Hyderabad: Nearly four years since its unceremonious exit from Andhra Pradesh due to a falling out with the Jaganmohan Reddy government, the Abu Dhabi-based Lulu Group has launched a grand mall in Hyderabad, the capital of neighbouring Telangana.

The 5,00,000 sq ft-mall, thrown open to the public Wednesday, is a Rs 300 crore refurbishment of an existing complex, but Lulu has over Rs 3,000 crore earmarked for various projects other projects in Telangana in the next five years, including a 2 million sq ft destination shopping mall in Hyderabad, mini-malls across the state, and food processing units.

In Andhra Pradesh, the Lulu group had signed a deal with the former Chandrababu Naidu government to build an international convention centre, a shopping mall, and a five-star hotel in Visakhapatnam, at a cost of Rs 2,200 crore.

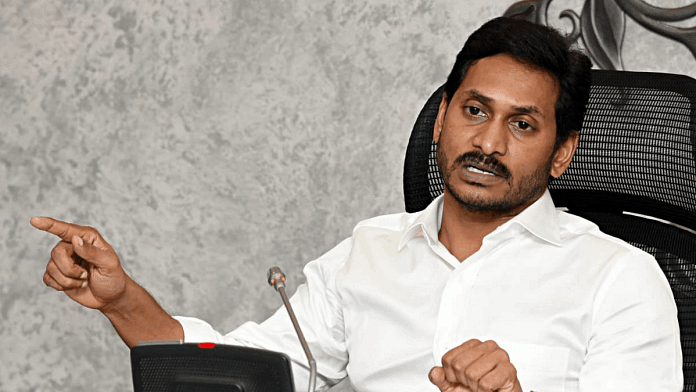

However, within months of Jaganmohan Reddy assuming power in 2019, the group withdrew from the project.

The decision came in the wake of the Jagan-led Yuvajana Sramika Rythu Congress Party (YSRCP) government citing “non-transparent procedures” and also revoking the 14-acre land allotment in a prime, sea-facing spot near Visakhapatnam’s popular RK beach.

Disagreeing with the term “non-transparent,” Lulu had in November 2019 announced its decision to not invest in any new projects in Andhra Pradesh. The group went on to build malls at locations in Uttar Pradesh, Jammu and Kashmir, and Tamil Nadu before coming to Telangana.

But Lulu is not the only investor to back out of Andhra Pradesh and turn to Telangana instead.

Other major companies that have taken similar steps in the last couple of years include battery major Amara Raja Batteries Limited (ARBL) and Page Industries, which manufactures Jockey brand innerwear.

“It is an unfortunate situation. A robust business climate has been collapsing right in front of our eyes. There is a visible push-out factor. It baffles me that AP ranks top in the Centre’s EoDB (Ease of Doing Business) rankings … maybe the parameters should change,” said L.V. Subrahmanyam, former chief secretary of Andhra Pradesh, now retired, speaking to ThePrint.

N Yuvaraj, secretary of the state Industries & Commerce department, declined to comment on the alleged political pressures that have been commonly cited as a reason for projects pulling out of Andhra Pradesh.

“I have joined the department recently, but my submission is that we are a state of immense opportunities, with a vast sea coast, ports, established and under construction, and other attractions. The Global Investors Summit held in March in Vizag attracted MoUs worth over Rs 13 lakh crore which indicates the investors’ confidence in our government and its industrial policy,” he told ThePrint.

“Of these, proposals worth Rs 3 lakh crore pertain to our industries department and we are on track to get the projects going as soon as possible,” he added.

High-profile exits

The business landscape of the two Telugu states has been witnessing a shift in the last two years or so, with politically tinged fracases in Andhra Pradesh, and Telangana emerging as a favoured destination for investment.

One example is Amara Raja Batteries Limited (ARBL), an Andhra Pradesh-based industrial and automotive battery major. In 2021, the state pollution control board issued closure notices to ARBL’s production units near Tirupati, leading to a political row.

The opposition Telugu Desam Party (TDP) accused the ruling YSRCP of political witch-hunt, as the company is run by the family of TDP Guntur MP Jayadev Galla. The government maintained that the notices were based on the detection of lead contamination and environmental pollution in the surroundings.

Later, media reports said that ARBL was considering neighbouring states for its future projects. Amara Raja ultimately chose Telangana and signed a Memorandum of Understanding (MoU) with the state government in December 2022 to set up a research and manufacturing facility for lithium-ion batteries. The proposed investment is Rs 9,500 crore over 10 years.

“We have had a long association with the state and are excited to finally have the opportunity to establish an industrial base here,” Galla said at the time of MoU in the presence of Telangana’s IT, industries minister K.T. Rama Rao (KTR).

This May, the company launched “India’s largest, and Telangana’s first Gigafactory” at Divitipalli in Mahbubnagar district, according to its press statement.

Then, last year, Page Industries, which manufactures Jockey brand clothing, abandoned its plan to set up a unit in AP’s Anantapur.

In March 2022, the ruling YSRCP and the TDP sparred over the deal falling through. Former TDP minister Paritala Sunitha cited a local YSRCP legislator’s alleged harassment for kickbacks of Rs 15 crore as the reason. On the other hand, YSRCP’s Raptadu MLA Prakash Reddy said that Rs 140 crore worth of land and undue incentives were given to the unit in what he called “a scam by the TDP government.”

In November 2022, top Page executives met KTR and announced setting up of manufacturing units at Ibrahimpatnam and Mulugu in Telangana worth Rs 290 crore.

In June 2021, after US-based Triton announced its plans to invest in Telangana, former Andhra minister Nara Lokesh accused CM Jagan’s regime of driving a huge investment, which went to AP during the TDP rule, to Hyderabad and also destroying job opportunities to locals.

From business figures to the general public, the prevailing sentiment is that Andhra Pradesh’s capital continues to flow into Hyderabad, further fueling Telangana’s growth at their expense.

“The Amara Raja episode in particular has raised many eyebrows. If a homegrown major has to deal with such a state of affairs, we can imagine the horror of outsiders,” said L.V. Subrahmanyam, who was also Jagan’s first chief secretary.

“In a climate of encouragement and support, Amara Raja might have chosen to set up its new plant in AP’s Kurnool, not far from Mahabubnagar in Telangana, with similar advantages,” he added.

Andhra’s push-out, Telangana’s pull-in?

While some investors are leaving Andhra Pradesh or are allegedly being driven out due to agreements made during the TDP rule, Telangana officials say they are going extra mile to greet them with attractive offers.

“Industrial units, investments are not coming to Telangana automatically, from Andhra or elsewhere. We do not want to comment on the experiences of some business groups in other states. We believe it is our pull factor — the sum of proactive approach by our minister KTR, sector-wise attractions, assistance, incentives offered, and a stable, supportive government — that is appealing to businesses,” Jayesh Ranjan, principal secretary, Telangana industries & commerce department, said to ThePrint.

He recounted an incident from July 2021 when Kitex announced its withdrawal from a Rs 3,500 crore project in Kerala. “We sent a private jet to Kochi to bring its chairman, Sabu Jacob, here for discussions,” the official recalled.

Telangana officials said that major investments — be they from the Lulu group, Amara Raja, or Page — were an outcome of KTR’s outreach to the respective groups and a persuasive follow-up.

Meanwhile, known for their entrepreneurial prowess, Andhra businessmen are stung by this perceived image dent.

“This is an unforeseen situation. The business climate is not conducive; there is no stimulus, no engagement from the government side and there is demand for a big cut even before we visit the unit proposed location. People say it is the Reddy rajyam (regime), but I don’t think even Reddy (caste) entrepreneurs are daring to invest in AP now,” a former president of Confederation of Indian Industry (CII), Andhra Pradesh, said on the condition of anonymity.

This businessman claimed that he himself has shelved a real estate project in Amaravati.

A Vizag-based entrepreneur in the shipping-logistics sector said on the condition of anonymity that he is moving to Paradip, Odisha, for business expansion.

“If the situation continues like this, people will go as far as Bihar. Andhra people prefer Telangana as it was a part of the same state, with same language-speaking people and strong relations, friendships, and political connections. Of course, Telangana officials’ approach to businessmen also gives confidence.”

Andhra capital flow & Hyderabad’s continuing boom

Shortly after assuming office in 2019, Jagan halted all projects related to Chandrababu Naidu’s initiatives for Amaravati, the planned capital city of Andhra Pradesh.

In November that year, Jagan cancelled the agreement with a consortium of Singaporean companies tasked with developing the Amaravati start-up area, planned in an area of 1,691 acres to serve as the financial center of the state.

According to Dr. Shankar Rao, an economist based in Vijayawada, the net result of all this, is Andhra wealth accumulating in what is now Telangana’s capital. The major grouse in Andhra Pradesh during the bifurcation was the loss of Hyderabad to Telangana.

“AP’s bifurcation, and giving the growth engine of Hyderabad to Telangana, offered us an opportunity to develop our own capital, Amaravati,” he said, adding that the aim was to create a world-class business hub and also facilitate decentralised industrial development.

“We expected a reverse flow of Andhra entrepreneurial capital from Hyderabad to Amaravati but unfortunately, it did not as the capital project is stuck,” Rao added.

Though some education institutions, such as SRM, VIT, were set up in Amaravati, for Andhra students and job seekers, Hyderabad is still the go-to-place.

One measure of Hyderabad’s continuing boom, which analysts say is largely at Amaravati’s expense, is the real estate sector growth. The BRS government’s auction of a layout at Kokapet on Hyderabad outskirts last month fetched a dizzying Rs 100 crore per acre.

“About 75 percent of real estate entrepreneurs here are now operating in Hyderabad. In the last four and half years, the Vizag urban authority has developed only seven layouts,” a former office-bearer of AP Chambers of Commerce and Industry Federation said.

According to him, one of the factors contributing to this is uncertainty over Andhra’s capital. In January, Jagan declared Visakhapatnam as the capital, only for the Rajya Sabha to clarify that Amaravati still held that designation. Now, Jagan is reportedly planning to shift his administration to Vizag in October.

While CM Jagan, speaking at the GIS 2023 said he is just a call away, Lakshmi Prasad, chairman, CII, AP, said they have been seeking an appointment with Jagan to present their grievances. “There is no major difficulty but our requests include fast paced movement in land allocation, subsidised power, and sops, tax incentives to encourage new investments, expansions,” Prasad said to ThePrint.

(Edited by Smriti Sinha)

Also read: Pawan Kalyan’s JSP declares alliance with TDP in Andhra. What’s keeping BJP from joining them