Gross savings constitute savings of households, private corporate sector and the public sector. Savings by the household sector is the most prominent component of savings. The large financing needs of investment in infrastructure require long-term financial savings of households to increase and to be channelled for this need. This requires reform and development of the financial sector that can play the role of this intermediation. The first is the reform on the savings side. Savings of Indian households are primarily in short-term assets. The challenge is to incentivise these into long-term savings such as insurance and pensions. The Union budget and tax incentives play a critical role in encouraging households to save in these instruments. The coming budget needs to give priority to this need.

In a recent paper on ‘Savings and Investment in India’, Radhika Pandey and I analyse trends in savings and investment in India and the challenges faced in channelling domestic savings into the infrastructure sector where the needs for long term funds runs into thousands of crores of rupees. We argue that these needs can be met only if infrastructure investment moves away from the banking system and households save more in insurance and pension assets and a deep and well-functioning market intermediates these funds effectively.

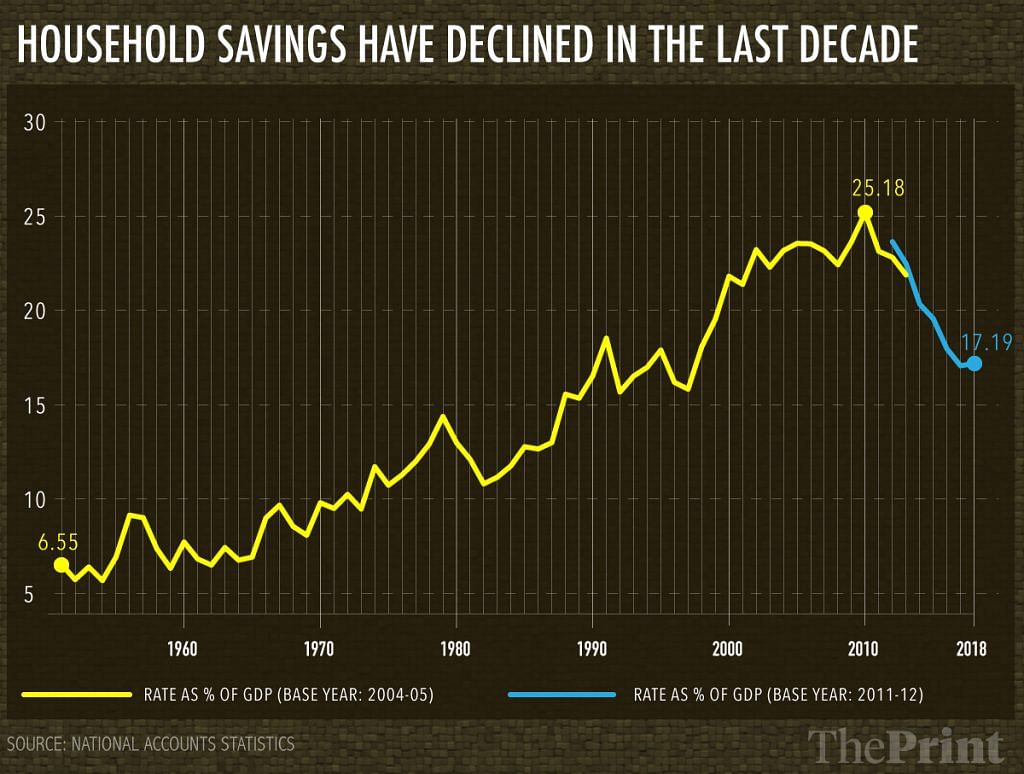

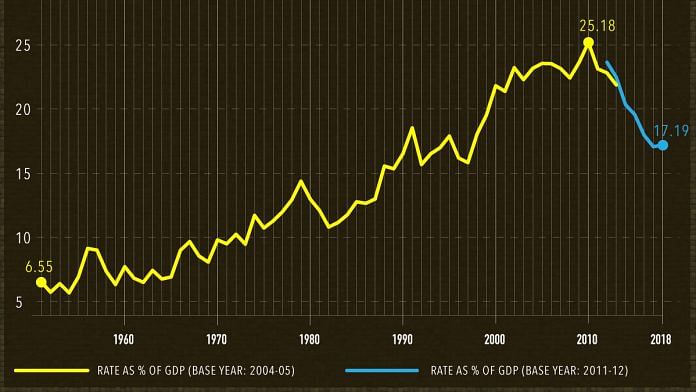

A high domestic savings rate has been an important part of India’s growth story. High investment and an economic boom during the 2003-2008 period were supported by a strong savings rate. The savings rate surged from 25.9% in 2003 to 36.8% in 2008. The rise in the aggregate savings rate during the high growth phase in 2003-2008 was driven by savings in the household sector. However, since 2012, we have seen a decline in the aggregate savings rate as well as in household savings rate. The aggregate savings rate declined from 34% in 2012 to 30.5% in 2017-18. The household savings rate declined from 22.4% in 2012-13 to 17.2% in 2017-18.

Household savings as a per cent to Gross Domestic Product (GDP) show a steep decline in recent years (See graphic above). What could be the possible explanation for the decline in household savings? The term ‘households’ includes not only individual households but also non-corporate businesses. The unregistered micro, small and medium enterprises are thus covered under the definition of household sector. It is this sector that suffered due to the twin shocks of demonetisation and Goods and Services Tax, which might be part of the explanation for the decline.

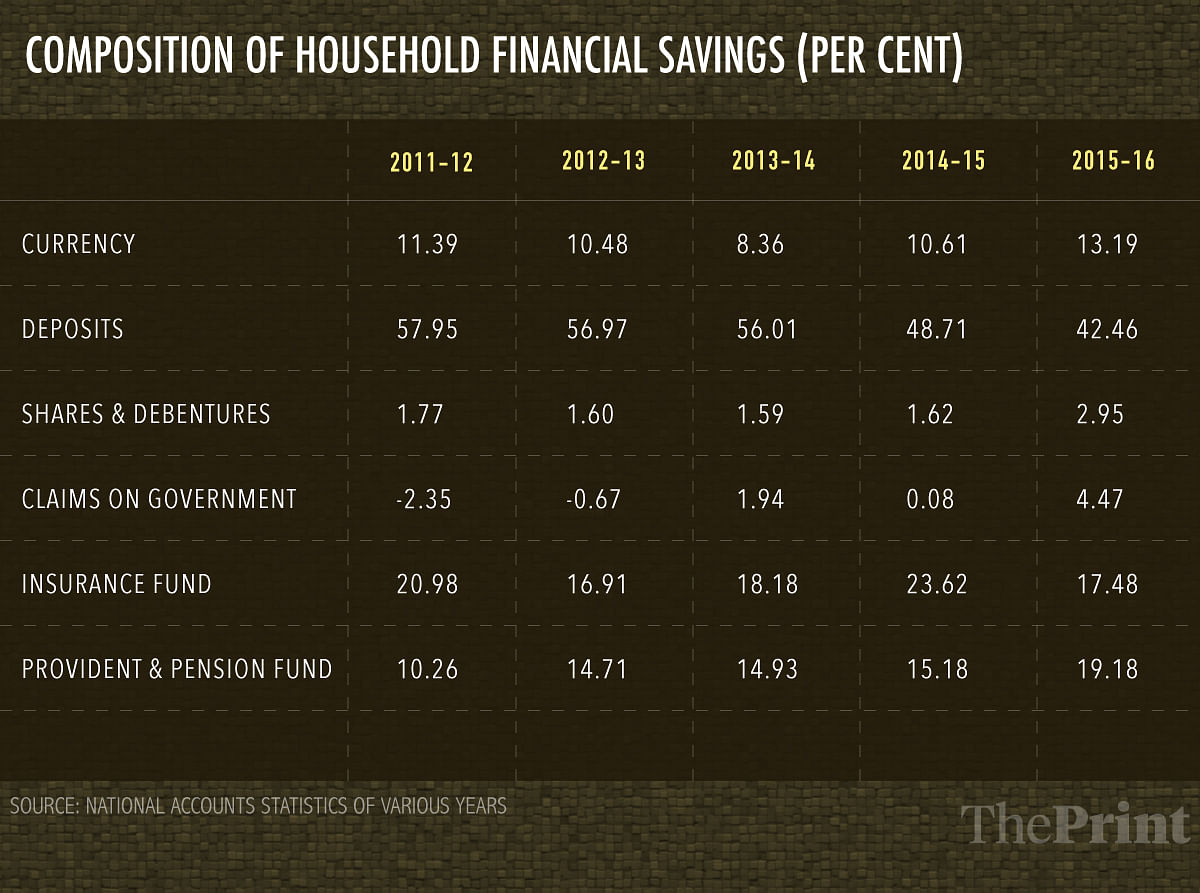

Table 1 shows the profile of financial savings over a shorter-term horizon. Bank deposits constitute the bulk of household financial savings, although its share in the overall household financial savings has seen a dip from 2011-2012 onwards. Still 57% of the financial savings are in cash and deposits leave a very small portion of savings in long-term savings. Shares and debentures constitute a small part of the overall financial savings of households. Investments in provident and pension funds have seen a gradual rise, though they still constitute a small proportion of the overall saving.

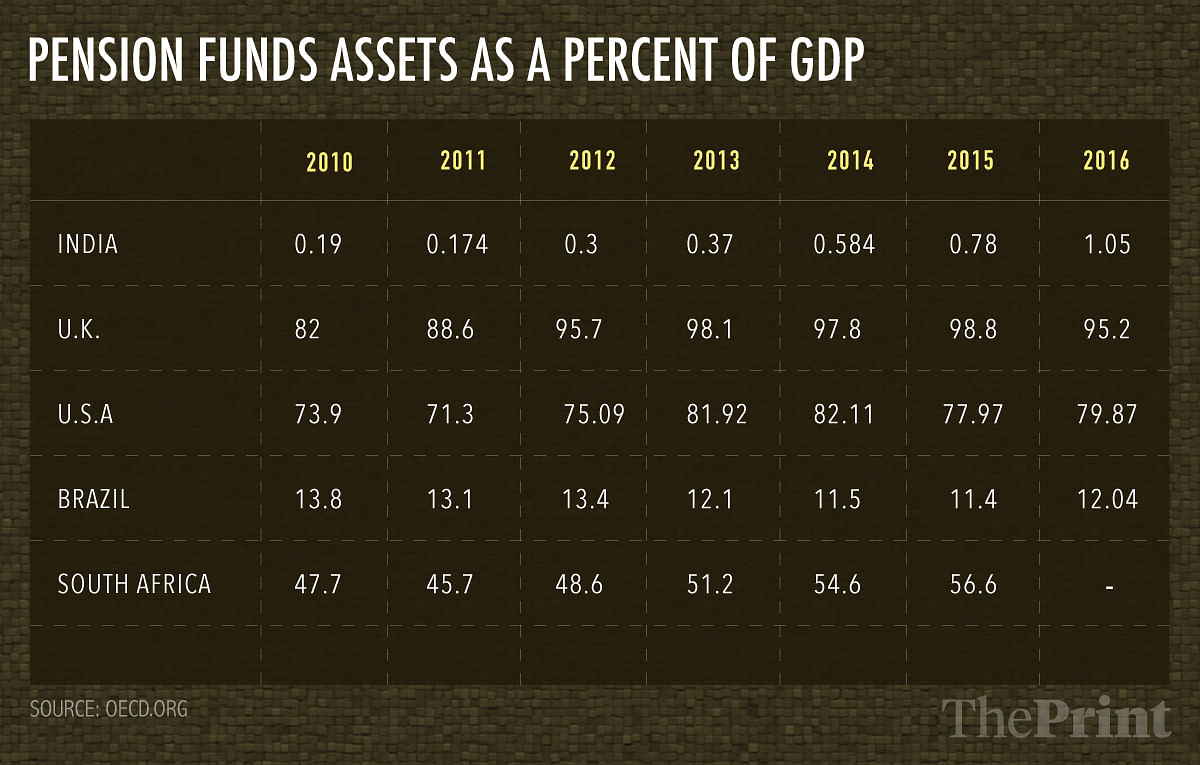

Insurance and pension penetration are low by international standards. Table 2 illustrates the assets of pension funds as a percent to GDP. Assets of pension funds are defined as assets bought with the contributions to a pension plan for the exclusive purpose of financing pension plan benefits. The pension fund is a pool of assets forming an independent legal entity. India lags behind not only advanced economies but is also placed after emerging economies in pension funds penetration.

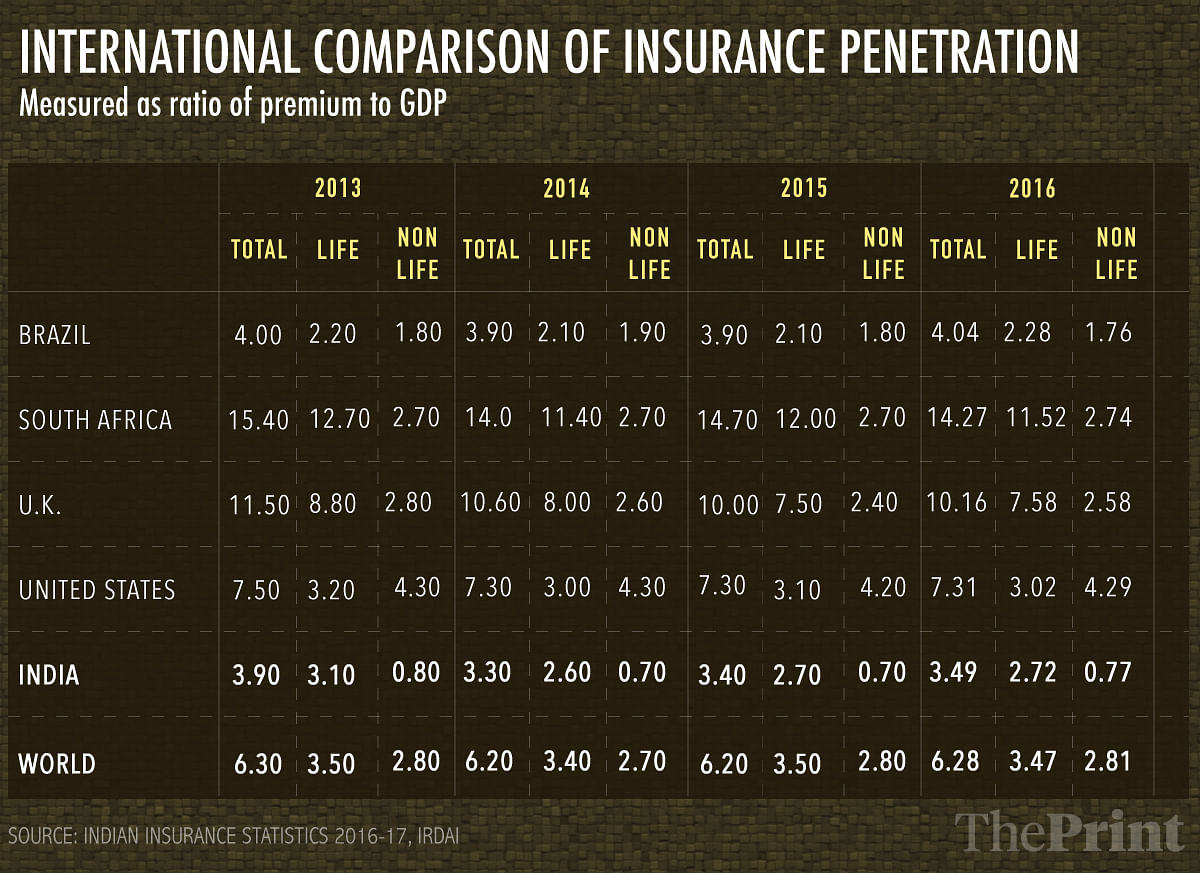

Table 3 provides a comparison of insurance penetration (measured as ratio of insurance premium to GDP) in India with advanced and emerging economies. India significantly trails other countries in insurance penetration. The life and non-life insurance premium income formed 2.72% and 0.77% of GDP respectively in 2016. This is low compared to the global average of 3.47% and 2.81% of life and non-life insurance premium respectively. We attempt to estimate the time it would take for India to reach the current level of global average insurance penetration. Assuming the present average growth of insurance penetration in India, it would take us approximately 21 years to catch up with the global average.

The main challenge is not the unavailability of savings but the composition of savings and the intermediation to channel savings into investment. In previous research, we found that there is a deep link between tax incentives and household savings in pension and insurance. The forthcoming budget needs to keep this in mind.

Read the full IPF-2018 paper here.

The author is an economist and a professor at the National Institute of Public Finance and Policy. Views are personal.

Also read: Consumption has long propped up India’s economy, so its decline is cause for alarm

Thank you for this very timely and thought provoking article. It is rightly said: ” The large financing needs of investment in infrastructure require long-term financial savings of households to increase and to be channelled for this need. This requires reform and development of the financial sector that can play the role of this intermediation. The first is the reform on the savings side. Savings of Indian households are primarily in short-term assets. The challenge is to incentivise these into long-term savings such as insurance and pensions.”

When I started learning economics and problems of the Indian economy, first in school in the late fifties, and then in college/university in the early sixties (ending 1966), we were taught that savings must always be accorded the most important place vis-a-vis investments as the basis of economic growth. Many savings related initiatives/schemes of the govt, apart from being welfare measures, also thus sought to take are of the savings aspect. All was going well, until suddenly and overnight about two decades or more ago, the post office savings bank interest rates were slashed by more than 6 or 7%, thus destroying the financial base of millions of households, especially of the retired people with no pensionary benefits and solely dependent on the small savings and insurance schemes by way of source of income and security. One cannot blame the headless politicians as they really do not know the woes of those deprived of the right to unjust enrichment–unlike the bureaucrats. What I wonder is about the wisdom of those flower eating bureaucrats, proverbially divorced totally from the world of realities of the life of toiling millions, who advised the govt over the years to ignore household/small savings as a source of investment and also as a great tool of social security. Over the years, therefore, we have seen how mindlessly the rates of commission of the PO Savings Agents have been reduced and finally withdrawn, oblivion of the role of these facilitators in the field of for encouraging and helping the growth of small savings for decades, apart from acting also, as insurance agents, helping common people saving through insurance policies. Why the rate of interest on post office savings bank deposits must be linked to bank interest defies any logic, when considered from the basic question of finding resources for investment fore economic growth. Moreover, these parasites called bureaucrats are incapable of understanding the needs of the common people on the streets and are so insulated that they cannot simply understand as to how they really (manage to) live–as it is said that “half the world does not know how the other half lives!

It is hoped that the bureaucrats and “authorities” of Niti Ayog read the old text books of the sixties and seventies on Indian Economy/Economic Development of India and do ponder over the fundamental issues of investments being the function of savings. It is imperative to again take active steps to encourage savings– at least the small savings of households in the post office savings bank accounts, Jan Dhan accounts, and the like–at the earliest. Once this is done, the govt can then think of making larger investments in the priority sectors. It would also be essential to encourage savings in the banks who must rethink their business plans.

Socialist Modi squandering money on freebies subsidies, has no money for infrastructure and defence.