for the quarter ended March 2023 to 3.47 per cent for the quarter ended June — a decline of 37 basis points. For the bank, as a whole, the margin declined by 27 basis points.

Fierce competition among banks to attract more customers could lead to further compression in net interest margins. The table below shows that of the top five public sector banks, three banks reported a sequential moderation in net interest margins.

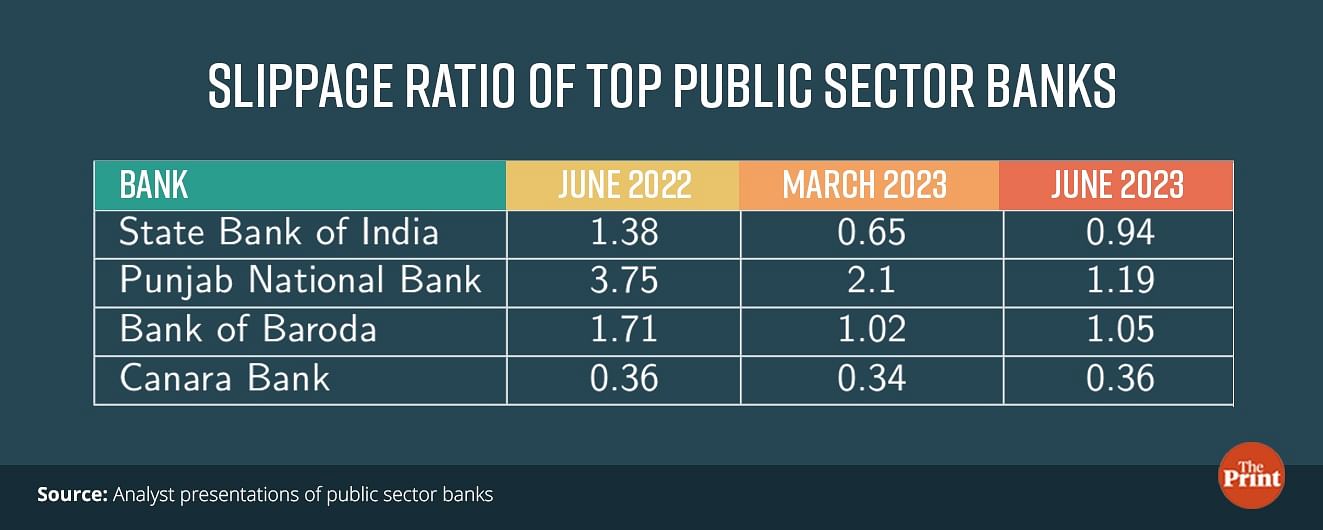

The other source of stress is the increase in slippages.

Slippages are the fresh addition to the existing stock of NPAs. SBI reported fresh slippages of Rs 7,659 crore, double the amount in the March quarter. To be sure, on a year-on-year basis, fresh slippages declined in the June quarter. Expressed as a proportion of advances, slippages saw a sequential increase for three of the top four public sector banks.

Similar to slippages, there is a sequential increase in NPAs in certain segments of the banks’ loan portfolio. Since loans to the retail sector have risen at a sharp pace, signs of stress are also emerging in this sector. SBI reported a sequential increase in NPAs in the retail loan segment. NPAs are also seen to be rising in loans to MSMEs.

While the health of the Indian banking sector looks sound, there are emerging signs of stress that need continuous monitoring.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: Muted tax collection in Q1 of FY24 widened fiscal deficit, govt focus still on capex