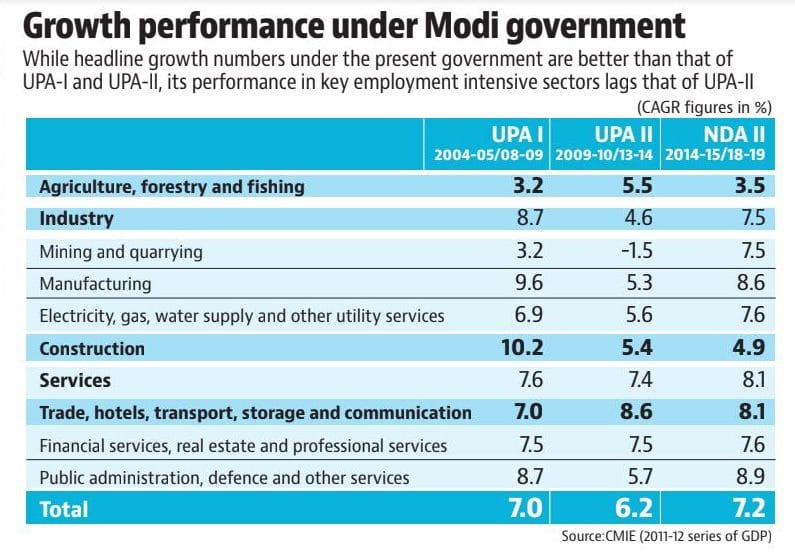

The nature of higher growth under PM Modi has been such that it hasn’t helped the most employment-intensive sectors or created jobs.

New Delhi: The Narendra Modi government will present its sixth (and therefore interim) budget on Friday. Full-fledged budgets are preceded by the presentation of an Economic Survey, a document prepared by the office of the Chief Economic Advisor (CEA), which conventionally used to contain a detailed discussion about various sectors of the economy. The document was given a broader ambit under the three previous CEAs; Kaushik Basu, Raghuram Rajan and Arvind Subramanian, who started including topics that went beyond the ritualistic annual discussion on the state of the economy in earlier surveys. Because it is an interim budget, incumbent CEA Krishnamurthy Subramanian will not be presenting an Economic Survey on Thursday and we will have to wait for the next government’s budget to see whether the new Economic Survey will be different from its earlier versions.

Since there is not going to be an economic survey this year, HT has analysed important economic and policy indicators to provide a snapshot of the state of the Indian economy after five years of the present government. The analysis throws up two contradictory conclusions.

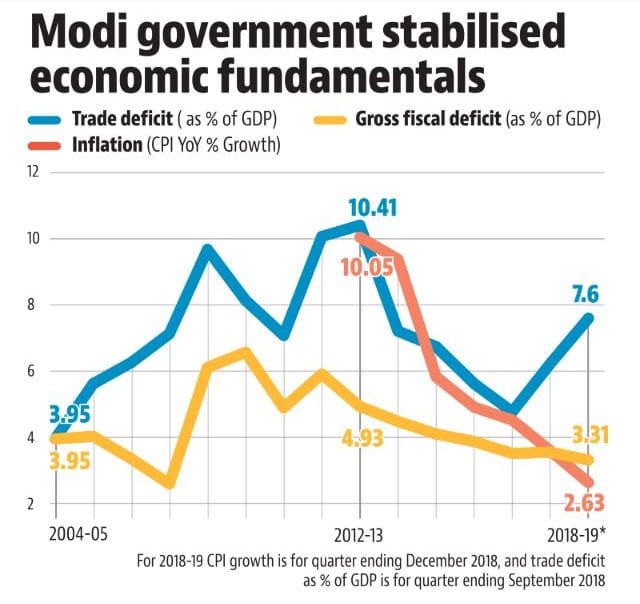

One, this government will leave the Indian economy with much better macro fundamentals – growth, inflation, external and fiscal deficits – than those it inherited from its predecessor. Two, this improvement has failed to ensure either widespread gains for various stakeholders or unequivocal confidence in economic observers due to three reasons.

A significant part of the improvement in macro fundamentals is due to the fact that this government has not had to face high crude prices for most of its tenure. For a big oil-importing economy like India, crude prices are fait accompli in shaping macroeconomic outcomes.

The nature of growth under the present government has not helped the most employment-intensive sectors in agriculture, industry and services. This has prevented the fruits of higher growth from percolating to a large section of the workforce. Or, for that matter, creating jobs

Last, but not the least, is the rising concern that the government has damaged what used to be a bipartisan institutional consensus about autonomy of institutions such as the Reserve Bank of India (RBI) and statistical agencies. Not only has this raised concerns about the robustness of in-built checks and balances in India’s economic governance, serious doubts are being raised, and increasingly so, on the integrity of important economic indicators or the lack of them. Put simply, the data has enough doubters.

Narendra Modi’s government assumed office in May 2014. The two to three years preceding its election were marked by low growth along with accelerated inflation and a higher external deficit. According to the 2011-12 Gross Domestic Product (GDP) series, Gross Value Added (GVA) grew less than 6% in 2011-12, 2012-13 and 2013-14. This is the only instance of GVA growth going below the 6% mark from 2004-05 onwards, except in 2008-09, which was the year a financial crisis disrupted economic activity across the world.

Also read: Bank recapitalisation bonds increased Centre’s debt to 46.5% of GDP in FY18

Even according to the 2004-05 series, GDP growth was less than 5% in 2012-13 and 2013-14. This deceleration in growth came at a time when inflation touched double digits and the trade deficit as a percentage of GDP also breached the 10% barrier. Fiscal deficit too remained higher than or precariously close to the 5% mark under almost the entire second term of the second United Progressive Alliance (UPA) government. While things started improving towards the end of UPA II, the current government consolidated the stabilisation process. Inflation slowed swiftly, to the extent that it has created its own problems (more on this later). The fiscal deficit was brought in line and put on a trajectory to achieve the statutory requirement of 3% of GDP under the Fiscal Responsibility and Budgetary Management (FRBM) Act. The trade deficit improved sharply. While it has slowly increased in the second half of the government, it has not yet reached levels which could precipitate an immediate crisis. All this happened at a time when economic growth has remained above or close to the 7% mark.

To be sure, the current government’s macroeconomic achievements came in a more favourable environment than what its predecessor had to face. Crude oil prices were more than $100/barrel in the last three years of the UPA II government. They came down sharply after May 2014. The average crude price under UPA II was $96/barrel. This figure is $61/barrel under the present government if one were to take figures until December 2018 for the current fiscal year. An RBI study published earlier this month has highlighted the importance of crude prices in India’s inflation and deficit levels. “We find that if a crude price shock hits the Indian economy, the Current Account Deficit to GDP ratio will rise sharply irrespective of a higher GDP growth; and a 10 USD/barrel increase in oil price will raise the inflation by roughly 49 basis points (bps) or increase the fiscal deficit by 43 bps (as a percentage of GDP) if the government decides to absorb the entire oil price shock rather than passing it to the end users”, it says. These findings suggest that had crude prices been at the level they were under the UPA II, this government’s macroeconomic record would not have been as impressive.

The favourable oil scenario notwithstanding, higher growth should have led to a stronger “feel-good” environment vis-à-vis the present government. Two key factors have muted the positive impact of economic growth under the present government.

Agriculture, which still employs almost half of India’s workforce, has experienced a steady deterioration in its terms of trade under the present government.. Even though agricultural output has increased, prices of farm products have failed to keep pace with non-farm prices in the economy. This has created a situation where, despite an increase in production, farm incomes have been squeezed. This author had pointed out on 15 January, 2019 that the current slump in farm prices has been the steepest in two decades. In fact, a large part of the decline in inflation under the present government has come due to lower food prices, while core inflation – the non-food, non-fuel component of inflation – has remained high and sticky.

Even in the non-farm economy, two of most employment-intensive sectors; construction and trade, hotel, transport, storage and communication, have seen lower growth under the present government than what was achieved under UPA II. This has created a situation where the fruits of growth have been distributed in a skewed manner and perhaps explains why economic sentiment has steadily worsened in the latter half of the current government.

Even the corporate sector does not seem to have done very well under the present government. Statistics from the Centre for Monitoring Indian Economy (CMIE) show that the private corporate sector’s profit after tax (PAT) actually declined in two out of the four full years under the present government for which data is available. The sharp fall in PAT in 2017-18 could be a result of back-to-back disruptions to economic activity caused by demonetisation and implementation of the Goods and Services Tax (GST).

To be sure, legacy issues might have led to a deceleration in corporate profit growth under the present government. An irrational exuberance, rooted in the assumption that the pre-crisis economic boom in India would last forever, among large businesses led to a large accumulation of credit under the UPA government. As growth started declining and economic activity took a hit, firms started defaulting on the debt. This created what was termed as the twin balance sheet problem in the Indian economy where banks and companies were unable to lend or borrow (in order to invest) because of the existing debt overhang. RBI statistics show that the bad loan problem in India’s banking sector peaked last year and the share of non-performing assets (NPAs) in the total advances of banks has started coming down. This is likely to boost to economic activity and revenue and profits in the future.

The economic legacy of the present government, however, will go beyond what should ideally have been a dispassionate analysis of numbers. Some of its big economic policy decisions have created a polarisation wherein an overwhelming majority of independent but acclaimed economists have expressed serious doubts on the rationale and veracity of economic claims made by the government. Demonetisation, which led to the abrupt withdrawal of 86% of currency in circulation by an executive order, was the first such move. It is increasingly clear that none of the primary objectives of demonetization, especially claims of it being able to purge unaccounted wealth, have materialised. On the other hand, the policy’s collateral damage in terms of a squeeze in incomes and liquidity has been significant. Neither has the government come clean on the exact nature of deliberations (or whether they happened at all) before the controversial policy, nor has it displayed any intent of assessing the costs and benefits of demonetisation in an objective manner. That two RBI governors left office on what would not be described as amicable terms, and the government has been insisting that the central bank transfer a greater share of its capital to it, has raised further questions on whether the executive has undermined the independence of the central bank.

Even the growth numbers under the 2011-12 GDP back series, which challenged the received wisdom that the UPA-I period was the best boom phase in the Indian economy, are not above doubt. There has been no credible explanation why GDP figures before 2004-05 have not been made available. The involvement of NITI Aayog in releasing the GDP figures has been seen by many as unnecessary and probably mala fide intervention by the government in statistical exercises which should have been left to technocrats. These suspicions have gained further ground after the resignation of the only two external members of the National Statistical Commission, J.V. Meenakshi and P.C. Mohanan, on the grounds that the NSC has lost its effectiveness, and subtle suggestions that the present government has bypassed the views of these members in crucial statistical activities such as calculation of GDP back-series data and publication of employment figures.

Also read: Jobs, GDP, rules, Modi govt ignored us on everything — expert who quit statistics panel

Such claims are difficult to accept or refute as the truth would lie in the government’s files or even discretionary decisions rather than transparently available statistics on the economy. However, it will not be an exaggeration to say that the economic legacy of this government will have a discernible imprint of polarisation on issues which could easily have been sorted out with transparency and a willingness to shed notions of infallibility.

By special arrangement with ![]()