Two new sets of data released over the last few days suggest the Indian economy is witnessing a slowdown in consumption demand. Automobile sales dropped by 17 per cent in April compared to a year ago — the steepest in a decade.

Second, the performance of ‘fast moving consumer goods’ or FMCG companies — those that sell biscuits and shampoo and other consumer products — also turned out to be surprisingly weak. Their sales have been quite stable in the past, and the sector has been a reliable source of buoyancy for the economy.

The slowdown in demand is caused by a combination of weak business cycle conditions coupled with financial stress. For example, loans from banks and non-banking financial companies (NBFCs) are important to both buyers of automobiles and dealers holding an inventory of automobiles. The problems in the NBFC sector have weighed on both kinds of buyers.

Automobile sales data in India reflects the sales of automobiles by large companies to dealers, not sales by dealers to households. Earlier reports had suggested a build-up of inventories with car dealers after Diwali in 2018. This would inevitably lead to buyers reducing their purchases and this is showing up in 2019. Manufacturers reducing sales of cars is likely to lead to production cutbacks, reduction in purchases of automobile components, and its impact across the country.

The main components of demand in an economy are private consumption, investment, net exports and government spending. Let us examine each of them separately.

Investment

Strong private investment is critical to ensure the Indian economy performs strongly, particularly as almost all jobs are created by the private sector. For many years, beginning 2011-12, the Indian business cycle was slowing down because of weak investment demand. This downswing in investment did not begin immediately after the global financial crisis, but with a lag.

Despite attempts to reduce stalled projects, give clearances to infrastructure projects and speed up the process of permissions, the business environment remained uncertain, financing was hard to obtain, and firms were afflicted by poor profitability and capacity utilisation.

Private sector confidence has since been adversely affected and, as a consequence, private investment has remained low.

Also read: SEBI’s new focus on rating agencies is the first step towards bond market reform

Exports

At the same time, export growth in this period was particularly low, and even negative in some years. Exports were thus not the engine of growth that they had been in the early 2000s.

Going forward, a global trade slowdown triggered by the US-China trade war is a risk. A slowdown in world trade will be bad for the Indian economy.

While some experts have hoped that India could step into China’s shoes in global manufacturing, India is not in a position to take significant advantage of this. India has considerable presence in automobile supply chains and can rapidly gain at China’s expense, but is absent in most other fields, including electronics.

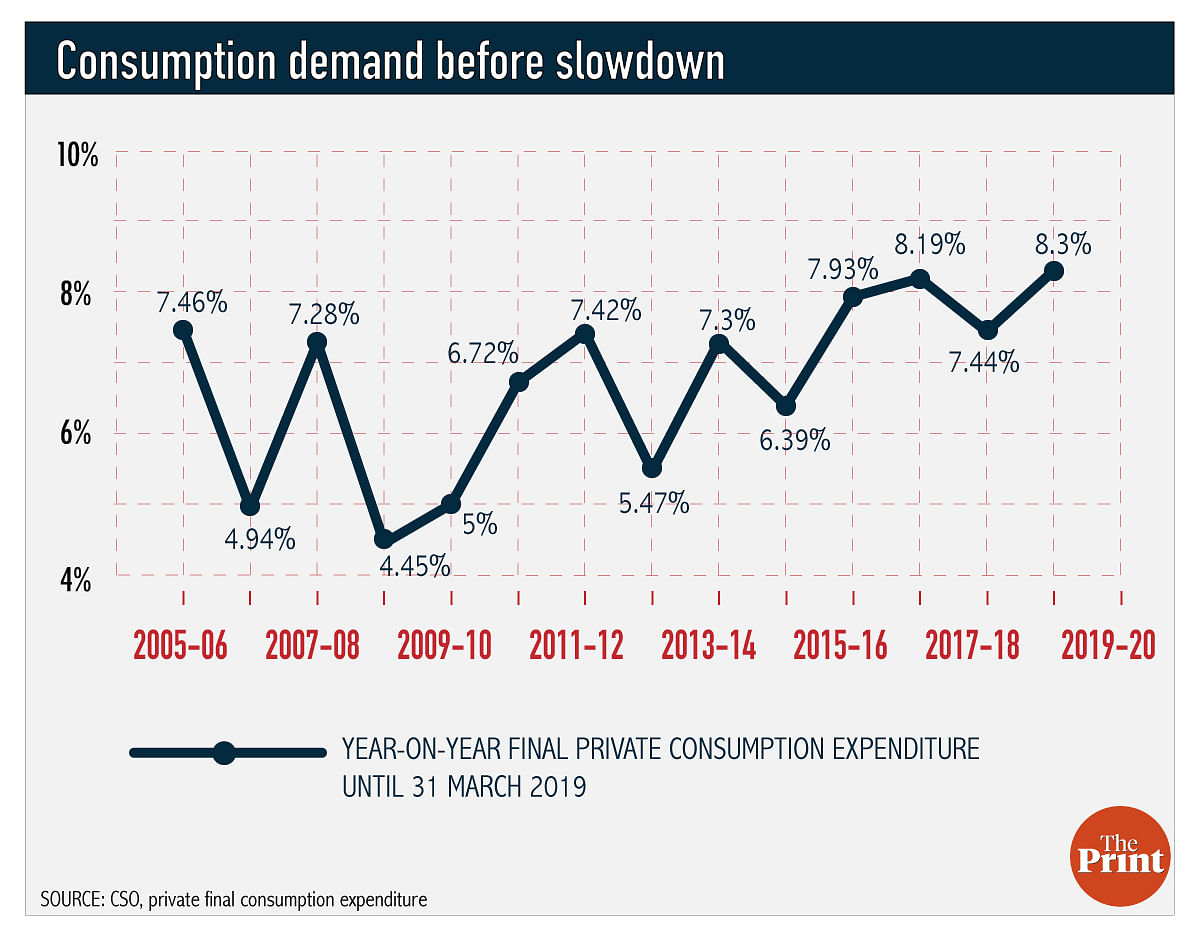

Consumption

Consumption demand, which is the most stable part of overall demand, held up well in the years of the recent slowdown. At a time when exports and investment were faring poorly, consumption propped up the economy. This is why the latest data on falling consumption demand is a matter of concern. One engine of growth that the economy relied upon in recent years may also be at risk of a slowdown.

There is a concern about rural demand. Low food inflation has meant a low growth of incomes in the farm sector. Employment in agriculture has continued to rise in recent years while revenues have stagnated, thus hampering per-worker income. At the same time, credit for durables in rural India was more dependent on NBFCs rather than banks owing to the lack of outreach of banks. The NBFC crisis has resulted in a contraction of durable goods purchases financed by credit.

There is much more to the rural economy than agriculture. Informal firms are engaged in food processing, manufacturing and services. There is a concern that these firms may have been hurt by demonetisation. Informal manufacturing and services, construction, real estate, trade and money lending where transactions were dependent on cash, were potentially hurt.

There is a linkage between the discussion on jobs and the discussion on consumption demand, as well as an ongoing debate about the extent to which there is a problem in the labour market. Earlier, strong consumption demand was a factor which was inconsistent with the claim that job growth is stagnant. However, if we see a picture with weak consumption growth, then it is more consistent with a sense that there is a problem in the labour market also.

Also read: Improved credit growth doesn’t mean there is an improvement in the health of Indian banks

Election-related uncertainty

The question of who wins the Lok Sabha elections and forms the next government will be answered in the coming days. But the run-up to the election could have led to higher economic uncertainty, which would tend to make households and firms defer decisions such as purchases of durables or investment. To this extent, economic data in the months leading up to May 2019 would be subdued.

Challenge

The picture of the macroeconomy appears more sombre, through a combination of the long-standing difficulties of financing and investment, and the new problems of consumption demand and election-related uncertainty. The new government will need to take stock of these problems and implement many reforms to address them.

The author is an economist and a professor at the National Institute of Public Finance and Policy. Views are personal.

The baby bump can no longer be hidden by wearing a loose fitting garment. Consumption by households is the ultimate rationale for any economy to exist, although one could forget that by seeing the ballooning of government expenditure. Whichever one sees it, either as a professional economist or a housewife managing her monthly budget, the signs of economic pain and distress are all around us. President Trump’s trade war with China is a recent disruption. Before that, very early in the term, there was a welcome fall in oil and commodity prices and a steady improvement in global growth and merchandise trade. 2. Ms Puja Mehra has written a book on India’s lost / wasted decade. The first half was caused in large part by global factors centred around 2008. The second half is entirely man made, no justification / excuses / alibis. Jo karna chahiye tha, woh nahin kiya. Jo bilkul nahin karna chahiye tha, woh kiya.