New Delhi: The government’s push to improve India’s infrastructure — including in power, roads, rail, and housing sectors — has led to surging orders and new business for public sector companies operating in these and related areas, which has in turn pushed their stock prices to meteoric levels over the past year.

What also helped is the ongoing push to enhance India’s renewable energy capacity, and the Make in India push, especially to do with defence orders. In addition, since a lot of the announcements made by the government are highly visible, they are driving up the stock prices of related companies even if their current revenues don’t support such optimism.

The expectation is that growth will come very soon, and that expectation is creating a strong positive sentiment in the stock markets.

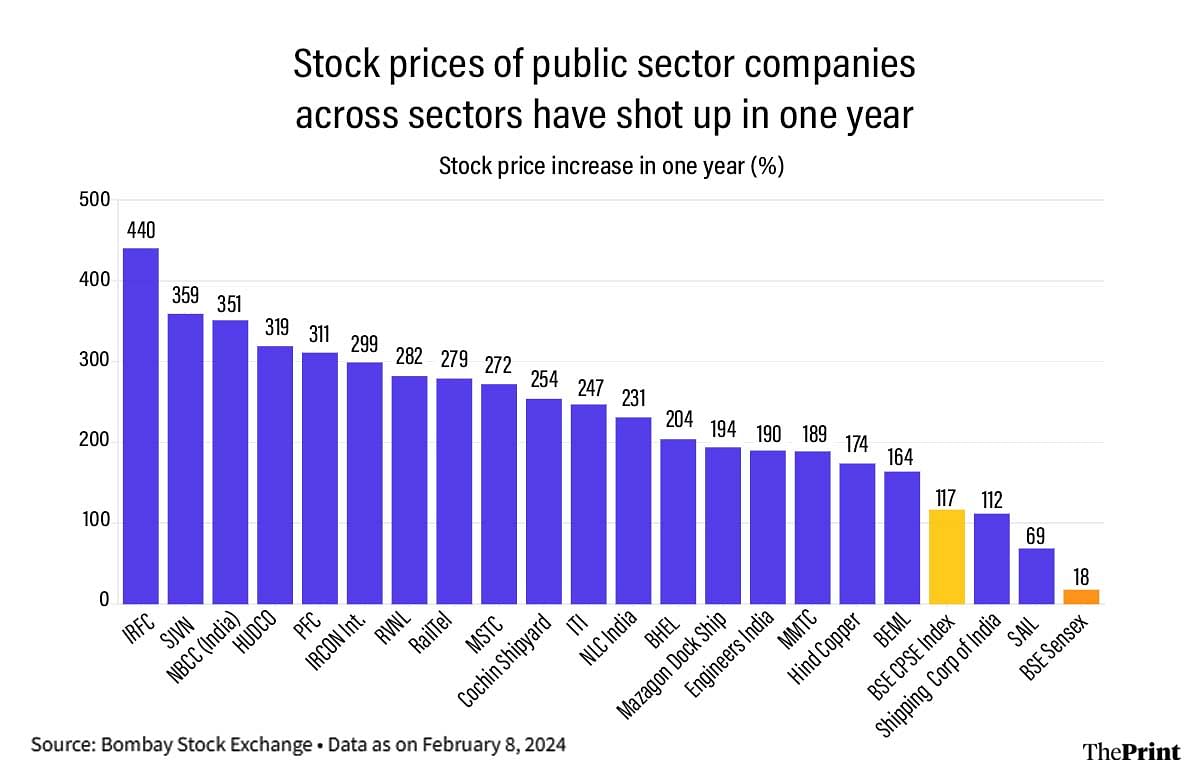

An analysis by ThePrint of the stock prices and underlying fundamentals of the listed central public sector enterprises (CPSEs) has found that 19 public sector companies, operating in railways, power, housing, shipping, metals, telecom, and heavy machinery spaces have seen their stock prices surge over 100 percent over the past year, with many seeing a jump of 300-400 percent.

The reasons for this surge, according to analysts and the companies themselves, is a significant uptick in new business. Many of these sectors — such as housing, power, and telecom, or metals, railways, and heavy equipment manufacturing — are interlinked and so increased activity in one has a positive knock-on effect on others.

Data shows that these companies have seen their stock prices outpace the growth seen in the overall Sensex, the benchmark index of the Bombay Stock Exchange (BSE), and also the BSE CPSE index.

“Not only government companies, but even the private sector ones connected to the overall infrastructure push are doing well,” Gaurang Shah, senior vice-president at Geojit Financial Services told ThePrint. “The overall sense is that largely three sectors are doing and will do well — defence, railways, and power generation and transmission — because all are interdependent on each other.”

“On infrastructure, if you want to go to a 7 percent or higher growth rate on a sustained basis, you can’t do it with the current infrastructure,” he added. “You have to modernise existing infrastructure and create new infrastructure. So both public and private sector companies in these spaces will benefit.”

He further added that a push towards a $5 trillion economy will require banking, finance and power generation to substantially improve. The government is pushing forward in these areas, and the initial outcome is visible in the order books of such companies, and the resultant jump in their stock prices.

The highest gainers — with stock prices rising 300-400 percent over the past year — among public sector companies have been the railways companies, and a previous analysis by ThePrint found that this was driven by full order books and capacity expansion.

In addition to this, the push to expand railway capacity continues. The Cabinet Committee on Economic Affairs Thursday approved six projects of the Ministry of Railways with a total estimated cost of Rs 12,343 crore, with 100 percent funding from the central government.

Also Read: Indian equity market’s dream run is up against PSUs with low-floating stocks. Regulation is key

Power, metals & heavy equipment makers gain big

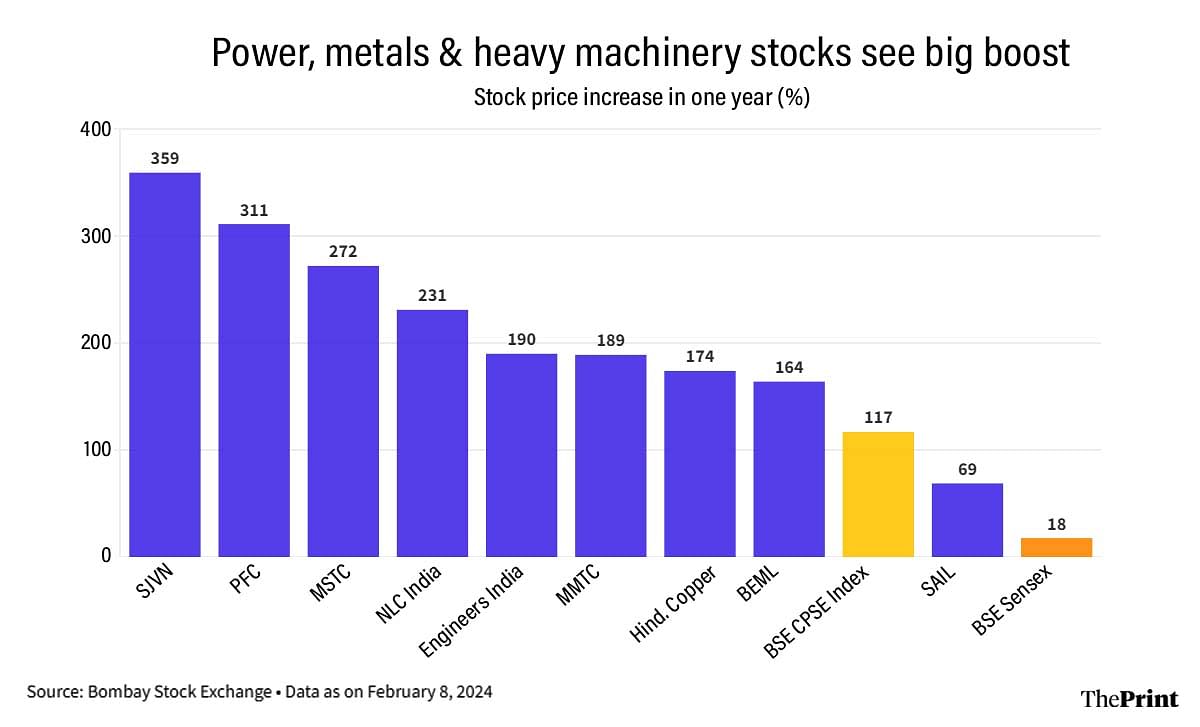

Among the other major gainers in terms of stock prices are public sector companies operating in the power, metals, and heavy equipment manufacturing sectors.

The annual reports of these companies provide some clues why. For example, SJVN, formerly known as Satluj Jal Vidyut Nigam, saw its stock price rise 359 percent over the past year, up to 8 February. A look at the company’s annual report shows that the capacity of projects in its pipeline grew a robust 57 percent in one year, from 10,842 MW as of March 2022, to 17,026 MW as of March 2023.

“The government has lined up over the next 3-5 years close to 350-500 GW of new power generation capacity, focusing on solar and wind, so that will benefit power generation, power transmission, and power equipment companies,” Shah explained.

The next highest gainer in this segment was Power Finance Corporation (PFC), which saw its stock price jump 311 percent over the last year.

Interestingly, according to analysts, companies like PFC and Rural Electrification Corporation are riding high on sentiment and the perception that the government’s push to transition to greener fuels will bring in new business in a sustained manner.

“If you look at the last six quarters of results given by PFC and REC, there’s been absolutely no growth in the net interest income,” Digant Haria of Greenedge Wealth Services said in an interview to CNBC-TV18 last September, when the surge in stock prices of these companies was first noticed.

“So right now, it’s all about the narrative,” he added. “We have all been discussing that the electricity sector has been doing really well because India needs more conventional as well as renewable energy, nuclear, and ethanol. A lot of these energy transition themes are playing out together, so there’s a lot of excitement that a lot of growth is going to come in the future and that this growth will sustain, it’s not just a flash in the pan.”

MSTC, which comes under the Ministry of Steel and operates in trading of various items and e-commerce services through e-auctions and e-procurement services, saw its stock price jump 272 percent over the past year.

According to analysts, the government’s initiatives over the past few years to e-auction major and minor mineral blocks has created new opportunities for MSTC, which has gone on to sign agreements with most state governments, which sets up the company for a solid revenue stream in the future.

Hindustan Copper, which saw its stock price rise 174 percent over the past year, believes that the government’s ongoing renewable energy and electric vehicle push will have strong positive knock-on effects on the copper industry due to increased demand for copper.

“The growing demand from the power sector in view of the Government laying thrust on renewable energy and increasing demand from the households for consumer durables will increase the demand for copper in India,” the company said in its 2023 annual report. “Manufacturers of hybrid and electric vehicles (EVs) will also augment the consumption of copper as EVs use four times more copper than traditional internal combustion engines.”

The company went on to say that the market for EVs is only set to grow as manufacturers unveil new products, the prices of batteries fall, and governments around the world incentivise their adoption.

“Copper is essential to EV technology and its supporting infrastructure,” Hindustan Copper said. “The projected demand for copper due to EVs is expected to increase by around 1.7 million tonnes by 2027.”

The company’s capital work in progress grew from Rs 682 crore in March 2022 to Rs 731 crore in March 2023.

MMTC, an importer and exporter of metals, saw its stock price jump 189 percent over the last year for similar reasons. The overall infrastructure push has also created demand for engineering services and heavy machinery, which has led to companies in these areas, such as Engineers India and BEML, seeing their stock prices rise a solid 190 percent and 164 percent, respectively, over the last year.

Housing & telecom firms benefit from govt schemes

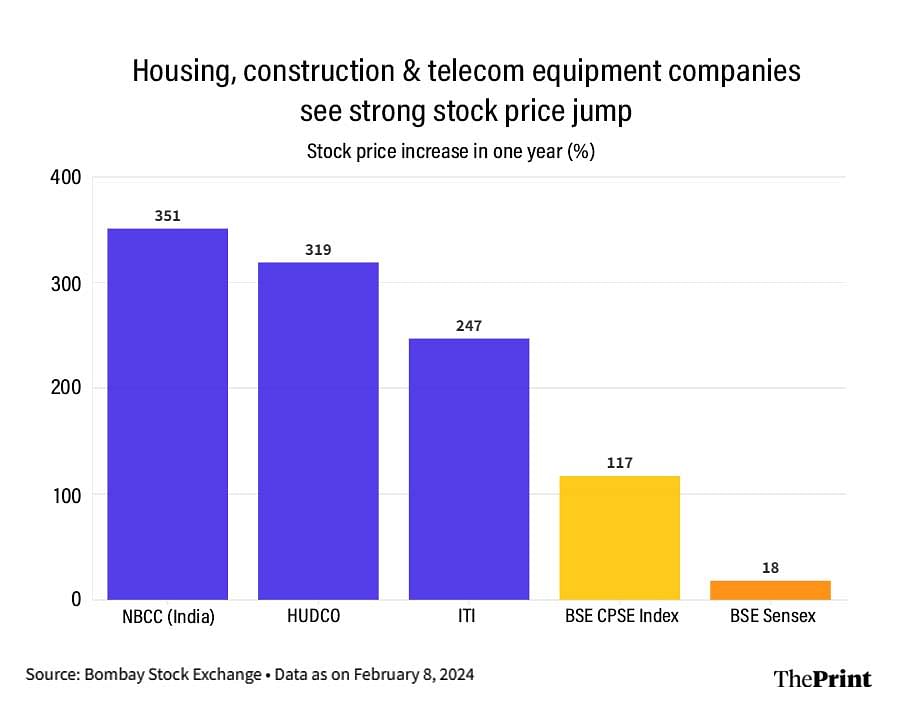

Schemes like the government’s PM Awas Yojana to provide housing for all and its push for telecom and internet connectivity across India have benefited both public sector construction companies as well as telecom equipment providers.

For example, NBCC (India), which executes key construction and redevelopment projects for the government, saw its stock price jump a very strong 351 percent over the last year. In its annual report, the company said its order book stood at a strong Rs 45,275.01 crore as on 31 March 31, 2023, and added that about 10 percent of this was added during 2022-23 itself.

A similar story is unfolding for Housing and Urban Development Corporation (HUDCO), which saw a 319 percent increase in its stock price.

“The future outlook in terms of Government’s sectoral focus and related developments have positive implications for HUDCO’s medium-term and long-term strategies,” the company said in its 2023 annual report.

“The enhanced allocation for Pradhan Mantri Awas Yojana (Urban & Rural) by 66 percent to over Rs 79,000 crore announced in 2023-24 Union Budget will have a positive effect on the housing activities in the country,” it added.

The housing scheme received another boost in the interim budget 2024-25, in which Finance Minister Nirmala Sitharaman announced that two crore more houses would be constructed over the next five years.

ITI, earlier known as Indian Telephone Industries, has seen a boost because of the government’s 4G push in rural areas, the company said. As a result, its stock price has jumped 247 percent over the last year.

“ITI Limited has bagged a completely indigenous 4G technology order from BSNL which is worth Rs 2421.49 crore including supply, installation and commissioning of 4G radio in 23,633 sites in the West Zone,” the company’s chairman and managing director said in its 2023 annual report.

“This was the most awaited order and is very important for ITI Limited as it opens new avenues in the 5G technology arena also.”

Defence boost to shipping sector

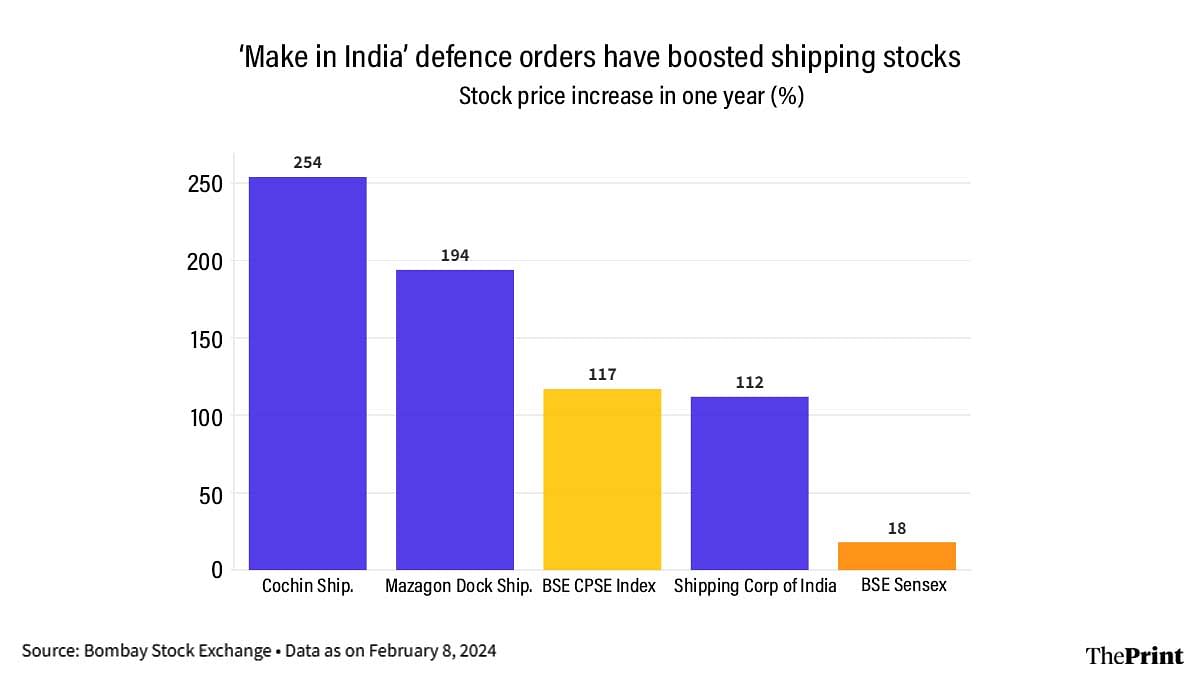

According to the Indian Navy, as of November 2023, 67 of its ships are under construction, of which 65 are being made in India. Apart from this, the Indian Coast Guard also places orders for ships, all of which go to Indian manufacturers. The Navy has further said that all future capacity expansions will be made in India.

What this has meant is that Indian shipbuilders have received a significant boost in their orders, which has pushed up their stock prices to record highs.

Cochin Shipyard, for example, saw its stock price jump 254 percent over the last year. In December 2023, the company said it had bagged an order worth Rs 488.25 crore from the Ministry of Defence.

Also in December, Mazagon Dock Shipbuilders said it will be constructing and supplying six vessels to the Indian Coast Guards (ICG) for about Rs 1,600 crore. The company’s stock price has risen nearly 200 percent over the last year.

(Edited by Amrtansh Arora)

Also Read: Pakistan stock market growth has beaten India’s by more than a mile, with a spark from IMF