Mumbai: Reserve Bank of India (RBI) Governor Shaktikanta Das has so far chaired nine meetings of the central bank’s six-member monetary policy committee (MPC), which sets interest rates. The panel has reduced the key policy rate or the repo rate in seven out of those nine meetings.

The rate review committee is scheduled to meet later this week (4 to 6 August). However, this meeting will be conducted under a very different set up to the previous nine.

For the first time since October 2015, when the inflation targeting framework was put in place, the panel faces the grim prospect of missing its mandate.

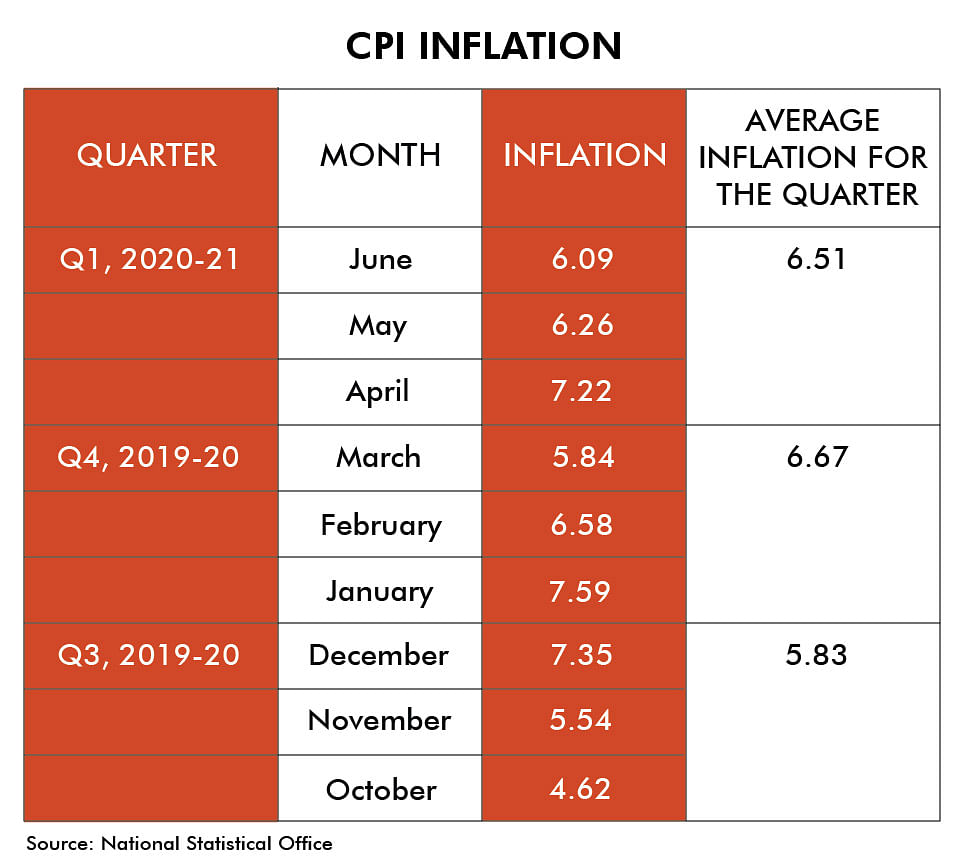

The RBI Act mandates the MPC to maintain consumer price index (CPI)-based inflation at 4 per cent, within a range of +/-2, that is, between 2 per cent and 6 per cent. It will be seen as a failure of the monetary policy if average inflation for three consecutive quarters overshoots or undershoots the range, for which the RBI has to provide an explanation to Parliament and a strategy to bring it back within the range.

The average CPI-based inflation was over 6 per cent for two consecutive quarters — January-March and April-June. It was 5.83 per cent in the October-December quarter of 2019-20.

Also read: With tax revenues at only 8% of full year targets, India’s fiscal deficit zooms in Q1

Difficult choice this time

There is clamour for further interest rate cuts from the industry and the Narendra Modi government, as the Indian economy is expected to shrink 5-12 percentage points during the current financial year in the wake of the pandemic.

In all the previous MPC meetings Das chaired, decision-making was not so complicated.

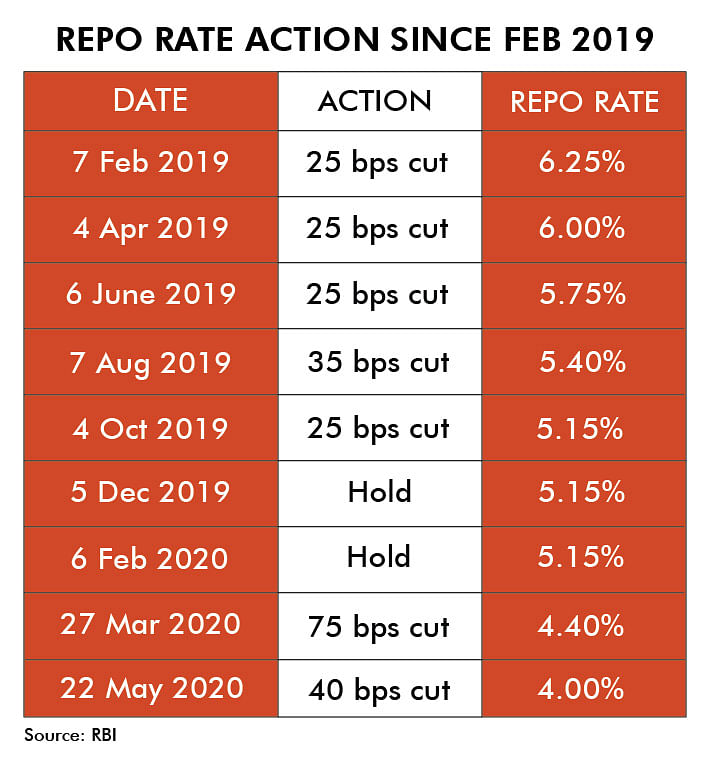

Economic growth was sluggish — quarterly GDP growth plunged below 5 per cent even before the pandemic — while inflation was within the tolerance band, so decision-making was not about whether to reduce the interest rate or not, but by how much. And after the nationwide lockdown imposed in March due to the pandemic, the MPC advanced its meeting twice and delivered two sharp rate cuts — by 75 basis points (bps) and then by 40 bps (100 bps equal one percentage point).

Since February 2019, when Das chaired his first MPC meeting, the central bank has reduced interest rates by 250 bps — from 6.5 per cent to 4 per cent — to support growth. The RBI was lauded for seeing the slowdown early and being proactive.

Also read: Govt expands MSME loan guarantee scheme to include lawyers, doctors & large firms

‘Temporary pause’ likely

However, the August policy could see the central bank holding on to the current rates even if growth prospects are dim.

“For policy, the rate-cutting cycle might slip into a temporary pause in August,” DBS Bank economist Radhika Rao said in a note to its clients.

“Apart from the above-target inflation prints in 2Q20 (June quarter), staple vegetables have risen across multiple states due to monsoon-driven supply disruption and high transport/fuel costs in July,” Rao said, adding inflation is likely to stay sticky at the 5.5-6 per cent range over the next two-three months before easing towards the 4 per cent mark in the December quarter.

Another reason why the central bank could opt for a pause in August is that transmission of interest rates has been inadequate. Banks are yet to cut their lending rates to the extent of policy rate reduction by RBI in March and May.

“I think they might want to stay on hold because the transmission of interest rates is not happening quickly. They have cut a lot. And they should save interest rate cuts for the future,” Abheek Barua, chief economist at HDFC Bank, told ThePrint.

In response to RBI’s 115 bps rate cut since March, the weighted average lending rate on fresh rupee loans of all scheduled commercial banks fell from 8.82 per cent to 8.54 per cent between March and May.

“Given the 6 per cent inflation and the uncertainty over the trajectory of the inflation as there are supply shortages in certain sectors due to supply chain disruptions, so you may see the next couple of (inflation) prints close to 6 per cent. So the RBI may pause now and focus on the other issues,” Barua said.

The NPA factor

Both Barua and Rao agree that the issue of financial stability could be a key theme of the August policy due to expectation of increase in bad loans over the next few quarters.

“At this point there are much bigger issues involved than interest rates. One is whether credit is being delivered to the MSME (micro, small and medium enterprises) sector. If there can be a loan recast? What kind of extension of moratorium will be there? The issue is of financial stability as NPAs are likely to go up substantially. So part B of the monetary policy statement, which is the developmental and regulatory measures, is going to be more important,” Barua added.

In its Financial Stability Report released last month, the RBI said the gross NPA ratio of the banking system could increase to 12.5 per cent by March 2021 from 8.5 per cent in March 2020 under baseline scenario, and to 14.7 per cent under severely stressed scenario.

Also read: GST collections drop to Rs 87,422 crore in July from Rs 90,917 crore in June