The central government has budgeted a fiscal deficit target of 5.9 per cent for the current financial year. The first quarter trends on revenue and expenditure give some early indications of the likely trajectory of government finances in the remaining quarters of the current financial year.

While tax collections have seen a muted growth in the quarter ended June, capital expenditure of the central government has seen a strong growth of 59 per cent, indicating a steady improvement in the expenditure mix.

Muted tax collections have led to fiscal deficit in the first quarter widening to 25.3 per cent of the budgeted target as compared to 21.2 per cent reported in the corresponding period of the last year. Impressive non-tax revenue collections could ease some pressure owing to slowdown in tax collections.

State finances present an encouraging picture with better tax revenue mop-up and improved capex spending in the first quarter of the current year. Global headwinds and a possible slowdown in central tax collections could impact state finances.

Also read: RBI less than worried on growth front, but spikes in food & oil prices still loom

Slowdown in tax collections

Total receipts of the central government stood at Rs 5.99 lakh crore in the first quarter of the current financial year, amounting to 22.1 per cent of the budget estimate.

Last year, by this time, the government had managed to achieve 26 per cent of its budget estimates.

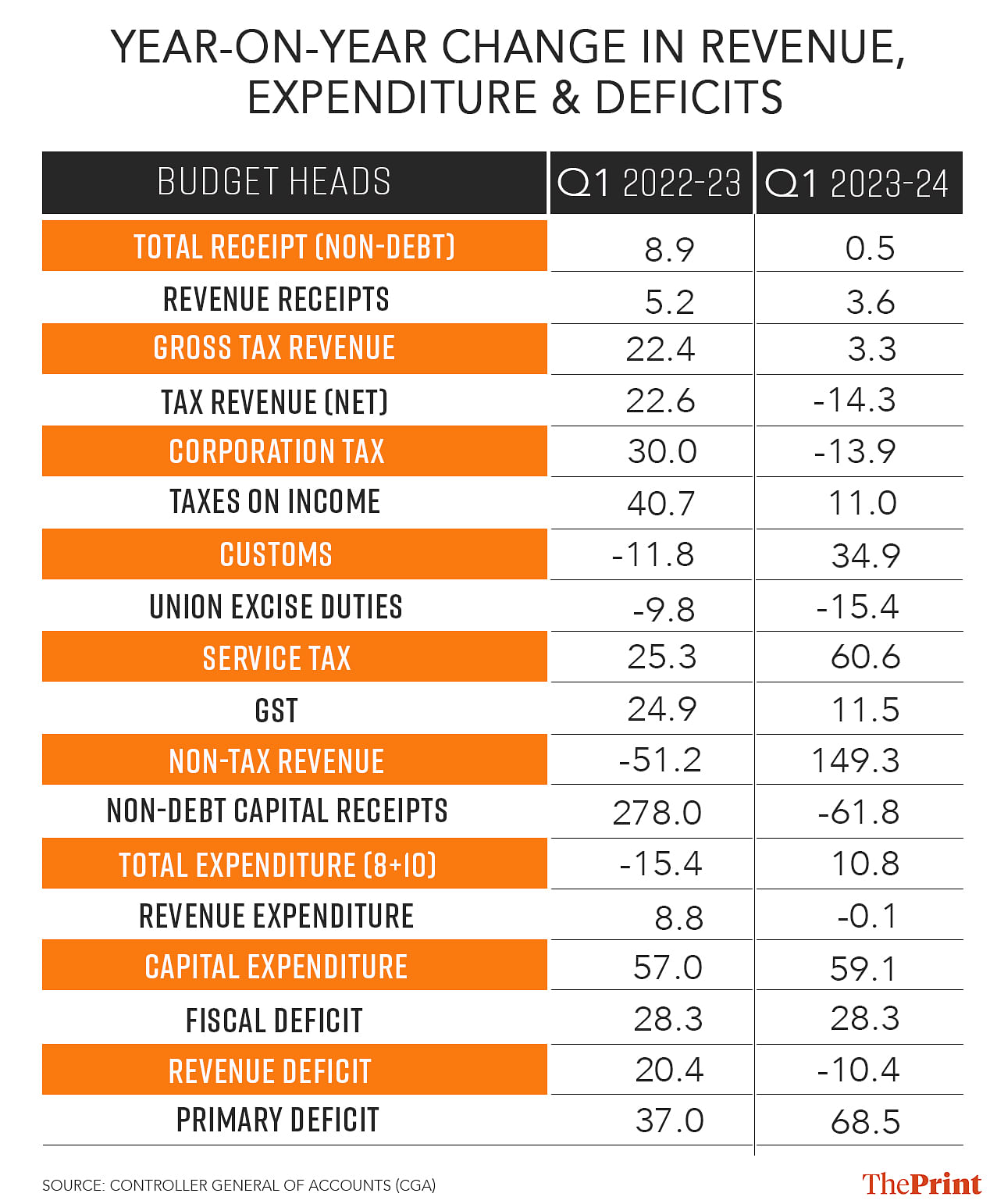

The slowdown in receipts is attributed to weak growth in gross tax revenues of the central government. The gross tax revenues grew by just 3 per cent in the first quarter of the current financial year. The annual target for gross tax revenue collections has been kept at 10 per cent, lower than the 12.7 per cent growth achieved in the last financial year.

Despite keeping a conservative growth target of 10 per cent for the current year, the first quarter gross tax revenue collections have been subdued.

While on a gross basis, tax revenues reported a growth of 3 per cent, the net tax revenues of the central government reported a contraction in the first quarter. Accelerated devolution of central taxes, with an additional instalment over and above the normal monthly instalment in June contributed to the year-on-year contraction in net tax revenues in the first quarter.

A break-up of tax revenue collections presents a mixed picture. Collections from corporation tax declined by 14 per cent in the first quarter. Revenues from corporation tax had shown a strong growth of 30 per cent in the first quarter of 2022-23. Excise duty collections, too, decelerated by 15 per cent in the first quarter as compared to the corresponding period of last year.

The deceleration in corporate tax collections seems to be at odds with the overall double-digit profits of listed companies in the June quarter. Latest data shows that profit-before-tax of listed companies posted a strong growth of 29 per cent in the June quarter. However, there are sectoral variations in profits. Companies in the oil and information technology sector have reported lower profits due to decline in commodity prices and subdued demand respectively. This could explain the contraction in corporate tax collections.

In contrast, revenues from personal income tax, custom duties and goods and services tax (GST) reported double-digit growth as compared to the first quarter of the previous year. Growth in personal income tax and GST collections were lower than the same period of last year.

While it may be premature to judge the trajectory of tax collections solely based on the first quarter trends, the slowdown in tax collections, if sustained, could make it challenging for the government to achieve its fiscal deficit target of 5.9 per cent.

The good news is on the non-tax revenue front, where the government managed to achieve more than 51 per cent of the budgeted target in the first quarter.

Growth in non-tax revenues has been on account of higher-than-expected RBI’s surplus transfer of Rs 87,000 crore. The RBI has tripled its annual surplus transfer this year. This will help ease worries about deviation from the fiscal consolidation roadmap amid a lacklustre disinvestment receipts.

Revenue expenditure flat while capex surged

A key feature of the quarterly fiscal trends of the government is the visible improvement in the quality of expenditure. Government’s capital expenditure grew by 59 per cent in the first quarter over the same quarter of last year. Even in the first quarter of last year, the government’s capital expenditure had grown by a robust 57 per cent. Almost 28 per cent of the budgeted capex has been spent in the first quarter. This is in consonance with the strong budgetary push to capex. The budget for the current financial year has projected a growth of more than 37 per cent over the Revised Estimates (RE) of the last financial year.

In contrast, revenue expenditure growth was almost flat in the first quarter of the current financial year. Notably, the government has targeted a modest growth of 1.3 per cent in revenue expenditure for the current year. There could be a risk of overshooting the revenue deficit target if additional allocations are required to be made for the rural jobs guarantee scheme.

In the first four months of the current financial year, more than half of the budgeted amount of Rs 60,000 crore has already been disbursed. The government’s supply side interventions to cool prices could lead to higher allocations on subsidies. This could translate into minor slippages from the revenue deficit target.

The state of state finances

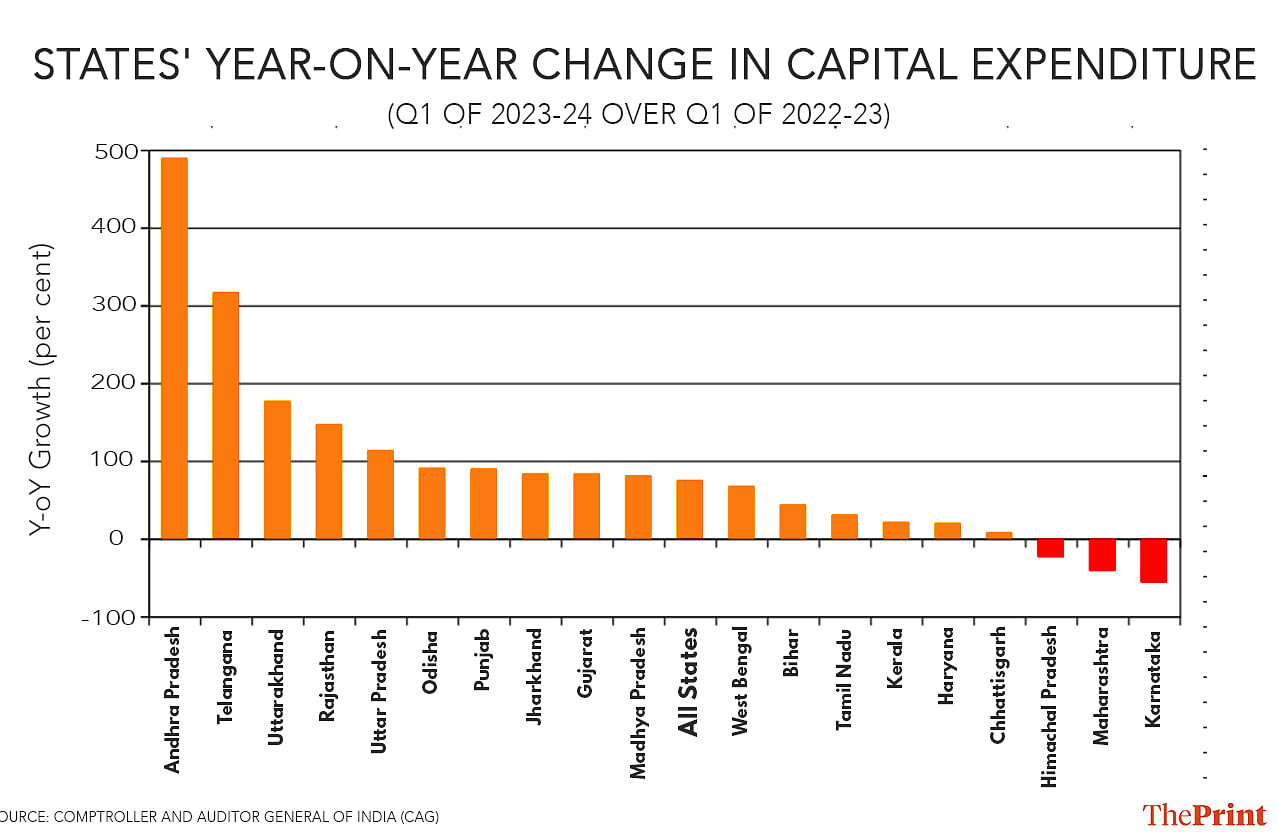

Similar to the central government, states have also witnessed an improvement in their capital expenditure.

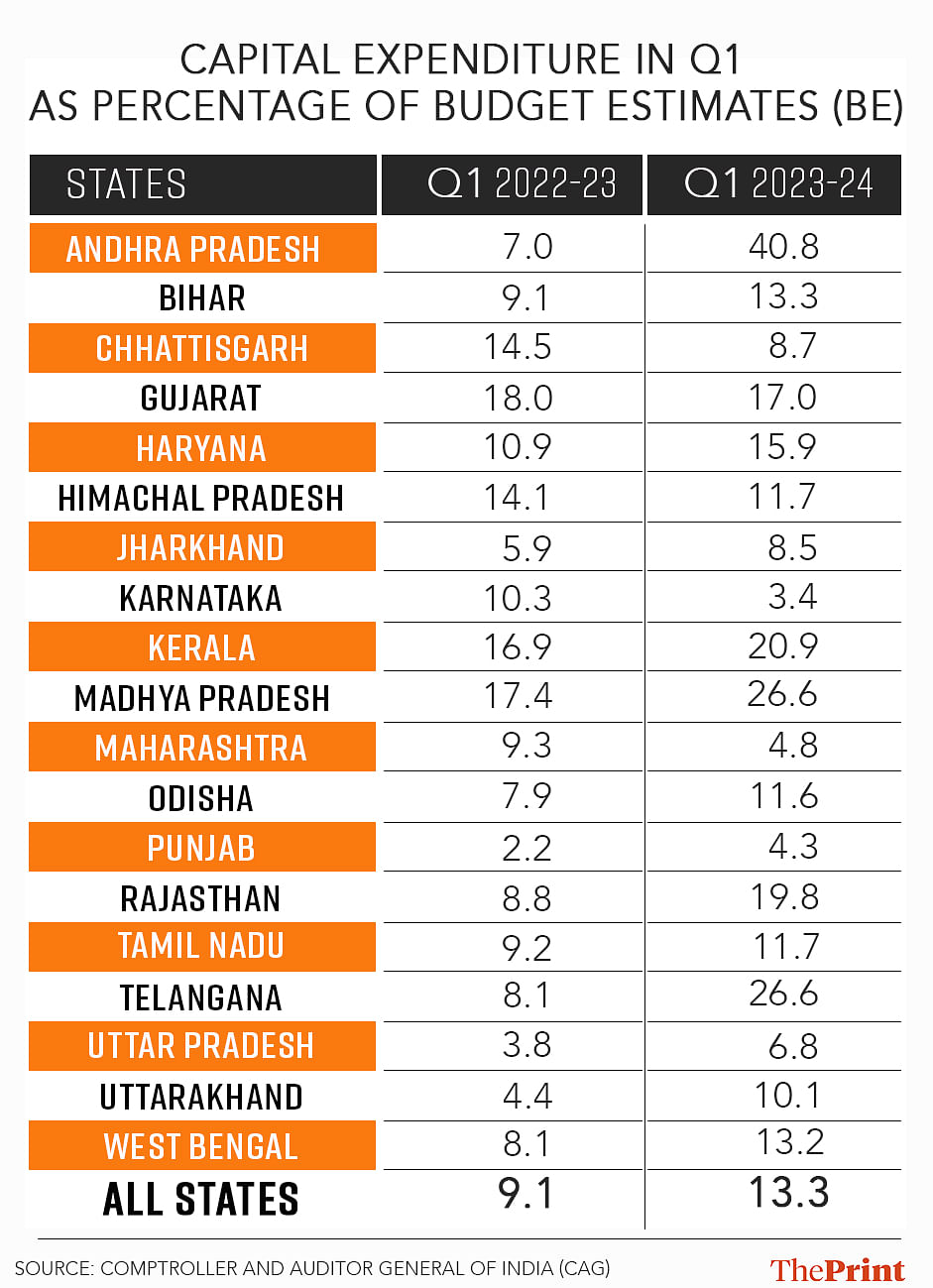

An analysis of the finances of 19 big states suggests that of the Rs 7.8 lakh crore allocated for capital expenditure in the current financial year, states have spent Rs 1.04 lakh crore in the first quarter, accounting for 13 per cent of the budget estimates.

Of the 19 states, 14 states have spent a greater share of the full year’s capex target in the first quarter than the corresponding period last year. Andhra Pradesh tops the chart having spent roughly 41 per cent up till June as compared to 7 per cent last year.

Telangana, Haryana, Rajasthan, Bihar, Kerala and Madhya Pradesh have also spent more as a proportion of the budget estimate. Maharashtra, Karnataka and Chhattisgarh are states with lower spending on capex.

On a year-on-year basis, capex of states has seen a massive jump of 75 per cent but there is wide disparity in growth among states.

Tax revenue collections of the 19 states in the first quarter accounted for 21.2 per cent of the budgeted tax revenues. Again, while most of the states have done better in the first quarter of the current year as compared to the same quarter last year, there are some stark variations.

Bihar is one such state that has managed to mop up just 4 per cent of its budgeted tax collections in the first quarter. While most of the states have managed to achieve more than 20 per cent of their budgeted tax revenues in the first quarter, going forward, the volatile global economic outlook and subdued exports could negatively impact on export-linked sectors and hence state revenues.

Radhika Pandey is associate professor and Rachna Sharma is a Fellow at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: It’s China & upcoming RBI monetary policy that India is concerned about, not US ratings downgrade