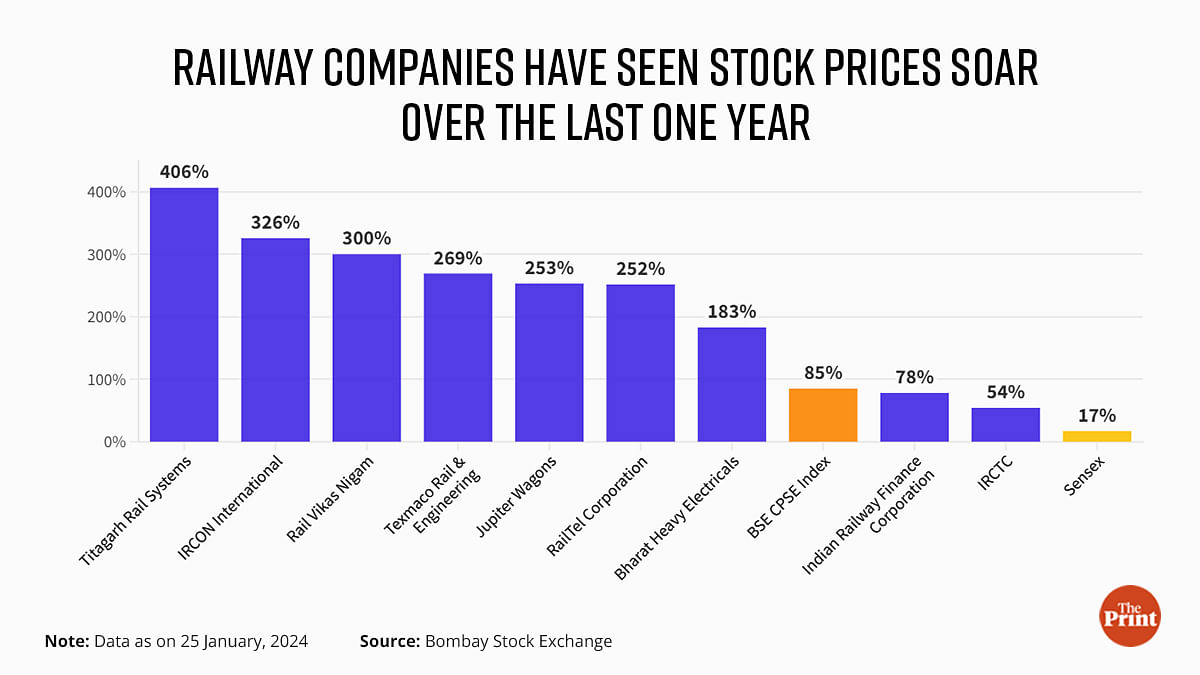

New Delhi: The central government’s strong push to expand railway operations and start more Vande Bharat trains has resulted in a bonanza for those holding stocks of railway companies. Over the last year, several of these companies have seen their stock prices rise more than 300 percent, even crossing 400 percent in some cases.

This, at a time when the benchmark index on the Bombay Stock Exchange (BSE) rose 17 percent over the last year.

While the central public sector enterprises (CPSEs) have seen their overall stock prices rise sharply over the last year, with the BSE CPSE index rising 85 percent, the railway companies have significantly outpaced even this rapid growth.

“During Budget 2023-24, a capital outlay of Rs 2.4 lakh crore was provided for the railways,” Naveen Kaushik Rajan, a manager at smallcase, a stock market analytics company, and senior director at Windmill Capital, a research analytics firm, told ThePrint.

“This was the highest-ever outlay and is about nine times the outlay made in 2013-14,” he said. “According to news sources, the Ministry of Railways has spent Rs 1.44 lakh crore, which is about 60 percent of the capital outlay, during the first half of the fiscal.”

In addition to this, the government in November 2023 announced it would be adding 3,000 new trains in the next four-five years.

What this has meant is that the order books of railway companies, and those in ancillary industries, have swelled — sometimes to multi-year and all-time highs — and this expectation of future revenue has, in turn, driven up their stock prices to historic highs.

What’s more, this performance isn’t restricted to public sector companies, with private companies also benefiting from government orders. “While the industry is witnessing rapid expansion, individual stocks have also benefited from this trend,” Rajan said.

Jupiter Wagons managing director Vivek Lohia stated in the annual report for 2022-23 that the “current order book for Jupiter Wagons Limited as of FY23 stands at Rs 58,200 crore, of which the order book for wagons is around Rs 50,000 crore”.

“Compared to the annual revenues of Rs 2,068 crore in FY23, this provides significant visibility for the next three years.”

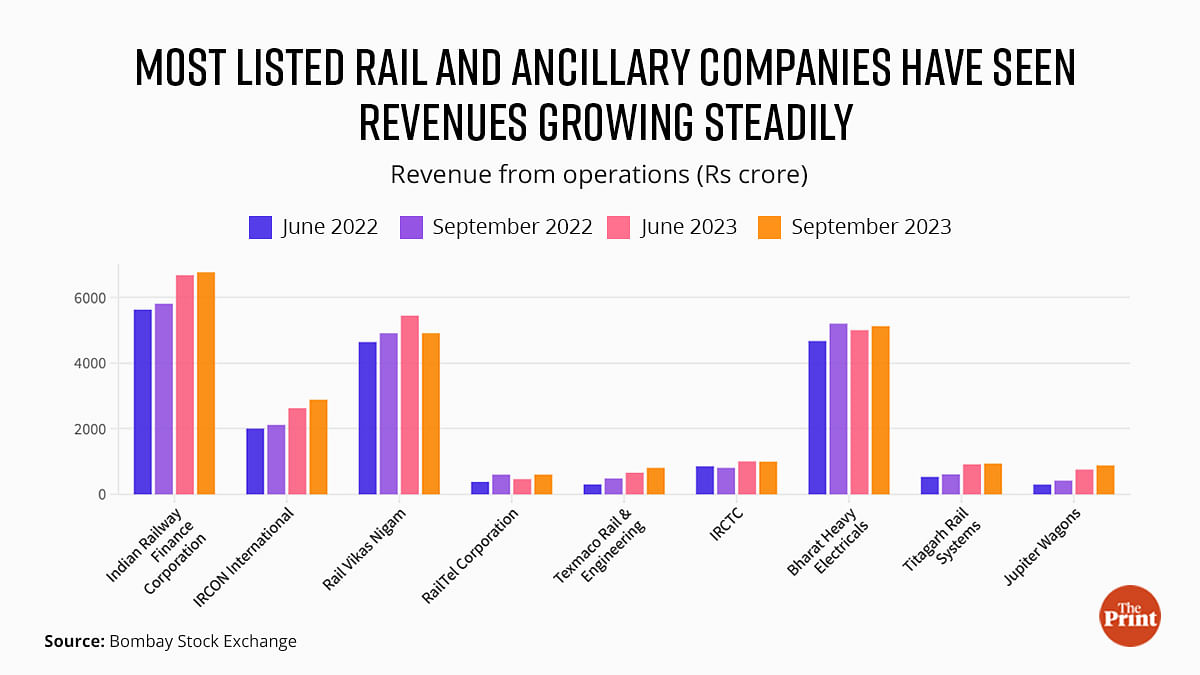

Soaring order books & revenue

While many companies do not release a consolidated amount for the size of their order books, a look at their annual reports can give some insight.

Titagarh Rail Systems, formerly Titagarh Wagons Ltd., for example, a private sector railway wagon-maker, saw its stock price jump a whopping 406 percent over the last year.

“The order book of the company stood at a healthy amount aggregating Rs 27,890 crore as on 30 June, 2023, which is the highest ever in the history of the company,” Titagarh Rail Systems said in its annual report for 2022-23.

The company reported a revenue growth of 54 percent in the September 2023 quarter, coming right after 72 percent growth in the June quarter.

Similarly, IRCON International, an integrated railway engineering and construction company, saw its stock price surge 326 percent over the last year.

“IRCON International will be a direct beneficiary of the government’s plans to procure new trains,” Rajan said. “The company also has a strong order book of Rs 32,000 crore (2.5 times its trailing 12-month revenue). It was also recently declared a ‘Navaratna’ company by the government.”

IRCON saw its revenue from operations jump 36 percent in the September quarter and 31 percent in the June quarter.

Rail Vikas Nigam recorded the next highest jump in its stock price, of 300 percent over the last year. This, too, coincided with the company winning new orders. In early January this year, it entered into a MoU with REC — a public sector company under the aegis of the Ministry of Power — to finance up to Rs 35,000 crore worth infrastructure projects to be executed by the Rail Vikas Nigam over the next five years.

The same month, it also entered into a joint venture with Karnataka Road Development Corporation for a significant upgrade of Varkala Sivagiri railway station.

The share price of private sector Texmaco Rail & Engineering, which manufactures rolling stock such as wagons, coaches, and locomotive shells, increased 269 percent over the last year.

This performance seems to coincide with a combination of order wins and improved fundamental performance.

The company last December won an order worth Rs 1,374.4 crore from the Ministry of Railways for the manufacture and supply of 3,400 wagons and saw its revenue grow 64 percent in the September 2023 quarter.

Ancillary industries gain

Apart from the core railway companies, the government’s push to enhance rail connectivity has also benefited firms that are partly connected to the sector.

For example, over the last year, BHEL has seen its stock price rise 183 percent.

“The total outstanding order book as on 31 March, 2023, stands at Rs 91,336 crore,” BHEL said in its annual report for 2022-23. “With the receipt of the prestigious order for 80 Vande Bharat train sets in April 2023, the total outstanding order book has crossed Rs 1 lakh crore (excluding taxes), which is the highest in the last four years.”

This order for 80 Vande Bharat trains — worth Rs 23,000 crore — was won by a two-party consortium led by BHEL and included Titagarh Rail Systems.

Apart from BHEL, other ancillary companies such as BEML (113 percent), and ARSS Infrastructure Projects (13 percent) also saw jumps in their share prices over the last year.

(Edited by Nida Fatima Siddiqui)

Also Read: CAG report flags Railways’ worst-ever operating ratio in FY22. Rs 100 earned for every Rs 107 spent