Don’t get your hopes up that India’s infrastructure will start to look like China’s after Narendra Modi’s historic victory.

Modi’s Bharatiya Janata Party made big promises in its election manifesto, among them 100 trillion rupees ($1.4 trillion) of investments in infrastructure by 2024 that would double the length of highways by 2022 and lead to a similar increase in the number of large commercial airports.

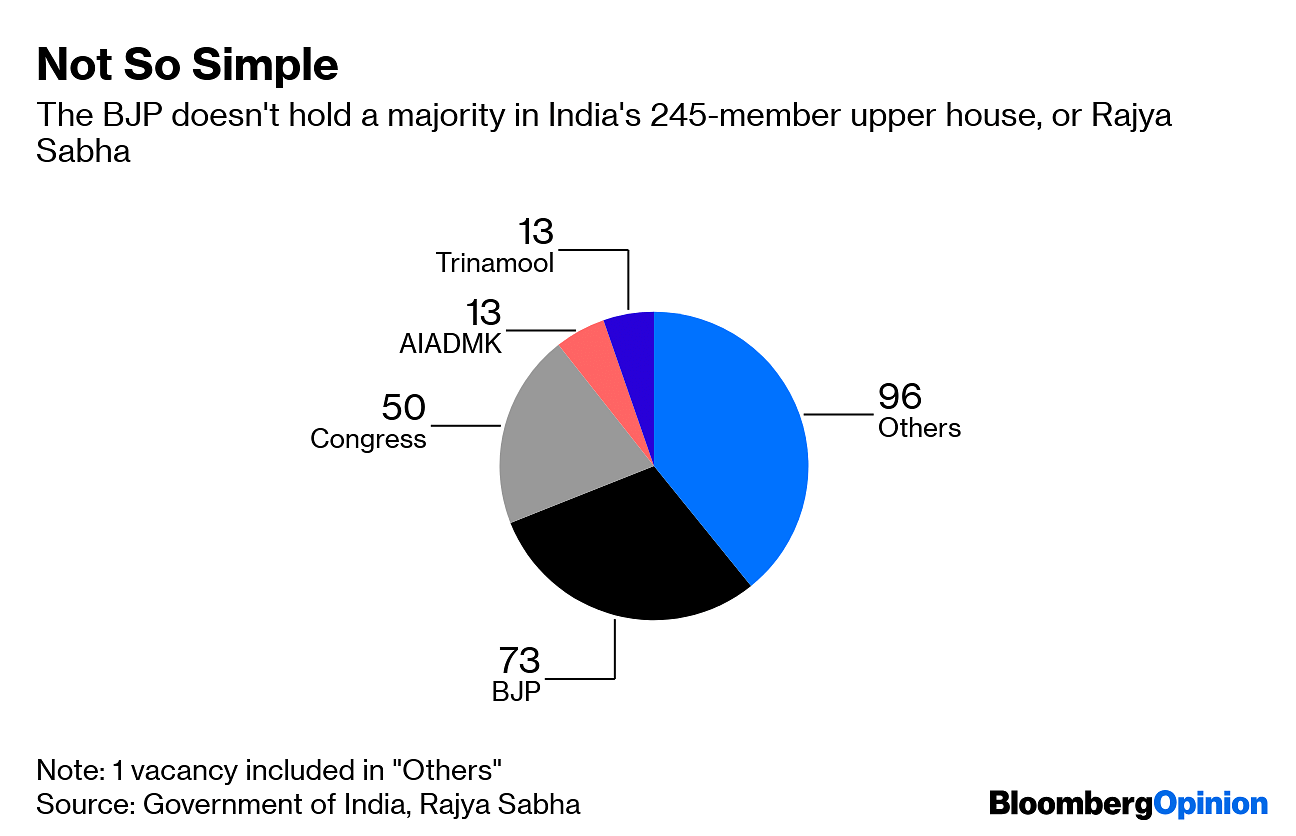

Despite the impressive show Modi and his party put up in the lower-house elections, they don’t have a majority in the upper house of India’s parliament. Numbers move more slowly in the Rajya Sabha, with a third of members retiring every two years. That means that passing legislation such as a land-acquisition bill, which is crucial to speed up infrastructure development, will remain a tough ask until at least 2020.

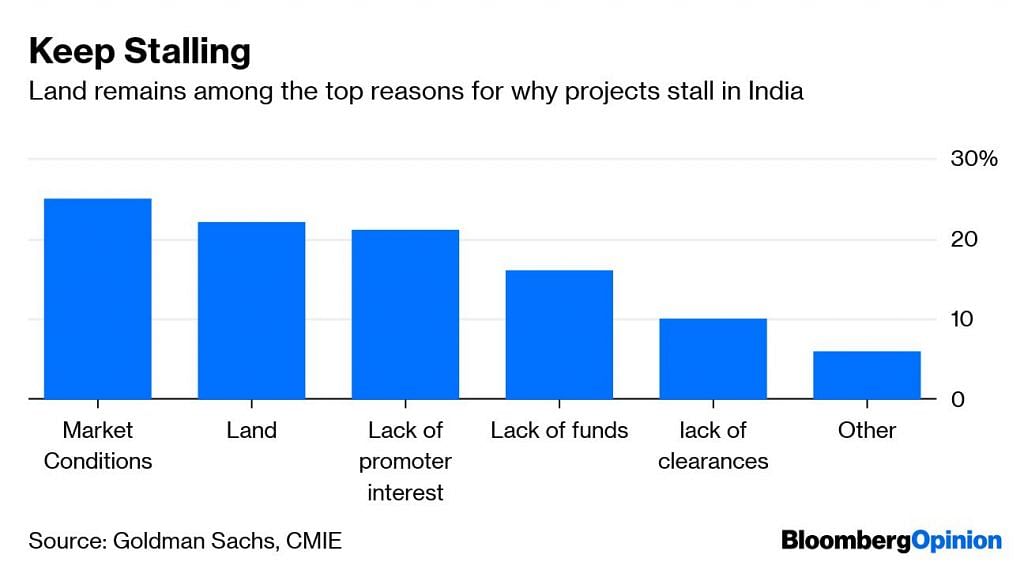

Access to land, which is expensive and difficult to acquire, remains the single biggest issue for why road and other construction projects stall in India, according to capital expenditure surveys and Goldman Sachs Group Inc. The upper house previously rejected a land acquisition bill.

Also read: These are the market winners and losers after Modi wins a second term

Modi’s decisiveness may have won over voters, but he doesn’t have a track record of boosting confidence among Indian companies. They aren’t going to start spending until they see signs that the government is making progress on cutting through the perennial regulatory hurdles surrounding land. During Modi’s first term, private companies slowed their spending on plants and machinery to a 9.2% rate of annual expansion, and employment growth fell to 1.3%. A decade ago, spending was growing at 19.5% and employment at 10.5%, according to data from the Center for Monitoring Indian Economy, or CMIE.

The value of stalled projects has risen to almost 3 trillion rupees since June 2018, even if a flurry was completed just prior to the election. Fewer are being revived. New investment proposals in the last fiscal year were the lowest in 14 years, after rising when Modi first came to power. Meanwhile, the private sector’s role in new investment proposals fell to 47% between 2014 and 2016, from 62% between 2006 and 2011, according to Mahesh Vyas of the CMIE. Even the amounts committed by mostly indebted government-backed companies have fallen during Modi’s term, from already paltry levels.

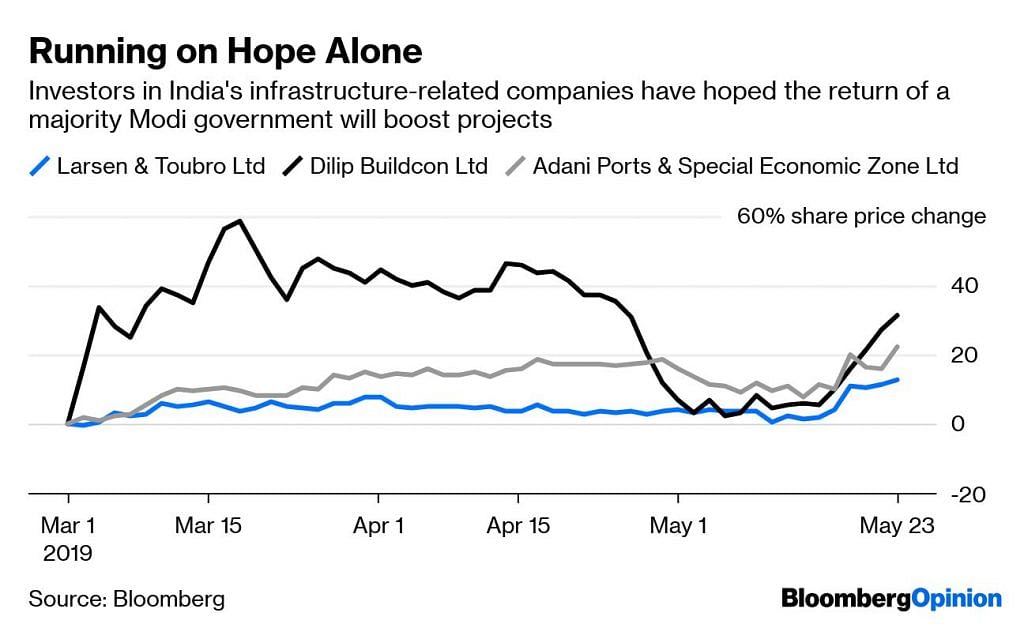

Shares of construction and transport companies such as Larsen & Toubro Ltd., Dilip Buildcon Ltd. and Adani Ports & Special Economic Zone Ltd. have risen sharply this year on hopes of a “New India.” The reality for infrastructure companies is that Old India will be around for a while longer.

Anjani Trivedi is a Bloomberg Opinion columnist covering industrial companies in Asia. She previously worked for the Wall Street Journal.- Bloomberg

For latest updates on Lok Sabha elections, click here

Well written and detailed but the problem is that these facts will be watered down against his nationalism speeches. Personally, this government did not have any clue to run the large economy and messes it up.

But they are good talkers and people are fooled with great campaigning and lost the site of the reality

Doomberg as usual spreading gloom and doom.

Infrastructure has blown the Indian banking system out of the water. Whether it is the mountain of NPAs or the implosion of ILFS, no one who has touched the sector – barring Minister Nitin Gadkari – is smiling. There are no “ innovative financing solutions “ for projects that are not viable, do not generate cash streams to service debt. Spending public funds to “ boost the economy “ is a terrible idea. Let the economic viability of each project be rigorously examined. Failing that, all our criticisms of China’s BRI will apply to us as well.