If there ever was a time when regulatory authorities and investigative agencies overseeing Indian equity markets needed to be reminded of Thomas Jefferson’s exhortation of ‘Let the eye of vigilance never be closed’, it is now.

The last few quarters have seen a torrent of inflows from retail investors in mid, small and micro-capitalisation companies, either through direct investment or mutual funds. Investors seem to be hypnotised by what psychologists term as ‘recency effect’—a common human tendency that involves placing undue significance on recent experiences or the latest information when forecasting future events.

India’s emergence as the fastest-growing economy, its deft macro-economic management, relative political stability ensuring continuity in policymaking, emphasis on massive infrastructure rollout, embrace of leading digital technologies for delivery of public goods, a sweet geo-strategic position where it is wooed by the US-led West while maintaining its strategic autonomy, a $4 trillion economy with a young demographic, rising aspirations, and increasing affluence among the top 10-15 per cent of the population mark India as the final frontier that multinational corporations (MNCs) simply cannot ignore.

Trends like friendshoring and diversifying supply chains away from an increasingly hostile China, leveraging government initiatives of production-linked incentives (PLIs) for manufacturing in various sectors to reduce import dependence, and using such scalable, highly efficient, lower-cost operations to target export markets have led to renewed interest among both foreign and domestic investors in Indian equity markets.

Also read: Why India’s small, retail investors are making a beeline for beaten-down stocks

Low free float encouraging speculative shenanigans

It is in times of such euphoria that there is utmost need for eternal vigilance among regulatory authorities and investigative agencies to protect millions of retail investors being lured by the promise of multi-baggers and doubling and tripling of their hard-earned savings in relatively short periods by unscrupulous share market operators and price manipulators.

One of the most brazen acts of manipulation currently being played out, endangering retail investors, is by targeting companies with low floating stocks, that is, non-promoter holdings. Many government-owned public sector undertakings (PSUs) and smaller government-owned banks (PSBs) have emerged as a favourite playground for such ramping-up schemes, as speculators remain confident that no large-scale supply of shares is likely from the government to disrupt their ramping-up operations. This confidence is based on the fact that the approval process for further sale of shares by the government is long, tedious, and involves multiple levels.

In January 2023 the government had exempted public sector entities from the Minimum Public Shareholding (MPS) rule, which mandates at least a 25 per cent public float for all listed companies. The exemption would apply to these entities regardless of the government’s direct or indirect holding. In a booming equity market, such an exemption has unfortunately encouraged speculative excesses in government-owned companies with low public float.

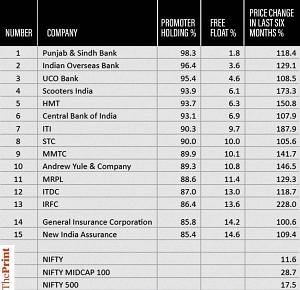

The table below illustrates 15 government-owned companies and banks where low floating stocks available for trading have heightened concerns about large-scale speculative trading volumes distorting the discovery of intrinsic or fair value of these businesses.

Many of these companies have bloated cost structures, anaemic sales growth, low return ratios, or are simply loss-making. Some of the banks have cleaned up their balance sheets by making adequate provisions for past non-performing loans and are back on the steady path to recovery, but are now trading at valuations significantly higher than their larger, more-efficient, and profitable public sector peers which, due to their large floating stocks, remain shielded from large-scale speculative shenanigans.

What must be done

All this is playing out when Indian equity markets are scaling new highs. One of the easiest ways to deter these excesses is by opening the spigot of supply of shares in these low floating stock companies by the promoter, that is, the government of India, quickly and decisively through follow-on offerings. A blanket Cabinet approval valid for the sale of partial stakes in such companies valid for a longer duration like one year ought to be taken and utilised opportunistically to maximise realisation proceeds depending on the sharp upmove in market prices.

What is ironic is that in view of the dream run in Indian equities and taking advantage of frothy valuations, private sector promoters and private equity funds have sold shares worth more than Rs 1,60,000 crore in the last one year to monetise their holdings partially or fully, but the government has fallen woefully short in meeting its modest disinvestment target of Rs 61,000 for FY 23-24. The revised estimate for disinvestment proceeds for FY 23-24 is disappointingly pegged at just Rs 30,000 crore. As hope springs eternal, the budgeted estimate for FY 24-25 stands at Rs 50,000 crore.

Millions of new investors have entered the Indian equity market in the last three to four years. This deepening equity cult needs to be nurtured by fostering practices that lead to long-term wealth creation in the economy. It is time for regulatory authorities and investigative agencies to proactively step up and stamp out any emerging malfeasance that has the potential to threaten market integrity and harm investors’ interests.

Ajay Bodke is an analyst covering economic & financial policy and markets. Views are personal.

(Edited by Prashant)