Recent data suggests that the economic recovery in India is gaining momentum as the third wave of the Covid-19 pandemic recedes.

The rollout of Covid vaccines and easing of restrictions have led to an improvement in mobility and a pick up in economic activity. At the same time, people are stepping out and loosening their purse strings.

As businesses see an uptick in demand, they are stepping up hiring activity. While some high frequency indicators such as GST collections, exports and e-way bills have been showing strong growth for a few months now, recent weeks have seen a pick up in some of the typically sluggish indicators such as consumer sentiments and bank credit.

However, rising crude oil prices amid escalating geopolitical tensions and elevated commodity prices pose risks to economic outlook.

Also read: Oil at $100 threatens world economy inflation shock, Ukraine crisis may fuel inflation

Manufacturing, services activity point to demand revival

The Purchasing Managers’ Index (PMI) for the manufacturing sector was robust at 57.5 in February and 57.7 in January 2022. The strong numbers were on account of strong demand which resulted in manufacturer’s lifting their stock of inventories.

The services sector PMI recorded its sharpest pace of expansion in a year amid improved demand and favourable market conditions.

Consumer sentiments report an uptick

With a decline in Covid cases, consumer sentiments have also seen an improvement. Consumer confidence typically lags the uptick seen in other high frequency indicators. But gets a boost when consumers perceive a sustained rise in income and employment prospects.

According to the CMIE data, consumer sentiments have seen significant improvements in February. During each of the three weeks of February, the Index of Consumer Sentiments (ICS) in the range of 62-63, was higher than in any week since the onset of the pandemic and consequent lockdown in March 2020.

The two components of the ICS — assessment of current economic conditions (reflected in the Index of Current Economic Conditions) and expectations of future conditions (reflected in the Index of Consumer Expectations) — have seen an impressive improvement in the three weeks of February.

The results of the Reserve Bank of India (RBI)’s Consumer Confidence Survey for January 2022 also recorded improvement. The results indicate that consumers are relatively more optimistic about the general economic situation. They are also more confident about their income and spending prospects.

The improvement in consumer sentiments is encouraging and in contrast to the first advance estimates of national income for 2021-22, released by the National Statistical Office that suggested that household expenditure and consumption have not recovered to the pre-pandemic level.

The uptick in consumer sentiments suggest that demand is likely to pick up in the coming months if there are no further restrictions.

Bank credit sees a pick up

Another indicator that is showing signs of improvement after a prolonged period of muted growth is the credit by banks.

Bank credit growth accelerated to 9.2 per cent as of December 2021 as compared to 7.1 per cent in November. Even as the headline number showed a strong growth, credit growth to industry also improved significantly to 7.6 per cent in December.

While credit to micro, small and medium industries have been strong, credit to large industries also posted a positive growth in December.

Estimates suggest banking sector credit growth could hit double digits for the first time in eight years supported by healthy demand for loans from companies to finance capital expenditure.

Also read: Will RBI’s digital rupee be a hit? Well, there are so many ifs and buts

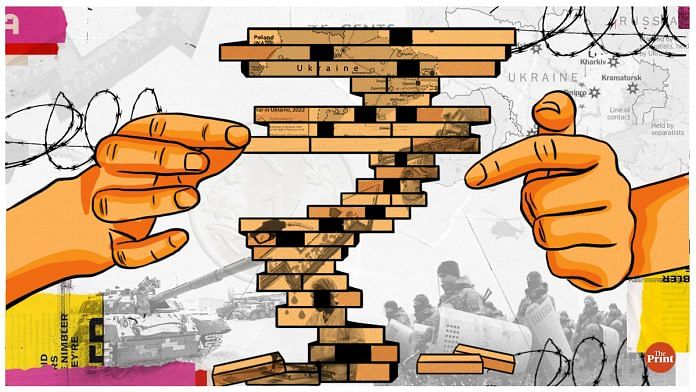

Crude oil prices and geopolitical tensions

The invasion in Ukraine has caused crude oil prices to surge. The Russian action and the possibility of consequent sanctions by the US and Europe could disrupt supplies of oil globally.

Even as supply could suffer a jolt, demand has been rising following the decline in Covid cases and opening up of the global economy.

On 24 February, after the invasion began, Brent crude oil prices hit $103 a barrel, the highest mark since 2014. Higher crude oil prices could result in higher fuel prices for consumers.

RBI’s projections suggest that if crude oil prices rise 10 per cent above the baseline of $75 per barrel, inflation could inch up by 0.3 per cent. Higher fuel prices could have spillover impact in the form of higher transport costs and rise in prices of goods and services in the coming months.

Inflation hitting margins of companies

Wholesale price index (WPI), a proxy for producer prices, remained in double digits, for the tenth month in a row in January.

Rising input costs such as fuel, metals and chemicals have resulted in higher expenses and lower profit margins for firms in the December quarter as compared to the previous quarter. Companies with strong brands have started raising prices to combat the pressures from input costs.

The consumer price index has also breached the top of the RBI’s tolerance band of 2-6 per cent.

While the RBI sees retail inflation moderating to 4.5 per cent in the coming year, hardening crude oil prices and elevated commodity prices present a major upside risk to the inflation outlook.

Keeping interest rate hike on hold amid prolonged elevated inflation could lead to inflationary expectations of households becoming more entrenched and weaken consumption.

Ila Patnaik is an economist and a professor at National Institute of Public Finance and Policy.

Radhika Pandey is a consultant at NIPFP.

Views are personal.

Also read: RBI’s double-edged decision — not hiking rates helps govt borrow, but runs inflationary risk