New Delhi: PPK NewsClick Studio Private Limited — the company that owns the news website NewsClick — earned an overwhelming share of its revenue from foreign sources between 2019-20 and 2021-22, an analysis of the company’s financial statements shows.

This marks a complete reversal of its earning pattern in the previous two years when it depended almost entirely on domestic sources of revenue.

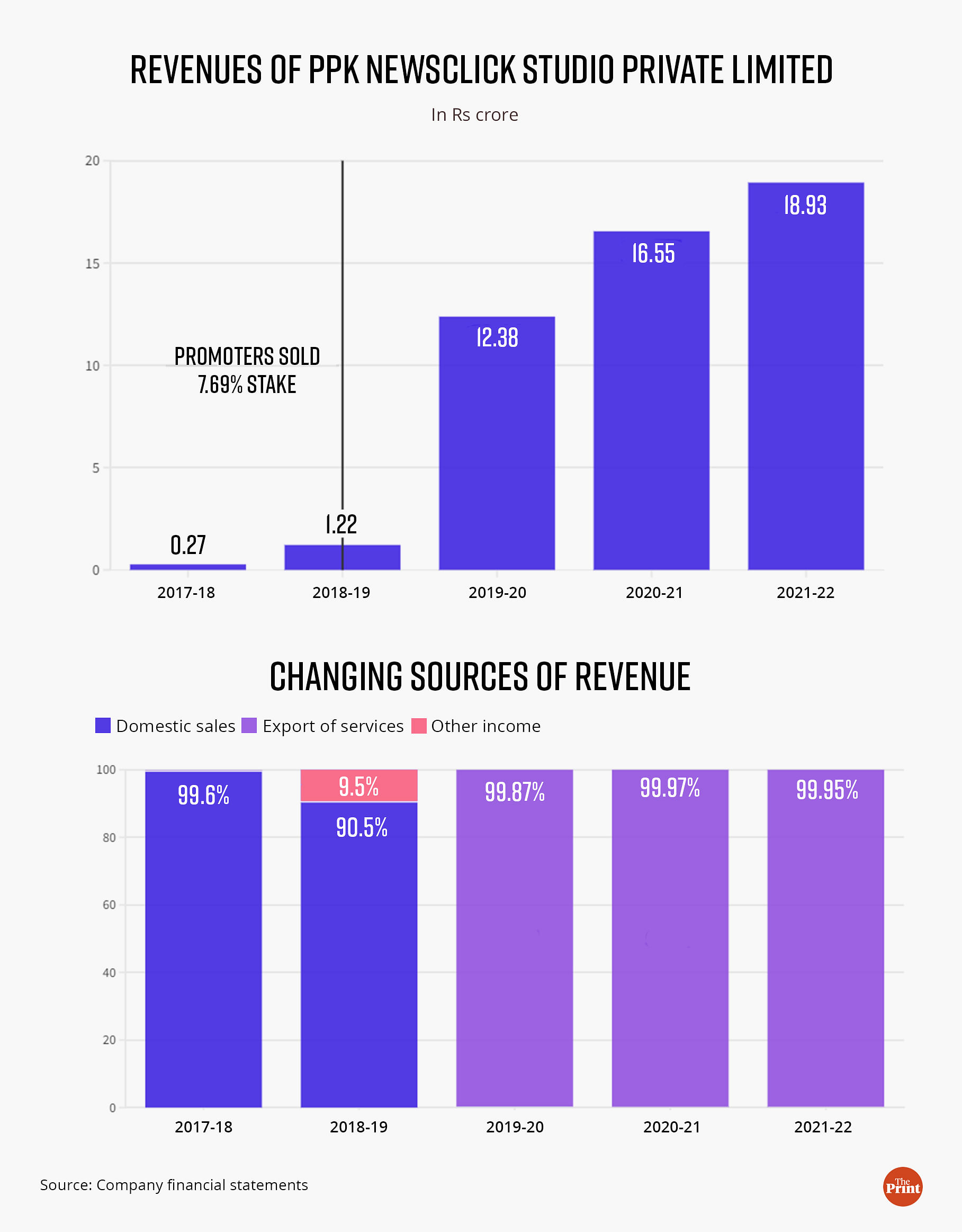

ThePrint analysed the company’s financial records for the period from 11 January 2018 to 31 March 2022 — the only publicly available financial data on the company — and found that this reversal of revenue trends coincides with the sale of shares by the company’s promoters to entities not named in the records.

That is, before the sale, revenue came from within India, and, after the stake sale, it came from abroad.

This period also marked a vast turnaround in the company’s fortunes, moving from growing losses to accumulating significant profits.

Founded in 2009, NewsClick has been accused by the Delhi Police Special Cell of accepting Chinese funds to incite disaffection against India, among other things — an allegation denied as “bogus” by the news website.

The Economic Offences Wing of the Delhi Police, which registered a case against the company in 2021, said in an affidavit in the Delhi High Court that NewsClick founder and editor-in-chief Prabir Purkayastha hatched a conspiracy with his “friends” Neville Roy Singham — an American businessman accused by the Enforcement Directorate (ED) of being NewsClick’s “China link” — and Jason Petcher to receive donations for the company in the guise of Foreign Direct Investment (FDI).

In the affidavit, a copy of which has been accessed by ThePrint, the EOW says Purkayastha implemented the conspiracy in two steps — first by infusing funds through FDI to create infrastructure and employ a number of people, and then receiving periodic funding for “export of services” to run daily operations.

It also says Purkayastha manipulated the valuations of his company and got FDI funding based on inflated value.

The ED subsequently got involved over allegations of money laundering.

Earlier this month, the Delhi Police Special Cell conducted raids against NewsClick as well as associated journalists, and arrested Purkayastha and the head of HR, Amit Chakravarty, under the stringent Unlawful Activities (Prevention) Act, 1967. Both were remanded in seven-days’ police custody by a Delhi court.

The news website has denied all allegations, saying the government “has not been able to substantiate any charges against NewsClick”.

“NewsClick has been targeted by a series of actions by various agencies of the Government of India since 2021,” NewsClick said in a statement after the arrest of Purkayastha and Chakravarty.

Also Read: Headlines say it all—NewsClick coverage shows a deeply divided Indian media

Improving financials, booming net worth

According to the financial statements of PPK NewsClick Studio Private Limited, it was incorporated on 11 January 2018.

For the financial year ending March 2018, the company reported a negative net worth of Rs 1.42 crore, and a loss of Rs 37.80 lakh.

In 2018-19, while the company’s losses ballooned to Rs 10.57 crore, its net worth turned positive, jumping to Rs 1.55 crore.

This could be attributed to the divestment of stakes by the company’s promoters in that financial year as they drew in investment worth Rs 9.59 crore for the preferential allotment of 8,333 shares that amounted to a 7.69 percent stake in the company.

It’s not clear from the financial statements who the shares were sold to. The shares were allotted at a premium of Rs 11,510 per share.

As a result, the promoters’ ownership was diluted to 92.31 percent, the company reported in its annual returns for 2018-19.

The next financial year, the company turned profitable and reported a profit of Rs 4.54 lakh while its net worth jumped further to Rs 1.60 crore.

The real turnaround in the company’s performance, however, came in 2020-21, when its net profit zoomed nearly 30 times over the previous financial year — to Rs 1.27 crore. The net worth of the company also saw a massive jump this year, to Rs 2.87 crore.

The company reported an impressive set of financials in the next financial year as well, with a profit of Rs 1.59 crore (25 percent growth) and a net worth of Rs 4.48 crore (56 percent growth).

This change in fortunes of the company coincided with a change in the nature of the business — from catering to the domestic market to almost exclusively earning revenue from foreign sources, as gleaned from the documents.

A complete turnaround

For the brief period of 2017-18 following its incorporation, the firm did not report any revenue from the export of services, while its domestic sales formed the overwhelming share of its revenue.

The domestic revenue reported during this period was Rs 27.04 lakh (99.6 percent of its total revenue). The rest came from “other revenues”, whose break-up is not present in the documents.

The trend continued in 2018-19 as well — nil revenues from the export of services while domestic revenue from supply of services came to Rs 1.10 crore — more than 300 percent higher than the previous year, and 90.50 percent of total revenues.

This was the year the company’s promoters sold the 7.69 percent stake.

Thereafter, the financials reveal a complete turnaround of the company’s revenue patterns. The export of services became the driving force of the company’s booming revenue, while domestic sales plummeted to zero.

According to its “statement of profit and loss” for 2019-20, the company earned Rs 12.37 crore from the export of services — more than 1,000 percent higher than the previous year, and 99.87 percent of its total revenue. The next year, revenues from the export of services jumped to Rs 16.54 crore, forming 99.97 percent of the total revenue. In 2021-22, the “export turnover” stood at Rs 18.93 crore and accounted for 99.95 percent of total revenues, while the “domestic turnover” is stated as zero.

In its financial statements for these financial years (2019-20, 2020-21 and 2021-22), the company has divulged that there was one principal product or service that accounted for the entire revenue that came from its export stream.

The service was described as “preprd unrecorded media for sound recrdn (sic)” in the financial statements.

(Edited by Sunanda Ranjan)