Zee is seeking to assure investors that the share plunge won’t hit Subhash Chandra’s plans to sell half of his stake & reduce debt.

Mumbai: Indian media tycoon Subhash Chandra scrambled over the weekend to stem a crisis that wiped $1.6 billion off his flagship Zee Entertainment Enterprises Ltd.’s market value on Friday and threatened to derail his plans to sell a stake in the company.

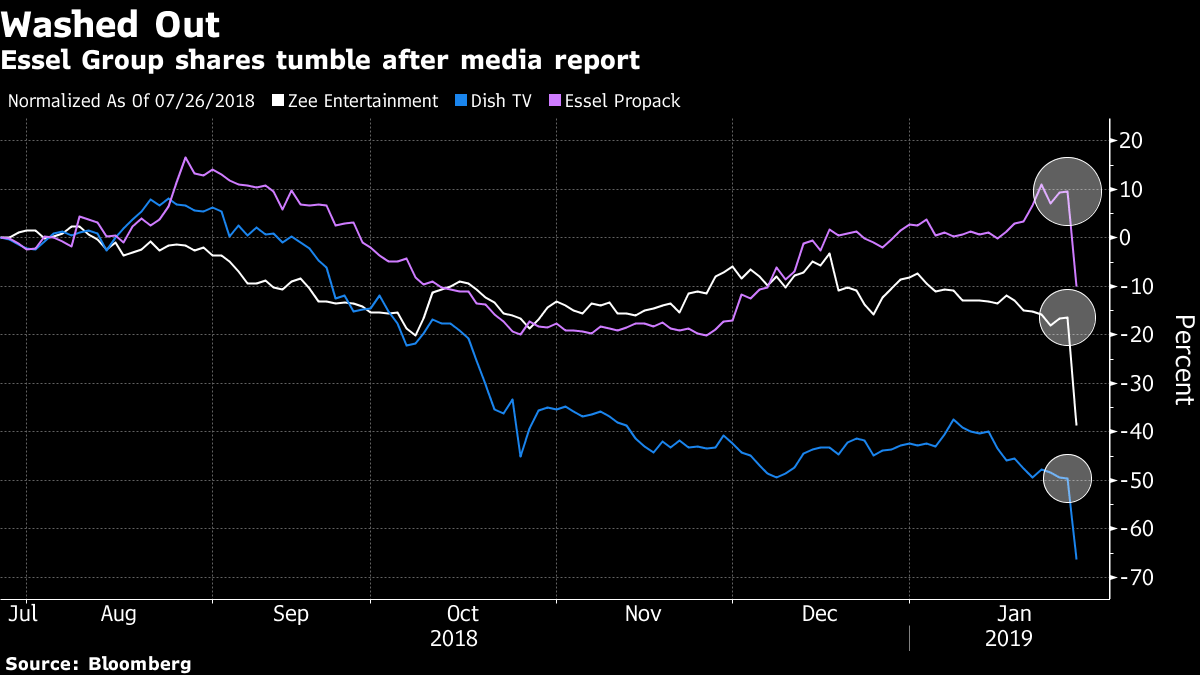

Shares of India’s biggest television network and group company Dish TV India Ltd. plunged more than 25 per cent in the last two hours of trading after news website The Wire published a report alleging that companies linked to Chandra were involved in fraud and money laundering. The group released statements on Friday and Sunday denying the allegation.

On Friday, Zee’s Chief Executive Officer Punit Goenka told investors on a call that the share plunge won’t hit Chandra’s plans to sell half of his stake in Zee. Chandra, 68, later that evening issued an open letter blaming poor investments in the infrastructure sector combined with its exposure to the failed lender Infrastructure Leasing & Financial Services Ltd. for the group’s rising debt and apologized to his investors and creditors for the conglomerate’s financial woes.

Chandra, who started Zee in 1992, is seeking a strategic investor to help him fend off competition from Netflix Inc., Amazon.com Inc. and hundreds of local TV channels vying to tap India’s booming demand for content. Plunging shares may hinder those plans and his attempts at reducing debt. Goenka sought to ease concerns by saying that Zee is also trying to sell stressed assets for an enterprise value of 200 billion rupees ($2.8 billion).

“There’s no change to business fundamentals,” Kapil Singh and Siddhartha Bera, analysts at Nomura Holdings Inc. in Mumbai wrote in a report Saturday. Zee trades at a “very attractive” valuation, they said, maintaining their buy recommendation on the stock.

Zee is close to selling an infrastructure asset and expects to complete the sale of road and solar power projects by April, Goenka said. Zee’s owners have pledged 59 per cent of their shares to lenders as collateral, and the asset sales may help them revoke the pledges.

Friday’s slump may have “exacerbated risk of pledges being invoked,” CLSA analysts Deepti Chaturvedi and Akshat Agarwal wrote, while also recommending clients buy the shares.

Zee on Thursday reported a 75 per cent jump in profit to 5.6 billion rupees on sales of 21.7 billion rupees for the December quarter.

Chandra, a former rice trader, in his letter urged lenders to “maintain patience, till the process of Zee Entertainment’s stake sale is completed.” “Post the sale process, we will be positively able to repay the entire dues, but if the lenders react in a panic situation, it will only hurt them and us.” –Bloomberg