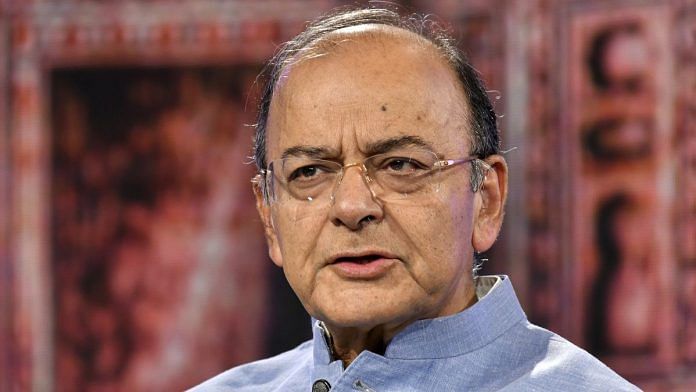

The Modi govt had been monitoring IL&FS for two weeks and decision to oust its board was taken by finance minister Arun Jaitley.

Mumbai: With the future stability of the Indian financial system on the line, executives running a giant infrastructure lender gathered at the company’s glassy, modernist headquarters in Mumbai and hammered out an ambitious restructuring plan last Saturday to manage a $12.6 billion debt burden after a string of defaults.

Except that they weren’t really calling the shots any more. The very next day, the government in New Delhi authorized a plan to sweep in and seize control of Infrastructure Leasing & Financial Services Ltd., a vast conglomerate that’s raised billions of dollars in the corporate bond market and powered the nation’s public project building boom.

The stunning move, more typical of China’s command-and-control economy than a free-wheeling democracy like India, caught investors by surprise. Prime Minister Narendra Modi’s government also unveiled an investigation into IL&FS’s management by the Serious Fraud Investigation Office.

The decision to oust the company’s board was taken by Finance Minister Arun Jaitley after the government had quietly reached out, at least two days earlier, to former bureaucrats and current bankers to orchestrate a board coup, according to people familiar with the matter. The government had been monitoring the lender for two weeks, one of the people said.

Following a series of meetings last week, and months after the first defaults by the systemically important lender, the ministry was worried about the multiple shocks to the financial markets that would follow from IL&FS’s collapse.

“The restoration of confidence of the money, debt and capital markets, the banks and financial institutions in the credibility and financial solvency of the IL&FS Group is of utmost importance for the financial stability of capital and financial markets,” the government said in a statement Monday.

Systemic risk

In addition to handpicking a new board of directors, the government is expected to overhaul the management and monitor any future restructuring plan, a process that seems likely to extend well into 2019. The newly constituted board led by Asia’s richest banker, Uday Kotak is likely to meet Thursday. It must devise a plan for the group and file a response to the National Company Law Tribunal, which endorsed the government’s move, by 15 Oct. The tribunal will next hear the matter on 31 Oct.

Modi’s government concluded it had few options. The economy was already grappling with surging fuel prices and a plunging currency. The last thing the government needed was more turmoil in the debt market, with plans underway to raise a net 2.47 trillion rupees ($34.7 billion) through March to bridge India’s fiscal gap.

Another consideration, and a big one, is that Modi’s Bharatiya Janata Party faces a general election in early 2019. During his four years in power, Modi has tried to cultivate an image of being a champion of the downtrodden. That will be tested as the opposition questions IL&FS’s loan-fueled expansion.

“The government was left with no choice but had to act quickly and decisively,” said Mathew Antony, managing partner of Aditya Consulting, an advisory firm based in Mumbai. “The risk from IL&FS’s default was spreading to all corners of the market and any indecisiveness would have eroded the political capital of the government further.”

The troubles at IL&FS had been intensifying since July, when company founder Ravi Parthasarathy stepped down, citing health reasons. Defaults from August within the group rattled India’s money markets, added to pressure on corporate bond yields and sparked a sell-off in the stock market.

The Reserve Bank of India has initiated a special audit, given the potential systemic risk to other non-bank lenders. There were also worries about upcoming group debt payments.

Secret memo

Over the past week, Jaitley had come under pressure to act after receiving formal letters, including one from opposition lawmaker K.V. Thomas, raising concerns about operations at IL&FS, according to people familiar with the matter. Jaitley’s team on Sunday sent a confidential note to the Ministry of Corporate Affairs recommending that the company court be approached for the “reconstitution” of the IL&FS board.

In the secret memo, the finance ministry said it was concerned that just 28 billion rupees of IL&FS securities owned by mutual funds could set off a chain reaction of redemptions by investors. That, in turn, may send sovereign bond yields soaring to 8.5 per cent, a level not seen since 2014, and possibly derail the government’s borrowing plan, according to the note seen by Bloomberg. Finance ministry spokesman D.S. Malik declined to comment.

On Monday, government lawyers sought the National Company Law Tribunal’s approval to oust the board calling the directors a “parasite on public fund,” because of their “hefty” salary packages. Former Managing Director and Vice Chairman Hari Sankaran was paid 77.6 million rupees in the year ended 31 March, while founder Chief Executive Officer Parthasarathy took home 205 million rupees, according to the company’s annual report.

The IL&FS Group is a bewilderingly complex conglomerate, with 169 direct and indirect subsidiaries. To defuse the long-running crisis at the company, the financier had considered selling short-term bonds, recapitalizing the company, and selling or stalling existing infrastructure projects, according to an ousted director, who asked not to be identified because the person isn’t authorized to talk to the media.

Another option was a bailout orchestrated by its biggest investors, which include Life Insurance Corp., India’s largest life insurer; State Bank of India, its largest bank; and Housing Development Finance Corp, its largest mortgage lender. Japan’s Orix Corp. is the company’s second-largest shareholder.

A plan to raise funds by selling stake to Piramal Enterprises Ltd., controlled by billionaire Ajay Piramal, in 2015 was rejected by the shareholders. That prompted the firm, which lent for projects that take years to complete, to seek short-term funds, according to the director.

Default run

Enter the Reserve Bank of India. The nation’s central bank in an attempt to clean-up a burgeoning pile of stressed debt issued stringent new rules barring fresh loans to borrowers with dud debt. That made it difficult for struggling companies to get new loans from banks.

Five special purpose vehicles of IL&FS Transportation Networks Ltd. failed to service obligations in June, followed by defaults by parent IL&FS and its units on commitments including bonds and commercial papers starting August. A state lender Small Industries Development Bank of India filed an insolvency petition against IL&FS and its unit last month over missed payments.

The government in its court filing said IL&FS was “indiscriminately” borrowing money. IL&FS “has been presenting a rosy picture and camouflaging its financial statements by hiding severe mismatch between its cash flows and payment obligations, total lack of liquidity and glaring adverse financial ratios,” according to the 44-page filing.

The events that led to the firing of the board started with a complaint against an unit written to the Ministry of Corporate Affairs office in Mumbai a few weeks ago. That was followed by lawmaker Thomas’s letter to Jaitley on 20 Sept in which he asked the minister to help IL&FS to avoid the world’s fastest growing major economy from plunging “into a recession.”

Following is the time line of developments in the run up to India’s shock decision to oust IL&FS’s board.

25 Sept

Jaitley meets LIC’s Chairman V.K. Sharma, central bank Deputy Governor Viral Acharya, State Bank of India Chairman Rajnish Kumar and Central Bank of India Managing Director Pallav Mohapatra

27 Sept

Jaitley meets RBI officials including Governor Urjit Patel at his residence

28 Sept

Economic Affairs Secretary Subhash Garg meets shareholders of IL&FS, including LIC and SBI. Separately, the RBI meets LIC and Orix representatives in MumbaiFinance ministry officials start reaching out to potential board-member candidates

29 Sept

IL&FS hosts its annual general meeting and decides to raise 150 billion rupees from a non-convertible debt issue

30 Sept

Ministry of Finance writes to Ministry of Corporate Affairs recommending IL&FS’s board be oustedMinistry asks India’s Serious Fraud Investigation Office to begin probe into IL&FS’s finances

1 Oct

A court in Mumbai approves the government’s petition to fire IL&FS’s board

3 Oct

Government inducts a seventh board member: Former bureaucrat C.S. Rajan

Shares of the the group’s listed units have been rallying since the ousting of the board. IL&FS Investment Managers Ltd. surged 10 per cent on Wednesday, while IL&FS Transportation Networks advanced 19 per cent.

“Investors didn’t want to put more money without a strong leadership and we can’t imagine a better team than the newly constituted board,” said Gaurang Shah, chief investment strategist at Geojit Financial Services Ltd. in Mumbai. “Assurance by the government and the necessary action taken against the erstwhile board has brought the much needed confidence.” – Bloomberg

Not a day too soon. The first default from the ILFS group was a call to arms. LIC, a financial behemoth and ILFS’ largest shareholder, with Board representation, must have been aware for at least a couple of years that the group was struggling. The outreach to Piramals in 2015 suggests a build up of stress.